UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

| | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

|

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-36103

TECOGEN INC.

(Exact name of Registrant as specified in its charter)

|

| |

Delaware | 04-3536131 |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

|

| |

45 First Avenue | |

Waltham, Massachusetts | 02451 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (781) 466-6400

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

| |

Title of each class | Name of each exchange on which registered |

Common Stock, $.001 par value | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or an amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer o Accelerated filer o Non –accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes ¨ No ý

As of June 30, 2016, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates was: $54,992,061. Solely for purposes of this disclosure, shares of common stock held by executive officers and directors of the registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of executive officers and directors as affiliates is not necessarily a conclusive determination for any other purposes.

As of March 21, 2017, 20,043,052 shares of common stock, $.001 par value per share, of the registrant were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Part III of this Annual Report on Form 10-K is incorporated by reference to the Tecogen Inc. definitive proxy statement for its 2017 Annual Meeting of Stockholders, which shall be filed with the Securities and Exchange Commission pursuant to Regulation 14A of the Securities Exchange Act of 1934, as amended, within 120 days following the registrant’s fiscal year ended December 31, 2016.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

THIS ANNUAL REPORT ON FORM 10-K CONTAINS FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER FEDERAL SECURITIES LAWS. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, AND ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD-LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS.

WE GENERALLY IDENTIFY FORWARD-LOOKING STATEMENTS BY TERMINOLOGY SUCH AS “MAY,” “WILL,” “SHOULD,” “EXPECTS,” “PLANS,” “ANTICIPATES,” “COULD,” “INTENDS,” “TARGET,” “PROJECTS,” “CONTEMPLATES,” “BELIEVES,” “ESTIMATES,” “PREDICTS,” “POTENTIAL” OR “CONTINUE” OR THE NEGATIVE OF THESE TERMS OR OTHER SIMILAR WORDS. THESE STATEMENTS ARE ONLY PREDICTIONS. THE OUTCOME OF THE EVENTS DESCRIBED IN THESE FORWARD-LOOKING STATEMENTS, INCLUDING, WITHOUT LIMITATION, THE PROPOSED ACQUISITION OF AMERICAN DG ENERGY, INC. IS SUBJECT TO KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS THAT MAY CAUSE OUR, OUR CUSTOMERS’ OR OUR INDUSTRY’S ACTUAL RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS TO DIFFER.

THIS REPORT ALSO CONTAINS MARKET DATA RELATED TO OUR BUSINESS AND INDUSTRY. THESE MARKET DATA INCLUDE PROJECTIONS THAT ARE BASED ON A NUMBER OF ASSUMPTIONS. IF THESE ASSUMPTIONS TURN OUT TO BE INCORRECT, ACTUAL RESULTS MAY DIFFER FROM THE PROJECTIONS BASED ON THESE ASSUMPTIONS. AS A RESULT, OUR MARKETS MAY NOT GROW AT THE RATES PROJECTED BY THESE DATA, OR AT ALL. THE FAILURE OF THESE MARKETS TO GROW AT THESE PROJECTED RATES MAY HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION AND THE MARKET PRICE OF OUR COMMON STOCK.

SEE “ITEM 1A. RISK FACTORS,” “ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS” AND “ITEM 1. BUSINESS,” AS WELL AS OTHER SECTIONS IN THIS REPORT, THAT DISCUSS SOME OF THE FACTORS THAT COULD CONTRIBUTE TO THESE DIFFERENCES. THE FORWARD-LOOKING STATEMENTS MADE IN THIS ANNUAL REPORT ON FORM 10-K RELATE ONLY TO EVENTS AS OF THE DATE OF WHICH THE STATEMENTS ARE MADE. EXCEPT AS REQUIRED BY LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR RELEASE ANY FORWARD- LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

TABLE OF CONTENTS

|

| | |

|

| | |

Item 1A. | Risk Factors. | |

Item 1B. | Unresolved Staff Comments. | |

Item 2. | Properties. | |

Item 3. | Legal Proceedings. | |

Item 4. | Mine Safety Disclosures. | |

| | |

PART II |

| | |

Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |

Item 6. | Selected Financial Data. | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | |

Item 8. | Financial Statements and Supplementary Data. | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | |

Item 9A. | Controls and Procedures. | |

Item 9B. | Other Information. | |

| | |

PART III |

| | |

Item 10. | Directors, Executive Officers and Corporate Governance. | |

Item 11. | Executive Compensation. | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence. | |

Item 14. | Principal Accountant Fees and Services. | |

| | |

PART IV |

| | |

Item 15. | Exhibits and Financial Statement Schedules. | |

Item 16. | Form 10-K Summary. | |

| | |

SIGNATURES | | |

Item 1. Business

The Company

Tecogen® Inc. (“Tecogen,” the “Company,” “we,” “our,” or “us”) was incorporated in the State of Delaware on September 15, 2000. Our principal executive offices are located at 45 First Avenue, Waltham, Massachusetts 02451 and our telephone number is (781) 446-6400. The Company designs, manufactures, markets, and maintains high efficiency, ultra-clean cogeneration products including natural gas engine-driven combined heat and power, air conditioning systems, and water heaters for residential, commercial, recreational and industrial use. The Company is known for cost efficient, environmentally friendly and reliable products for distributed power generation that, through patented technology, nearly eliminate criteria pollutants and significantly reduce a customer’s carbon footprint.

The Company’s history dates to the early 1960s when it served as the Research and Development New Business Center of Thermo Electron Corporation, now Thermo Fisher Scientific Inc. For the next two decades, this group performed fundamental and applied research in many energy-related fields to develop new technologies. In 1982, the Research and Development group released its first major product, a 60-kilowatt (kW) cogenerator. In the late 1980s and early 1990s, air-conditioning and refrigeration products using the same gas engine-driven technology were introduced. In 1987, Tecogen was spun out as a separate entity by Thermo Electron and, in 1992, became a division of the newly formed Thermo Power Corporation. In 2000, Thermo Power Corporation was dissolved, and Tecogen was sold to a group of private investors including the Company's Co-CEO, John N. Hatsopoulos.

In 2009, Tecogen created a subsidiary, Ilios® Inc., a Delaware corporation (“Ilios”), to develop and distribute a line of high-efficiency heating products, starting with a water heater. We believe that these products are much more efficient than the conventional boilers traditionally used in commercial buildings and industrial processes (see “Our Products” below).

In December 2015, the Company entered into a joint venture agreement with a group of European strategic investors relating to the formation of Ultra Emissions Technologies Ltd. (“Ultra Emissions”), organized under the laws of the Island of Jersey, Channel Islands, a joint venture company. Ultra Emissions was organized to develop and commercialize Tecogen’s patented technology, Ultera®, for the automotive market. The technology is designed to reduce harmful emissions generated by engines using fossil fuels. Tecogen contributed an exclusive license for use of Ultera in the automotive space to the joint venture, and the strategic partners have committed to financing the initial research, development and testing of a viable product. See “Our Products - Ultera Low-Emissions Technology” below for a more in depth discussion of the Ultra emissions opportunity. Although Tecogen originally owned 50% of the joint venture, due to investment by outside investors, as of December 31, 2016, Tecogen’s ownership interest is 43%. See Note 13 to the Company’s Consolidated Financial Statements for the year ended December 31, 2016.

Recent Developments

In April 2016 pursuant to share exchange agreements, holders of the non-controlling interest in Ilios agreed to exchange every 7.86 of their restricted Ilios shares of common stock for 1 share of the Company's common stock. In addition, the Company granted each exchanging shareholder registration rights with respect to the Company's common stock such shareholder received in exchange for such shareholder's Ilios shares. Thereafter, the Company effected a statutory merger of Tecogen and Ilios. Ilios remains a brand name for our line of heat pump products.

In May 2016, Tecogen entered into a joint venture agreement, (the "JV Agreement") with Tedom a.s., a European combined heat and power product manufacturer incorporated in the Czech Republic ("Tedom") and Tedom’s subsidiary, Tedom USA, Inc., a Delaware corporation. Pursuant to the JV Agreement, the parties formed TTcogen LLC, a Delaware limited liability company (“TTcogen”), through which the joint venture is operated. TTcogen offers Tedom's line of Combined Heat and Power ("CHP") products to the United States via Tecogen's nationwide sales and service network consisting of 27 CHP modules ranging in size from 35 kW up to 4 MW and fully capable of running on a variety of fuel feedstocks (including natural gas, propane, and biofuel).

