Energy Efficiency Reimagined

NASDAQ: TGEN

Year-End 2017 Earnings Review

March 21, 2018

Participants

Co-Chief Executive Officer, DirectorJohn Hatsopoulos

Co-Chief Executive OfficerBenjamin Locke

President & Chief Operating OfficerRobert Panora

Chief Accounting OfficerBonnie Brown

2

Safe Harbor Statement

This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or

other non-historical matters, or projected revenues, income, returns or other financial measures, that may include words such as

"believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and

similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and

unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by

such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any

forward-looking statements.

In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”,

among the factors that could cause actual results to differ materially from past and projected future results are the following:

fluctuations in demand for our products and services, competing technological developments, issues relating to research and

development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory

environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on

favorable terms to fund existing operations and anticipated growth.

In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA

which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business

operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the

underlying operating performance of our current business and enables investors to better understand and evaluate our historical and

prospective operating performance by eliminating items that vary from period to period without correlation to our core operating

performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures.

3

Earnings Call Agenda

John Hatsopoulos

Introduction

Benjamin Locke

Why Tecogen

Year-End 2017 Review

Recent Achievements

Market and Regulatory Developments

Robert Panora

Emissions Update

Bonnie Brown

Financial Review

Benjamin Locke

Opportunities and Outlook

Q&A

4

Heat, Power, and/or Cooling that is

Advanced Modular

Cogeneration Systems

Cheaper

Industry leading efficiency

Cleaner

Lower emissions thanks to efficiency and emissions technology

More reliable

Real time monitoring enables prompt service

All of Tecogen’s equipment is powered by internal combustion

engines that use clean, abundant natural gas and is equipped with

Tecogen’s patented Ultera emissions system

5

Sustained Positive

Financial Results

Record annual revenue in 2017 of

$33.2 million

Sustained step change to profitability

achieved in 3Q’16

Six consecutive quarters of positive

operational results

Adjusted EBITDA of $1.1 million for

the year, $533K in 4Q’17

Adjusted EBITDA is defined as net income (loss) attributable to Tecogen

Inc, adjusted for interest, depreciation and amortization, stock based

compensation expense, and one-time merger related expenses.

