Rodman & Renshaw 19th Annual Global Investment

Conference

John Hatsopoulos, Co-CEO

NASDAQ: TGEN September 12, 2017

Safe Harbor Statement

This presentation includes forward-looking statements within the

meaning of Section 27-A of the Securities Act of 1933, and Section

21-E of the Securities Exchange Act of 1934. Such statements

include declarations regarding the present intent, belief, or current

expectations of the Company and its management. Prospective

investors are cautioned that any such forward looking statements are

not guarantees of future performance, and involve a number of risks

and uncertainties that can materially and adversely affect actual

results as identified from time to time in the Company‘s SEC filings.

Forward looking statements provided herein as of a specified date

are not hereby reaffirmed or updated. The company undertakes no

obligation to publicly update any forward-looking statement, whether

written or oral, that may be made from time to time, whether as a

result of new information, future developments, or otherwise.

2

John N. Hatsopoulos:

Co-CEO & Director

3

• Retired President and Vice Chairman of the

board of directors of Thermo Electron Corp.

(now Thermo Fisher Scientific)

• Developed Thermo’s famous ‘spinout’

strategy, resulting in the spinout of 24 public

companies from the parent

• Raised nearly $5B from 1990 – 1998 as

Thermo CFO for the parent company and it’s

various spinout subsidiaries

• Board of Directors of the American Stock

Exchange from 1994 – 2000

• Former “Member of the Corporation” of

Northeastern University

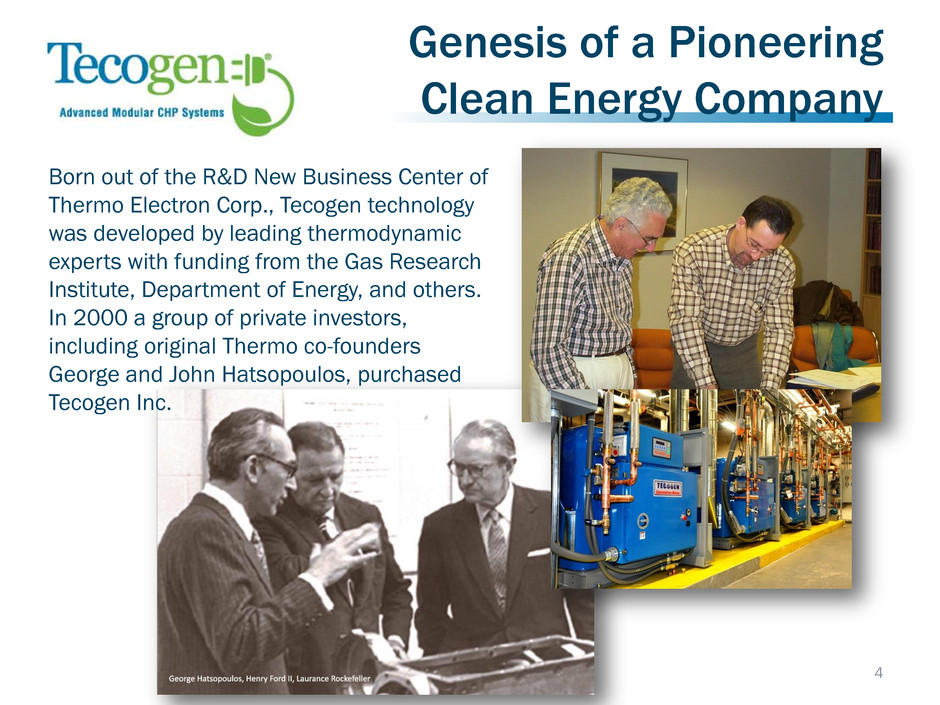

Genesis of a Pioneering

Clean Energy Company

4

Born out of the R&D New Business Center of

Thermo Electron Corp., Tecogen technology

was developed by leading thermodynamic

experts with funding from the Gas Research

Institute, Department of Energy, and others.

In 2000 a group of private investors,

including original Thermo co-founders

George and John Hatsopoulos, purchased

Tecogen Inc.

