UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

| | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

|

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 333-178697

TECOGEN INC.

(Exact name of Registrant as specified in its charter)

|

| |

Delaware | 04-3536131 |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

|

| |

45 First Avenue | |

Waltham, Massachusetts | 02451 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (781) 622-1120

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

| |

Title of each class | Name of each exchange on which registered |

Common Stock, $0.001 par value | N/A |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or an amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| |

Large accelerated filer o | Accelerated filer o |

Non –accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

The aggregate market value of the voting shares of the registrant held by non-affiliates is not applicable because our common stock was not yet trading as of June 28, 2013.

As of March 31, 2014, the registrant’s shares of common stock outstanding were: 15,156,600.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

THIS ANNUAL REPORT ON FORM 10-K CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER FEDERAL SECURITIES LAWS. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, AND ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD-LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS.

WE GENERALLY IDENTIFY FORWARD-LOOKING STATEMENTS BY TERMINOLOGY SUCH AS “MAY,” “WILL,” “SHOULD,” “EXPECTS,” “PLANS,” “ANTICIPATES,” “COULD,” “INTENDS,” “TARGET,” “PROJECTS,” “CONTEMPLATES,” “BELIEVES,” “ESTIMATES,” “PREDICTS,” “POTENTIAL” OR “CONTINUE” OR THE NEGATIVE OF THESE TERMS OR OTHER SIMILAR WORDS. THESE STATEMENTS ARE ONLY PREDICTIONS. THE OUTCOME OF THE EVENTS DESCRIBED IN THESE FORWARD-LOOKING STATEMENTS IS SUBJECT TO KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS THAT MAY CAUSE OUR, OUR CUSTOMERS’ OR OUR INDUSTRY’S ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS, TO DIFFER.

THIS REPORT ALSO CONTAINS MARKET DATA RELATED TO OUR BUSINESS AND INDUSTRY. THESE MARKET DATA INCLUDE PROJECTIONS THAT ARE BASED ON A NUMBER OF ASSUMPTIONS. IF THESE ASSUMPTIONS TURN OUT TO BE INCORRECT, ACTUAL RESULTS MAY DIFFER FROM THE PROJECTIONS BASED ON THESE ASSUMPTIONS. AS A RESULT, OUR MARKETS MAY NOT GROW AT THE RATES PROJECTED BY THESE DATA, OR AT ALL. THE FAILURE OF THESE MARKETS TO GROW AT THESE PROJECTED RATES MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION AND THE MARKET PRICE OF OUR COMMON STOCK.

SEE “ITEM 1A. RISK FACTORS,” “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” AND “BUSINESS,” AS WELL AS OTHER SECTIONS IN THIS REPORT, THAT DISCUSS SOME OF THE FACTORS THAT COULD CONTRIBUTE TO THESE DIFFERENCES. THE FORWARD-LOOKING STATEMENTS MADE IN THIS ANNUAL REPORT ON FORM 10-K RELATE ONLY TO EVENTS AS OF THE DATE OF WHICH THE STATEMENTS ARE MADE. EXCEPT AS REQUIRED BY LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR RELEASE ANY FORWARD- LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

TABLE OF CONTENTS

|

| | |

|

| | |

| | |

Item 1A. | Risk Factors. | |

Item 1B. | Unresolved Staff Comments. | |

Item 2. | Properties. | |

Item 3. | Legal Proceedings. | |

Item 4. | Mine Safety Disclosures. | |

| | |

PART II |

| | |

Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |

Item 6. | Selected Financial Data. | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | |

Item 8. | Financial Statements and Supplementary Data. | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | |

Item 9A. | Controls and Procedures. | |

Item 9B. | Other Information. | |

| | |

PART III |

Item 10. | Directors, Executive Officers and Corporate Governance. | |

Item 11. | Executive Compensation. | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence. | |

Item 14. | Principal Accountant Fees and Services. | |

| | |

PART IV |

| | |

Item 15. | Exhibits and Financial Statement Schedules. | |

Item 1. Business

Overview

Tecogen designs, manufactures, sells, and services systems that produce electricity, hot water, and air conditioning for commercial installations and buildings and industrial processes. These systems, powered by natural gas engines, are efficient because they drive electric generators or compressors, which reduce the amount of electricity purchased from the utility, plus they use the engine’s waste heat for water heating, space heating, and/or air conditioning at the customer’s building. We call this cogeneration technology CHP for combined heat and power.

Tecogen manufactures three types of CHP products:

| |

• | Cogeneration units that supply electricity and hot water; |

| |

• | Chillers that provide air-conditioning and hot water; and |

| |

• | High-efficiency water heaters. |

All of these are standardized, modular, small-scale CHP products that reduce energy costs, carbon emissions, and dependence on the electric grid. Market drivers include the price of natural gas, local electricity costs, and governmental energy policies, as well as customers’ desire to become more socially responsible. Traditional customers for our cogeneration and chiller systems include hospitals and nursing homes, colleges and universities, health clubs and spas, hotels and motels, office and retail buildings, food and beverage processors, multi-unit residential buildings, laundries, ice rinks, swimming pools, factories, municipal buildings, and military installations; however, the economic feasibility of using our systems is not limited to these customer types. Through our factory-owned service centers in California, New York, Massachusetts, Connecticut, New Jersey, and Michigan our specialized technical staff maintain our products through long-term contracts. We have shipped approximately 2,000 units, some of which have been operating for almost 25 years. We have 67 full-time employees and 3 part-time employees, including 6 sales and marketing personnel and 39 service personnel.

Our CHP technology uses low-cost, mass-produced engines manufactured by GM and Ford, which we modify to run on natural gas. In the case of our mainstay cogeneration and chiller products, the engines have proved to be cost-effective and reliable. In 2009, our research team developed a low-cost process for removing air pollutants from the engine exhaust. Because these systems are fueled by natural gas, they typically produce lower levels of “criteria” air pollutants (those that are regulated by the EPA, because they can harm human health and the environment) compared with systems fueled by propane, gasoline, distillates, or residual fuel oil. We offer our new Ultra low-emissions technology as an option in our CHP systems.

After a successful field test of more than a year, in 2012 we introduced the technology commercially as an option for all of our products under the trade name Ultra, which was recently patented in the US in October 2013. The Ultra low-emissions technology repositions our engine-driven products in the marketplace, making them comparable environmentally with emerging technologies such as fuel cells, but at a much lower cost and greater efficiency.

Our products are designed as compact modular units that are intended to be applied in multiples when utilized for larger CHP plants. Approximately 68% of our CHP modules are installed in multi-unit sites ranging up to 12 units. This approach has significant advantages over utilizing single, larger units, such as building placement in constrained urban settings and redundancy during service outages. Redundancy is particularly relevant in regions where the electric utility has formulated tariff structures that have high “peak demand” charges. Such tariffs are common in many areas of the country, and are applied by such utilities as Southern California Edison, Pacific Gas and Electric, Consolidated Edison of New York, and National Grid of Massachusetts. Because these tariffs assess customers’ peak monthly demand charge over a very short interval (typically only 15 minutes), a brief service outage for a system comprised of a single unit is highly detrimental to the monthly savings of the system. For multiple unit sites, a full system outage is less likely and consequently these customers have a greater probability of capturing peak demand savings.

Our in-licensed microgrid technology enables our InVerde CHP products to provide backup power in the event of power outages that may be experienced by local, regional, or national grids.

Our CHP products are sold directly to customers by our in-house marketing team and by established sales agents and representatives, including American DG Energy and EuroSite Power which are affiliated companies. We have shipped approximately 2,000 units, some of which have been operating for almost 25 years. Our principal engine supplier is GM, and our principal generator supplier is Marathon Electric. To produce air conditioning, our engines drive a compressor purchased from J&E Hall International.

In 2009, we created a subsidiary, Ilios, to develop and distribute a line of high-efficiency heating products, starting with a water heater. We believe that these products are much more efficient than conventional boilers in commercial buildings and industrial processes (see “Our Products” below). As of the date of this filing, we own a 63.7% interest in Ilios.

Tecogen was formed in the early 1960s as the Research and Development New Business Center of Thermo Electron Corporation, which is now Thermo Fisher Scientific Inc. For the next 20 years, this group performed fundamental and applied research in many energy-related fields to develop new technologies. During the late 1970s, new federal legislation enabled electricity customers to sell power back to their utility. Thermo Electron saw a fit between the technology and know-how it possessed and the market for cogeneration systems.

In 1982, the Research and Development group released its first major product, a 60-kilowatt, or kW, cogenerator. In the late 1980s and early 1990s, they introduced air-conditioning and refrigeration products using the same gas engine-driven technology, beginning with a 150-ton chiller (tons are a measure of air-conditioning capacity). In 1987, Tecogen was spun out as a separate entity by Thermo Electron and, in 1992, Tecogen became a division of the newly formed Thermo Power Corporation.

In 2000, Thermo Power Corporation was dissolved, and Tecogen was sold to private investors including Thermo Electron’s original founders, Dr. George N. Hatsopoulos and John N. Hatsopoulos. Tecogen Inc. was incorporated in the State of Delaware on September 15, 2000. Our business and registered office is located at 45 First Avenue, Waltham, Massachusetts, 02451. Our telephone number is 781-466-6400.

