Tecogen Announces Third Quarter 2017 Results

Tecogen has now Generated Positive GAAP Net Income in Four out of the Last Five Quarters

WALTHAM, Mass., November 9, 2017 - Tecogen® Inc. (NASDAQ:TGEN), a leading manufacturer of clean energy

products which, through patented technology, nearly eliminate criteria pollutants and significantly reduce a

customer's carbon footprint, reported revenues of $8,501,198 for the quarter ended September 30, 2017 compared to

$6,616,455 for the same period in 2016, or 28.5% growth in top line revenue. The completion of the merger with

American DG Energy on May 18th added $1,556,115 in revenue to the quarterly result.

Income from operations was $85,539 compared to $249,493 in the prior year comparable period. Similarly, Tecogen

delivered net income for the quarter of $27,211 compared to $207,868 in the third quarter 2016. The quarter's

results included non-recurring expenses totaling $37,445 related to the company's merger with American DG

Energy.

Depreciation and amortization jumped to $160,061 for the third quarter of 2017 from $66,484 for the same period

in the prior year. The increase is related to the depreciation of the equipment that American DG Energy owns to

deliver energy to its customers and the amortization of the corresponding contracts. Excluding merger related

expenses, adjusted non-GAAP EBITDA(1) was a positive $295,755 for the third quarter of 2017 versus $382,802 for

the third quarter of 2016, a decrease of $87,047. (Adjusted EBITDA is defined as net income attributable to

Tecogen Inc, adjusted for interest, depreciation and amortization, stock based compensation expense, and merger

related expenses. See table following the statements of operations for a reconciliation from net income to Adjusted

EBITDA as well as important disclosures about the company's use of Adjusted EBITDA).

Commenting about the quarter, Tecogen Co-Chief Executive Officer Benjamin Locke noted, "Operationally, it was

another positive quarter for Tecogen. The addition of revenue from American DG Energy more than offset lower

product revenue, pushing total revenue to a quarterly record. With our backlog hovering near record levels, we are

poised for a strong finish to the year. We have a handful of internal projects under way in the fourth quarter that

should help to sustain our momentum going into 2018. We are rolling out an update of our Tecopower CHP unit,

upgrading our chiller manufacturing capacity, and updating some internal software systems to improve our

operational efficiency."

Revenue results were driven by solid growth in services related revenues as well as the addition of energy

production revenues provided by newly acquired American DG Energy. Total services related revenues for the third

quarter of 2017 grew 20.0% over the prior year period, driven primarily by installation activity, while product

revenue declined 14.9% compared to the third quarter of 2016. Chiller and heat pump sales more than doubled,

partly offsetting a 30.2% decline from what were record cogeneration sales in the year-ago period.

Changes in sales mix, partly offset by a full quarter of ADGE's high margin contribution, resulted in an 8.6%

decline in gross margin to 38.3% compared to 41.9% in the third quarter of 2016. Nevertheless, this remains well

within management's targeted 35-40% gross margin range.

On a combined basis, operating expenses increased to $3,172,492 for the third quarter 2017 from $2,525,325 in the

same quarter of 2016. An increase in selling expenses, which rose 37.0% to $503,415, merger related expenses of

$37,445, and the consolidation of ADGE's core overhead, accounted for most of the increase. The increase in

selling expenses was due to an uptick in marketing related activity and higher sales commissions.

Backlog of products and installations was $14.5 million as of third quarter end, and stood at $16.8 million as of

November 8, 2017.

Speaking about the results Mr. Locke added, "The third quarter of 2016 was a breakout quarter for the company, but

as such is a tough quarter to benchmark against. Despite that, the bottom line of this year's third quarter actually

compares quite well. We had some remnant merger related expenses to take care of and we chose to increase the

budget for selling expenses as an investment in future growth. Getting the merger with ADGE done required a lot of

effort and non-quantifiable costs by management and administrative staff. Its successful completion was an

important milestone for Tecogen and enables us to now focus squarely on that future growth. In all, I am quite

pleased with how the quarter turned out."

Co-CEO John Hatsopoulos said, “The third quarter showed the strategic importance of Tecogen’s acquisition of

American DG Energy. It adds another stable stream of revenue to help cushion the ups and downs of our product

revenue. We’ve now been profitable for five quarters in a row based on adjusted EBITDA(1) and are in a position of

strength to meet the opportunities that lie ahead."

Major Highlights:

Financial

• Gross profit for the third quarter of 2017 was $3,258,031 compared to $2,774,818 in the third quarter of

2016, an increase of 17.4% versus the same period in the prior year. This substantial growth was generated

by the full-quarter contribution of American DG Energy.