-$1,500

-$1,000

-$500

$0

$500

$1,000

20

14

Q1

20

14

Q2

20

14

Q3

20

14

Q4

20

15

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

16

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

17

Q1

20

17

Q2

20

17

Q3

20

17

Q4

Adjusted EBITDA

Quarterly with T4Q Average (dotted line) - $Thousands

Sustained step change

to profitability 6

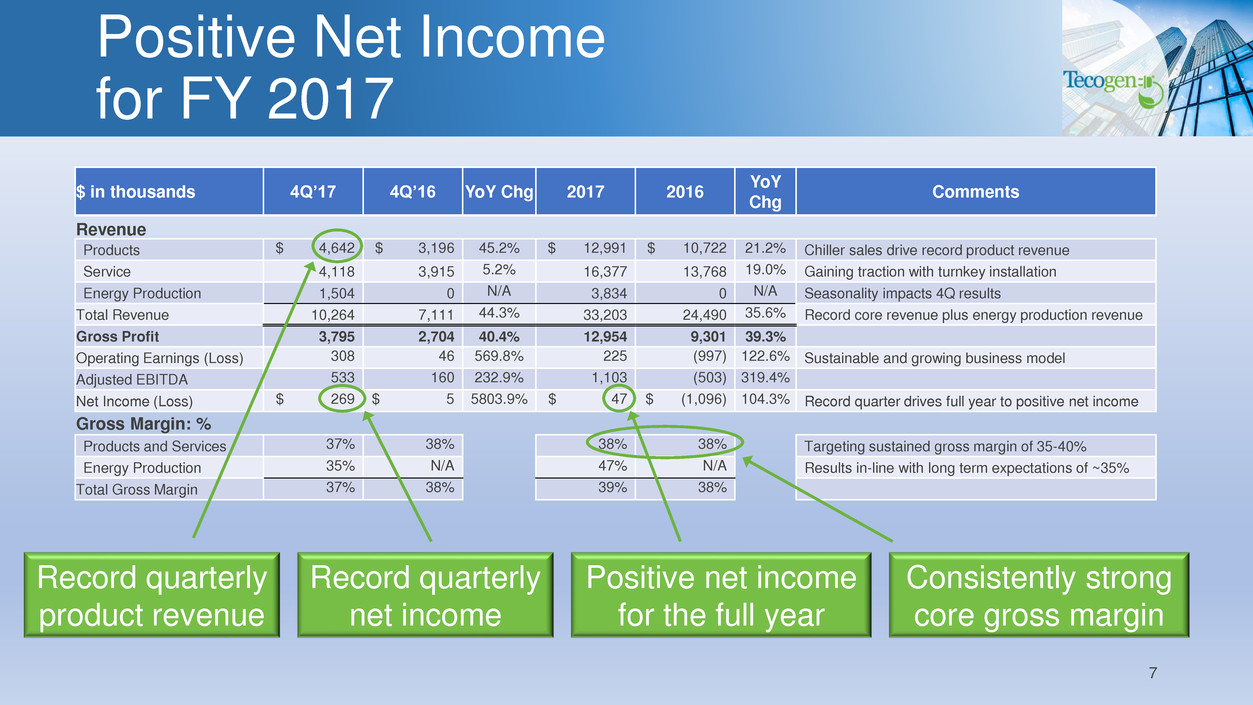

$ in thousands 4Q’17 4Q’16 YoY Chg 2017 2016

YoY

Chg

Comments

Revenue

Products $ 4,642 $ 3,196 45.2% $ 12,991 $ 10,722 21.2% Chiller sales drive record product revenue

Service 4,118 3,915 5.2% 16,377 13,768 19.0% Gaining traction with turnkey installation

Energy Production 1,504 0 N/A 3,834 0 N/A Seasonality impacts 4Q results

Total Revenue 10,264 7,111 44.3% 33,203 24,490 35.6% Record core revenue plus energy production revenue

Gross Profit 3,795 2,704 40.4% 12,954 9,301 39.3%

Operating Earnings (Loss) 308 46 569.8% 225 (997) 122.6% Sustainable and growing business model

Adjusted EBITDA 533 160 232.9% 1,103 (503) 319.4%

Net Income (Loss) $ 269 $ 5 5803.9% $ 47 $ (1,096) 104.3% Record quarter drives full year to positive net income

Gross Margin: %

Products and Services 37% 38% 38% 38% Targeting sustained gross margin of 35-40%

Energy Production 35% N/A 47% N/A Results in-line with long term expectations of ~35%