Industry Background

During the 20th century, fossil-fuel power plants worldwide evolved toward large, complex central stations using high-temperature steam turbines. This technology, though steadily refined, reached a maximum efficiency of about 40% that persists to this day. As used throughout, efficiency means electrical energy output per unit of fuel energy input. According to the EPA website, the average efficiency of fossil-fuel power plants in the United States is 33% and has remained virtually unchanged for four decades.

According to a 2002 report from the Northwest Power Planning Council, titled “Natural Gas Combined-cycle Gas Turbine Power Plants,” the best efficiency obtainable at the time of the report was about 50% from a combined-cycle steam turbine. More recent reports have expressed that comparable efficiency rates are obtainable from a fuel cell. A combined-cycle system incorporates a second turbine powered by exhaust gases from the first turbine. Large-scale replacement of existing power plants with combined-cycle technology would require considerable capital investment and time. Fuel cells have high capital costs as well.

CHP, which harnesses waste energy from the power generation process and puts it to work on-site, can boost the efficiency of energy conversion to nearly 90%, a better than two-fold improvement over the average efficiency fossil fuel plant.

The implications of the CHP approach are significant. If CHP were applied on a large scale, global fuel usage might be curtailed dramatically. Small on-site power systems, in sizes like boilers and furnaces, would serve customers ranging from homeowners to large industrial plants. This is described as “distributed” energy, in contrast to central power.

CHP became recognized in the late 1970s as a technology important to aiding the reduction of fossil fuel consumption, pollution, and grid congestion. Since then, CHP has been applied increasingly around the world. According to a report by the International Energy Agency, or IEA, titled “Cogeneration and District Energy: Sustainable energy technologies for today...and tomorrow (2009), ” the value of CHP technology to customers and policy makers stems from the fact that CHP systems are “inherently energy efficient and produce energy where it is needed.”

According to the IEA report, the benefits of CHP include:

| |

• | Dramatically increased fuel efficiency; |

| |

• | Reduced emissions of carbon dioxide (CO2 ) and other pollutants; |

| |

• | Cost savings for the energy consumer; |

| |

• | Reduced need for transmission and distribution networks; and |

| |

• | Beneficial use of local energy resources, providing a transition to a low-carbon future. |

CHP generates about 10% of the world’s electricity. According to the IEA report, CHP could supply up to 24% of the energy generation of the Group of Eight + Five countries, while meeting 40% of Europe’s target reductions in carbon emissions.

In the United States, CHP represents only about 8% of the generating capacity. A paper issued by the United States Department of Energy, or DOE, in 2012, Combined Heat and Power, A Clean Energy Solution, states that CHP is an underutilized resource. On August 30, 2012, the White House issued an executive order, or the Executive Order, aimed at promoting investments in industrial energy efficiency, including CHP, and established a national goal of deploying 40 GW (or 40,000 megawatts, or MW) of new CHP in the United States by 2020.

On-site CHP not only eliminates the loss of electric power during transmission, but also offsets the capital expense of upgrading or expanding the utility infrastructure. The national electric grid is already challenged to keep up with existing power demand. The grid consists of power generation plants as well as the transmission and distribution network consisting of substations and wires.

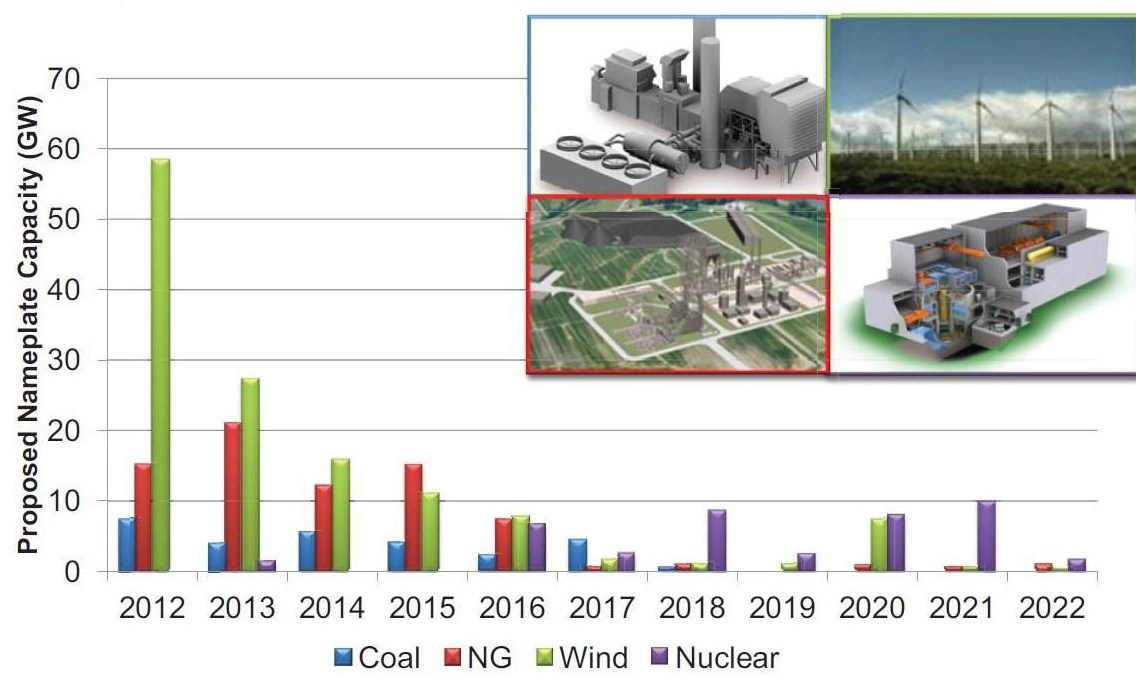

Power plants are aging, and plans for new power plants are on the decline (Figure 1). According to the U.S. Energy Information Administration’s “ Form EIA-860 Annual Electric Generator Report (2010),” the average age of a U.S. coal-fired power plant is 44 years. Coal plants account for about 40% of the nation’s generation capacity.

Figure 1 — Proposed U.S. New Capacity: Coal, Natural Gas, Wind, and Nuclear

Source: National Energy Technology Laboratory, Tracking New Coal Fired Power Plants (2012).

In addition, the transmission and distribution network is operating at capacity in urban areas. Decentralizing power generation by installing equipment at customer sites not only relieves the capacity burden on existing power plants, but also unburdens transmission and distribution lines. This ultimately improves the grid’s reliability and reduces the need for costly upgrades. Consolidated Edison, Inc., the electric utility of New York City and surrounding areas, has identified an opportunity to integrate energy efficiency, distributed generation, and demand response as a way to defer new infrastructure investments, according to the utility’s 2010 long-range plan.

We believe that increasingly favorable economic conditions could improve our business prospects domestically and abroad. Specifically, we believe that natural gas prices might increase from their current depressed values, but only modestly, while electric rates could go up over the long-term as utilities pay for better emission controls, efficiency improvements, and the integration of renewable power sources. The net result of relative gas and electric prices could be greater cost savings and annual rates of return to CHP customers.

Moreover, we believe that natural gas could win favor politically as a domestic fuel with low carbon emissions. Government policy, both here and abroad, might promote CHP as a way to conserve natural resources and reduce carbon and toxic emissions. Renewable wind and solar sources could encounter practical limitations, while nuclear power is likely to be affected by its safety setbacks.

Tecogen’s Strategy for Growth

Target markets and new customers

The traditional markets for CHP systems are buildings with long hours of operation and with coincident demand for electricity and heat. Traditional customers for our cogeneration systems include hospitals and nursing homes, colleges and universities, health clubs and spas, hotels and motels, office and retail buildings, food and beverage processors, multi-unit residential buildings, laundries, ice rinks, swimming pools, factories, municipal buildings, and military installations.

Traditional customers for our chillers overlap with those for our cogeneration systems. Chiller applications include schools, hospitals and nursing homes, office and apartment buildings, hotels, retailers, ice rinks and industrial facilities. Engine-driven chillers are utilized as replacements for aging electric chillers, since they both take up about the same amount of floor space.

The Company believes that the largest number of potential new customers in the U.S. require less than 1,000 kW of electric power and less than 1,200 tons of cooling capacity. We are targeting customers in states with high electricity rates in the commercial sector, such as California, Connecticut, Massachusetts, New Hampshire, New Jersey, and New York. These regions also have high peak demand rates, which favor utilization of our modular units in groups so as to assure redundancy and peak demand savings, as discussed above. Some of these regions also have generous rebates that improve the economic viability of our systems.

As stated earlier, the U.S. government’s goal, according to the Executive Order, is to deploy 40 GW (40,000 MW) of new CHP in the United States by 2020. In order to estimate the share of that new deployment of CHP that is addressable by products in our size range, we reference a study done by ICF International on the California market that breaks down projected market penetration by kW output range. According to the April 2010 Combined Heat and Power Market Assessment, prepared for the California Energy Commission, in 2029, new CHP in the size range of our products (50 kW to 500 kW), is projected to be 476 MW in the base case, or 684 MW if incentives such as carbon credits and power export credits are considered. This size range constitutes 17.4% of the total California market potential in the base case, or 11% in the case with incentives. If we assume California’s apportionment of small size CHP is applicable to the country, and conservatively extend the government’s goal of 40,000 MW to 2029, we can estimate the U.S. market addressable by our products as 17.4% of 40,000 MW in the base case (11% with incentives) which amounts to 6,972 MW (4,416 MW with incentives). If we assume we can capture 30% of the market for CHP products in the size range of 50 kW to 500 kW, we can estimate that our potential for new unit sales over the next twenty years is between 13,250 and 20,920 InVerde (100 kW) units, or approximately $1.5 to $2.4 billion in revenue, at $112,500 per unit.

