NASDAQ: TGEN

3Q 2017 Earnings

November 9, 2017

3Q 2017 Earnings Call 2

John Hatsopoulos

•Co-Chief Executive Officer, Director

Benjamin Locke

•Co-Chief Executive Officer

Robert Panora

• President & Chief Operating Officer

Bonnie Brown

• Chief Accounting Officer

Participants

3Q 2017 Earnings Call 3

This presentation This conference call and any accompanying documents, contain "forward-looking statements" within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek,"

"believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Examples of forward-looking

statements include, among others, statements we make regarding:

• Expected operating results, such as revenue growth, gross profit and backlog; and

• Strategy for growth, product development, and market position.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and

assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions.

Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and

many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements include, among others, the following:

• Decrease in interest in our products.

• The elimination of incentives and rebates related to our products.

• Competing technological developments.

• Issues in the research, development, and commercialization of new products.

• Tecogen’s inability to obtain sufficient funding. AND

• Such other factors as discussed throughout the "Risk Factors" section of Tecogen’s 10-K that was filed with the SEC on March 31, 2017 and can be found at

www.sec.gov.

Any forward-looking statement made by us in this conference call and any accompanying documents is based only on information currently available to us and speaks

only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from

time to time, whether as a result of new information, future developments or otherwise.

Safe Harbor Statement

3Q 2017 Earnings Call 4

Speaker Topic(s)

John Hatsopoulos Introduction

Benjamin Locke

Why Tecogen

3rd Quarter Review

Recent Achievements

Robert Panora Emissions Update

Bonnie Brown Financial Review

Benjamin Locke Opportunities and Outlook

Q&A

3Q Agenda

Heat, Power & Cooling that is Cheaper, Cleaner, & More Reliable

Tecogen’s compelling ROI proposition meets the needs of a diverse range of customers.

Hospitality Health Care Education Multi-Unit Residential Industrial Municipal Recreation

“Unregulated Utility”

CHP Modules

Electricity & Heat

Ilios Water Heaters

2-3x Heat

Efficiency

TECOCHILL

Cooling & Heat

Emissions Control

Ultra-Clean

Emissions

Ultera

On-Site Utility

American DG

ADGE

3Q 2017 Earnings Call 5

Why Tecogen?