• Overall gross margin in the third quarter of 2017 decreased to 38.3% compared to 41.9% in 2016. A shift in

sales mix to lower margin items was partly offset by the addition of high margin energy production

revenue.

• Product gross margin was 36.6% for third quarter of 2017 compared to 39.8% in third quarter of 2016 as

revenue from chiller sales accounted for a larger portion of product sales compared to the year-earlier

period.

• Services gross margin declined to 34.0% in the period compared to the 43.5% in the prior year. Strong

growth in lower margin turnkey installations accounted for the lion's share of the drop in margin.

• Energy production gross margin was an exceptionally strong 53.5% following the completion of the merger

with American DG Energy on May 18th. We would expect energy production gross margin to fluctuate

materially due to seasonality.

• On a combined basis, operating expenses rose to $3,172,492 for the third quarter of 2017 from $2,525,325

in the third quarter of 2016. The consolidation of ADGE's operations, $37,445 in merger related expenses

and an increase in selling expenses to $503,415 from $367,412 accounted for most of the year-over-year

increase.

• Excluding non-recurring merger related costs and stock compensation expense, adjusted non-GAAP

EBITDA(1) was $295,755 for the quarter compared to adjusted non-GAAP EBITDA of $382,802 during the

comparative third quarter of 2016.

• Consolidated net income attributable to Tecogen, for the three months ended September 30, 2017 was

$27,211 compared to $207,868 for the same period in 2016.

• Net income per share was $0.00 compared to $0.01 for the three months ended September 30, 2017 and

2016, respectively.

• Current assets at quarter end of $23,592,614 were more than double current liabilities of $9,399,283.

Current liabilities include $850,000 of short-term debt due to a related party, which came to Tecogen via the

acquisition of American DG Energy.

Sales & Operations

• Product revenues declined 14.9% from the same period in 2016. The launch of the InVerde e+ in early 2016

and uncertainty regarding the outlook for NYSERDA funding caused sales to jump in the second half of

2016. While cogeneration sales have pulled back 30.2% after last year's surge, they remain well above sales

levels prior to InVerde's upgrade. In contrast, chiller sales increased 176.3% year over year. Increasing

interest from both the indoor agriculture market and the growing recognition of the value proposition of

"mechanical CHP" are the key drivers.

• Services revenues grew 20.0% year-on-year, benefiting from increasing penetration in service contracts and

favorable operating metrics for the installed fleet as well as an active period for installations work.

Continued penetration of our 'turnkey lite' offering, which includes custom value-added engineering design

work as well as custom factory engineered accessories and load modules, has been a good source of

services revenue growth and is expected to continue to develop as an important revenue stream.

• Current sales backlog of equipment and installations as of Wednesday, November 8, 2017 was $16.8

million, driven by strong traction in the InVerde and Tecochill product lines and Installation services. As of

September 30, 2017 the backlog was $14.5 million, in line with the Company’s goal of consistently

delivering a quarter-end product backlog greater than $10 million.

• Indoor agriculture continues to be a rapidly emerging new opportunity for growth, particularly for the

Tecochill line of natural gas powered chillers. To-date, Tecogen has inked eight transactions in the space, all

but one of which is to buyers who intend to grow cannabis. Interest for our products from new growers

entering the market is ongoing.

• On September 28th, Tecogen filed an 8-K declaring that it was exercising its right to terminate its TTcogen

joint venture with Tedom. The 8-K also states that Tecogen "intends to work together with Tedom to come

to an amicable decision to create a new path forward for TTcogen and the relationship between the

Company and Tedom and/or facilitate an amicable wind up of TTcogen's affairs as provided for in the LLC

Agreement and in accordance with the terms therewith."

Emissions Technology

• ULTRATEK - Subsequent to the quarter close, Tecogen announced that the Company and its co-investors

have agreed to dissolve their Ultra Emissions Technologies S.à r.l. ("ULTRATEK") joint venture. The

dissolution process will take place under Luxembourg law and is expected to close by the end of the year.

Once the process is complete, all unspent funds will be distributed to the ULTRATEK investors as agreed

by a unanimous consent of the shareholders executed on October 24, 2017. As part of this disbursement,

Tecogen will receive all its invested funds, $2 million in cash, and the sole exclusive IP that it licensed to

ULTRATEK. Tecogen will then purchase all the non-cash assets of ULTRATEK, including all intellectual

property, for $400,000. The IP includes two awarded patents, four patent applications, and all data and

knowhow associated with the emissions testing performed by AVL.