Total Gross Margin 37% 38% 39% 38%

Positive Net Income

for FY 2017

Positive net income

for the full year

Consistently strong

core gross margin

Record quarterly

product revenue

7

Record quarterly

net income

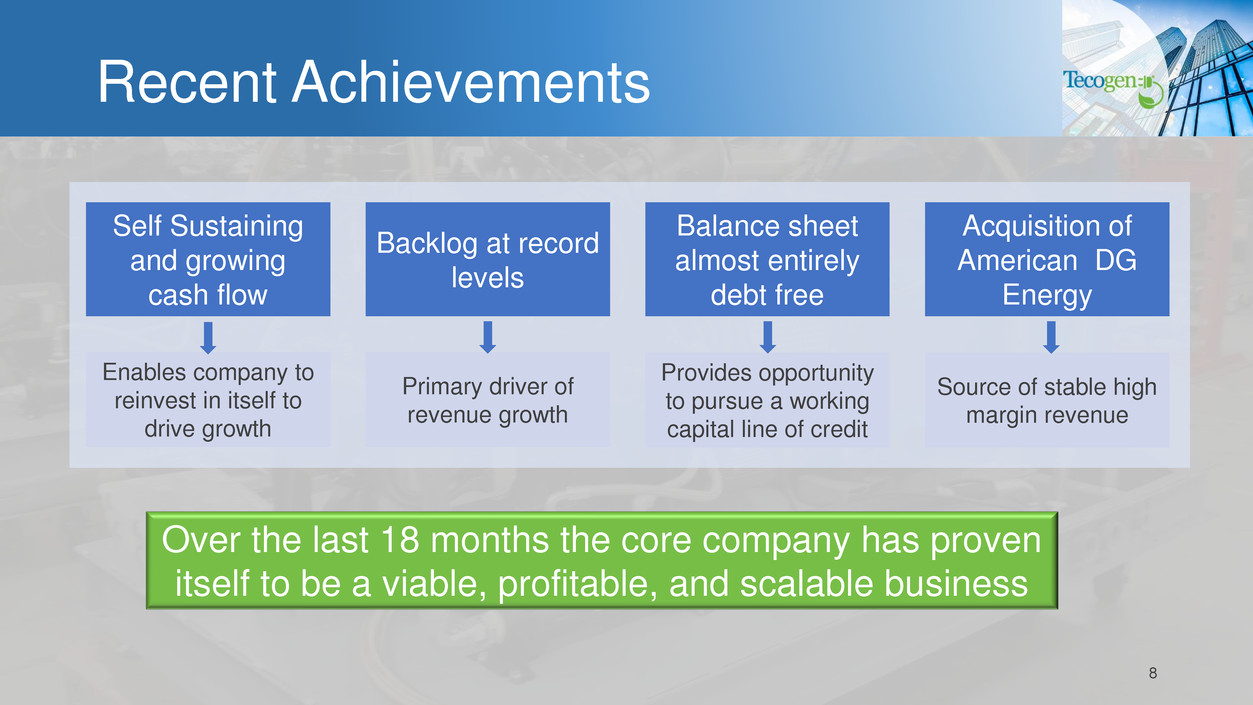

Recent Achievements

Over the last 18 months the core company has proven

itself to be a viable, profitable, and scalable business

8

Self Sustaining

and growing

cash flow

Backlog at record

levels

Balance sheet

almost entirely

debt free

Acquisition of

American DG

Energy

Enables company to

reinvest in itself to

drive growth

Primary driver of

revenue growth

Provides opportunity

to pursue a working

capital line of credit

Source of stable high

margin revenue

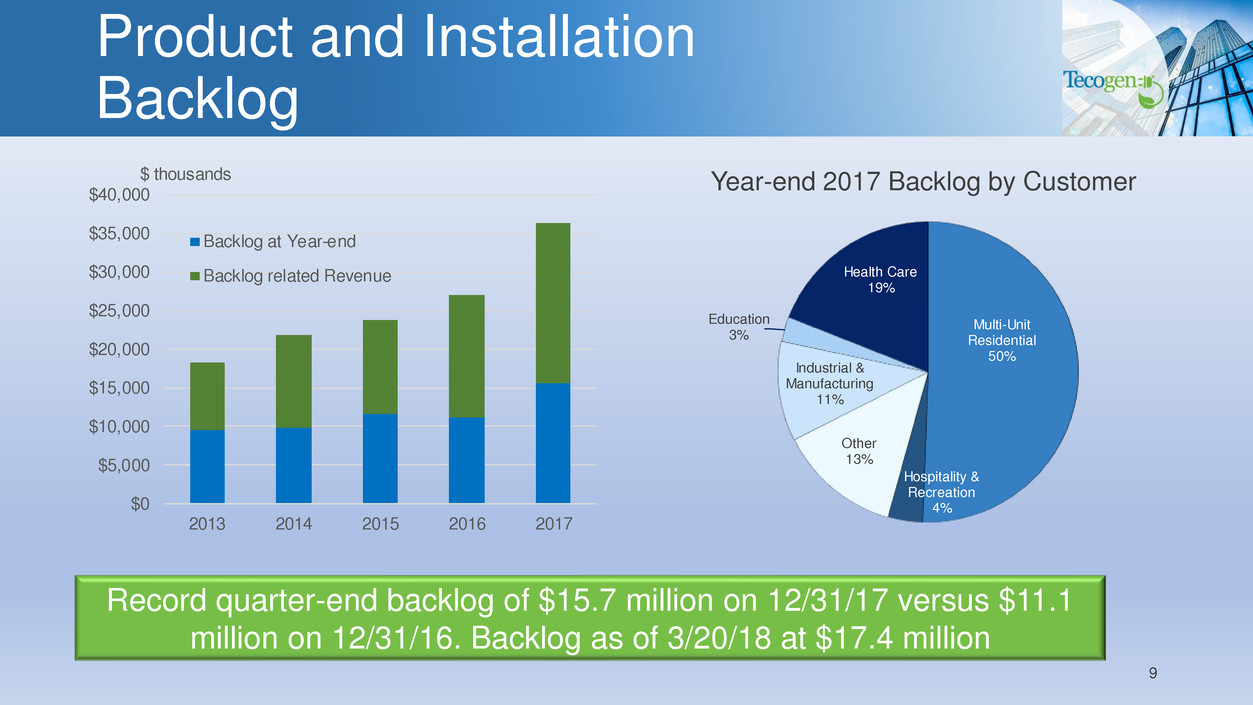

Product and Installation

Backlog

Year-end 2017 Backlog by Customer

Record quarter-end backlog of $15.7 million on 12/31/17 versus $11.1