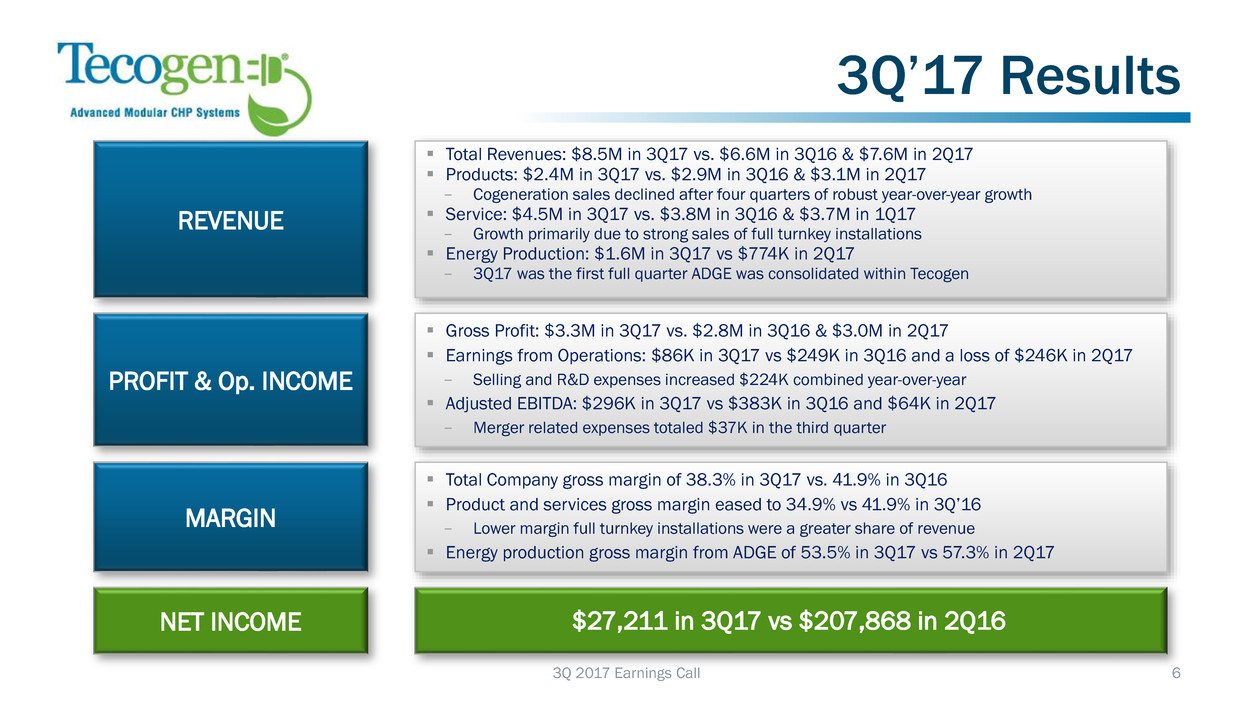

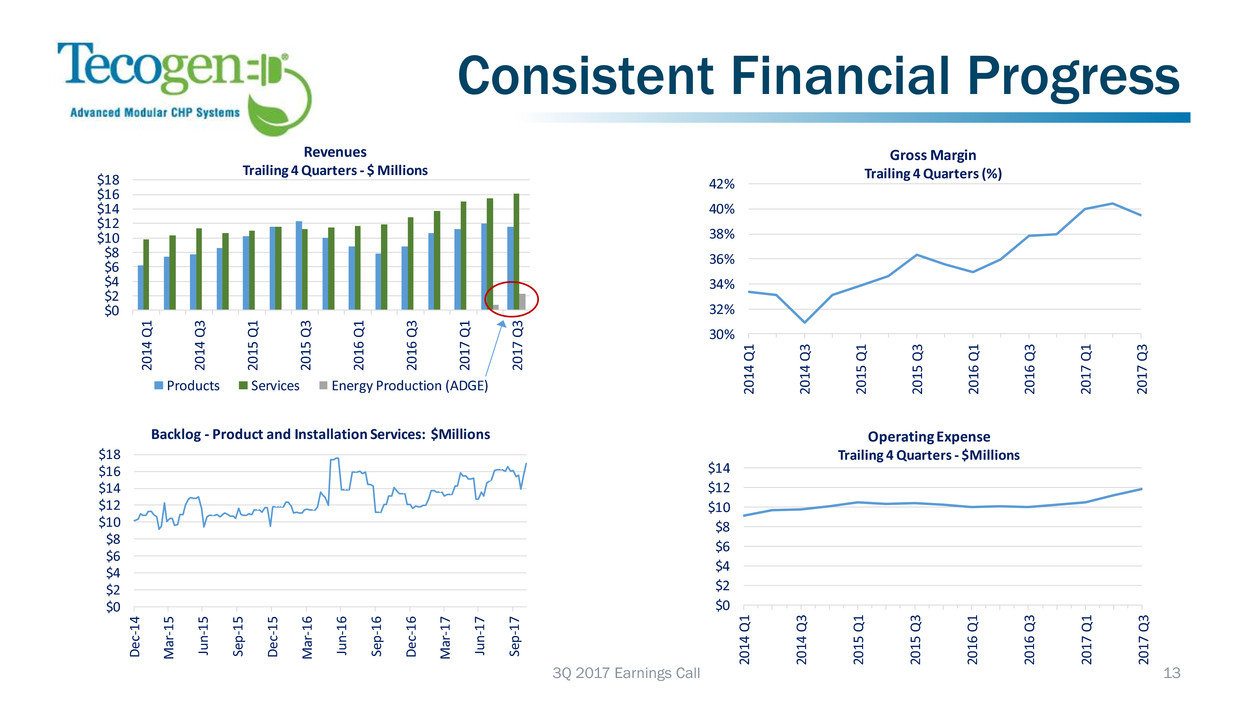

REVENUE

▪ Total Revenues: $8.5M in 3Q17 vs. $6.6M in 3Q16 & $7.6M in 2Q17

▪ Products: $2.4M in 3Q17 vs. $2.9M in 3Q16 & $3.1M in 2Q17

− Cogeneration sales declined after four quarters of robust year-over-year growth