Leading Manufacturer of

Clean Energy Solutions

2000 2002 2004 2006 2008 2010 2012

Thermo sale of

TECOGEN

to private investor

group

First (and only) engine-

driven CHP module to

obtain full California

Electric Rule 21

certification

CEC awards TGEN

Research Contract for

development of new

Microgrid CHP

Module

First inverter-based

CHP module to obtain

CE mark for EU

TGEN

IPO

InVerde

Launched

Ilios

Dynamics

Created

Ultera

Emissions

Reduction

Technology

Introduced

Leading provider of cost efficient, clean and reliable products for power

production, heating and cooling which, through patented technology, nearly

eliminate criteria pollutants and significantly reduce a customer’s carbon

footprint. With over 2,500 units shipped, Tecogen technology is

revolutionizing distributed generation for residential, commercial, and

industrial cogeneration customers in North America.

2014

Vehicle

Emissions JV

Launched

InVerde e+

Launched

Gas

Company

selling

agreement

TTcogen JV

Quadruples

Portfolio

2016

ADGE

Acquisition Exclusive

permanent

magnet

generator

introduced

5

Why Tecogen?

Heat, Power & Cooling that is Cheaper, Cleaner, & More Reliable

Tecogen’s compelling ROI proposition meets the needs of a diverse range of customers.

Hospitality Health Care Education Multi-Unit Residential Industrial Municipal Recreation

“Unregulated Utility”