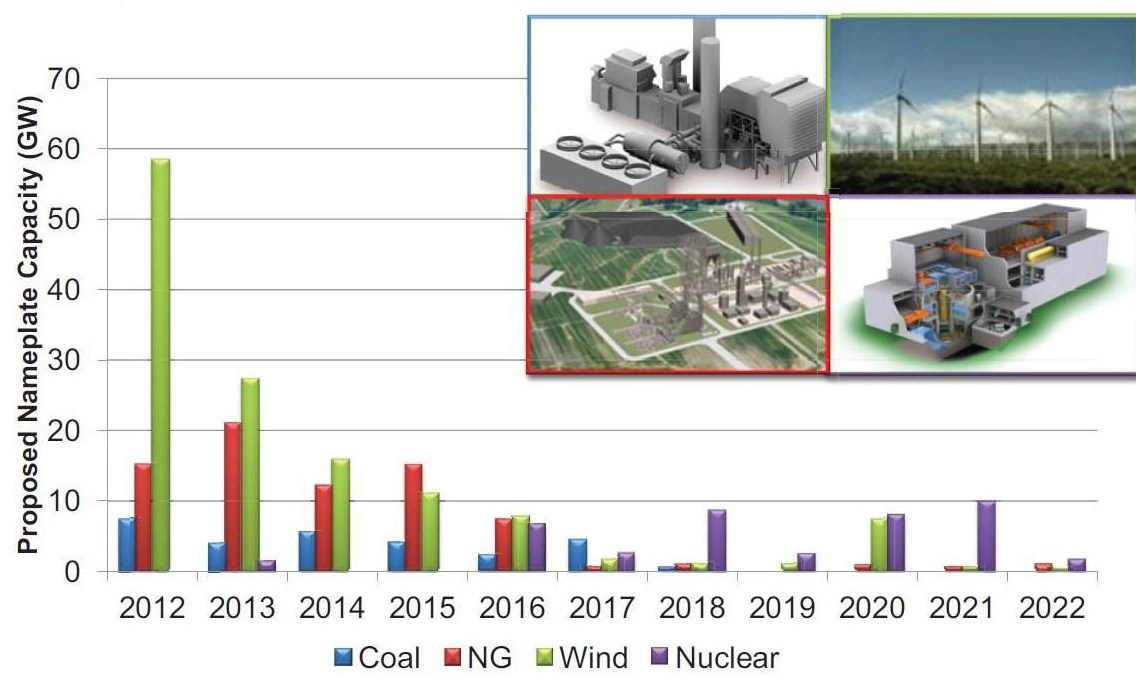

The largest market sectors identified by ICF that are suitable for our products closely match our sales data from January 2007 through June 2012 (Figure 2).

Figure 2 — Tecogen Customer Distribution (CHP and Engine-Driven Chiller Systems)

From January 2007 through June 2012

Source: Tecogen Inc.

The ICF report reveals CHP’s relatively low existing market penetration in the smaller system sizes. Given that multi-megawatt CHP is already well-established (Table 1), the market opportunity increases as size decreases. Small systems (less than one MW) may grow almost six-fold. The missed opportunity is evident and likely even more disproportionate nationally. Most areas of the country, except the Northeast, are essentially without significant market penetration of small-scale (less than 500 kW) CHP systems.

Table 1 — CHP Market Penetration by Size in California and Potential Through 2029

Source: ICF International, Combined Heat and Power Market Assessment (2010)

|

| | | | | | | | | | | | |

System Size (MW) | | <1 | | 1 - 4.9 | | 5 – 19.9 | | >20 |

2009 Inventory (MW) | | 200 |

| | 350 |

| | 750 |

| | 7,900 |

|

New Potential Through 2029 (MW) | | 1,138 |

| | 1,279 |

| | 764 |

| | 3,015 |

|

Relative Growth Potential (%) | | 569 | % | | 365 | % | | 102 | % | | 38 | % |

The DOE/EPA report confirms that CHP is a “largely untapped resource” and states that there is significant technical market potential for CHP at commercial and institutional facilities at just over 65 GW. This report also indicates that there was a significant decline in CHP in the early 2000s due to deregulation of the power markets that resulted in market uncertainty and delayed energy investments. However, a significant rebound and expansion of the CHP market may occur because of the following emerging drivers:

| |

• | Changing outlook for natural gas supply and pricing as a result of shale exploration; |

| |

• | Growing state policymaking and support; and |

| |

• | Changing market conditions for the power and industrial sectors such as ageing power plants and boilers, as well as more strict air regulations. |

We intend to seek both domestic and international customers in areas where utility pricing and government policy align with our advantages. These areas would include regions that have strict emissions regulations, such as California, or those that reward CHP systems that are especially non-polluting, such as New Jersey. There are currently 23 states that recognize CHP as part of their Renewable Portfolio Standards or Energy Efficiency Resource Standards and several of them, including New York, California, Massachusetts, New Jersey, and North Carolina, have initiated specific incentive programs for CHP (DOE/EPA report).

Our new microgrid capability, where multiple InVerde units can be seamlessly isolated from the main utility grid in the event of an outage and re-connected to it afterward, will likewise be exploited wherever utilities have resisted conventional generator interconnection but have conceded to UL-certified inverters (such as Consolidated Edison in New York and Pacific Gas and Electric Company in California). Because our InVerde systems operate independently from the grid, we also plan to exploit the need for outage security in certain market segments. These segments include military bases, hospitals, nursing homes, and hotels.

As noted above in “Industry Background,” the IEA report estimates that power from CHP produced by the Group of Eight + Five countries, currently at 10%, could increase to 24% under a best-case scenario. We hope to participate in a robust international market, which we believe will be as large as or larger than the domestic market.

Alliances

We continue to forge alliances with utilities, government agencies, universities, research facilities, and manufacturers. We have already succeeded in developing new technologies and products with several entities, including:

| |

• | General Motors Company — supplier of raw materials pursuant to a supplier agreement since the development of our cogeneration product in the early 1960s. |

| |

• | Sacramento Municipal Utility District — has provided test sites for the Company since 2010. |

| |

• | Southern California Gas Company and San Diego Gas & Electric Company, each a Sempra Energy subsidiary — have granted us research and development contracts since 2004. |

| |

• | Lawrence Berkeley National Laboratory — research and development contracts since 2005. |

| |

• | Consortium for Electric Reliability Technology Solutions — research and development contracts and provided a test site to the Company since 2005. |

| |

• | California Energy Commission — research and development contracts from 2004 until March 2013. |

| |

• | The AVL California Technology Center — support role in performance of research and development contracts as well as internal research and development on our emission control system from August 2009 to November 2011. |

We also have an exclusive licensing agreement from the Wisconsin Alumni Research Foundation (WARF) for its proprietary control software that enables our microgrid system. The software allows our products to be integrated as a microgrid, where multiple InVerde units can be seamlessly isolated from the main utility grid in the event of an outage and re-connected to it afterward. The licensed software allows us to implement such a microgrid with minimal control devices and associated complexity and cost. Tecogen pays WARF a royalty for each cogeneration module sold using the licensed technology. Such royalty payments have been in the range of $5,000 to $20,000 on an annual basis through the year ended December 31, 2013. In addition, WARF reserved the right to grant non-profit research institutions and governmental agencies non-exclusive licenses to practice and use, for non-commercial research purposes technology developed by Tecogen that is based on the licensed software.

Our efforts to forge partnerships continue to focus on utilities, particularly to promote the InVerde, our most utility-friendly product. The nature of these alliances varies by utility, but could include simplified interconnection, joint marketing, ownership options, peak demand mitigation agreements, and customer services. We have commissioned a microgrid with the Sacramento Municipal Utility District at its headquarters in Sacramento, California, where the central plant incorporated three InVerde systems equipped with our Ultra low-emissions technology. Some expenses for this project were reimbursed to the utility through a grant from the California Energy Commission.

Certain components of our InVerde product were developed through a grant from the California Energy Commission. This grant includes a requirement that we pay royalties on all sales of all products related to the grant. As of December 31, 2012, such royalties accrued in accordance with this grant agreement were less than $10,000 on an annual basis.

We also continue to leverage our resources with government and industry funding, which has yielded a number of successful developments. These include the Ultra low-emissions technology, sponsored by the California Energy Commission and Southern California Gas Company, and new 35-kW engine technology we developed with the California Energy Commission’s support.

Pursuant to the terms of the grants from the California Energy Commission, the California Energy Commission has a royalty-free, perpetual, non-exclusive license to these technologies, for government purposes.

For the years ended December 31, 2013 and 2012, we spent approximately $866,700 and $384,500, respectively, in research and development activities, of which $127,500 and $126,500, was reimbursed through a grant agreement, respectively.

Tecogen’s Solution

Our CHP products address the inherent efficiency limitation of central power plants by siting generation close to the loads being served. This allows customers with energy-intensive buildings or processes to reduce energy costs and operate with a lower carbon footprint. Furthermore, with technology we have introduced within the last two years, such as our Ultra low-emissions technology our products can now contribute to better air quality at the local level.