▪ Service: $4.5M in 3Q17 vs. $3.8M in 3Q16 & $3.7M in 1Q17

− Growth primarily due to strong sales of full turnkey installations

▪ Energy Production: $1.6M in 3Q17 vs $774K in 2Q17

− 3Q17 was the first full quarter ADGE was consolidated within Tecogen

PROFIT & Op. INCOME

▪ Gross Profit: $3.3M in 3Q17 vs. $2.8M in 3Q16 & $3.0M in 2Q17

▪ Earnings from Operations: $86K in 3Q17 vs $249K in 3Q16 and a loss of $246K in 2Q17

− Selling and R&D expenses increased $224K combined year-over-year

▪ Adjusted EBITDA: $296K in 3Q17 vs $383K in 3Q16 and $64K in 2Q17

− Merger related expenses totaled $37K in the third quarter

MARGIN

▪ Total Company gross margin of 38.3% in 3Q17 vs. 41.9% in 3Q16

▪ Product and services gross margin eased to 34.9% vs 41.9% in 3Q’16

− Lower margin full turnkey installations were a greater share of revenue

▪ Energy production gross margin from ADGE of 53.5% in 3Q17 vs 57.3% in 2Q17

NET INCOME $27,211 in 3Q17 vs $207,868 in 2Q16

3Q 2017 Earnings Call 6

3Q’17 Results

Performance

• Tecochill experiencing increasingly broad market penetration

• Growing interest in full turnkey installation

• Backlog sustained at near record levels

Groundwork for Continued Growth

• Expanding base of ESCO partnerships

• Tracking state approvals for indoor grow facilities

• Continued focus on improving ADGE fleet performance

• Identifying and implementing cost savings measures of

consolidated company

Emissions Development for Future Growth

• Completed prototype of fork truck emissions program

• Completed installation of emissions packages on stationary

generators seeking California air permit

• Developing next steps to commercialize technology for

automotive applications

3Q 2017 Earnings Call 7

Recent Achievements

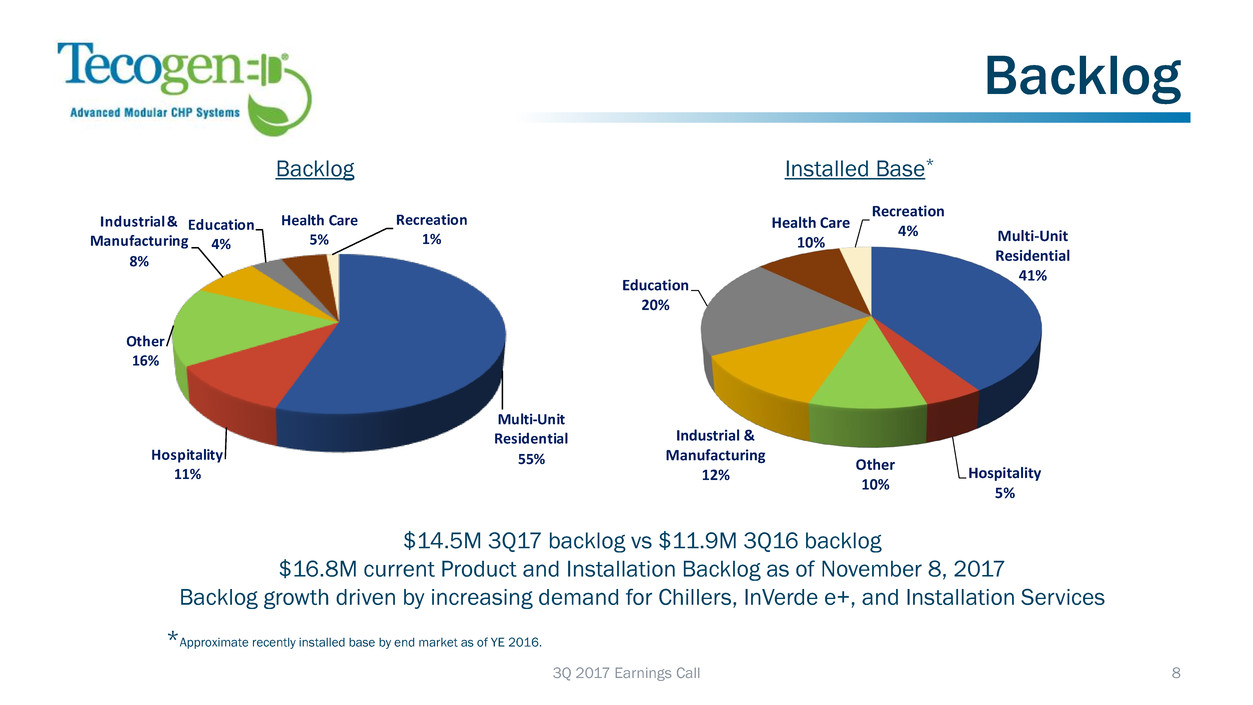

Installed Base* Backlog

$14.5M 3Q17 backlog vs $11.9M 3Q16 backlog

$16.8M current Product and Installation Backlog as of November 8, 2017

Backlog growth driven by increasing demand for Chillers, InVerde e+, and Installation Services

*Approximate recently installed base by end market as of YE 2016.