CHP Modules

Electricity & Heat

Ilios Water Heaters

2-3x Heat Efficiency

TECOCHILL

Cooling & Heat

Emissions Control

Ultra-Clean Emissions

Ultera

On-Site Utility

American DG

ADGE

6

Opportunities & Outlook

a growing company in a growing industry

•High ROI product

•Technological

innovation

•Relationships with

key partners

•Increasing

environmental and

regulatory

pressures

•Resiliency and

Demand Response

concerns

Sales

•Turnkey installation

•Long term service

agreements

•Nationwide presence

•High margin revenue

stream

•Additional growth

anticipated

Service

•Predictable, annuity

type revenue

•Enhancing

profitability of

existing fleet

•Reduced operational

costs through

Tecogen service

•Additional growth

possibility

American

DG

•Double digit CAGR

•>$40B market

potential for CHP

•Margins 35% - 40%

•>$10M product and

installation backlog

•<50% manufacturing

capacity utilization

•Stable operating

expense profile

Growth &

Margins

7

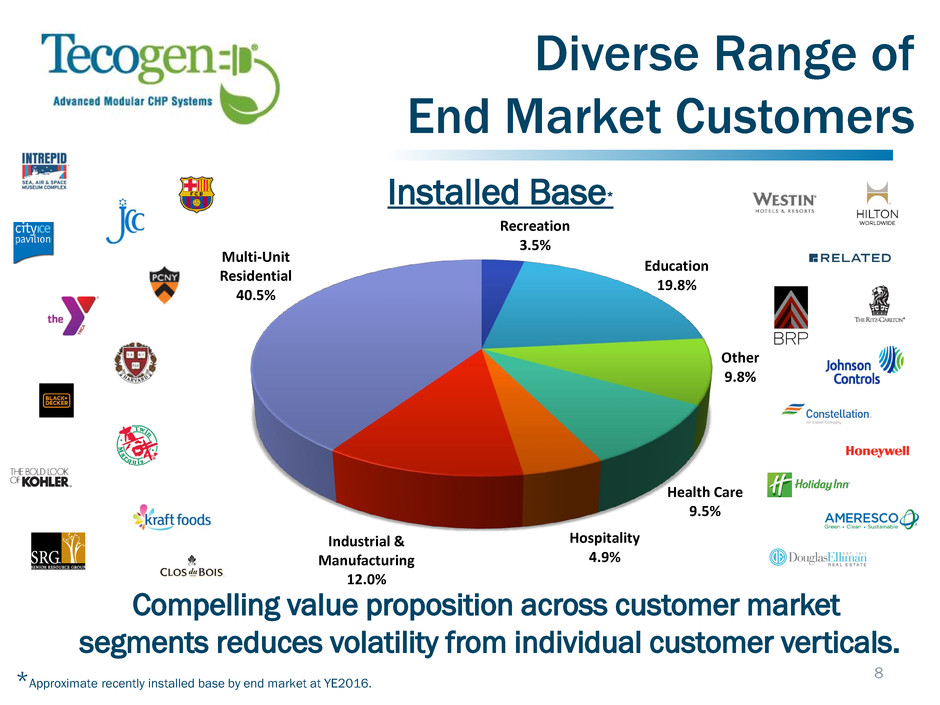

Diverse Range of

End Market Customers

Installed Base*

Compelling value proposition across customer market

segments reduces volatility from individual customer verticals.

8 *Approximate recently installed base by end market at YE2016.

Recreation

3.5%

Education

19.8%

Other

9.8%

Health Care

9.5%

Hospitality

4.9%

Industrial &

Manufacturing

12.0%

Multi-Unit

Residential

40.5%

Merger with ADGE

9

Successfully completed merger with

Tecogen and became a wholly-owned

subsidiary on May 18, 2017

On-Site Utility business model installs,

owns, and maintains natural gas

powered cogeneration systems

Fleet: 93 systems, 5.5MW of installed

capacity

One 500KW site under construction

American DG Energy Profile Combined Company Benefits

Stable Revenue Base – Provides a

fourth source of revenue, which

generates a consistent “annuity-like”

revenue stream from long term

contracts

Cost Savings – Elimination of

overlapping functions yields strong

cash flows

Fleet Management - Technical

support of Tecogen’s experienced

service teams will further improve

fleet performance and profitability

Creates a vertically integrated clean technology company with a complete

end-to-end distributed generation offering –

design, manufacturing, financing, installation, and maintenance.

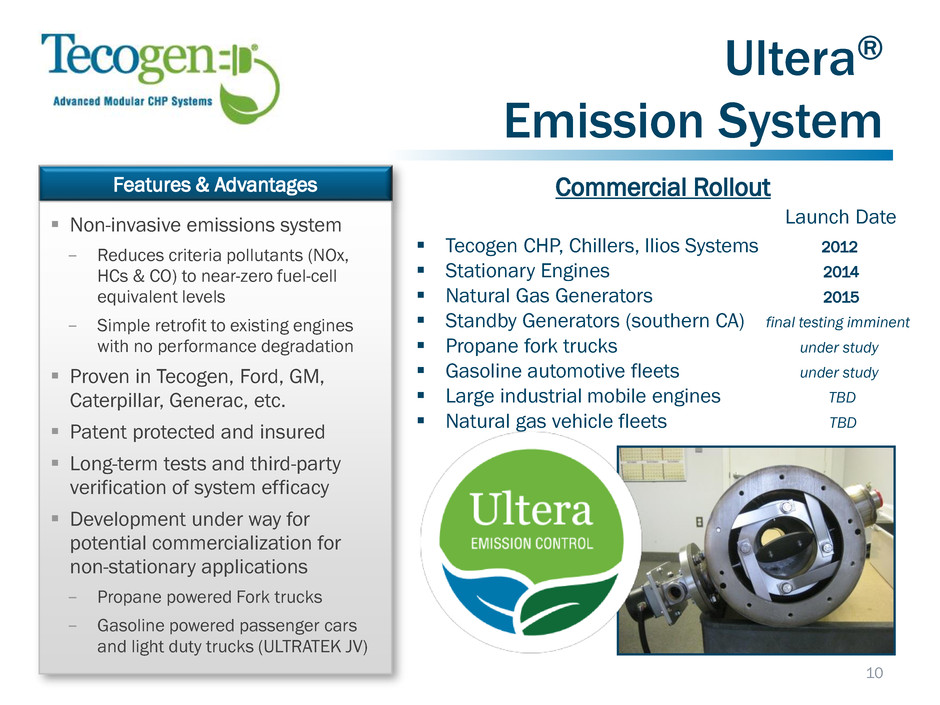

Ultera®

Emission System

Features & Advantages

Non-invasive emissions system

− Reduces criteria pollutants (NOx,

HCs & CO) to near-zero fuel-cell

equivalent levels

− Simple retrofit to existing engines

with no performance degradation

Proven in Tecogen, Ford, GM,

Caterpillar, Generac, etc.