Proposed Acquisition of American DG Energy, Inc.

On November 1, 2016, Tecogen and Tecogen.ADGE Acquisition Corp., a Delaware corporation and wholly-owned subsidiary of Tecogen (“Merger Sub”) formed for the purpose of effecting the merger, entered into an Agreement and Plan of Merger (the “Merger Agreement”) with American DG Energy, Inc., a Delaware corporation (“ADGE”). Pursuant to the Merger Agreement, the Merger Sub will be merged with and into ADGE (the “Merger”), with ADGE continuing as the surviving company in the Merger. Following the Merger, ADGE will become a wholly-owned subsidiary of Tecogen. The Merger Agreement sets forth the terms and conditions of the proposed acquisition of ADGE.

Subject to the terms and conditions set forth in the Merger Agreement, at the effective time of the Merger, each share of ADGE common stock, $.001 par value per share, issued and outstanding immediately prior to the effective time of the Merger will be converted into the right to receive 0.092 shares of Tecogen common stock, $.001 par value per share (the “Exchange Ratio”). The Exchange Ratio may be subject to adjustment in the event of any stock split, reverse stock split, stock dividend, recapitalization, reclassification, combination, exchange of shares or other similar event with respect to the number of ADGE’s

or Tecogen’s shares outstanding after the date of the Merger Agreement and prior to the effective time of the Merger. Options to acquire ADGE shares of common stock and restricted stock awards with respect to ADGE shares of common stock granted before the effective time of the Merger will remain in effect until they expire or are terminated and shall be exercisable for or relate to a number of shares of common stock of Tecogen equal to the Exchange Ratio, as adjusted.

The Merger Agreement contains customary representations and warranties of Tecogen and ADGE relating to the respective businesses and public filings of Tecogen and ADGE. In addition, the Merger Agreement provides for customary pre-closing covenants of Tecogen and ADGE, including covenants relating to conducting the respective businesses of Tecogen and ADGE in all material respects in the ordinary course of business in accordance with past practice and to use commercially reasonable efforts to maintain in all material respects Tecogen’s and ADGE’s assets and properties in their current condition.

Prior to the receipt of the approval of the Merger Agreement by the stockholders of both Tecogen and ADGE, the Merger Agreement may be terminated and the Merger may be abandoned by either Tecogen or ADGE pursuant to a resolution of its respective board of directors to withdraw or fail to make when required under the Merger Agreement, propose publicly to withdraw or fail to make or include in the joint proxy statement/prospectus for the Merger, a recommendation that its stockholders vote in favor of the Merger or, in the case of ADGE, may terminate the Merger Agreement in the event its board approves, recommends or declares advisable, or proposes publicly to approve, recommend or declare advisable a competing proposal or offer by a third party to purchase 20% or more of the assets or outstanding capital stock, other equity securities, or voting power, of ADGE, or any merger, business combination, consolidation, share exchange, recapitalization or similar transaction as a result of which the holders of its common stock immediately prior to the transaction do not own at least 80% of the outstanding voting power of the surviving or resulting entity in such transaction after the consummation of the transaction (“competing proposal”). The foregoing is subject to compliance with written notice of termination and the furnishing of the reasons for such termination. In the event of a termination, there shall be no liability on the part of the terminating party to the other party or parties except in the case of fraud, gross negligence, or willful misconduct.

The Merger Agreement does not provide for the payment by ADGE or Tecogen of a breakup or termination fee in the event of such a termination.

Also, the Merger Agreement contains a “go shop” provision, pursuant to which, following the date of the Merger Agreement and prior to the receipt of the approval of the Merger by ADGE’s and Tecogen’s stockholders, ADGE and its officers, directors, employees, financial and other advisors may initiate or solicit a competing proposal.

Further, the Merger Agreement provides that at any time before the closing of the Merger, either ADGE’s or Tecogen’s board of directors may terminate the Merger Agreement if such board (or a committee of such board) has determined in good faith, after consultant with its financial advisors and legal counsel (“advisors”), that there is a reasonable probability the failure to take such action would cause the board of ADGE or Tecogen, as the case may be, the violate its fiduciary duties to its stockholders under applicable law. The Merger Agreement requires the terminating company to provide ten days’ prior written notice; the terminating company (or its representative) is required to negotiate in good faith with the other party during the five business day period after giving such notice to the extent such other party wishes to negotiate and, in the case of a termination by ADGE’s board, and to the extent Tecogen wishes to negotiate, to enable Tecogen to propose in writing a binding offer to effect revisions to the terms of the Merger Agreement that would obviate the need for a termination by ADGE, and, in the case of a termination by the board of Tecogen, to enable both companies to agree to revisions to the terms of the Merger Agreement that would obviate the need for a termination by Tecogen. At the end of the notice period, the terminating company’s board (or committee), is required to have considered in good faith any such binding offer, and to have determined in good faith, after consultation with its advisors, that there is a reasonable probability the failure to effect the termination would cause such board to violate its fiduciary duties to its stockholders under applicable law. In the event of such a termination by either there shall be no liability on the part of the terminating party to the other party or parties except in the case of fraud, gross negligence, or willful misconduct.

Consummation of the Merger is subject to a number of customary conditions including, among others, conditions relating to the approval of the Merger by the requisite vote of the stockholders of Tecogen and ADGE, the receipt of all required regulatory approvals, and the effectiveness of a registration statement on Form S-4 of Tecogen related to the Merger.

In connection with the proposed Merger, on December 21, 2016, Tecogen filed a registration statement on Form S-4 (the "Registation Statement") with the SEC and, on January 27, 2017, filed an Amendment No. 1 to the Registration Statement. The Registration Statement relates to the registration of the shares of common stock of Tecogen to be issued in the Merger and includes a joint proxy statement/prospectus pursuant to which Tecogen and ADGE will solicit the votes of their respective stockholders for the approval of the Merger at separate special meetings of such stockholders. Tecogen and ADGE expect to make the joint proxy statement/prospectus available to their respective stockholders and to file other documents regarding the proposed Merger with the SEC, including one or more further amendments to the Registration Statement. This Annual Report is not intended to be, and is not, a substitute for such filings or for any other document that Tecogen or ADGE may file with the SEC in connection with the proposed Merger. Stockholders of Tecogen are urged to read all relevant documents filed with the SEC, including the effective registration statement and the joint proxy statement/prospectus contained therein carefully when they become available, because

they will contain important information about Tecogen, ADGE, and the proposed Merger. Investors and security holders will be able to obtain copies of the definitive joint proxy statement/prospectus as well as other filings containing information about Tecogen, ADGE, and the Merger once they become available, without charge, at the SEC's website at http://www.sec.gov. Copies of documents filed with the SEC by Tecogen will be made available free of charge on Tecogen’s investor relations website at http://ir.tecogen.com/all-sec-filings. The information on Tecogen’s web site is not incorporated by reference into this annual report on Form 10-K.

Litigation Related to the Proposed Merger

Massachusetts Superior Court Action

On or about February 6, 2017, ADGE, John Hatsopoulos, George N. Hatsopoulos, Charles T. Maxwell, Deanna M. Petersen, Christine Klaskin, John Rowe, Joan Giacinti, Elias Samaras, Tecogen, and Merger Sub were served with a verified complaint by William C. May, individually and on behalf of the other shareholders of ADGE as a class. The complaint alleges the proposed Merger is subject to certain conflicts of interest; that the registration statement on Form S-4 contained material omissions; that Tecogen aided and abetted ADGE’s board’s breaches of its fiduciary duties; and other claims. The plaintiff is seeking preliminary and permanent injunctions related to the Merger, rescissory damages, compensatory damages, accounting, and other relief.

For the description of a lawsuit filed in the United States District Court, but as to which no service of process has been effected, see "Business - Litigation."