3Q 2017 Earnings Call 8

Multi-Unit

Residential

41%

Hospitality

5%

Other

10%

Industrial &

Manufacturing

12%

Education

20%

Health Care

10%

Recreation

4%

Multi-Unit

Residential

55%Hospitality

11%

Other

16%

Industrial &

Manufacturing

8%

Education

4%

Health Care

5%

Recreation

1%

Backlog

3Q 2017 Earnings Call 9

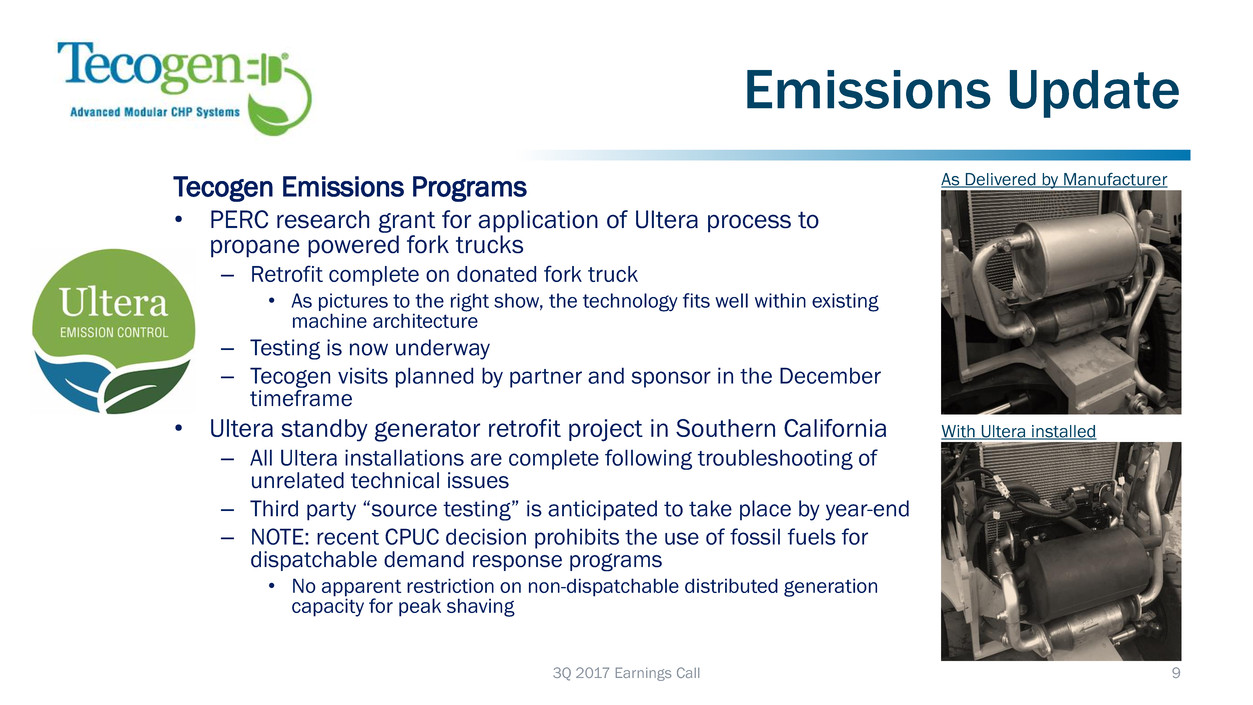

As Delivered by Manufacturer

With Ultera installed

Tecogen Emissions Programs

• PERC research grant for application of Ultera process to

propane powered fork trucks

– Retrofit complete on donated fork truck

• As pictures to the right show, the technology fits well within existing

machine architecture

– Testing is now underway

– Tecogen visits planned by partner and sponsor in the December

timeframe

• Ultera standby generator retrofit project in Southern California

– All Ultera installations are complete following troubleshooting of

unrelated technical issues

– Third party “source testing” is anticipated to take place by year-end

– NOTE: recent CPUC decision prohibits the use of fossil fuels for

dispatchable demand response programs

• No apparent restriction on non-dispatchable distributed generation

capacity for peak shaving

Emissions Update

Ultera Adaption to Vehicle Emissions

• Dissolution of Ultratek pending

– Tecogen to receive $2 million in cash

– Transaction to acquire all the IP within

Ultratek for $400,000 to follow

• Initial conversations with investors in

new entity underway

• Goal is to have structure in place to

begin research & development