million on 12/31/16. Backlog as of 3/20/18 at $17.4 million

9

Multi-Unit

Residential

50%

Hospitality &

Recreation

4%

Other

13%

Industrial &

Manufacturing

11%

Education

3%

Health Care

19%

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

2013 2014 2015 2016 2017

$ thousands

Backlog at Year-end

Backlog related Revenue

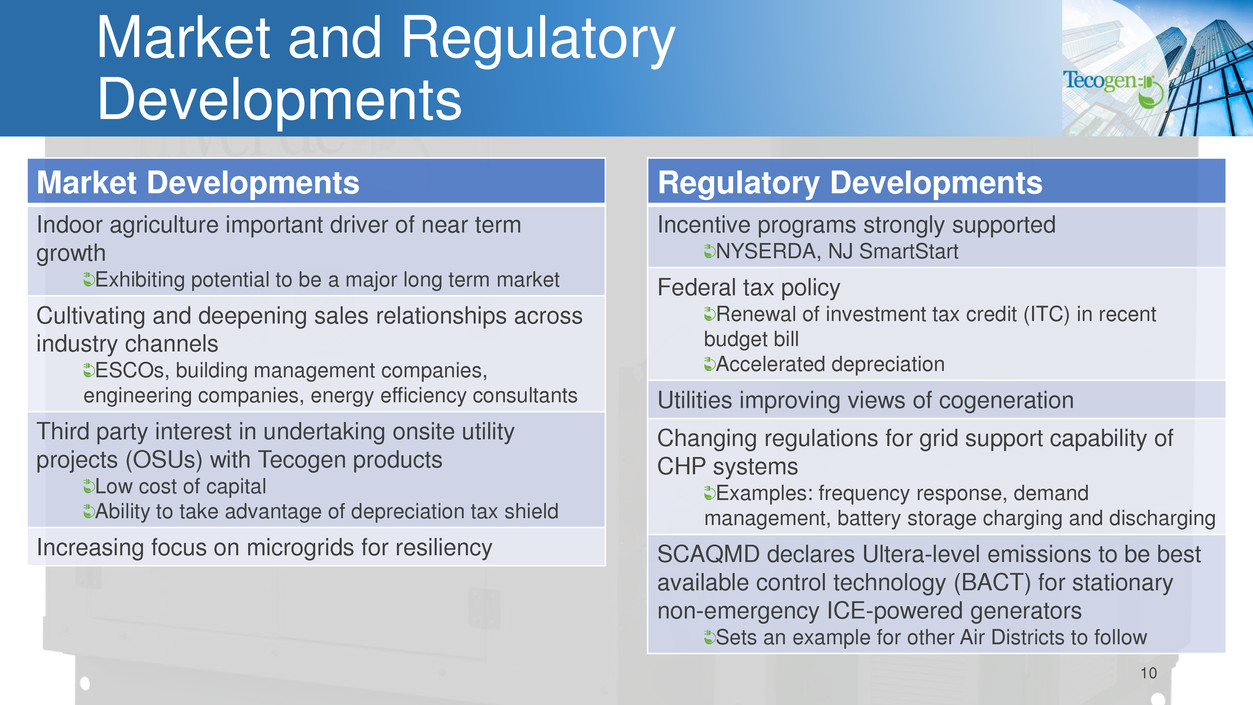

Market and Regulatory

Developments

Market Developments

Indoor agriculture important driver of near term

growth

Exhibiting potential to be a major long term market

Cultivating and deepening sales relationships across

industry channels

ESCOs, building management companies,

engineering companies, energy efficiency consultants

Third party interest in undertaking onsite utility

projects (OSUs) with Tecogen products

Low cost of capital

Ability to take advantage of depreciation tax shield

Increasing focus on microgrids for resiliency

Regulatory Developments

Incentive programs strongly supported

NYSERDA, NJ SmartStart

Federal tax policy

Renewal of investment tax credit (ITC) in recent

budget bill

Accelerated depreciation

Utilities improving views of cogeneration

Changing regulations for grid support capability of

CHP systems

Examples: frequency response, demand

management, battery storage charging and discharging

SCAQMD declares Ultera-level emissions to be best

available control technology (BACT) for stationary

non-emergency ICE-powered generators

Sets an example for other Air Districts to follow

10

Emissions Update Topics

11

Topics of Discussion

Fork trucks

Automotive

Stationary

Standby generator program

Best Available Control Technology

(BACT) in South Coast Air Quality

Management District (SCAQMD)