Patent protected and insured

Long-term tests and third-party

verification of system efficacy

Development under way for

potential commercialization for

non-stationary applications

− Propane powered Fork trucks

− Gasoline powered passenger cars

and light duty trucks (ULTRATEK JV)

Commercial Rollout

Tecogen CHP, Chillers, Ilios Systems 2012

Stationary Engines 2014

Natural Gas Generators 2015

Standby Generators (southern CA) final testing imminent

Propane fork trucks under study

Gasoline automotive fleets under study

Large industrial mobile engines TBD

Natural gas vehicle fleets TBD

Launch Date

10

Fork trucks that operate indoors must meet

stringent emissions standards

− CO and NOX can be deadly

Significant interest from manufacturers

− Propane is already the fuel of choice thanks to

affordability, robust distribution network, and good

power profile

− Batteries and fuel cells greatly compromise

performance and increase operating costs

Retrofit of donated fork truck underway

− Baseline testing complete

− Initial testing of retrofit planned for September

Non-stationary

Ultera® Applications

11

Fork Trucks ULTRATEK Joint Venture

Goal is to commercialize Ultera for

passenger vehicles and light trucks

Tecogen owns 43% and controls 50%

of Board seats, ensuring veto power

− Private investors own the remainder

− Managed by Tecogen’s President,

Robert Panora, and Board Director, Dr

Ahmed Ghoniem

Successful Phase 1 and 2 testing

complete

− Highly impactful proof of concept

subject of internationally peer-reviewed

SAE paper

Next phases include evaluating

feedback from manufacturers

− Refine the design

− Prove reliability, practicality, and cost

effectiveness

TTcogen JV:

INFINITE POTENTIAL

12

Features

50/50 Joint Venture launched in

May 2016 with European CHP

expert TEDOM

Brings TEDOM packaged CHP

portfolio to U.S. via Tecogen sales

& service network

Combined product portfolio serves

energy needs from 35 kW – 4 MW

– quadruples addressable market

for CHP

Flexible fuel options including

natural gas, propane, renewable

biogas, etc.