"The rigorous testing completed by ULTRATEK resulted in unassailable documentation and proof of the

effectiveness of the Ultera process in reducing criteria emissions from gasoline-powered vehicles with no

loss of performance or fuel economy," said Robert Panora, Tecogen President and COO. "Our engagement

with both regulators and leading industry manufacturers has provided us with strategic insight regarding the

path we should take to gain the confidence of the automotive industry that we possess a practical solution to

a difficult problem, one that will neither be resolved in the near or medium term by electrification nor

tolerated by the public and regulators. We very much look forward to taking this exciting technology to the

next level."

• PERC - As reported in the last quarter of 2016, we received research grant funding from the Propane

Education and Research Council (PERC) to demonstrate the viability of our emissions technology in fork

trucks. The program’s goal is to develop a retrofit emissions system for fork trucks to reduce their

emissions to levels more acceptable for air quality in indoor work environments. Earlier in the year,

baseline testing of the unmodified fork truck was completed utilizing a donated fork truck from a major

manufacturer that has expressed strong interest in Ultera and has agreed to assist our research effort. The

data indicates that the fork truck is an excellent fit for Ultera technology, exhibiting an emissions profile

that can be significantly impacted by our process. At this time, we have completed modification to the fork

truck associated with the Ultera retrofit and are beginning shakedown testing of the system. Executives

from the manufacturer and PERC are tentatively planning to visit Tecogen in December to view the

prototype operation first hand.

• California Air Permit for Ultera on Standby Generators - Now that facility technical staff have overcome

some unrelated technical issues with the final generator, we are able to report that all generators at the

facility have been retrofitted with the Ultera system and commissioned for their normal, intended use.

Informal testing utilizing our portable emissions analyzers confirmed that all units are compliant to the

Southern California standard. We anticipate the customer will complete third party “source testing” of the

units, the final step in the permit process, in the upcoming month, at which time we will have independent

confirmation of our ground-breaking emissions reduction capability applied to this very stringent

application.

Conference Call Scheduled for Today at 11:00 am ET

Tecogen will host a conference call today to discuss the third quarter results beginning at 11:00 am eastern time. To

listen to the call dial (877) 407-7186 within the U.S. and Canada, or (201) 689-8052 from other international

locations. Participants should ask to be joined to the Tecogen 3rd quarter 2017 earnings call. Please begin dialing

at least 10 minutes before the scheduled starting time. The earnings press release will be available on the Company

website at www.Tecogen.com in the "News and Events" section under "About Us." The earnings conference call

will be webcast live. To view the associated slides, register for and listen to the webcast, go to

http://investors.tecogen.com/webcast. Following the call, the webcast will be archived for 30 days.

The earnings conference call will be recorded and available for playback one hour after the end of the call through

Thursday November 23, 2017. To listen to the playback, dial (877) 660-6853 within the U.S. and Canada, or

(201) 612-7415 from other international locations and use Conference Call ID#: 13672659.

About Tecogen

Tecogen Inc. designs, manufactures, sells, installs, and maintains high efficiency, ultra-clean, cogeneration products

including natural gas engine-driven combined heat and power, air conditioning systems, and high-efficiency water

heaters for residential, commercial, recreational and industrial use. The company is known for cost efficient,

environmentally friendly and reliable products for energy production that, through patented technology, nearly

eliminate criteria pollutants and significantly reduce a customer’s carbon footprint.

In business for over 20 years, Tecogen has shipped more than 2,300 units, supported by an established network of

engineering, sales, and service personnel across the United States. For more information, please visit

www.tecogen.com or contact us for a free Site Assessment.

Tecogen, InVerde, Ilios, Tecochill, Ultera, and e+, are registered trademarks or trademark pending registration of

Tecogen Inc.

Forward Looking Statements

This press release and any accompanying documents, contains "forward-looking statements" within the meaning of

the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements

can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate,"

"expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Examples of

forward-looking statements include, among others, statements we make regarding:

• The future structure and funding of Tecogen and any of its joint ventures.

• The status of any intellectual property rights or assets.

• Expected operating results, such as revenue growth and backlog.

• Strategy for growth, product development, and market position. AND

• Strategy for risk management.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are

based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans

and strategies, projections, anticipated events and trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are outside of our control. Our actual results and

financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you

should not rely on any of these forward-looking statements. Important factors that could cause our actual results and

financial condition to differ materially from those indicated in the forward-looking statements include, among

others, the following:

• Competing technological developments.

• Lack of market interest in our joint venture’s products.

• Issues obtaining intellectual property protection.

• Issues in the research and development of new products.

• Tecogen’s inability to properly fund its joint ventures. AND

• Such other factors as discussed throughout the "Risk Factors" section of Tecogen’s 10-K that was

filed with the SEC on March 31, 2017 and can be found at www.sec.gov.