Potential new SoCal sale

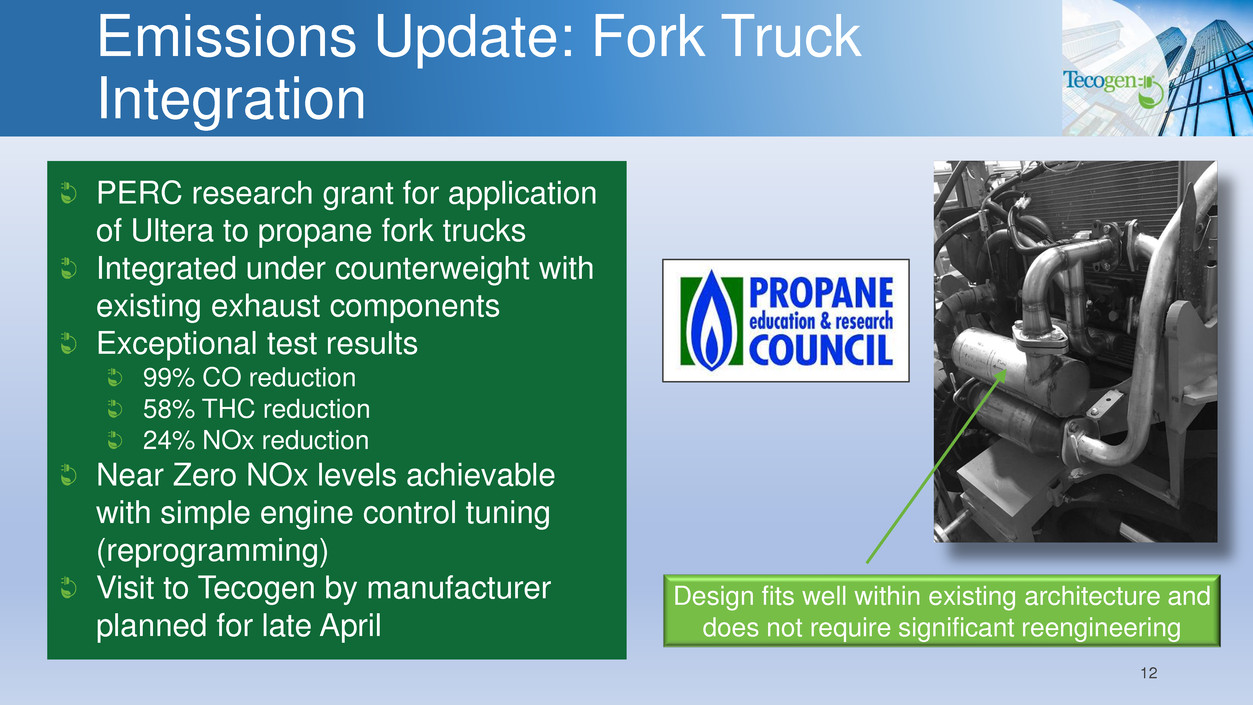

Emissions Update: Fork Truck

Integration

12

PERC research grant for application

of Ultera to propane fork trucks

Integrated under counterweight with

existing exhaust components

Exceptional test results

99% CO reduction

58% THC reduction

24% NOx reduction

Near Zero NOx levels achievable

with simple engine control tuning

(reprogramming)

Visit to Tecogen by manufacturer

planned for late April

Design fits well within existing architecture and

does not require significant reengineering

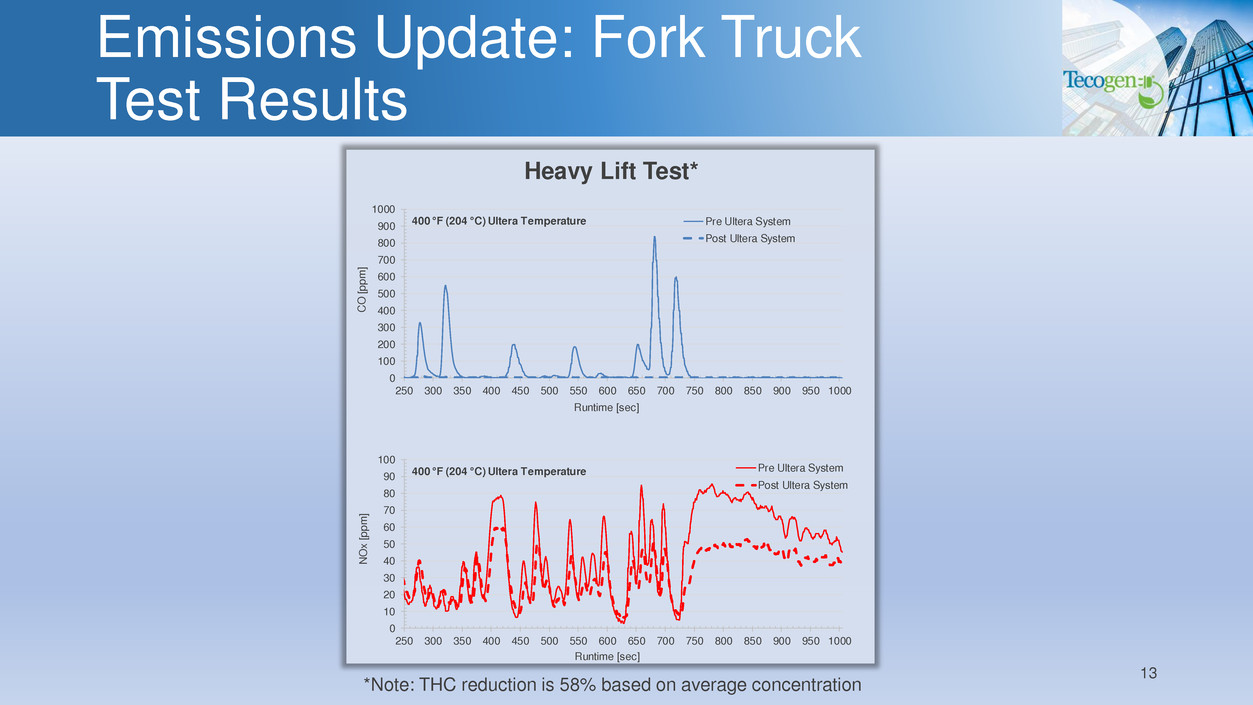

Emissions Update: Fork Truck

Test Results

13

0

100

200

300

400

500

600

700

800

900

1000

250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1000

CO

[pp

m

]