process in early 2018

3Q 2017 Earnings Call 10

Emissions Update

Financial Metrics

Revenues, Margins, Growth

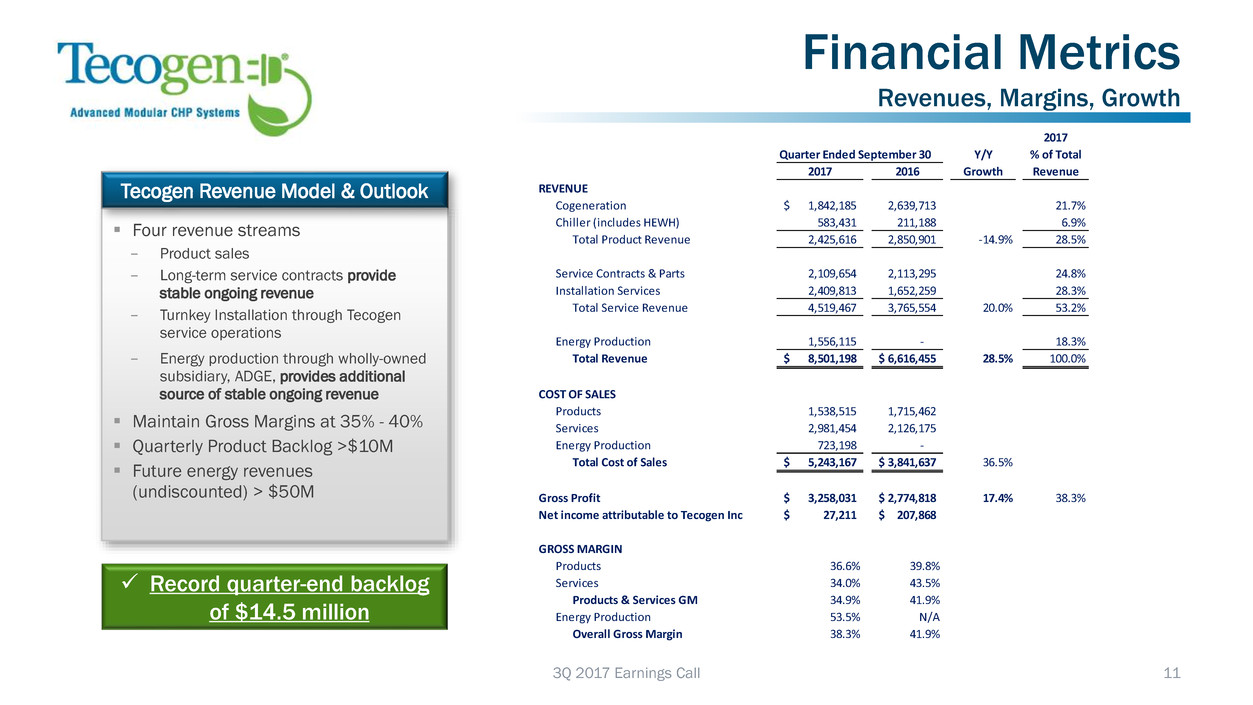

▪ Four revenue streams

− Product sales

− Long-term service contracts provide

stable ongoing revenue

− Turnkey Installation through Tecogen

service operations

− Energy production through wholly-owned

subsidiary, ADGE, provides additional

source of stable ongoing revenue

▪ Maintain Gross Margins at 35% - 40%

▪ Quarterly Product Backlog >$10M

▪ Future energy revenues

(undiscounted) > $50M

Tecogen Revenue Model & Outlook

✓ Record quarter-end backlog

of $14.5 million

3Q 2017 Earnings Call 11

2017

Quarter Ended September 30 Y/Y % of Total

2017 2016 Growth Revenue

REVENUE

Cogeneration 1,842,185$ 2,639,713 21.7%

Chiller (includes HEWH) 583,431 211,188 6.9%

Total Product Revenue 2,425,616 2,850,901 -14.9% 28.5%

Service Contracts & Parts 2,109,654 2,113,295 24.8%

Installation Services 2,409,813 1,652,259 28.3%

Total Service Revenue 4,519,467 3,765,554 20.0% 53.2%

Energy Production 1,556,115 - 18.3%

Total Revenue 8,501,198$ 6,616,455$ 28.5% 100.0%

COST OF SALES

Products 1,538,515 1,715,462

Services 2,981,454 2,126,175

Energy Production 723,198 -

Total Cost of Sales 5,243,167$ 3,841,637$ 36.5%

Gross Profit 3,258,031$ 2,774,818$ 17.4% 38.3%

Net income attributable to Tecogen Inc 27,211$ 207,868$

GROSS MARGIN

Products 36.6% 39.8%

Services 34.0% 43.5%

Products & Services GM 34.9% 41.9%

Energy Production 53.5% N/A

Overall Gross Margin 38.3% 41.9%

3Q 2017 Earnings Call 12