Business Overview

Tecogen designs, manufactures, markets, and maintains high efficiency, ultra-clean cogeneration products including natural gas engine-driven combined heat and power, air conditioning systems, and water heaters for residential, commercial, recreational and industrial use. The company is known for cost efficient, environmentally friendly and reliable products for distributed power generation that, through patented technology, nearly eliminate criteria pollutants and significantly reduce a customer’s carbon footprint.

Tecogen’s natural gas powered cogeneration systems (also known as combined heat and power or “CHP”) are efficient because they drive electric generators or compressors, which reduce the amount of electricity purchased from the utility while recovering the engine’s waste heat for water heating, space heating, and/or air conditioning at the customer’s building.

Tecogen manufactures three types of CHP products:

•Cogeneration units that supply electricity and hot water including the InVerde® 100, InVerde e+®, CM-75 and CM-60;

•Chillers that provide air-conditioning and hot water marketed under the TECOCHILL® brand name; and

•Ilios® branded high-efficiency water heaters.

All of these are standardized, modular, CHP products that reduce energy costs, carbon emissions, and dependence on the electric grid. Tecogen’s products allow customers to produce power on-site in parallel with the electric grid, or stand alone when no utility grid is available via inverter-based black-start capability. Because our CHP systems also produce clean, usable heat energy, they provide economic advantages to customers who can benefit from the use of hot water, chilled water, air conditioning and heating.

Traditional customers for our cogeneration and chiller systems include hospitals and nursing homes, schools and universities, health clubs and spas, hotels and motels, office and retail buildings, food and beverage processors, multi-unit residential buildings, laundries, ice rinks, swimming pools, factories, municipal buildings, and military installations; however, the economic feasibility of using our systems is not limited to these customer types. Market drivers include the price of natural gas, local electricity rates, environmental regulations, and governmental energy policies, as well as customers’ desire to become more environmentally responsible.

Through our factory service centers in California, Connecticut, Massachusetts, Michigan, New Jersey, and New York our specialized technical staff maintain our products via long-term service contracts. The Company has shipped over 2,500 units, some of which have been operating for almost 25 years.

Our CHP technology uses low-cost, mass-produced engines, which we modify to run on natural gas. In the case of our mainstay cogeneration and chiller products, the engines have proven to be cost-effective and reliable. In 2009, in response to the changing regulatory requirements for stationary engines, our research team developed an economically feasible process for removing air pollutants from the engine exhaust. This technology's U.S. and foreign patents were granted beginning in October 2013 with other domestic and foreign patents granted or applications pending. Branded Ultera®, the ultra clean emissions technology, repositions our engine driven products in the marketplace, making them comparable environmentally with other technologies such as fuel cells, but at a much lower cost and greater efficiency. Because of this breakthrough design for emission control, our natural gas-fueled CHP modules fitted with the patented Ultera control technology are certified by the California Air Resources Board ("CARB") as meeting its stringent 2007 emissions requirements, the same emissions standard used to certify

fuel cells, and the same emissions levels as a state-of-the-art central power plant. We now offer our Ultera emissions control technology as an option on all our products or as a stand-alone application for the retrofitting of other rich-burn spark-ignited reciprocating internal combustion engines.

Tecogen products are designed as compact modular units that are intended to be installed in multiples when utilized in larger CHP plants. The majority of our CHP modules are installed in multi-unit sites with applications ranging up to 12 units. This approach has significant advantages over utilizing single larger units, allowing building placement in constrained urban settings and redundancy to mitigate service outages. Redundancy is particularly relevant in regions where the electric utility has formulated tariff structures that include high “peak demand” charges. Such tariffs are common in many areas of the country, and are applied by such utilities as Southern California Edison, Pacific Gas and Electric, Consolidated Edison of New York, and National Grid of Massachusetts. Because these tariffs are assessed based on customers’ peak monthly demand charge over a very short interval, typically only 15 minutes, a brief service outage for a system comprised of a single unit can create a high demand charge, and therefore be highly detrimental to the monthly savings of the system. For multiple unit sites, the likelihood of a full system outage that would result in a high demand charge is dramatically reduced, so consequently, these customers have a greater probability of capturing peak demand savings.

Our CHP products are sold directly to customers by our in-house marketing team, and by established sales agents and representatives, including ADGE.

Our Products

We manufacture natural gas engine-driven cogeneration systems, heat pumps, and chillers, all of which are CHP products that deliver more than one form of energy. Our cogeneration products are all standard, modular units that come pre-packaged from the Company’s factory for ease of installation at a customer’s site. The package incorporates the engine, generator, heat-recovery equipment, system controls, electrical switchgear, emission controls, and a data controller for remote monitoring and data transmission; minimizing the cost and complexity of installing the equipment at a site. This packaged, modular system simplifies CHP technology for small to mid-sized customers who typically are less experienced with the implementation and benefits of a CHP system.

All of our cogeneration systems and most of our chillers use the same engine, the TecoDrive 7400 model. This is an engine modified by us to use natural gas fuel. The small 25-ton chiller uses a similar engine, the 3000 model. We worked closely with the engine manufacturers and the gas industry (including the Gas Research Institute) in the 1980s and 1990s to modify the engine and validate its durability. For the Ilios water heater, we introduced a technologically advanced Ford engine that is enhanced for industrial applications.

Our commercial product line includes:

•the InVerde®, InVerde e+®, TECOGEN® and TTcogen cogeneration units;

•TECOCHILL® chillers;

•Ilios® high-efficiency water heaters; and

•Ultera® emissions control technology.

InVerde Cogeneration Units

Our premier cogeneration product is the InVerde, a 100-kW CHP system that not only provides electricity and hot water, but also satisfies the growing customer demand for operation during a utility outage, commonly referred to as “black-start” capability. Our exclusively licensed microgrid technology (see “Intellectual Property” below) enables our InVerde CHP products to provide backup power in the event of power outages that may be experienced by local, regional, or national grids.

The InVerde incorporates an inverter, which converts direct current, or DC, electricity to alternating current, or AC. With an inverter, the engine and generator can run at variable speeds, which maximizes efficiency at varying loads. The inverter then converts the generator’s variable output to the constant-frequency power required by customers in 50 or 60 Hertz.

This inverter technology was developed originally for solar and wind power generation. The Company believes that the InVerde is the first commercial engine-based CHP system to use an inverter. Electric utilities accept inverter technology as “safe” by virtue of its certification to the Underwriters Laboratory interconnection standard 1741. InVerde earned this certification. This qualifies our product for a much simpler permitting process nationwide and is mandatory in some areas such as New York City and California, a feature we consider to be a competitive advantage. The inverter also improves the CHP system’s efficiency at partial load, when less heat and power are needed by the customer.

The InVerde`s black-start feature addresses a crucial demand from commercial and institutional customers who are increasingly concerned about utility grid blackouts and brownouts, natural disasters, security threats, and antiquated utility infrastructure. Multiple InVerde units can operate collectively as a stand-alone microgrid, which is a group of interconnected loads served by one or more power sources. The InVerde is equipped with software that allows a cluster of units to seamlessly share the microgrid load without complex controls; a proprietary cost advantage for multiple modules at a single location.

The InVerde CHP system was developed in 2007 and began shipping in 2008. Our largest InVerde installation utilizes 12 units, which supply 1.2 MW of on-site power and about 8.5 million Btu/hr of heat (700,000 Btu/hr per unit).

In January 2016, the Company launched its newest edition to the InVerde line, the InVerde e+. The e+ builds on the success of the first generation InVerde and reinforces our goal to be at the forefront of the industry, providing our customers with the most advanced clean energy technologies available in the marketplace. Among the most differentiating features when compared to competitive CHP technology are that the InVerde e+ offers: best in class electrical efficiency; a DC input option for solar or battery array integration; rapid 10 second black-start; and requires just 4 inches of water column gas pressure which eliminated the need for additional costly pressure boosting equipment, unlike its competitors.

TECOGEN Cogeneration Units

The TECOGEN cogeneration system is the original model introduced in the 1980s; available in sizes of 60 kW and 75 kW and capable of producing up to 500,000 Btu/hr of hot water. This technology is based on a conventional single-speed generator. It is meant only for grid-connected operation and is not universally accepted by utilities for interconnection, in contrast to the InVerde. Although this cogeneration product has the longest legacy and largest installed population, much of its production volume has been supplanted by the InVerde and its broader array of product features.