Any forward-looking statement made by us in in this press release and any accompanying documents is based only

on information currently available to us and speaks only as of the date on which it is made. We undertake no

obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time

to time, whether as a result of new information, future developments or otherwise.

Tecogen Media & Investor Relations Contact Information:

John N. Hatsopoulos

P: 781-622-1120

E: John.Hatsopoulos@tecogen.com

Jeb Armstrong

P: (781) 466-6413

E: Jeb.Armstrong@tecogen.com

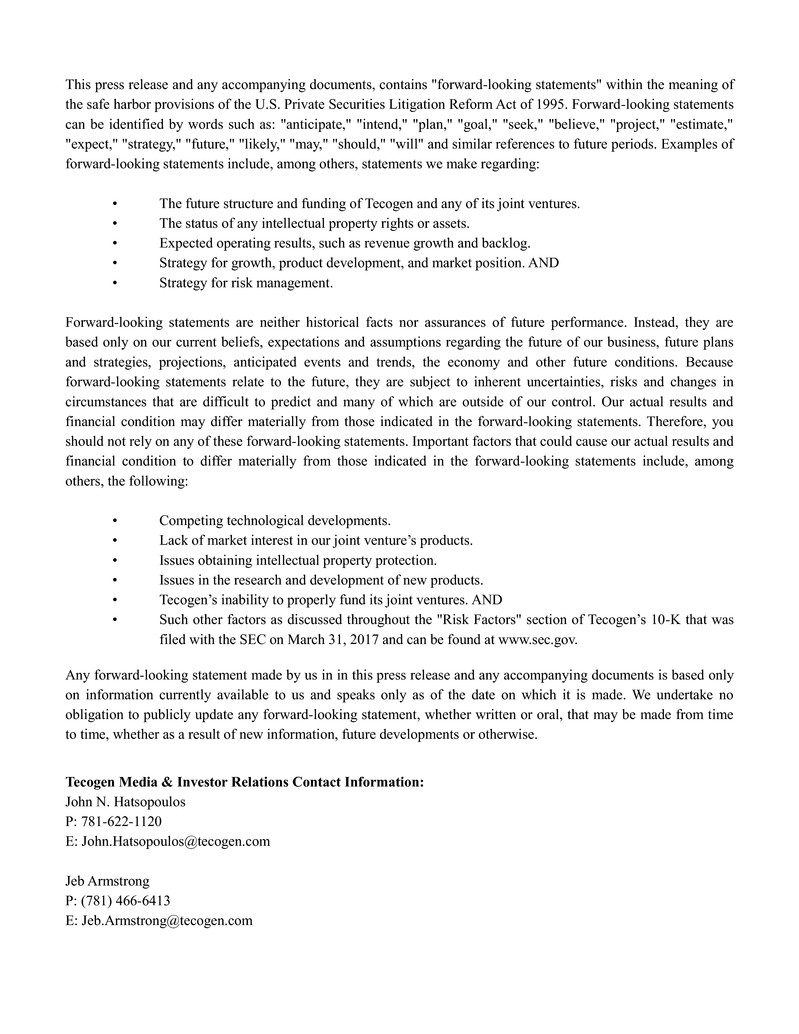

TECOGEN INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

As of September 30, 2017 and December 31, 2016

(unaudited)

September 30, 2017 December 31, 2016

ASSETS

Current assets:

Cash and cash equivalents $ 2,077,047 $ 3,721,765

Accounts receivable, net 11,094,287 8,630,418

Unbilled revenue 3,063,089 2,269,645

Inventory, net 6,118,835 4,774,264

Due from related party 496,655 260,988

Prepaid and other current assets 742,701 401,876

Total current assets 23,592,614 20,058,956

Property, plant and equipment, net 15,502,974 517,143

Intangible assets, net 2,430,178 1,065,967

Excess of cost over fair value of net assets acquired 12,602,409 —

Goodwill 40,870 40,870

Other assets 2,462,870 2,058,425

TOTAL ASSETS $ 56,631,915 $ 23,741,361

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable $ 5,356,449 $ 3,367,481

Accrued expenses 1,676,307 1,378,258

Deferred revenue 1,477,124 876,765

Loan due to related party 850,000 —

Interest payable, related party 39,403 —

Total current liabilities 9,399,283 5,622,504

Long-term liabilities:

Deferred revenue, net of current portion 386,494 459,275

Senior convertible promissory note, related party 3,149,086 3,148,509

Unfavorable contract liability 10,358,283 —

Total liabilities 23,293,146 9,230,288

Commitments and contingencies (Note 9)

Stockholders’ equity:

Tecogen Inc. stockholders’ equity:

Common stock, $0.001 par value; 100,000,000 shares authorized;

24,724,392 and 19,981,912 issued and outstanding at September

30, 2017 and December 31, 2016, respectively 24,724

19,982

Additional paid-in capital 56,081,026 37,334,773

Accumulated other comprehensive loss-investment securities (184,998 ) —

Accumulated deficit (23,065,226 ) (22,843,682 )

Total Tecogen Inc. stockholders’ equity 32,855,526 14,511,073

Noncontrolling interest 483,243 —

Total stockholders’ equity 33,338,769 14,511,073

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 56,631,915 $ 23,741,361

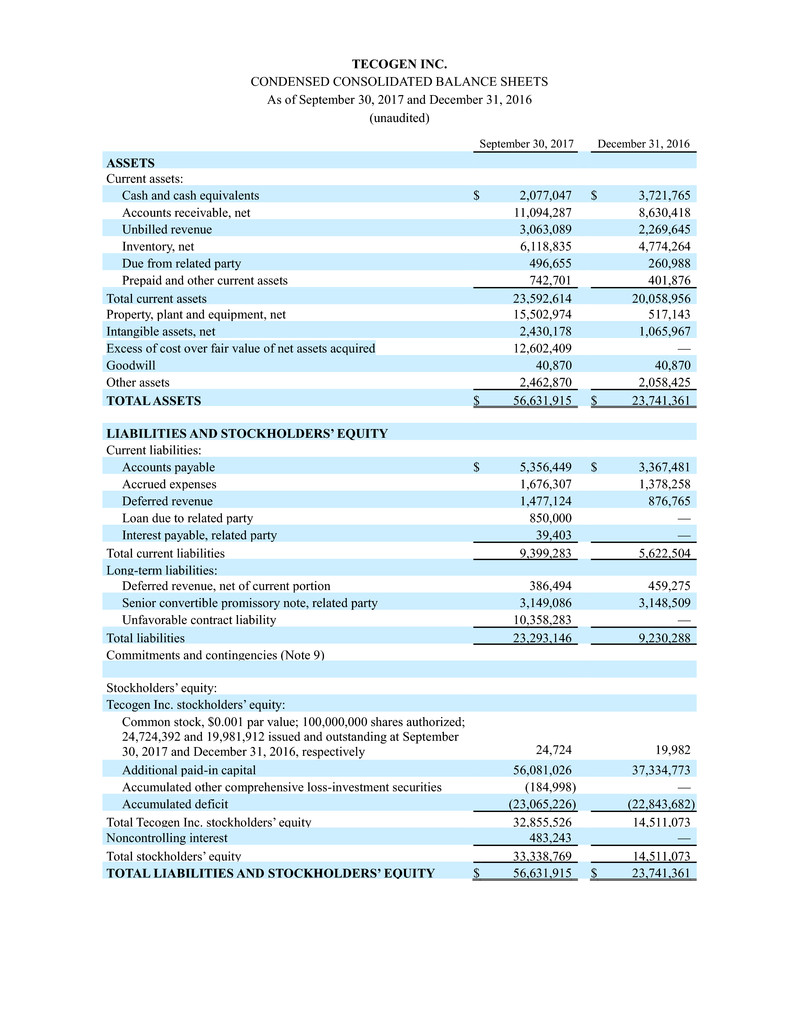

TECOGEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(unaudited)

Three Months Ended

September 30,

2017

September 30,

2016

Revenues

Products $ 2,425,616 $ 2,850,901

Services 4,519,467 3,765,554

Energy production 1,556,115 —

Total revenues 8,501,198 6,616,455

Cost of sales

Products 1,538,515 1,715,462

Services 2,981,454 2,126,175

Energy production 723,198 —

Total cost of sales 5,243,167 3,841,637

Gross profit 3,258,031 2,774,818

Operating expenses

General and administrative 2,427,352 2,003,838

Selling 503,415 367,412

Research and development 241,725 154,075

Total operating expenses 3,172,492 2,525,325

Income from operations 85,539 249,493

Other income (expense)

Interest and other income 14,849 3,914

Interest expense (45,242 ) (45,539 )

Total other expense, net (30,393 ) (41,625 )

Consolidated net income 55,146 207,868

Income attributable to the noncontrolling interest (27,935 ) —

Net income attributable to Tecogen Inc. 27,211 207,868

Other comprehensive income - unrealized gain on securities 39,361 —

Comprehensive income $ 66,572 $ 207,868

Net income per share – basic $ 0.00 $ 0.01

Net income per share – diluted $ 0.00 $ 0.01

Weighted average shares outstanding – basic 24,720,613 19,640,812

Weighted average shares outstanding – diluted 24,930,624 20,229,120

Non-GAAP financial disclosure (1)