According to our estimates and public sources, our cogeneration systems convert nearly 90% of the natural gas fuel to useful energy in the form of electricity and hot water or space heat. This compares to about 40% for central power. Other on-site upgrades such as insulation or lighting can help cut energy use as well, but they do not displace nearly as much low-efficiency electricity. Our engine-driven chillers, when the waste heat is effectively used, offer similar efficiency benefits compared with running an electric chiller plus a furnace or boiler.

Cogeneration and chiller products can often reduce the customer’s operating costs (for the portion of the facility loads to which they are applied) by approximately 30% to 50% based on Company estimates, which provides an excellent rate of return on the equipment’s capital cost in many areas of the country with high electricity rates. Our chillers are especially suited to regions where utilities impose extra charges during times of peak usage, commonly called “demand” charges. In these cases, the gas-fueled chiller reduces the use of electricity during the summer, the most costly time of year.

Our water heater product, introduced by Ilios, operates like an electric heat pump but uses a natural gas engine instead of an electric motor to power the system (see “Our Products” for an explanation of the heat pump). The gas engine’s waste heat is recovered and used in the process, unlike its electric counterpart, which runs on power that has already lost its waste heat. As of December 31, 2013 , we have shipped eight Ilios water heaters and have additional two in inventory to fulfill current orders.

The net effect is that our heat pump’s efficiency far surpasses that of conventional boilers for water heating. Similarly, if used for space heating, the engine-powered heat pump would be more efficient than an electric heat pump, again because heat is recovered and used. The product’s higher efficiency translates directly to lower fuel consumption and, for heavy use customers, significantly lower operating costs.

Our products also address the global objective of reducing greenhouse gas emissions. When burned to generate power, natural gas produces lower carbon emissions per unit of energy than any fossil fuel (Table 2), according to the EPA combined heat and power emissions calculator.

Table 2 — Fossil Fuel Carbon Emissions

Source: EPA Emissions Calculator

|

| | |

| |

Fuel | CO2 emissions, lbs/million Btu |

Natural Gas | 116.7 |

|

Distillate Oil | 160.9 |

|

Coal | 206.7 |

|

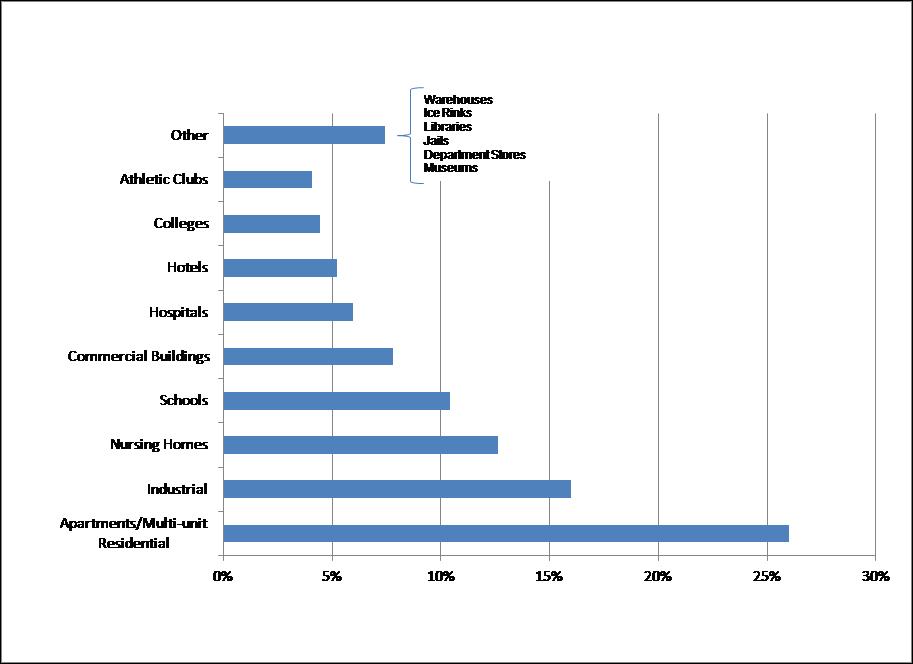

Our products, in addition to using the lowest amount of carbon fuel, further reduce CO2 emissions (greenhouse gases) because of CHP’s higher efficiency. Figure 3 compares the CO2 output of our products to that of the national electric grid and other generation technologies. Our products are far superior to the grid and even outperform the CHP technologies of fuel cells and microturbines.

Figure 3 — Comparison of Carbon Emissions (GHG) for Various Sources

Including Tecogen’s CHP and Chiller Products

Source: Tecogen Inc.

| |

(1) | Average U.S. Powerplant CO2 emission rate of 1,293 (lb/MWh) from USEPA eGrid 2010. |

| |

(2) | Coal Combined Cycle emissions based upon 50% efficiency (assumed to be the same as Natural Gas) and coal CO2 emission rate from EPA website. |

| |

(3) | “Best in Class” Natural Gas combined cycle plant emissions based upon 50% efficiency. (Northwest Power Planning Council “Natural Gas Combined-cycle Gas Turbine Power Plants, August 2002). |

| |

(4) | Fuel Cell and Microturbine emissions based upon data listed in the ICF International Combined Heat and Power Market Assessment, April 2010. |

Furthermore, one Tecogen 100-kW CHP unit will reduce carbon emissions by 390 tons per year (based on 8,000 run-hours), which, according to the EPA website’s calculator, is the equivalent of 64 cars on the road. A microturbine of the same size would reduce carbon emissions by only 245 tons per year, the equivalent of 41 cars, which is less than two-thirds the emissions reduction of our CHP product. Our Ilios water heater also reduces CO2 emissions in proportion to its fuel savings.

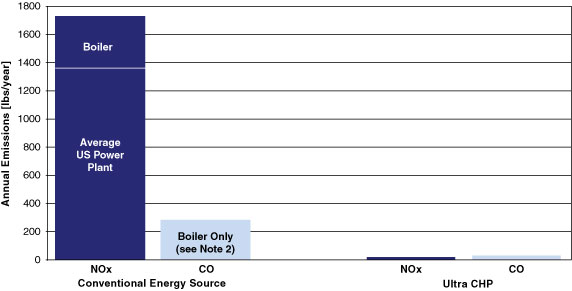

In addition to reducing greenhouse gases, our products with Ultra low-emission controls can improve air quality by reducing such pollutants as NOx and CO. Figure 4 presents the annual output of emissions of the InVerde unit equipped with the Ultra technology and compares it to alternative energy technologies producing the equivalent energy output on an annual basis (100 kW, 670,000 Btu/hr). Thus, for example, in lieu of an InVerde, a building would obtain electricity from a power plant and heat energy from a boiler. As Figure 4 shows, the Ultra CHP system’s emissions are significantly less than the combined emissions of the power plant and boiler for the same energy output.

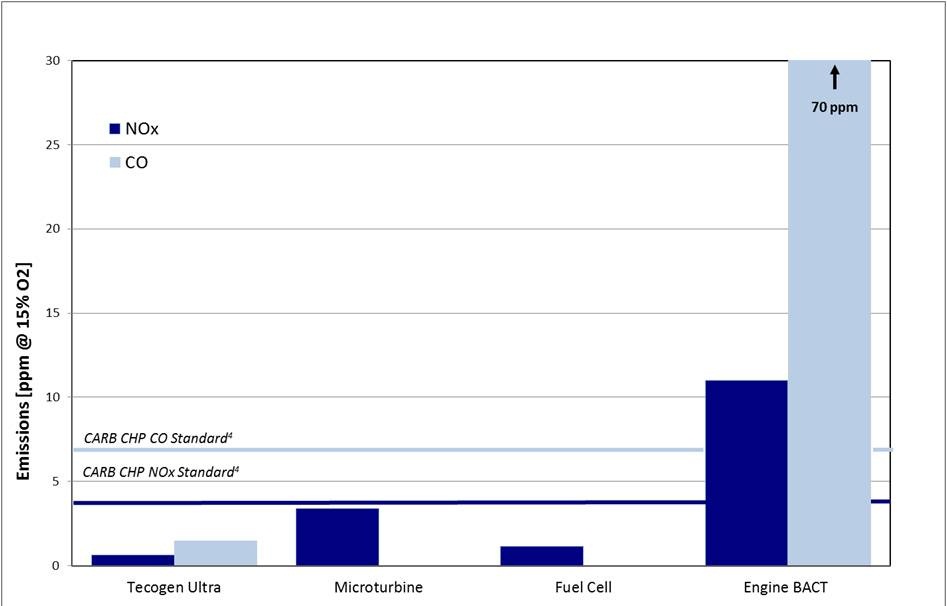

Figure 5 presents the criteria pollutant levels of the Ultra system versus alternative CHP sources of microturbines, fuel cells, and conventional reciprocating engines. Microturbines and fuel cells, newer CHP technologies typically considered low-emission alternatives to engines, produce more NOx than an Ultra engine CHP unit. Moreover, when compared to a conventional engine’s “best available control technology” (BACT) as defined by the EPA for natural gas engines, both NOx and CO are reduced by nearly tenfold. Consequently, the Ultra low-emissions technology is potentially transformative to the engine’s reputation in the energy marketplace, allowing it to now be characterized as a source of clean power.