TECOCHILL Chillers

Our TECOCHILL natural gas engine-driven chillers are available in capacities ranging from 25 to 400 tons, with the smaller units air-cooled and the larger ones water-cooled. Using technology first developed in 1987, the engine drives a compressor that makes chilled water, while the engine’s free waste heat can be recovered to satisfy the building’s needs for heat or hot water. This process is sometimes referred to as “mechanical” cogeneration, as it generates no electrical power, and the equipment does not have to be connected to the utility grid.

A gas-fueled chiller provides enough air conditioning to avoid most of the utility’s seasonal peak charges for electric usage and capacity. In summer when electric rates are at their highest, natural gas is “off-peak” and quite affordable, allowing TECOCHILL customers to avoid typically higher summer-time “peak-usage” electric rates. Gas-fueled chillers also free up the building’s existing electrical capacity to use for other loads and can operate on minimal electric load in case of electric grid blackout; a key feature for customers concerned about load demand on backup power generators.

Ilios High-Efficiency Water Heaters

Tecogen has developed several heat pumps under the Ilios brand name including a High Efficiency ("HE") Air-Source Water Heater, HE Water-Sourced Water Heater, and HE Air-Sourced “Split System” Water Heater. Our water heater products operate like an electric heat pump but use a natural gas engine instead of an electric motor to power the system. The Ilios high-efficiency water heater uses a heat pump, which captures warmth from outdoor air even if it is moderately cool outside. Heat pumps work somewhat like a refrigerator, but in reverse. Refrigerators extract heat from inside the refrigerator and move it outside the refrigerator while heat pumps extract heat from outside and move it indoors.

The gas engine’s waste heat is recovered and used in the process, unlike its electric counterpart, which runs on power that has already lost its waste heat. This means that the heat being captured from outdoors is supplemented by the engine’s waste heat, which increases the efficiency of the process. The net effect is that an Ilios heat pump’s efficiency far surpasses that of conventional boilers for water heating; gas engine heat pumps can deliver efficiencies in excess of 200%.

Similarly, if used for space heating, the engine-powered heat pump is more efficient than an electric heat pump, again because heat is recovered and used for other building processes. The product’s higher efficiency translates directly to lower fuel consumption and, for heavy use customers, significantly lowers operating costs when compared with conventional equipment.

In 2013, a water-sourced model of the heat pump was added to our product line. This heat pump captures heat from a water source such as a geothermal well or from a pre-existing chilled water loop in the facility; the latter configuration provides simultaneous heating and cooling benefits, doubling the effect.

Following on the success of the water-sourced model, in early 2015 a 'split system' Ilios model was introduced. The new split system offers increased flexibility because its air-source evaporator package can be installed remotely. The engine driven heat pump, which is contained in a small acoustic enclosure, can be located with a building's mechanical space while the quiet air-source evaporator package can be installed on a roof, or in any outdoor space. The outdoor evaporator component is connected to the indoor heat pump via refrigerant lines, therefore eliminating all freeze protection issues in colder climates. All of the water being heated remains inside the conditioned space, eliminating the need for a costly isolation heat exchanger and additional pumps, which simplifies installation and increases efficiency by being able to operate at a lower delivery temperature.

The heat pump water heater serves as a boiler, producing hot water for drinking and washing, for space heating, swimming pools, or other building loads. Energy cost savings to the customer depend on the climate. Heat pumps in general, whether gas or electric, perform best in moderate weather conditions although the performance of the Ilios water-source heat pump is not impacted by weather or climate conditions. In a typical building, the Ilios heat pump would be added on to an existing heating or water heating system, and would operate as many hours as possible. The conventional boiler would be left in place, but would serve mainly as a backup when the heat pump’s engine is down for maintenance or when the heat pump cannot meet the building’s peak heating load. In areas where low electric rates make CHP less economical, the Ilios heat pump could be a financially attractive alternative because its economics depend only on natural gas rates. In some areas with high electric rates, the Ilios option could have advantages over CHP; for example where it is hard to connect to the utility grid or where the building’s need for electricity is too low for CHP to be economically sound.

Ultera Low-Emissions Technology

All of our CHP products are available with the patented Ultera low-emissions technology as an equipment option. This breakthrough technology was developed in 2009 and 2010 as part of a research effort partially funded by the California Energy Commission and Southern California Gas Company. The objective was to bring our natural-gas engines into compliance with California’s stringent air quality standards.