Net income attributable to Tecogen Inc. $ 27,211 $ 207,868

Interest expense, net 30,393 41,625

Depreciation & amortization, net 160,061 66,484

EBITDA 217,665 315,977

Stock based compensation 40,645 66,825

Merger related expenses 37,445 —

Adjusted EBITDA $ 295,755 $ 382,802

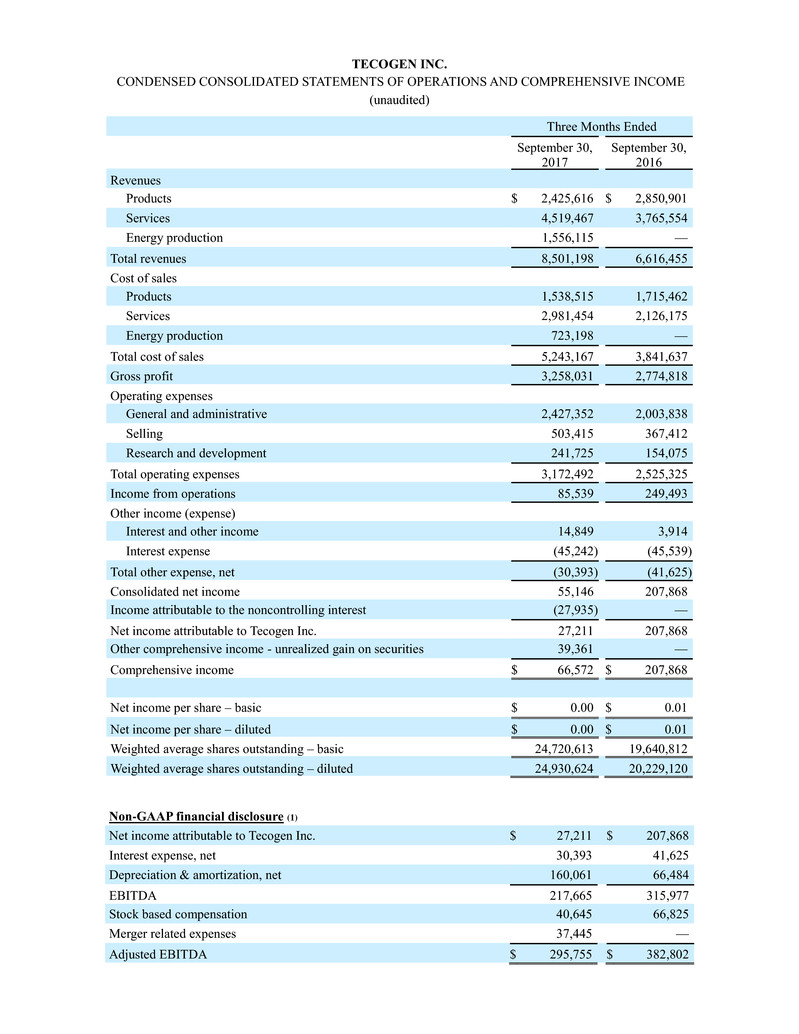

TECOGEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

Nine Months Ended

September 30,

2017

September 30,

2016

Revenues

Products $ 8,349,159 $ 7,525,909

Services 12,259,037 9,853,369

Energy production 2,330,307 —

Total revenues 22,938,503 17,379,278

Cost of sales

Products 5,261,245 5,035,230

Services 7,464,193 5,746,992

Energy production 1,053,741 —

Total cost of sales 13,779,179 10,782,222

Gross profit 9,159,324 6,597,056

Operating expenses

General and administrative 7,042,500 5,898,230

Selling 1,558,378 1,217,533

Research and development 641,064 524,696

Total operating expenses 9,241,942 7,640,459

Loss from operations (82,618 ) (1,043,403 )

Other income (expense)

Interest and other income 21,033 9,575

Interest expense (115,026 ) (131,973 )

Total other expense, net (93,993 ) (122,398 )

Consolidated net loss (176,611 ) (1,165,801 )

(Income) loss attributable to the noncontrolling interest (44,933 ) 64,962

Net loss attributable to Tecogen Inc. $ (221,544 ) $ (1,100,839 )

Other comprehensive loss - unrealized loss on securities $ (184,998 ) $ —

Comprehensive loss $ (406,542 ) $ (1,100,839 )

Net loss per share - basic and diluted $ (0.01 ) $ (0.06 )

Weighted average shares outstanding - basic and diluted 22,643,406 19,071,497

Non-GAAP financial disclosure (1)