Sales backlog of $884 thousand

as of date of 2Q’17 earnings call

Indoor Agriculture

13

Tecochill natural gas powered chillers provide

a unique value proposition for indoor farming

-Only natural gas powered chiller on the market

-No need to upgrade electrical system

-Removes heat generated by lighting

-Dehumidifies the air

-Virtually pure CO2 exhaust can be utilized to

help speed plant growth

Rapidly growing market

Indoor farming poised for exponential growth

− 5x over five years globally according to Agrilyst

Cannabis primary near-term driver in the US

− Leafy greens, herbs, and tomatoes also attracting capital

Typically located in or near urban centers

− Often have older infrastructure and higher electricity rates

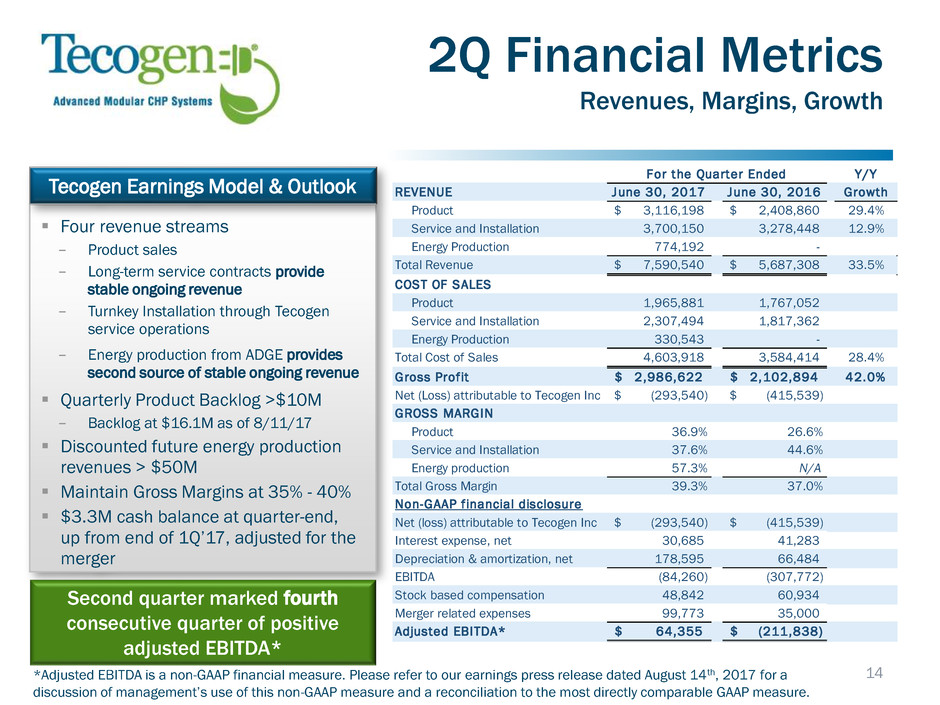

2Q Financial Metrics

Revenues, Margins, Growth

Four revenue streams

− Product sales

− Long-term service contracts provide

stable ongoing revenue

− Turnkey Installation through Tecogen

service operations

− Energy production from ADGE provides

second source of stable ongoing revenue

Quarterly Product Backlog >$10M

− Backlog at $16.1M as of 8/11/17

Discounted future energy production

revenues > $50M

Maintain Gross Margins at 35% - 40%

$3.3M cash balance at quarter-end,

up from end of 1Q’17, adjusted for the

merger

Tecogen Earnings Model & Outlook

14

Second quarter marked fourth

consecutive quarter of positive

adjusted EBITDA*

*Adjusted EBITDA is a non-GAAP financial measure. Please refer to our earnings press release dated August 14th, 2017 for a

discussion of management’s use of this non-GAAP measure and a reconciliation to the most directly comparable GAAP measure.

For the Quarter Ended Y/Y

REVENUE June 30, 2017 June 30, 2016 Growth

Product 3,116,198$ 2,408,860$ 29.4%

Service and Installation 3,700,150 3,278,448 12.9%

Energy Production 774,192 -

Total Revenue 7,590,540$ 5,687,308$ 33.5%

COST OF SALES

Product 1,965,881 1,767,052

Service and Installation 2,307,494 1,817,362

Energy Production 330,543 -

Total Cost of Sales 4,603,918 3,584,414 28.4%

Gross Prof it 2,986,622$ 2,102,894$ 42.0%

Net (Loss) attributable to Tecogen Inc (293,540)$ (415,539)$

GROSS MARGIN

Product 36.9% 26.6%

Service and Installation 37.6% 44.6%

Energy production 57.3% N/A

Total Gross Margin 39.3% 37.0%

Non-GAAP f inancial disclosure

Net (loss) attributable to Tecogen Inc (293,540)$ (415,539)$

Interest expense, net 30,685 41,283

Depreciation & amortization, net 178,595 66,484

EBITDA (84,260) (307,772)