Figure 4 — Comparison of Emissions Levels of Tecogen’s Ultra Low-Emissions Technology to Conventional Energy Sources (Based on 6,000 hrs/year of operation at 100 kW and 670,000 Btu/hr)

Source: Tecogen Inc.

| |

(1) | Based upon an annual output of 100 kW and 670,000 Btu/hr of hot water. |

| |

(2) | Average U.S. powerplant NOx emission rate of 1.7717 lb/MWh from (USEPA eGrid 2010), CO data not available. |

| |

(3) | Gas boiler efficiency of 78% (www.eia.gov) with emissions of 20 ppm NOx @ 3% O2 (California Regulation SCAQMD Rule 1146.2) and 50 ppmvCO @ 3% O2 (California Regulation SCAQMD BACT). |

Figure 5 — Comparison of Tecogen Ultra Low-Emissions Technology to Other Technologies

Source: Tecogen Inc.

| |

(1) | Tecogen emissions based upon actual third party source test data. |

| |

(2) | Microturbine and Fuel Cell NOx data from California Energy Commission, Combined Heat and Power Market Assessment 2010, by ICF international. |

| |

(3) | Stationary engine BACT as defined by SCAQMD. |

| |

(4) | Limits represent CARB 2007 emission standard for Distributed Generation with a 60% (HHV) Overall Efficiency credit. |

| |

(5) | CO data not available for microturbine and fuel cell. |

Our Products

We manufacture natural gas engine-driven cogeneration systems and chillers, all of which are CHP products that deliver more than one form of energy. We have simplified CHP technology for inexperienced customers. Our cogeneration products are all standard, modular units that come pre-packaged from the factory. They include everything the customer needs to minimize the cost and complexity of installing the equipment at a site. The package incorporates the engine, generator, heat-recovery equipment, system controls, electrical switchgear, emission controls, and modem for remote monitoring and data logging.

All of our cogeneration systems and most of our chillers use the same engine, the TecoDrive 7400 model supplied by GM and modified by us to use natural gas fuel. The small 25-ton chiller uses a similar GM engine, the 3000 model. We worked closely with GM and the gas industry (including the Gas Research Institute) in the 1980s and 1990s to modify the engine and validate its durability. For the Ilios water heater, we introduced a more modern Ford engine that is enhanced for industrial applications. As of December 31, 2013, we have shipped eight Ilios water heaters and have an additional two in inventory to fulfill current orders.

Our commercial product line includes:

| |

• | The InVerde® and TECOGEN® cogeneration units; |

| |

• | Ilios high-efficiency water heaters; and |

| |

• | Ultra low-emissions technology. |

InVerde Cogeneration Units

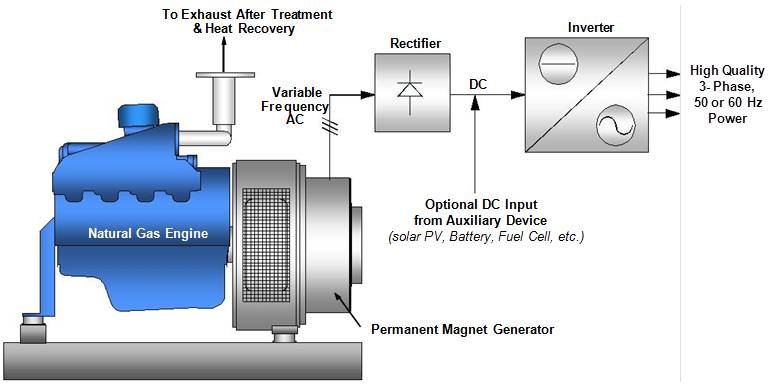

Our premier cogeneration product is the InVerde, a 100-kW CHP system that not only provides electricity and hot water, but also satisfies the growing customer demand for operation during a utility outage, commonly referred to as “black-start” capability. The InVerde incorporates an inverter, which converts direct current, or DC, electricity to alternating current, or AC. With an inverter, the engine and generator can run at variable speeds, which maximize efficiency at varying loads. The inverter then converts the generator’s variable output to the constant-frequency power required by customers (50 or 60 Hertz), as shown in Figure 6.

This inverter technology was developed originally for solar and wind power generation. The company believes that the InVerde is the first commercial engine-based CHP system to use an inverter. Electric utilities accept inverter technology as “safe” by virtue of its certification to the Underwriters Laboratory interconnection standard (1741) — a status that the InVerde has acquired. This qualifies our product for a much simpler permitting process nationwide and is mandatory in some areas such as New York City and California. The inverter also improves the CHP system’s efficiency at partial load, when less heat and power are needed by the customer.

The InVerde`s black-start feature addresses a crucial demand from commercial and institutional customers who are increasingly concerned about utility grid blackouts and brownouts, natural disasters, security threats, and antiquated utility infrastructure. Multiple InVerde units can operate collectively as a standalone microgrid, which is a group of interconnected loads served by one or more power sources. The InVerde is equipped with software that allows a cluster of units to seamlessly share the microgrid load without complex controls.

The InVerde CHP system was developed in 2007, and we began shipping it in 2008. Our largest InVerde installation utilizes 12 units, which supply 1.2 MW of on-site power and about 8.5 million Btu/hr of heat (700,000 Btu/hr per unit).

Figure 6 — Diagram of InVerde CHP System

Source: Tecogen Inc.

TECOGEN Cogeneration Units

The TECOGEN cogeneration system is the original model introduced in the 1980s, which is available in sizes of 60 kW and 75 kW, producing up to 500,000 Btu/hr of hot water. This technology is based on a conventional single-speed generator. It is meant only for grid-connected operation and is not universally accepted by utilities for interconnection, in contrast to the InVerde. Although this cogeneration product has the longest legacy and largest population, much of its production volume has been supplanted by the InVerde.

TECOCHILL Chillers

Our TECOCHILL natural gas engine-driven chillers are available in capacities ranging from 25 to 400 tons, with the smaller units air-cooled and the larger ones water-cooled. This technology was developed in 1987. The engine drives a compressor that makes chilled water, while the engine’s free waste heat can be recovered to satisfy the building’s needs for hot water or heat. This process is sometimes referred to as “mechanical” cogeneration, as it generates no electrical power, and the equipment does not have to be connected to the utility grid.

A gas-fueled chiller provides enough air conditioning to avoid most of the utility’s seasonal peak charges for electric usage and capacity. In summer when electric rates are at their highest, natural gas is “off-peak” and quite affordable. Gas-fueled chillers also free up the building’s existing electrical capacity to use for other loads.

Ilios High-Efficiency Water Heaters

Our newest product, the Ilios high-efficiency water heater, uses a heat pump, which captures warmth from outdoor air even if it is moderately cool outside. Heat pumps work somewhat like a refrigerator, but in reverse. Refrigerators extract heat from inside the refrigerator and move it outside the refrigerator. Heat pumps extract heat from outside and move it indoors. In both cases, fluids move the heat around by flowing through heat exchangers. At various points the fluids are compressed or expanded, which absorbs or releases heat.

In the Ilios water heater, the heat pump moves heat from outdoors to the water being heated in the customer’s building. The heat pump water heater serves as a boiler, producing hot water for drinking and washing or for space heating, swimming pools, or other building loads. Energy cost savings to the customer depend on the climate. Heat pumps in general (whether gas or electric) perform best in moderate weather conditions.

In a conventional electric heat pump, the compressor is driven by an electric motor. In the Ilios design, a natural gas-fueled engine drives the compressor. This means that the heat being captured from outdoors is supplemented by the engine’s waste heat, which increases the efficiency of the process. According to scientific studies, gas engine heat pumps can deliver efficiencies in excess of 200%.

Ultra Low-Emissions Technology

All of our CHP products are available with the Ultra low-emissions technology. This breakthrough technology was developed in 2009 and 2010 as part of a research effort funded by the California Energy Commission and Southern California Gas Company. The objective was to bring our emission control systems into compliance with California’s standards, which are the most stringent in the United States.

We were able to meet or exceed the standards with an emission control system that is cost-effective, robust, and reliable. The Ultra low-emissions technology keeps our CHP systems compliant with air quality regulations over the long term. Given the proprietary nature of this work, we obtained a patent in the United States and have filed patents that are pending in Europe, Australia, Brazil, Canada, China, Costa Rica, the Dominican Republic, India, Israel, Japan, Mexico, New Zealand, Nicaragua, Republic of Korea, Singapore, and South Africa. We shipped the first commercial CHP units equipped with Ultra low-emissions technology to a California utility in 2011.

We conducted three validation programs for this technology:

|

| |

1. | Third-party laboratory verification. The AVL California Technology Center, a long-standing research and technology partner with the international automotive industry, confirmed our results in their state-of-the-art dynamometer test cell, which was outfitted with sophisticated emissions measurement equipment. |

|

| |

2. | Verifying longevity and reliability in the field. We did so by equipping one of our TECOGEN 75-kW units, already operating at a customer location in Southern California, with the Ultra low-emissions technology and a device to monitor emissions continuously. To date, the Ultra low-emissions system has operated successfully for more than 25,000 hours (approximately 3 1/2 years) and has consistently complied with California’s emission standards. This field test is ongoing. |

|

| |

3. | Additional independent tests. During the field test, two companies licensed in California to test emissions each verified our results at different times. The results from one of these tests (obtained in August 2011) enabled us to qualify for New Jersey’s fast-track permitting. Virtually every state nationwide requires some kind of permit related to local air quality, but New Jersey allows an exemption for systems such as ours that demonstrate superior emissions performance. This certification was granted in November 2011, and since then we have sold Ultra low-emissions systems to several customers. |

In 2012, a 75 kW CHP unit equipped with the Ultra system became our first unit to obtain a conditional air permit (i.e. pending a third party source test to verify compliance) in Southern California since the strict regulations went into place in 2009. A state-certified source test, administered in January 2013, verified that our emissions levels were well below the new permitting requirements, and the final permit version was approved in August 2013. To date, we have shipped over fifty units fitted with the Ultra system to sites in the Northeast, as well as California.