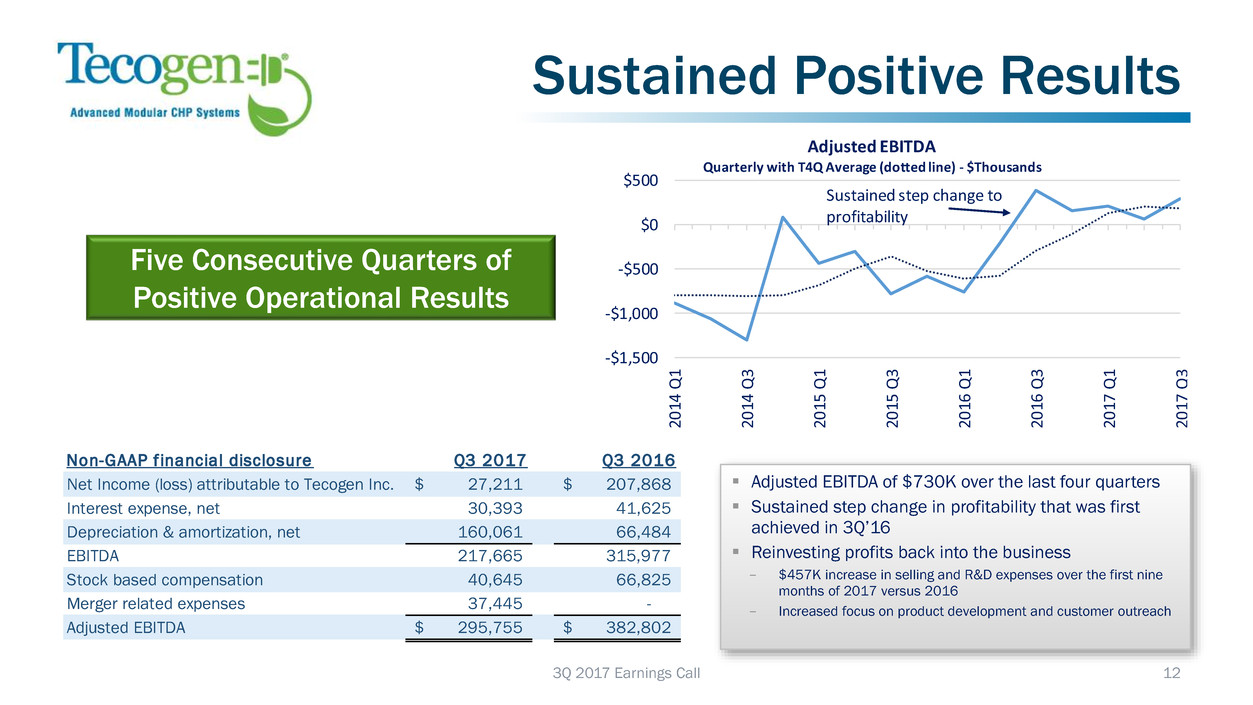

Sustained Positive Results

Five Consecutive Quarters of

Positive Operational Results

▪ Adjusted EBITDA of $730K over the last four quarters

▪ Sustained step change in profitability that was first

achieved in 3Q’16

▪ Reinvesting profits back into the business

− $457K increase in selling and R&D expenses over the first nine

months of 2017 versus 2016

− Increased focus on product development and customer outreach

Non-GAAP f inancial disclosure Q3 2017 Q3 2016

Net Income (loss) attributable to Tecogen Inc. 27,211$ 207,868$

Interest expense, net 30,393 41,625

Depreciation & amortization, net 160,061 66,484

EBITDA 217,665 315,977

Stock based comp nsation 40,645 66,825

Merger related expense 37,445 -

Adjusted EBITDA 295,755$ 382,802$

-$1,500

-$1,000

-$500

$0

$500

20

14

Q1

20

14

Q3

20

15

Q1

20

15

Q3

20

16

Q1

20

16

Q3

20

17

Q1

20

17

Q3

Adjusted EBITDA

Quarterly with T4Q Average (dotted line) - $Thousands

Sustained step change to

profitability

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

20

14

Q

1

20

14

Q

3

20

15

Q

1

20

15

Q

3

20

16

Q

1

20

16

Q

3

20

17

Q

1

20

17

Q

3

Revenues

Trailing 4 Quarters - $ Millions

Products Services Energy Production (ADGE)

3Q 2017 Earnings Call 13

Consistent Financial Progress

30%

32%

34%

36%

38%

40%

42%

20

14

Q

1

20

14

Q

3

20

15

Q

1

20

15

Q

3

20

16

Q

1

20

16

Q

3

20

17

Q

1

20

17

Q

3

Gross Margin

Trailing 4 Quarters (%)

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