Stock based compensation 48,842 60,934

Merger related expenses 99,773 35,000

Adjusted EBITDA* 64,355$ (211,838)$

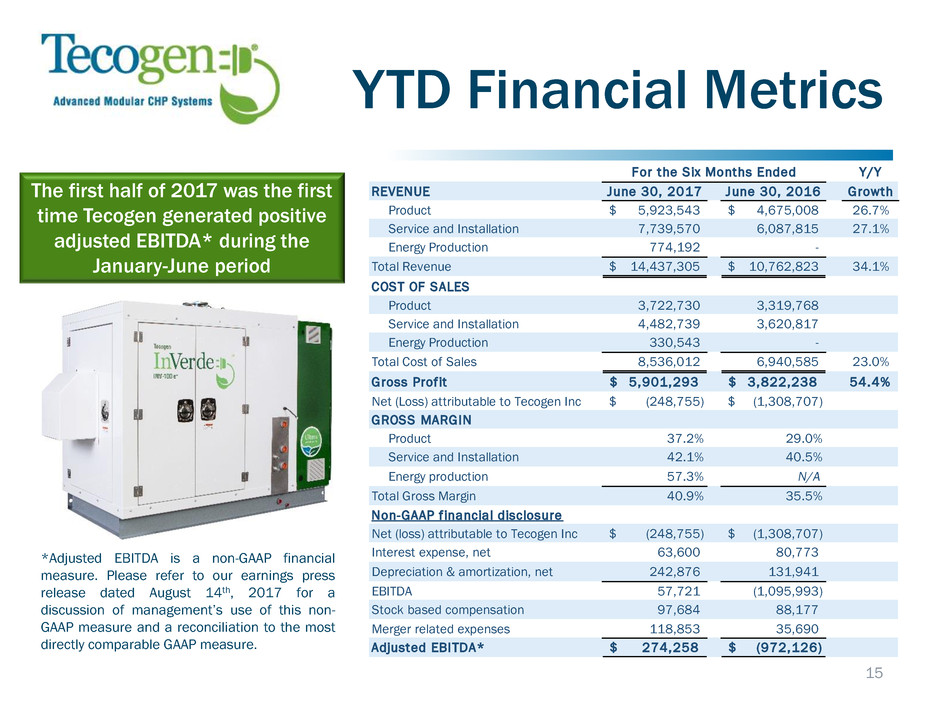

YTD Financial Metrics

15

*Adjusted EBITDA is a non-GAAP financial

measure. Please refer to our earnings press

release dated August 14th, 2017 for a

discussion of management’s use of this non-

GAAP measure and a reconciliation to the most

directly comparable GAAP measure.

The first half of 2017 was the first

time Tecogen generated positive

adjusted EBITDA* during the

January-June period

For the Six Months Ended Y/Y

REVENUE June 30, 2017 June 30, 2016 Growth

Product 5,923,543$ 4,675,008$ 26.7%

Service and Installation 7,739,570 6,087,815 27.1%

Energy Production 774,192 -

Total Revenue 14,437,305$ 10,762,823$ 34.1%

COST OF SALES

Product 3,722,730 3,319,768

Service and Installation 4,482,739 3,620,817

Energy Production 330,543 -

Total Cost of Sales 8,536,012 6,940,585 23.0%

Gross Prof it 5,901,293$ 3,822,238$ 54.4%

Net (Loss) attributable to Tecogen Inc (248,755)$ (1,308,707)$

GROSS MARGIN

Product 37.2% 29.0%

Service and Installation 42.1% 40.5%

Energy production 57.3% N/A

Total Gross Margin 40.9% 35.5%

Non-GAAP f inancial disclosure

Net (loss) attributable to Tecogen Inc (248,755)$ (1,308,707)$

Interest expense, net 63,600 80,773

Depreciation & amortization, net 242,876 131,941

EBITDA 57,721 (1,095,993)

Stock based compensation 97,684 88,177

Merger related expenses 118,853 35,690

Adjusted EBITDA* 274,258$ (972,126)$

Growth Opportunities

Core Business – Robust Demand for CHP Systems and Chillers

• Economic Fundamentals drive long term adaption of distributed generation

– high electricity prices, low cost natural gas, grid and building resiliency concerns

– >$40B market potential for CHP

• Technological innovation and unmatched industry reputation creates

sustainable competitive advantage

• Sales team expansion grows markets and geographies

• Strong relationships with key strategic partners generates repeat business

• TTcogen joint venture quadruples addressable market

• Indoor agriculture industry increasingly recognizes value of natural gas-powered

chillers

Emissions Control Opportunity (Ultera)

• Emission retrofit kits and propane fork truck initiative

• Upside potential from gasoline automotive emissions control development work

at Ultra emissions joint venture (ULTRATEK)

16

Tecogen at Prime Inflection Point for Growth

Q&A

Company Information

Tecogen Inc.

45 First Avenue

Waltham, MA 02451

NASDAQ: TGEN

www.tecogen.com

Contact

John Hatsopoulos, Co-CEO

781.622.1122

John.Hatsopoulos@tecogen.com

Jeb Armstrong, Director of Capital Markets

781.466.6413

Jeb.Armstrong@tecogen.com

17