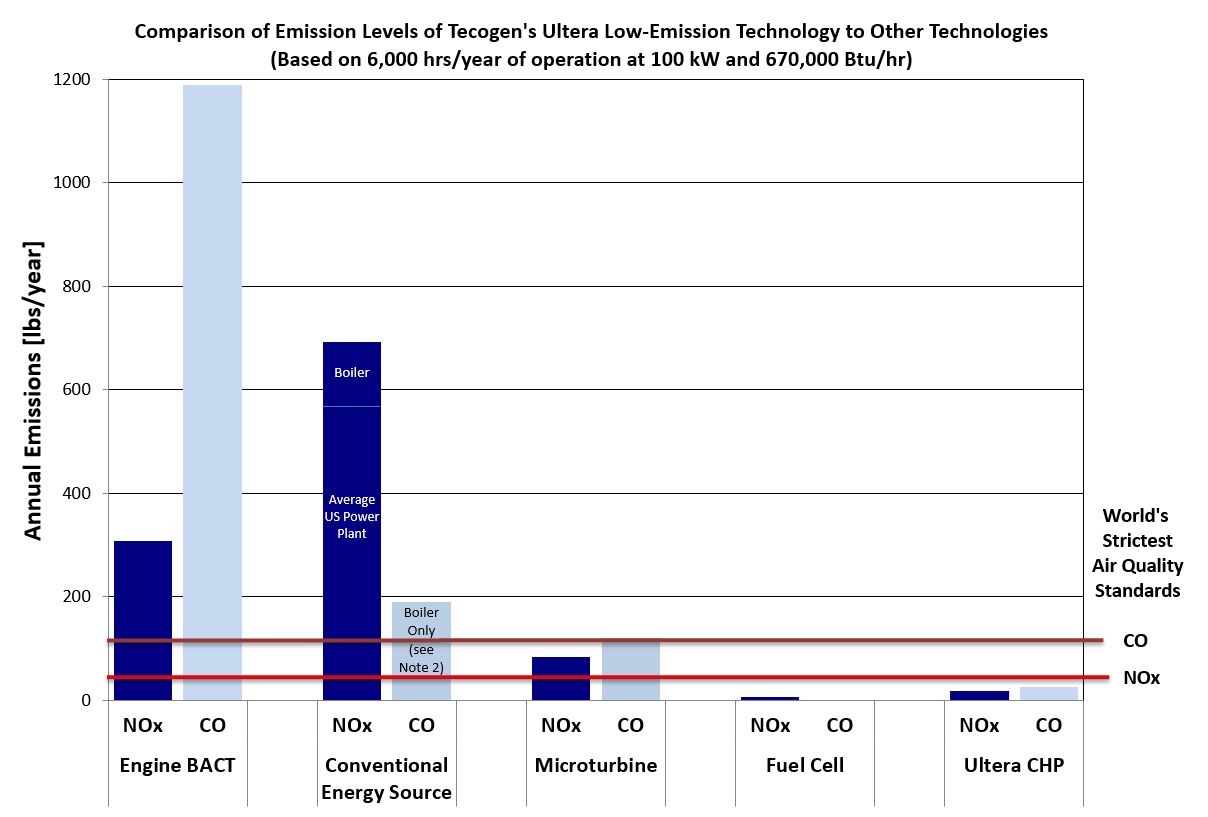

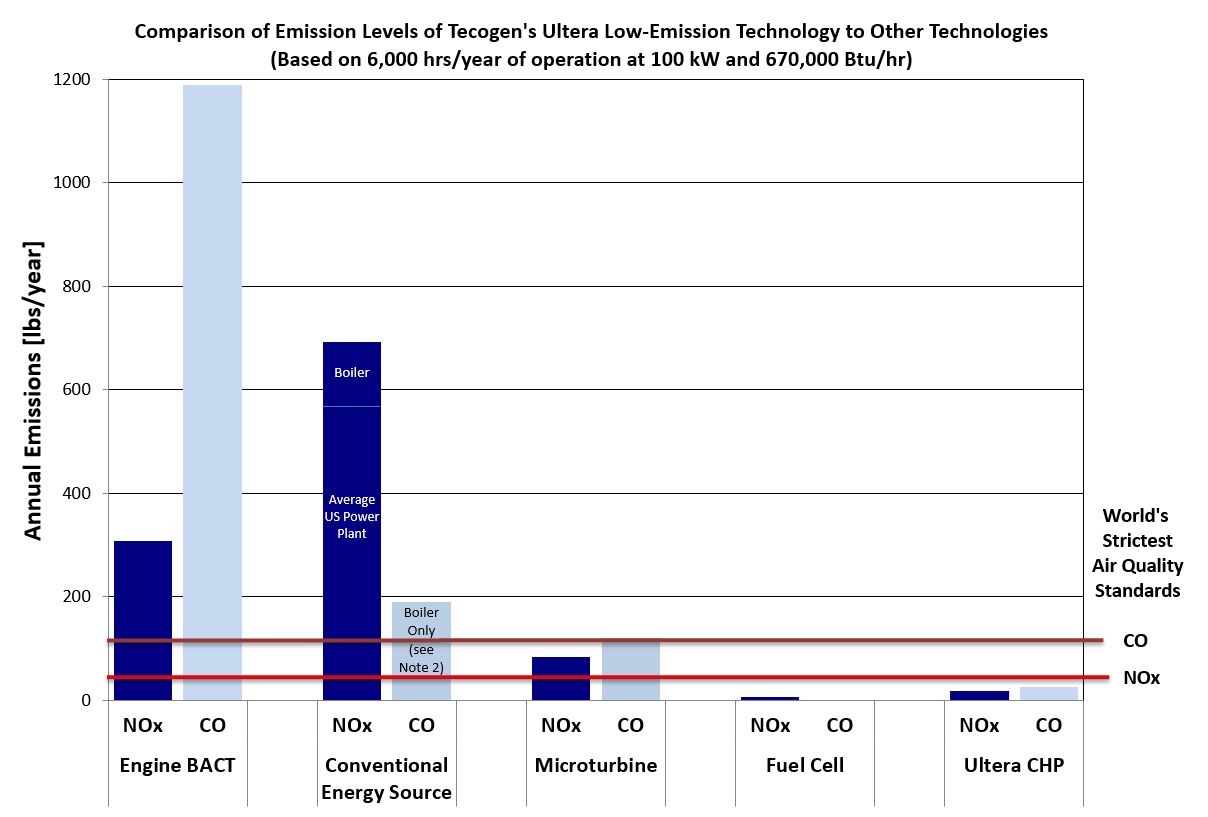

The chart below shows that, as of December 31, 2016, our Ultera CHP and fuel cell technologies are the only technologies that we know of which comply with California's air quality standards for CO and NOx, represented in the chart by the colored horizontal lines, shown as the world's strictest air quality standards on the lower right of the chart.

(5) (2) (4) (4) (3) (1)

(1) California has the strictest air quality standards for engines in the world

(2) Conventional Energy Source is U.S. powerplant and gas boiler. Average U.S. powerplant NOx emission rate of 0.9461 lb/MWh from (USEPA eGrid 2012),

CO data not available. Gas boiler efficiency of 78% (www.eia.gov) with emissions of 20 ppm NOx @ 3% O2 (California Regulation SCAQMD Rule 1146.2

and <50 ppmv CO @ 3% O2 (California Regulation SCAQMD BACT).

(3) Tecogen emissions based upon actual third party source test data.

(4) Microturbine and Fuel Cell emissions from EPA CHP Partnership - Catalog of CHP Technologies- March 2015.

(5) Stationary Engine BACT as defined by SCAQMD.

Through development of a two stage catalyst emission treatment system, the Company was able to meet or exceed the strict air quality regulations with a solution that is cost-effective, robust, and reliable. Inclusion of the patent-protected Ultera low-emissions technology as an option keeps our CHP systems compliant with air quality regulations. The first commercial CHP units equipped with Ultera low-emissions technology shipped to a California utility in 2011. We conducted three validation programs for this technology:

| |

1. | Third-party laboratory verification. The AVL California Technology Center, a long-standing research and technology partner with the international automotive industry, confirmed our results in their state-of-the-art dynamometer test cell, which was outfitted with sophisticated emissions measurement equipment. |

| |

2. | Verifying longevity and reliability in the field. By equipping one of our 75 kW units, already operating at a customer location in Southern California with the Ultera low-emissions technology and a device to continuously monitor emissions we verified longevity and reliability. The Ultera low-emissions system operated successfully for more than 25,000 hours, approximately 3.5 years, and consistently complied with California’s stringent emission standards over the entire field testing period. |

| |

3. | Additional independent tests. During the field test, two companies licensed in California to test emissions each verified our results at different times. The results from one of these tests, obtained in August 2011, enabled us to qualify for New Jersey’s fast-track permitting. Virtually every state nationwide requires some kind of permit related to local air quality, but New Jersey allows an exemption for systems such as ours that demonstrate superior emissions performance. This certification was granted in November 2011, and since then we have sold Ultera low-emissions systems to customers in this territory. |

In 2012, a 75 kW CHP unit equipped with the Ultera system became our first unit to obtain a conditional air permit (i.e., pending a third party source test to verify compliance) in Southern California since the strict regulations went into effect in 2009. A state-certified source test, administered in January 2013, verified that our emissions levels were well below the new permitting requirements, and the final permit version was approved in August 2013.

Standby Generators

After successfully developing the Ultera technology for our own equipment, the Tecogen research & development team began exploring other possible emissions control applications in an effort to expand the market for the ultra-clean emissions system. Retrofit kits were developed in 2014 for other stationary engines and in 2015 the Ultera Retrofit Kit was applied successfully to natural gas stand-by generators from other manufacturers, including Generac and Caterpillar.

Historically, standby generators have not been subjected to the strict air quality emissions standards of traditional power generation. However, generators which run for more than 200 hours per year or run for non-emergency purposes (other than routine scheduled maintenance) in some territories are subject to compliance with the same stringent regulations applied to a typical electric utility. As demand response programs become more economically attractive and air quality regulations continue to become more stringent, there could be strong demand for retrofitting of standby generators with our Ultera emissions control technology, thus providing a cost-effective solution to keeping the installed base of standby generators operational and in compliance.

Biogas

The Ultera emissions control technology developed by our engineering team applies specifically to rich-burn, spark-ignited, internal combustion engines. While it was originally intended for natural gas powered engines, there is reason to believe the technology may be adapted for other fuel types as long as the engine meets the rich-burn criteria.

In 2015 the Ultera system was applied to a biogas powered engine operating at the Eastern Municipal Water District’s (EMWD) Moreno Valley Region Water Reclamation Facility in Perris, California. The demonstration project was a result of an ongoing collaboration between Tecogen, the EMWD and various other partners. This project successfully applied an Ultera retrofit kit to a 50 liter Caterpillar engine fueled by biogas extracted from an anaerobic digester.

Biogas is a significant byproduct of wastewater treatment plants. Considered to be a renewable source of fuel, it is becoming an increasingly important resource for power generation. According to the American Biogas Council, nationwide there are over 1,100 engines fueled by wastewater-derived biogas, over 600 fueled by landfill-generated biogas, and over 100 running on biogas from agricultural waste. This represents a significant potential market for Ultera retrofit kit application as these biogas engines become subject to the same air quality standards as traditional power generation sources.

Gasoline Vehicles

In October 2015, following revelations of wide-scale problems with vehicle emissions compliance and testing, Tecogen formed an Emissions Advisory Committee to examine the potential application of Ultera to the automotive gasoline market. According to the U.S. EPA, 50 percent of nitrogen oxides (NOx) and 60 percent of all carbon monoxide (CO) emissions in the United States comes from vehicle exhaust. These are precisely the two pollutants Tecogen's Ultera emission control system is designed to target. After a thorough investigative process on the part of the Emissions Advisory Committee and various industry expert consultants, the group recommended Tecogen pursue a funded initiative to develop the technology for gasoline vehicles.