Contributions to Revenue

The following table summarizes net revenue by product line and services for the years ended December 31, 2013 and 2012:

|

| | | | | | | |

| December 31, 2013 | | December 31, 2012 |

Products: | |

| | |

|

Cogeneration | $ | 5,199,649 |

| | $ | 5,791,412 |

|

Chiller | 1,146,401 |

| | 1,661,810 |

|

Total Product Revenue | 6,346,050 |

| | 7,453,222 |

|

Services | 7,071,388 |

| | 7,089,491 |

|

Installations | 2,432,431 |

| | 711,259 |

|

Total Service Revenue | 9,503,819 |

| | 7,800,750 |

|

Total Revenue | $ | 15,849,869 |

| | $ | 15,253,972 |

|

All of the Company’s long lived assets reside in the United States of America. All of the Company’s revenue is generated in the United States of America.

Segments

The Company’s operations are comprised of one business segment. Our business is to manufacture and support highly efficient CHP products based on engines fueled by natural gas.

Product Reliability

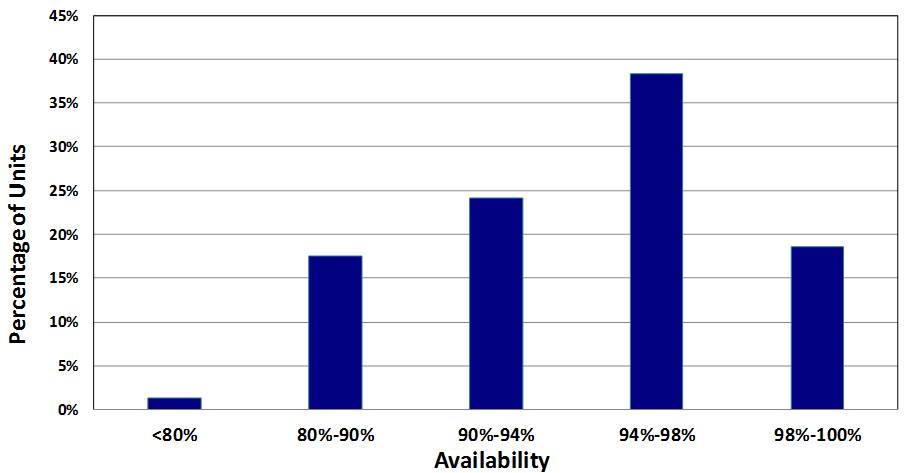

Our product lines have a long history of reliable operation. Since 1995, we have had a remote monitoring system in place that connects to hundreds of units daily and reports their “availability,” which is the amount of time a unit is running or is ready to run (% of hours). Figure 7 shows cumulative data for an installed base of 340 units. More than 80% of them operate above 90% availability, with the average being 93.8%. By comparison, the average availability for all fossil-fueled power plants in the United States was 87.5% during 2006 – 2010, according to a report by the North American Electric Reliability Corporation.

Figure 7 — Tecogen Product Reliability

Source: Tecogen Inc. – January 2014

Product Service

We provide long-term maintenance contracts, parts sales, and turnkey installation through a network of eight well-established field service centers in California, the Midwest, and the Northeast. These centers are staffed by full-time Tecogen technicians, working from local leased facilities. The facilities provide offices and warehouse space for inventory. We encourage our customers to provide Internet or phone connections to our units so that we can maintain communications, in which case we contact the machines daily, download their status, and provide regular operational reports (daily, monthly, and quarterly) to our service managers. This communication link is used to support the diagnosis effort of our service staff and to send messages to preprogrammed phones that a unit has experienced an unscheduled shutdown.

Our service managers, supervisors, and technicians work exclusively on our products. Because we manufacture our own equipment, our service technicians bring hands-on experience and competence to their jobs. They are trained at our manufacturing facility in Waltham, Massachusetts.

Most of our service revenue is in the form of annual service contracts, which are typically of an all-inclusive “bumper-to-bumper” type, with billing amounts proportional to achieved operating hours for the period. Customers are thus invoiced in level, predictable amounts without unforeseen add-ons for such items as unscheduled repairs or engine replacements. We strive to maintain these contracts for many years, so that the integrity and performance of the machine are maintained. Between 2007 and 2012, approximately 68% of customers signed service contracts.

R&D Capabilities

Our research and development tradition and ongoing programs have allowed us to cultivate deep engineering expertise and maintain continuity over several decades. We have strong core technical knowledge that is critical to product support and enhancements. Our TecoDrive engine, cogeneration and chiller products, InVerde, and most recently the InVerde Ultra and Ilios heat pump water heater were all created and optimized with both public and private funding support.

In March 2013, we successfully completed a $1 million program with the California Energy Commission, which was awarded in 2009, to develop a small CHP engine (about 35 kW) that uses advanced automotive technology. The engine achieves a nearly 20% fuel efficiency gain over our current TecoDrive technology. The program included an endurance test to qualify the engine for the CHP duty cycle. Final development work to transition to the 2012 model year advanced engine will occur in 2013 with rollout on the Ilios water heating product in late 2014. In 2015, we plan to develop a smaller InVerde unit (~35 kW) around this engine platform.

In October 2012, Tecogen was awarded a contract for a demonstration project to retrofit a natural-gas powered municipal water pump engine with Tecogen’s proprietary Ultra low-emissions technology. This project, co-sponsored by Southern California Gas Co. (SoCalGas), DE Solutions, and the Eastern Municipal Water District (EMWD) will be the first application of Tecogen’s emission control technology on a non-Tecogen engine, and an important proof of concept for its wider application. This system was commissioned in September 2013.

Tecogen also continues to support a contract with the DOE’s Lawrence Berkeley National Laboratory, awarded in 2012, for microgrid development work related to the InVerde.

Distribution Methods

Our products are sold directly to end-users by our sales team and by established sales agents and representatives. Various agreements are in place with distributors and outside sales representatives, who are compensated by commissions, including American DG Energy and EuroSite Power which are affiliated companies, for certain territories and product lines. For example, we have sales representatives for the chiller market in the New York City/New Jersey territory, but we do not have a sales representative for our cogeneration products in this territory. In New England, our affiliate, American DG Energy, has exclusive sales representation rights to our cogeneration products only (not including chillers). Sales through our in-house team or sales that are not covered by a representative’s territory carry no commission or only a fractional one.

Summary of our Products’ Advantages

| |

• | Our CHP products provide an efficient on-site solution to power generation as the market seeks cost savings and clean alternatives to centralized grid power. |

| |

• | Our CHP products are all standard, modular units that come pre-packaged from the factory to simplify installation and grid connection. The systems are supported in the field by a nationwide network of experienced professional staff. Standardized CHP units, as opposed to custom-designed systems, achieve lower cost, better quality control, higher reliability, and easier service. Emission controls are integrated, and complete system warranty and maintenance are available. |

| |

• | Our Ultra low-emissions technology eliminates the air quality concerns associated with engines. Our units comply with the most rigorous air quality regulations, including California’s. |

| |

• | Our cogeneration systems and chillers use standard, well-proven equipment made by reputable, well-established manufacturers. These components include rugged automotive engines, certified inverters, commercial generators, and conventional compressors. Certain key components are proprietary and have patent protection. Most notably, all control software is either proprietary (and copyright protected) or under an exclusive license agreement. Suppliers of the InVerde `s inverter and generator hold certain related patent protection. |

| |

• | All of our CHP products can be designed for installation of multiple units at a single site, depending on the customer’s particular needs. This enhances the ability of our products to meet the building’s varying demand for electricity, heat, and/or air conditioning throughout the day and from season to season. Also, multiple units operate more efficiently throughout the range of a customer’s high and low energy requirements. |

| |

• | Our InVerde product is opening new market opportunities and expanding our reach to customers beyond our traditional market segments. The InVerde`s black-start feature addresses a crucial demand from customers concerned about utility blackouts and brownouts, natural disasters, security threats, and antiquated grid infrastructure. The InVerde also provides premium-quality power, which is required by operators of computer server farms and precision instrumentation, for example. |

| |

• | The InVerde overcomes barriers related to grid interconnection, since the product is UL-certified as utility-safe. In microgrids, InVerde units can help prevent brownouts by maximizing their power output when utilities approach peak capacity. Unlike standby diesel generators, the InVerde can operate without hourly limits because its emissions are so low, and it can serve as a stable anchor in hybrid microgrids that incorporate solar power. |

| |

• | Our extensive use of standardized components lets us manufacture CHP products at competitive prices, even at relatively low production volumes. Proven, well-understood hardware increases the reliability and durability of the equipment and reduces the cost of servicing in the field. We are also able to minimize spare parts inventories and simplify training requirements. |

| |

• | The Ilios heat pump water heater roughly doubles the efficiency of conventional water heating systems. The Ilios heat pump targets a large international market that is characterized by heavy, year-round use. This will increase fuel savings and maximize return on investment for the customer. Also, such applications are mostly central heating and cooling systems, rather than units distributed throughout the building, so it is easier to integrate new equipment. The heat pump water heater product competes only against other gas-fueled water heaters, which could expand our market beyond areas with high electric rates, and regulatory issues should be minimal. |

Competitive Position and Business Conditions

Our products fall into the broad market category of distributed generation systems that produce electric power on-site to mitigate the drawbacks of traditional central power and the low efficiency of conventional heating processes.