Net loss attributable to Tecogen Inc. $ (221,544 ) $ (1,100,839 )

Interest expense, net 93,993 122,398

Depreciation & amortization, net 402,939 198,766

EBITDA 275,388 (779,675 )

Stock based compensation 138,329 117,065

Merger related expenses 156,298 35,690

Adjusted EBITDA $ 570,015 $ (626,920 )

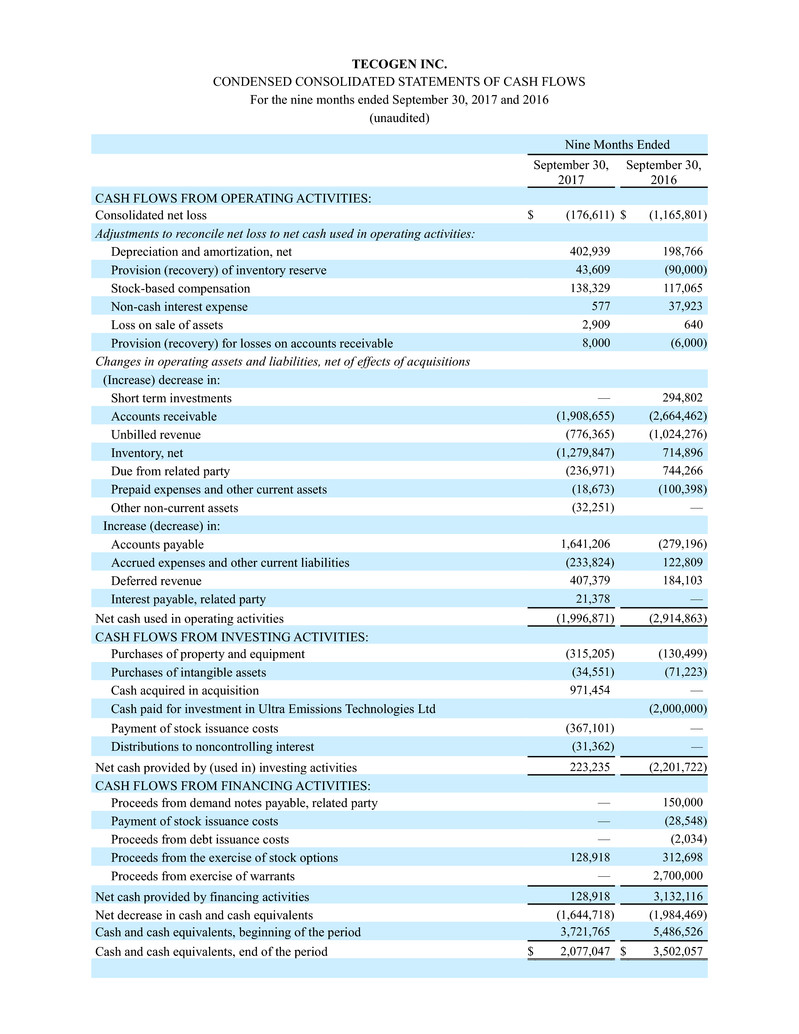

TECOGEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the nine months ended September 30, 2017 and 2016

(unaudited)

Nine Months Ended

September 30,

2017

September 30,

2016

CASH FLOWS FROM OPERATING ACTIVITIES:

Consolidated net loss $ (176,611 ) $ (1,165,801 )

Adjustments to reconcile net loss to net cash used in operating activities:

Depreciation and amortization, net 402,939 198,766

Provision (recovery) of inventory reserve 43,609 (90,000 )

Stock-based compensation 138,329 117,065

Non-cash interest expense 577 37,923

Loss on sale of assets 2,909 640

Provision (recovery) for losses on accounts receivable 8,000 (6,000 )

Changes in operating assets and liabilities, net of effects of acquisitions

(Increase) decrease in:

Short term investments — 294,802

Accounts receivable (1,908,655 ) (2,664,462 )

Unbilled revenue (776,365 ) (1,024,276 )

Inventory, net (1,279,847 ) 714,896

Due from related party (236,971 ) 744,266

Prepaid expenses and other current assets (18,673 ) (100,398 )

Other non-current assets (32,251 ) —

Increase (decrease) in:

Accounts payable 1,641,206 (279,196 )

Accrued expenses and other current liabilities (233,824 ) 122,809

Deferred revenue 407,379 184,103

Interest payable, related party 21,378 —

Net cash used in operating activities (1,996,871 ) (2,914,863 )

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment (315,205 ) (130,499 )

Purchases of intangible assets (34,551 ) (71,223 )