In December 2015, the Company and a group of strategic investors formed a joint venture company Ultra Emissions to advance Tecogen’s near-zero emissions technology for adaptation to transportation applications powered by spark-ignited rich-burn engines in the automobile and truck categories. Tecogen has granted Ultra Emissions an exclusive license for the development of its patented, emissions-related, intellectual property for the vehicle market.

Initially Ultra Emissions’ focus was on preliminary research, testing, and verification that the Ultera technology can in fact be applied to gasoline engines while maintaining similar near-zero emission results as have been demonstrated in other use cases. Having completed multiple phases of testing at AVL's California Technology Center, the Ultra Emissions team has verified the Ultera technology for gasoline automotive use and is moving forward with their development work.

If successfully developed, the market for automotive emissions control could be a source of future growth for the Company; although that potential could take several years to be realized and there is no guarantee we will be successful.

Propane Fork Trucks

In October 2016, the Company was awarded a Propane Education & Research Council (PERC) research grant funding for the Company's proposal to develop the Ultera ultra-clean emissions control technology for the propane powered fork truck market.

Electric fork trucks have been making significant in-roads in the fork truck industry, in part, because of their green image and indoor air quality benefit. The primary benefit of the Ultera-equipped ultra-clean propane fork truck will be fuel cell like emissions and a propane-green brand that offers a robust indoor air quality advantage without compromising vehicle performance. The project will assess the adaption of Tecogen’s near-zero emissions technology for the fork truck category and demonstrate the technical performance on popular propane fork truck models. Select industry-leading fork truck manufacturers are also participating in the research initiative.

Management believes that approximately 70,000 propane powered fork trucks are sold annually in the United States. Successful completion of this project could open a new emissions control market to Tecogen.

Other Ultera Applications

According to a 2013 Massachusetts Institute of Technology study, the U.S. experiences 200,000 early deaths each year due to emissions from heavy industry, transportation, and commercial and residential heating. As climate change and air quality continue to develop as areas of focus by government regulators, emissions restrictions are expected to become increasingly stringent around the world. These tightening regulations could open up new markets and applications for the Ultera near-zero emissions control technology. Some of these opportunities may include:

| |

• | Commercial and industrial natural gas fueled engines from other manufacturers |

| |

• | Natural gas and biogas powered vehicle fleets - such as municipal bus fleets |

TTcogen LLC

In May 2016, the Company and Tedom entered into a joint venture, of which a 50% interest is held by each of the Company and Tedom. As part of the joint venture, the parties agreed to create a Delaware limited liability company, TTcogen LLC, to carry out the business of the venture. Tedom granted TTcogen the sole and exclusive right to market, sell, offer for sale, and distribute certain products as agreed to by the parties throughout the United States. The product offerings of the joint venture expand the current Tecogen product offerings from small-scale MicroCHP of 35 kW up to large 4,000 kW (4 MW) custom plants. Tecogen agreed to refer all appropriate sale leads to TTcogen regarding the products agreed to by the parties and Tecogen shall have the first right to install, repair and maintain the products sold by TTcogen.

Product Service

We provide long-term maintenance contracts, parts sales, and turnkey installation through a network of nine well-established field service centers in California, the Midwest, and the Northeast. These centers are staffed by full-time Tecogen technicians, working from local leased facilities. The facilities provide offices and warehouse space for inventory. We encourage our customers to provide internet or phone connections to our units so that we may maintain remote communications with the installed equipment. For connected installations, the machines are contacted daily, download their status, and provide regular operational reports (daily, monthly, and quarterly) to our service managers. This communication link is used to support the diagnosis

effort of our service staff and to send messages to preprogrammed phones if a unit has experienced an unscheduled shutdown. In many cases, communications received by service technicians from connected devices allow for proactive maintenance; minimizing equipment downtime and improving operating efficiency for the customer.

The work of our service managers, supervisors, and technicians focuses on our products. Because we manufacture our own equipment, our service technicians bring hands-on experience and competence to their jobs. They are trained at our corporate headquarters and primary manufacturing facility in Waltham, Massachusetts.

Most of our service revenue is in the form of annual service contracts, which are typically of an all-inclusive “bumper-to-bumper” type, with billing amounts proportional to the equipment's achieved operating hours for the period. Customers are thus invoiced in level, predictable amounts without unforeseen add-ons for such items as unscheduled repairs or engine replacements. We strive to maintain these contracts for many years, assuring the integrity and performance of our equipment is maintained.

Our products have a long history of reliable operation. Since 1995, we have had a remote monitoring system in place that connects to hundreds of units daily and reports their “availability,” which is the amount of time a unit is running or is ready to run in hours. More than 80% of them operate above 90% availability, with the average being 93.8%. Our factory service agreements have directly impacted these positive results and represent an important, long-term, annuity-like stream of revenue for the Company.

In early 2016, we announced the selection of General Electric Company’s (NYSE: GE) Equipment Insight solution for new equipment sold beginning in 2016 and for select upgrades to the existing installed equipment fleet. With GE’s technology, Tecogen is able to collect, analyze, and manage valuable asset data continuously and in real-time, providing the service team with improved insight into the functionality of our installed CHP fleet. GE Equipment Insight allows Tecogen to provide a more seamless and proactive maintenance approach while also ensuring peak performance of installed equipment and improving the equipment payback period for our customers. This industrial internet solution enables the service department to perform remote monitoring and diagnostics and to view system results in real time via a computer, smart phone or tablet. The solution enables users to better utilize monitoring data, ensuring customers are capturing maximum possible savings and efficiencies from their installation. Through constant monitoring and analysis of equipment data, Tecogen expects to enhance the performance of installed equipment by ensuring machinery consistently operates at peak performance and is available to deliver maximum potential value for customers.

Contributions to Revenue

The following table summarizes net revenue by product line and services for the years ended December 31, 2016 and 2015:

|

| | | | | | | |

| 2016 | | 2015 |

Products: | |

| | |

|

Cogeneration | $ | 7,794,575 |

| | $ | 7,882,838 |

|

Chiller & Heat Pump | 2,927,710 |

| | 2,172,399 |

|

Total product revenue | 10,722,285 |

| | 10,055,237 |

|

Service & Parts | 8,541,047 |

| | 7,832,181 |

|

Installation Services | 5,227,054 |

| | 3,555,239 |

|

Total service revenue | 13,768,101 |

| | 11,387,420 |

|

Total revenue | $ | 24,490,386 |

| | $ | 21,442,657 |

|

All of the Company’s long lived assets reside in the United States. Currently, some revenue is generated outside the United States, including from sales in the United Kingdom, Mexico, Ireland, and others.

Sales & Distribution

Our products are sold directly to end-users by our sales team and by established sales agents and representatives. Various agreements are in place with distributors and outside sales representatives, who are compensated by commissions for certain territories and product lines. Sales through our in-house team or sales that are not covered by a representative’s territory carry no or nominal commissions. For the fiscal years ended 2016 and 2015, no distribution partner or customer relationship accounted for more than 10% of total combined company revenue.

Our product sales cycle exhibits typical seasonality for the HVAC industry with sales of chillers generally stronger in the warmer months while heat pump sales are stronger in the cooler months.

Total product and installation backlog as of December 31, 2016 was $11.1 million compared to year end 2015 backlog of $11.6 million. Please see "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and related Risk Factors below for additional information about the Company’s backlog.

Markets and Customers

Worldwide, stationary power generation applications vary from huge central stationary generating facilities (traditional electric utility providers) to back-up generators as small as 2 kW. Historically, power generation in most developed countries such as the United States has been part of a regulated central utility system utilizing high-temperature steam turbines powered by fossil-fuels. This turbine technology, though steadily refined over the years, reached a maximum efficiency (where efficiency means electrical energy output per unit of fuel energy input) of approximately 40%.