Renewable power sources, such as wind and solar, do not improve heating inefficiencies as CHP systems do, so they do not compete with our products. That is, CHP utilization is based on the redirection of fuel froman onsite boiler to an engine (or other device) for the production of electricity; the waste heat from the engine meets the heating load of the site with only a small incremental fuel consumption increase, but with the benefit of a significant amount of electricity production. As the boiler output cannot be displaced by renewable electricity production — the output of which is far more valuable displacing utility electric power, than used for water heating — the CHP opportunity remains available even in sites fully exploited relative to their renewable potential.

Cogeneration Systems

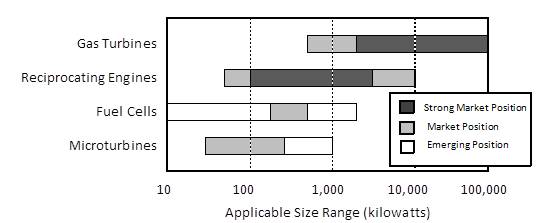

The ICF report breaks down the CHP market by technology as provided in Figure 8 below. We believe the California data applies to the domestic and international CHP market as a whole.

Figure 8 — Technology Size and Market Position

Source: ICF International, Combined Heat and Power Market Assessment (2010) (Data from 2004)

Our CHP products use automotive reciprocating engines originally designed for gasoline fuel and modified to run on natural gas. Diesel-fueled reciprocating engines will remain prominent in the CHP market, but only in larger, custom-designed systems (one MW or more), so these products do not compete with ours.

In smaller CHP sizes, competitors have duplicated our older design, coupling an automotive engine to a single-speed generator and adding controls and heat recovery. To be competitive with our designs, however, they would have to acquire comparable experience in the equipment and technology, installation contracting, maintenance and operation, economic evaluation of candidate sites, project financing, and energy sales, as well as the ability to cover broad regions. They would also have to meet the price of our products, which is low because we use standardized components.

We believe that no other company has developed a product that competes with our inverter-based InVerde, which offers UL-certified grid connection, outage capability, and variable-speed operation. We anticipate that an inverter-based product with at least some of these features will be introduced by others, but we believe that they will face serious challenges in duplicating the InVerde. Product development time and costs would be significant, and we expect that our patents and license for microgrid software will keep others from offering certain important functions.

Our patent application relating to the Ultra low-emissions technology was issued by the U.S. PTO in October 2013. We expect that this will make the development of alternative technologies by competitors difficult. If this is the case, we could retain a strong competitive advantage for all our products in markets where severe emissions limits are imposed or where very clean power is favored, such as New Jersey, California, and Massachusetts.

Newer technologies, such as fuel cells and microturbines, pose limited competition to our CHP products. ICF International’s 2010 CHP market assessment provides a comparison of the various small CHP technologies (50 – 500 kW), and a summary of this study is presented in Table 3. As shown, reciprocating engine CHP enjoys an economic advantage, as it has just over one-third the installed cost of a fuel cell and costs 20% less than a microturbine. With regard to operation and maintenance (O&M) costs, engine O&M costs are slightly less than those of microturbines, and just over half those of fuel cells. Although fuel cells have the highest electric efficiency (36%), they also have the lowest thermal output, so often fuel cells cannot recover enough heat to serve building loads effectively. Microturbines also recover less heat than engine CHP and have a lower electric efficiency. As a result, typical reciprocating engine CHP has the most favorable overall efficiency, at 79%, compared to 72% for microturbines and 67% for fuel cells.

With regard to pollutant emissions, Figure 5, above, compares all three technologies, along with the Tecogen engine CHP equipped with the Ultra technology. This figure illustrates that although fuel cells and microturbines are cleaner than conventional engine CHP (i.e., BACT), an engine equipped with Ultra technology now has comparable emissions to these other two technologies.

In the growing microgrid segment, neither fuel cells nor microturbines can respond to changing energy loads when the system is disconnected from the utility grid. Engines inherently have a fast dynamic response to step load changes, which is why they are the primary choice for emergency generators. Fuel cells and microturbines would require an additional energy storage device to be utilized in off-grid operation.

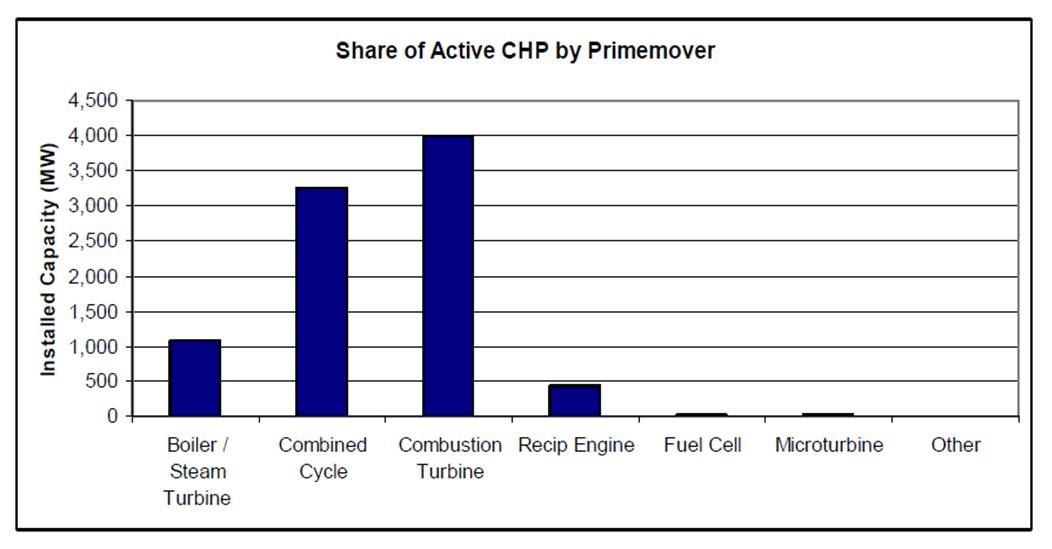

Most manufacturers of microturbines have refocused on other markets. We believe that Capstone Turbine Corporation is the only microturbine manufacturer with a commercial presence in CHP. Figure 9 reveals the modest impact of both microturbines and fuel cells in California’s CHP space.

Table 3 — Comparison of CHP Technologies

Source: ICF International, Combined Heat and Power Market Assessment (2010)

|

| | | | | | |

| | Microturbine 50 – 500 kW | | Fuel Cell 50 – 500 kW | | Generic Engine 100 kW |

Installed Costs, $/kW | | 2,739 | | 6,310 | | 2,210 |

O&M Costs, $/kWh | | 0.022 | | 0.038 | | 0.020 |

Electric Efficiency, % | | 25.2% | | 36.0% | | 28.4% |

Thermal Output, Btu/kWh | | 6,277 | | 2,923 | | 6,100 |

Overall Efficiency, % | | 72% | | 67% | | 79% |

Figure 9 — Share of Installed CHP by Prime Mover in California

Source: ICF International Combined Heat and Power Market Assessment (2010) — (Data from 2008)

Engine Driven Chillers (TECOCHILL)

According to the Energy Solutions Center (a non-profit consortium), three companies make gas-engine-driven chillers that compete with our products: Trane, a division of Ingersoll-Rand plc, York, a division of Johnson Controls, Inc. and Alturdyne. Natural gas can also fuel absorption chillers, which use fluids to transfer heat without an engine drive.

Today’s low natural gas prices in the United States improve the economics of gas-fueled chillers, so more competition could emerge. However, engine chillers will continue to have an efficiency advantage over absorption machines. Chiller performance is measured in terms of cooling energy output per unit of fuel input. This industry standard is called the coefficient of performance, or COP. Absorption chillers achieve COPs of about 1.2 (see, for example, The Chartered Institution of Building Services Engineers’ Datasheet 07, Absorption Cooling, February 2012). Our TECOCHILL products reach efficiencies well above that level (COPs ranging from 1.6 to 2.6).

Ilios Engine-Driven Heat Pump

Although a few companies manufacture gas-engine heat pumps, their products are not directly comparable to the Ilios. The Ilios water heater and other heat pump products compete in both the high-efficiency water heating market and the CHP market. In a typical building, the Ilios heat pump would be added on to an existing heating/water heating system, but would be operated as many hours as possible. The conventional boiler would be left in place, but would serve mainly as a backup when the heat pump’s engine is down for maintenance or when the heat pump cannot meet the building’s peak heating load.