Cash acquired in acquisition 971,454 —

Cash paid for investment in Ultra Emissions Technologies Ltd (2,000,000 )

Payment of stock issuance costs (367,101 ) —

Distributions to noncontrolling interest (31,362 ) —

Net cash provided by (used in) investing activities 223,235 (2,201,722 )

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from demand notes payable, related party — 150,000

Payment of stock issuance costs — (28,548 )

Proceeds from debt issuance costs — (2,034 )

Proceeds from the exercise of stock options 128,918 312,698

Proceeds from exercise of warrants — 2,700,000

Net cash provided by financing activities 128,918 3,132,116

Net decrease in cash and cash equivalents (1,644,718 ) (1,984,469 )

Cash and cash equivalents, beginning of the period 3,721,765 5,486,526

Cash and cash equivalents, end of the period $ 2,077,047 $ 3,502,057

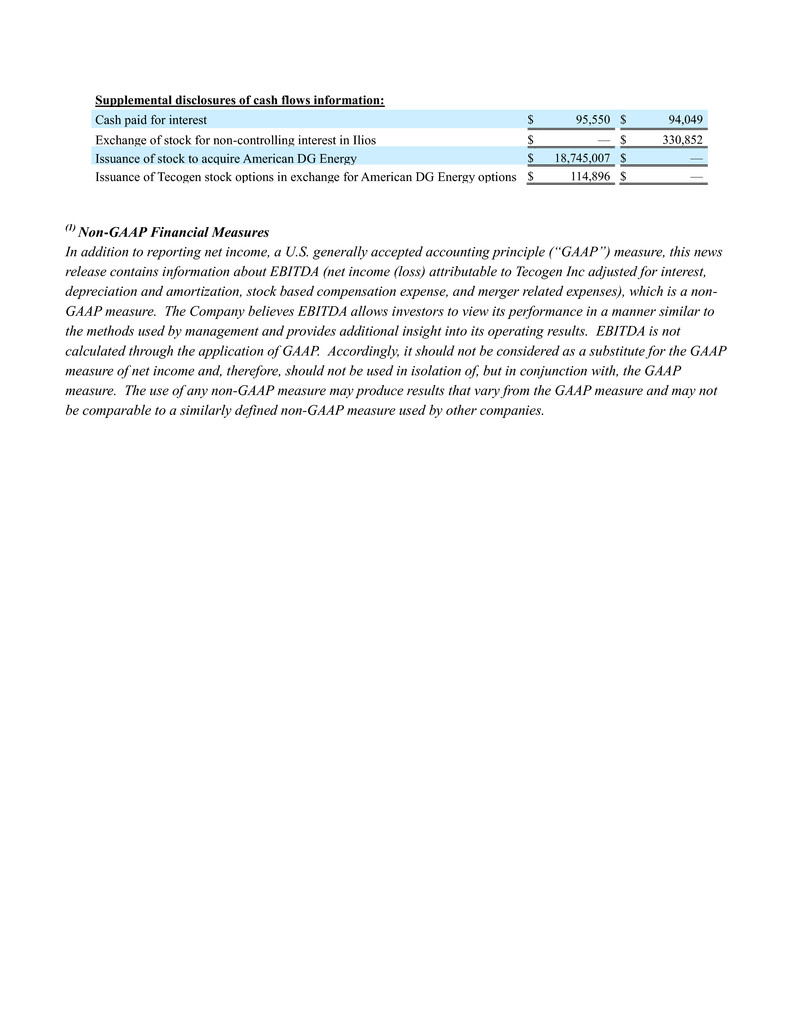

Supplemental disclosures of cash flows information:

Cash paid for interest $ 95,550 $ 94,049

Exchange of stock for non-controlling interest in Ilios $ — $ 330,852

Issuance of stock to acquire American DG Energy $ 18,745,007 $ —

Issuance of Tecogen stock options in exchange for American DG Energy options $ 114,896 $ —

(1) Non-GAAP Financial Measures

In addition to reporting net income, a U.S. generally accepted accounting principle (“GAAP”) measure, this news

release contains information about EBITDA (net income (loss) attributable to Tecogen Inc adjusted for interest,

depreciation and amortization, stock based compensation expense, and merger related expenses), which is a non-

GAAP measure. The Company believes EBITDA allows investors to view its performance in a manner similar to

the methods used by management and provides additional insight into its operating results. EBITDA is not

calculated through the application of GAAP. Accordingly, it should not be considered as a substitute for the GAAP

measure of net income and, therefore, should not be used in isolation of, but in conjunction with, the GAAP

measure. The use of any non-GAAP measure may produce results that vary from the GAAP measure and may not

be comparable to a similarly defined non-GAAP measure used by other companies.