A number of developments related primarily to the deregulation of the utility industry as well as significant technological advances have now broadened the range of power supply choices available to all types of customers. CHP, which harnesses waste energy from power generation processes and puts it to work for other uses on-site, can boost the energy conversion efficiency to nearly 90%, a better than two-fold improvement over the average efficiency of a fossil fuel plant. This distributed generation, or power generated on-site at the point of consumption rather than power generated centrally, eliminates the cost, complexity, and inefficiency associated with electric transmission and distribution. The implications of the CHP distributed generation approach are significant. If CHP were applied on a large scale, global fuel usage might be dramatically curtailed and the utility grid made far more resilient.

Our CHP products address the inherent efficiency limitation of central power plants by siting generation close to the loads being served. This allows customers with energy-intensive buildings or processes to reduce energy costs and operate with a lower carbon footprint. Furthermore, with technology we have introduced, like the Ultera low-emissions technology, our products can now contribute to better air quality at the local level while complying with the strictest air quality regulations in the United States.

Cogeneration and chiller products can often reduce the customer’s operating costs (for the portion of the facility loads to which they are applied) by approximately 30% to 60% based on Company estimates, which provides an excellent rate of return on the equipment’s capital cost in many areas of the country with high electricity rates. Our chillers are especially suited to regions where utilities impose extra charges during times of peak usage, commonly called “demand” charges. In these cases, the gas-fueled chiller reduces the use of electricity during the summer, the most costly time of year.

On-site CHP not only eliminates the loss of electric power during transmission, but also offsets the capital expense of upgrading or expanding the utility infrastructure. The national electric grids of many developed countries are already challenged to keep up with existing power demand. In addition, the transmission and distribution network is operating at capacity in a majority of urban areas. Decentralizing power generation by installing equipment at customer sites not only relieves the capacity burden on existing power plants, but also lessons the burden on transmission and distribution lines. This ultimately improves the grid’s reliability and reduces the need for costly upgrades.

Increasingly favorable economic conditions could improve our business prospects domestically and abroad. Specifically, we believe that natural gas prices might increase from their current depressed values, but only modestly, while electric rates would continue to rise over the long-term as utilities pay for grid expansion, better emission controls, efficiency improvements, and the integration of renewable power sources.

The largest numbers of potential new customers in the U.S. require less than 1 MW of electric power and less than 1,200 tons of cooling capacity. We are targeting customers in states with high electricity rates in the commercial sector, such as California, Connecticut, Massachusetts, New Hampshire, New Jersey, and New York. These regions also have high peak demand rates, which favor utilization of our modular units in groups so as to assure redundancy and peak demand savings. Some of these regions also have generous rebates that improve the economic viability of our systems.

We aggressively market to both potential domestic and international customers where utility pricing aligns with our advantages. These areas include regions that have strict emissions regulations, such as California, or those that reward CHP systems that are especially non-polluting, such as New Jersey. There are currently 23 states that recognize CHP as part of their Renewable Portfolio Standards or Energy Efficiency Resource Standards and several of them, including New York, California, Massachusetts, New Jersey, and North Carolina, have initiated specific incentive programs for CHP.

The traditional markets for CHP systems are buildings with long hours of operation and with corresponding demand for electricity and heat. Traditional customers for our cogeneration systems include hospitals and nursing homes, colleges and universities, health clubs and spas, hotels and motels, office and retail buildings, food and beverage processors, multi-unit residential buildings, laundries, ice rinks, swimming pools, factories, municipal buildings, and military installations.

Traditional customers for our chillers and heat pumps overlap with those for our cogeneration systems. Engine-driven chillers are often used as replacements for aging electric chillers because they both occupy similar amounts of floor space and require similar maintenance schedules.

Competition

Although we believe Tecogen offers customers a suite of premier best-in-class clean energy and thermal solutions, the market for our products is highly competitive. Our cogeneration products compete with the utility grid, existing technologies such as other reciprocating engine and microturbine CHP systems, and other emerging distributed generation technologies including solar power, wind-powered systems, and fuel cells. We believe that Capstone Turbine Corporation is the only microturbine manufacturer with a commercial presence in CHP.

Although solar and wind powered systems produce no emissions, the main drawbacks to these renewable powered systems are their dependence on weather conditions, their reliance on backup utility grid-provided power, and high capital costs that can often make these systems uneconomical without government subsidies. Similarly, while the market for fuel cells is still developing, a number of companies are focused on markets similar to ours. Fuel cells, like solar and wind powered systems, have received higher levels of incentives for the same type of applications as CHP systems in many territories. Management believes that, absent these higher government incentives, our CHP solutions provide a better value and more robust solution to end users in most applications.

Additionally, our patents relating to the Ultera ultra-low emissions technology give Tecogen products a strong competitive advantage in markets where severe emissions limits are imposed or where very clean power is favored, such as New Jersey, California, and Massachusetts.

Our products fall into the broad market category of distributed generation systems that produce electric power on-site to mitigate the drawbacks of traditional central power and the low efficiency of conventional heating processes.

Overall, we compete with end users’ other options for electrical power, heating and cooling on the basis of our clean technology’s ability to:

| |

• | Provide power when a utility grid is not available or goes out of service; |

| |

• | Reduce the customer’s total cost of purchasing electricity and other fuel; |

| |

• | Reduce emissions of criteria pollutants (NOx and CO) to near-zero levels and cut the emission of greenhouse gas such as carbon dioxide; |

| |

• | Provide reliable on-site power generation, heating and cooling services; and |

| |

• | Control maintenance costs and ensure optimal peak equipment performance. |

InVerde CHP

We believe that no other company has developed a product that competes with our inverter-based InVerde, which offers UL-certified grid connection, black-start capability, and patented variable-speed operation. An inverter-based product with at least some of these features has been introduced by others, but we believe that they face serious challenges in duplicating all the unique features of the InVerde. Product development time and costs could be significant, and we expect that our patents and license for Microgrid software will keep others from offering certain important functions.

Similarly, in the growing Microgrid segment, neither fuel cells nor microturbines can respond to changing energy loads when the system is disconnected from the utility grid. Engines such as those used in Tecogen’s equipment inherently have a fast dynamic response to step load changes, which is why they are the primary choice for emergency generators. Fuel cells and microturbines would require an additional energy storage device to be utilized in off-grid operation, giving our engine-driven solutions an advantage for Microgrid and resiliency applications.

TECOCHILL Chillers

The Company's TECOCHILL line of chiller is the only gas-engine-driven chiller available on the market. Natural gas can also fuel absorption chillers, which use fluids to transfer heat without an engine drive. However, engine chillers continue to have an efficiency advantage over absorption machines, TECOCHILL products reach efficiencies well above levels achieved by similarly sized absorption systems. Today’s low natural gas prices in the United States improve the economics of gas-fueled chillers while their minimal electric demand on back up power systems make them ideal for facilities requiring critical precision climate control.

Ilios Heat Pump

There are a few companies manufacturing gas-engine heat pumps, including Yanmar and Tedom. The Ilios water heater and other heat pump products compete in both the high-efficiency water heating market and the CHP market.

Research & Development

Tecogen has a long, rich, research and development tradition and sustained programs have allowed us to cultivate deep engineering expertise. We have strong core technical knowledge that is critical to product support and continuous product improvement efforts. Our TecoDrive engine, permanent magnet generator, cogeneration and chiller products, InVerde, Ilios heat pumps, and most recently the Ultera emissions control system were all created and optimized in-house with both public and private funding support.