The best customers for the Ilios heat pump water heater would be very similar to those for traditional CHP — heavy consumers of hot water and process heat. In areas where low electric rates make CHP not economical, the Ilios heat pump could be a financially attractive alternative because its economics depend only on natural gas rates. In some areas with high electric rates, the Ilios option could have advantages over CHP. For example, where it is hard to connect to the utility grid or where the building’s need for electricity is too low for CHP to work economically. As of December 31, 2013, we have shipped eight Ilios water heaters and have an additional two in inventory to fulfill current orders.

Intellectual Property

We currently hold three United States patents for our technologies:

| |

• | 8,578,704: “Assembly and method for reducing nitrogen oxides, carbon monoxide, and hydrocarbons in exhausts of internal combustion engines.” This patent, granted in November 2013, is for the Ultra emission system applicable to all our products. |

| |

• | 7,239,034: “Engine driven power inverter system with cogeneration”. This patent, granted in July 2007, pertains to the utilization of an engine-driven CHP module combined with an inverter and applies to our InVerde product specifically. |

| |

• | 7,243,017: “Method for controlling internal combustion engine emissions”. This patent, granted in July 2007, applies to the specific algorithms used in our engine controller for metering the fuel usage to obtain the correct combustion mixture. It applies to most of our engines. |

In addition, we have licensed specific rights to microgrid algorithms developed by University of Wisconsin researchers for which we pay royalties to the assignee, The Wisconsin Alumni Research Foundation (WARF). The specific patent named in our agreement is “Control of small distributed energy resources” (7,116,010), granted in 2006. Our specific rights are valid for engine-driven systems utilizing natural gas or diesel fuel in the application of power generation where the per unit output is less than 500 kW.

We consider our patents and license to be important in the present operation of our business. The expiration, termination, or invalidity of one or more of these patents may have a material adverse effect on our business. Our earliest patent, that licensed from WARF, was issued in 2006 and expires in 2022. Most of our patents expire between 2022 and 2027.

We believe that no other company has developed a product that competes with our inverter-based InVerde. We anticipate that an inverter-based product with at least some of these features will be introduced by others, but we believe that competitors will face serious challenges in duplicating the InVerde. Product development time and costs would likely be significant, and we expect that our patent for the inverter-based CHP system (7,239,034) would offer significant protection, especially in key features. Likewise, we consider the microgrid license with WARF to be a key feature of our InVerde product, and one that would be difficult to duplicate outside the patent.

The recent issuance by the U.S. PTO of the patent for the Ultra low-emissions technology keeps that technology exclusive to us. It applies to all of our gas engine-driven products and may have licensing applications to other natural gas engines. We have also filed for patents for this technology in Europe, Australia, Brazil, Canada, China, Costa Rica, the Dominican Republic, India, Israel, Japan, Mexico, New Zealand, Nicaragua, Republic of Korea, Singapore, and South Africa. There is no assurance, however, that the Ultra low-emissions patent applications will be approved in any other country.

Government Regulation and Its Effect on Our Business

Several kinds of government regulations affect our current and future business, such as:

| |

• | Product safety certifications and interconnection requirements; |

| |

• | Air pollution regulations, which govern the emissions allowed in engine exhaust; |

| |

• | State and federal incentives for CHP technology; and |

| |

• | Electric utility pricing and related regulations. |

Regulations that control air quality and greenhouse gases might increasingly favor our low-emission products. Regulations related to utility rates and interconnection, which are burdensome today, could evolve to embrace CHP because of its efficiency benefits.

Product Safety Certifications and Interconnection Requirements

Our products must comply with various local building codes and must undergo inspection by local authorities. Our products are also certified by a third party to conform to specific standards. These certifications require continuous verification by a company that monitors our processes and design every three months. Our InVerde product is also certified to Europe’s standard CE mark (European Conformity), which is mandatory for products imported into the European Union for commercial sale.

Our cogeneration CHP products are also certified to a particular group of standards specific to the distributed power industry, which are used in the utility interconnection permitting process. These unique certifications were developed by various manufacturers, utilities, and government regulators to standardize the process of getting the utility’s permission to jointly power a facility.

In essence, manufacturers of standard products are allowed to submit a sample unit to be “type-tested” by a Nationally Recognized Testing Laboratory. This test proves that the product adheres to safety requirements and that its design is fail-safe. The product then becomes eligible for a fast-track interconnection, after passing simple site-specific screens. Under state-mandated regulations, such as California Rule 21 and Massachusetts Interconnection Tariff 09-03, most utilities must accept the fast-track process, which includes the certification.

Simplified utility interconnection is important to CHP projects, so our interconnect certification, Underwriters Laboratory Standard 1741, or UL Certification, is a significant competitive advantage. Obtaining the UL Certification was a major reason for us to develop the inverter-based CHP product. As with our other product certifications, we plan to maintain the certification through routine processes when modest design changes occur. When complete recertification is required, such as when a new revision to the standard is applicable or when the design undergoes a major upgrade, the company will follow the normal procedures for first-time certification (third party design review and test verification). The company does not anticipate any changes to the standard that would preclude recertification, as the underlying content is carefully administered by balanced committees (representing utilities, inverter suppliers, and academia). In addition, the standard and its utilization as the criterion for systems to qualify for simplified interconnection programs, is important for the solar PV industry. The company believes that this importance to the solar industry will help assure the long-term relevance in interconnection of distributed generation devices.

Air Pollution Regulations

Stationary natural gas engines are subject to emissions regulations that are part of a complex hierarchy of state and federal regulations. The EPA establishes technology-specific standards that are based on cost-benefit analysis for emission control strategies. These standards, termed BACT (best available control technology), are imposed in regions that fail to meet federal clean air standards. Local regulators can and do restrict engine emissions to lower levels.

In some instances, regional standards in our key markets have become sufficiently strict, presenting a challenge in controlling pollution from natural gas engines. However, our development of the Ultra low-emissions technology has addressed this issue, allowing us to permit our equipment in the strictest region of Southern California. In January 2013, a state-certified source test at a new customer’s site verified that our emissions levels were well below the new permitting requirements. Since we have now successfully removed this barrier, we are not only competitive in the California market, but have an advantage as a cleaner CHP technology. Likewise, in the Northeast where emissions regulations are trending towards California levels, we have already established our Ultra CHP as a certified technology in New Jersey, exempt from the air permitting process and subsequent testing, a unique status that separates us from the competition.

On the East Coast, important CHP territories are also moving toward limits below federal BACT levels. Effective in 2012, Massachusetts, Rhode Island, and Connecticut require 3.6 ppm NOx and about 56 ppm CO, which is on par with California’s BACT standard. New Jersey also emulates California’s BACT, but allows the project to side-step the air permit process if the CHP device is “emissions certified” through third-party testing to 10 ppm NOx and 10 ppm CO. Our Ultra low-emissions technology has qualified for New Jersey’s “clean” certification, as noted earlier. In New York, clean power is encouraged through state grants that exclude products, or reduce the grant amount, unless low emissions are demonstrated.

Air emissions regulations also affect our air conditioning and Ilios heat pump products, though the effects are muted. TECOCHILL rebates are not common, and none has been tied to a specific emissions level. The heat pump’s small size often exempts it from regulations, and the market for heat pump products could lie in lightly regulated regions (those with low electric rates). Nevertheless, the Ultra low-emissions technology can be applied to these products if required to meet regulatory standards.

State and Federal Incentives

On August 30, 2012, the White House released an Executive Order to accelerate investments in industrial energy efficiency, including CHP. The goal of the Executive Order is to supply 40 GW of energy by 2020 from greater efficiency sources such as CHP systems. The DOE, Commerce, and Agriculture, and the Environmental Protection Agency, or EPA, in coordination with the National Economic Council, the Domestic Policy Council, the Council on Environmental Quality, and the Office of Science and Technology Policy, shall coordinate policies to encourage investment in industrial efficiency in order to

reduce costs for industrial users, improve U.S. competitiveness, create jobs, and reduce harmful air pollution. With this Executive Order, it is expected that barriers to CHP development will be removed with effective programs, policies, and financing opportunities, resulting in $40 – $80 billion in new capital investment in CHP. This initiative by the U.S. government may boost CHP awareness and stimulate market activity.

In addition, some states offer incentives to CHP systems. New York and New Jersey have incentive programs that rebate a significant portion of the CHP project cost. Similar incentive programs also exist in Massachusetts, Rhode Island, and Maryland albeit with different structures and terms. Massachusetts has an additional CHP incentive in the form of an annual rebate proportional to the carbon savings versus conventional technology.

Also our products installed before 2010 are eligible for the bonus depreciation included in the 2009 American Recovery and Reinvestment Act, and our products installed before January 1, 2014 are eligible for the bonus depreciation included in the 2012 American Taxpayer Relief Act. Also, the Energy Improvement and Extension Act of 2008 provides a 10% investment tax credit through 2016 for CHP in our size range, which applies to the total project cost. Our TECOCHILL and heat pump products also qualify for the credit when heat recovery achieves a minimum 60% efficiency.

Electric Utility Pricing and Related Regulations

Electricity prices, rate structures, and tariffs are another form of government incentive or disincentive. Utility pricing is administered through state agencies, typically public utility commissions, through formal proceedings involving the public, utilities, and various affected parties. Often, direct legislative mandates apply to specific issues. How these rules are structured and interpreted has a significant impact on the economic viability of CHP. These rules have hurt the CHP industry in the past, but we have designed our products to undermine their impact.