De

c-1

4

Ma

r-1

5

Jun

-15

Se

p-1

5

De

c-1

5

Ma

r-1

6

Jun

-16

Se

p-1

6

De

c-1

6

Ma

r-1

7

Jun

-17

Se

p-1

7

Backlog - Product and Installation Services: $Millions

$0

$2

$4

$6

$8

$10

$12

$14

20

14

Q

1

20

14

Q

3

20

15

Q

1

20

15

Q

3

20

16

Q

1

20

16

Q

3

20

17

Q

1

20

17

Q

3

Op ating Expense

Trailing 4 Quarters - $Millions

Opportunities & Outlook

a growing company in a growing industry

•High ROI product

•Technological

innovation

•Relationships with key

partners

•Increasing

environmental and

regulatory pressures

•Resiliency and

Demand Response

concerns

Sales

•Turnkey installation

•Long term service

agreements

•Nationwide presence

•High margin revenue

stream

•Additional growth

anticipated

Service

•Predictable, annuity

type revenue

•Enhancing profitability

of existing fleet

•Reduced operational

costs through Tecogen

service

•Additional growth

possibility

American DG

•Double digit CAGR

•>$40B market potential

for CHP

•Margins 35% - 40%

•>$10M product and

installation backlog

•<50% manufacturing

capacity utilization

•Stable operating expense

profile

Growth &

Margins

3Q 2017 Earnings Call 14

NASDAQ: TGEN

3Q 2017 Earnings Call 15

Q & A

Company Information

Tecogen Inc.

45 First Avenue

Waltham, MA 02451

www.tecogen.com

Contact

John Hatsopoulos, Co-CEO

781.622.1122

John.Hatsopoulos@tecogen.com

Jeb Armstrong, Director of Capital Markets

781.466.6413

Jeb.Armstrong@tecogen.com

3Q 2017 Earnings Call 16

Contact Information