We continue to seek to forge alliances with utilities, government agencies, universities, research facilities, and manufacturers. The Company has already succeeded in developing new technologies and products in collaboration with several entities, including:

| |

• | Sacramento Municipal Utility District has provided test sites for the Company since 2010. |

| |

• | Southern California Gas Company and San Diego Gas & Electric Company, each a Sempra Energy subsidiary have granted us research and development contracts since 2004. |

| |

• | Department of Energy’s Lawrence Berkeley National Laboratory, research and development contracts executed since 2005, including ongoing Microgrid development work related to the InVerde. |

| |

• | Eastern Municipal Water District has co-sponsored demonstration projects to retrofit both a natural-gas powered municipal water pump engine, and a biofuel powered pumping station engine with the Ultera low emissions technology since 2012. |

| |

• | Consortium for Electric Reliability Technology Solutions executed research and development contracts, and provided a test site to the Company since 2005. |

| |

• | California Energy Commission executed research and development contracts from 2004 until March 2013. |

| |

• | The AVL California Technology Center has performed a support role in research and development contracts as well as internal research and development on our emission control system from August 2009 to November 2011. Currently, this testing center's work on emissions from gasoline vehicles which began in January of 2016 continues for the Ultra Emissions joint venture. |

| |

• | Propane Education & Research Council (PERC) executed research and development contracts for work related to developing Ultera for the propane powered fork truck market. |

Our efforts to forge partnerships continue to focus on utilities, particularly to promote the InVerde, our most utility-friendly product. The nature of these alliances varies by utility, but could include simplified interconnection, joint marketing, ownership options, peak demand mitigation agreements, and customer services. We have commissioned a Microgrid with the Sacramento Municipal Utility District at its headquarters in Sacramento, California, where the central plant incorporated three InVerde systems equipped with our Ultera low-emissions technology. Some expenses for this project were reimbursed to the utility through a grant from the California Energy Commission.

Certain components of our InVerde product were developed through a grant from the California Energy Commission. This grant includes a requirement that we pay royalties on all sales of all products related to the grant. As of December 31, 2016, such royalties accrued in accordance with this grant agreement were less than $6,000 on an annual basis.

We also continue to leverage our resources with government and industry funding, which has yielded a number of successful developments, including the Ultera low-emissions technology, sponsored by the California Energy Commission and Southern California Gas Company. Pursuant to the terms of the grants from the California Energy Commission, the California Energy Commission has a royalty-free, perpetual, non-exclusive license to these technologies, for government purposes.

For the years ended December 31, 2016 and 2015, we spent approximately $667,064 and $591,585, respectively, in research and development activities.

Intellectual Property

Patents

We currently hold six United States patents for our technologies:

| |

• | 9,470,126: "Assembly and method for reducing ammonia in exhaust of internal combustion engines." This patent, granted in October 2016, is related to the Ultera emission control system applicable to all of our products. |

| |

• | 9,121,326: “Assembly and method for reducing nitrogen oxides, carbon monoxide and hydrocarbons in exhausts of internal combustion engines.” This patent, granted in September 2015, is related to the Ultera emission control system applicable to all of our products. |

| |

• | 8,829,698: “Power generation systems.” This patent, granted in September 2014, is for a power generation system that includes an internal combustion engine configured to provide rotational mechanical energy. |

| |

• | 8,578,704: “Assembly and method for reducing nitrogen oxides, carbon monoxide, and hydrocarbons in exhausts of internal combustion engines.” This patent, granted in November 2013, is for the Ultera emission system applicable to all our products. |

| |

• | 7,239,034: “Engine driven power inverter system with cogeneration.” This patent, granted in July 2007, pertains to the utilization of an engine-driven CHP module combined with an inverter and applies to our InVerde product specifically. |

| |

• | 7,243,017: “Method for controlling internal combustion engine emissions.” This patent, granted in July 2007, applies to the specific algorithms used in our engine controller for metering the fuel usage to obtain the correct combustion mixture and is technology used by most of our engines. |

We have filed for several additional patents - most notable among them:

| |

• | "Systems and methods for reducing emissions in exhaust of vehicles and producing electricity." This patent, filed in November 2015 and published in March 2016, is related to the development of the Ultera emission control system for vehicle applications. |

| |

• | “Poison-Resistant Catalyst and Systems Containing Same.” This application, filed in March 2016, relates to treatment of exhaust generated by internal combustion engines, combustion turbines, and boilers and more particularly to systems and method for treating exhausts containing one or more poisons, such as sulfur. |

| |

• | “Internal Combustion Engine Controller.” This application, filed in October 2015, relates to controllers and control circuits for controlling an internal combustion engine, including a gas fired internal combustion prime mover used for driving a generator for generating electrical power. |

| |

• | “Emissions Control Systems and Methods for Vehicles.” This application, filed in April 2016 relates to emissions control systems for vehicles. |

In addition, the Company licensed specific rights to Microgrid algorithms developed by University of Wisconsin researchers for which we pay royalties to the assignee, The Wisconsin Alumni Research Foundation (WARF). The specific patent named in our agreement is “Control of small distributed energy resources” (7,116,010), granted in 2006. Our exclusive rights are valid for engine-driven systems utilizing natural gas or diesel fuel in the application of power generation where the per-unit output is less than 500 kW.

The software allows our products to be integrated as a Microgrid, where multiple InVerde units can be seamlessly isolated from the main utility grid in the event of an outage and re-connected to it afterward. The licensed software allows us to implement such a Microgrid with minimal control devices and associated complexity and cost. Tecogen pays WARF a royalty for each cogeneration module sold using the licensed technology. Such royalty payments have been in the range of $5,000 to $20,000 on an annual basis through the year ended December 31, 2016. In addition, WARF reserved the right to grant non-profit research institutions and governmental agencies non-exclusive licenses to practice and use, for non-commercial research purposes technology developed by Tecogen that is based on the licensed software.

We consider our patents and licensed intellectual property to be important in the operation of our business. The expiration, termination, or invalidity of one or more of these patents may have a material adverse effect on our business. Our earliest patent, licensed from WARF, was issued in 2006 and expires in 2022. Most of our current patents expire between 2022 and 2027.

We believe that one other company has developed a product that competes with our inverter-based InVerde. We anticipate that an inverter-based product with at least some of these features will be introduced by others, but we believe that competitors will face serious challenges in duplicating the InVerde. Product development time and costs would likely be significant, and we expect that our patent for the inverter-based CHP system (7,239,034) would offer significant protection, especially in key features. Likewise, we consider the Microgrid license with WARF to be a key feature of our InVerde product, and one that would be difficult to duplicate outside the patent.

In 2013, we purchased rights to designs and technologies including patents granted or pending for our permanent magnet generators. A key component of our InVerde module uses this acquired technology.

The recent issuance by the U.S. PTO of the patent for the Ultera low-emissions technology keeps that technology exclusive to us. It applies to all of our gas engine-driven products and may have licensing applications to other rich-burn spark-ignited internal combustion engines. We have also filed for or been granted patents for this technology in Europe, Australia, Brazil, Canada, China, Costa Rica, Dominican Republic, India, Japan, Mexico, New Zealand, Republic of Korea, Singapore, and South Africa. There is no assurance, however, that the Ultera low-emissions patent applications will be approved in any other country.

Copyrights

Our control software is protected by copyright laws or on an exclusive license agreement.

Trademarks

The Company has registered the brand names of our equipment and logos used on our equipment. These registered trademarks include Tecogen, Tecochill, Ultera, InVerde, Ilios, and the associated logos. We will continue to trademark our product names and symbols.

We rely on treatment of our technology as trade secrets through confidentiality agreements, which our employees and vendors are required to sign. Also, we rely on non-disclosure agreements with others that have or may have access to confidential information to protect our trade secrets and proprietary knowledge.

Sourcing & Manufacturing

We are focused on continuously strengthening our manufacturing processes and increasing operational efficiencies within the Company. Many of the components used in the manufacture of our highly-efficient clean energy equipment are readily fabricated from commonly available raw materials or are standardly available parts sourced from multiple suppliers. We believe that in most cases, adequate supply exists to meet our near to medium term manufacturing needs. Tecogen has an on-going focus on developing and implementing new systems to simplify our manufacturing processes, product sourcing methods, and our supply chain.

The Company has a combined total of approximately 26,000 square foot manufacturing and warehouse footprint running on a single 5-day per week shift at the Waltham, Massachusetts facility. We believe we have sufficient spare capacity to meet near to medium term demand without accruing additional fixed cost.

Government & Regulation

Several kinds of federal, state and local government regulations affect our current and future business, including but not exclusive to:

| |

• | Product safety certifications and interconnection requirements; |

| |

• | Air pollution regulations, which govern the emissions allowed in engine exhaust; |

| |

• | State and federal incentives for CHP technology; |

| |

• | Various local building and permitting codes and third party certifications; and |

| |

• | Electric utility pricing and related regulations. |