Runtime [sec]

Pre Ultera System

Post Ultera System

400 F (204 C) Ultera Temperature

Heavy Lift Test*

0

10

2

3

4

5

6

70

80

90

100

250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1000

NO

x

[pp

m

]

Runtime [sec]

Pre Ultera System

Post Ultera System

400 F (204 C) Ultera Temperature

*Note: THC reduction is 58% based on average concentration

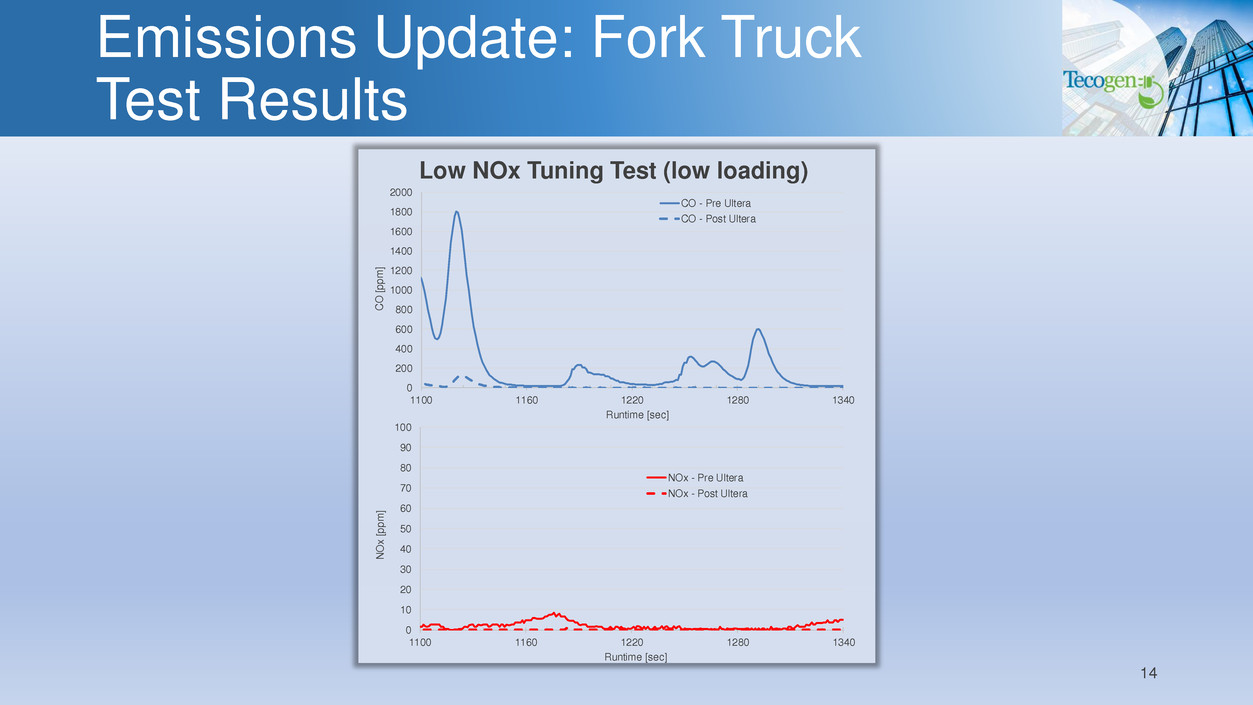

Emissions Update: Fork Truck

Test Results

14

0

200

400

600

800

1000

1200

1400

1600

1800

2000

1100 1160 1220 1280 1340

CO

[pp

m

]

Runtime [sec]

CO - Pre Ultera

CO - Post Ultera

Low NOx Tuning Test (low loading)

0

10

20

30

40

50

60

70

80

90

100

1100 1160 1220 1280 1340

NO

x

[pp

m

]

Runtime [sec]

NOx - Pre Ultera

NOx - Post Ultera

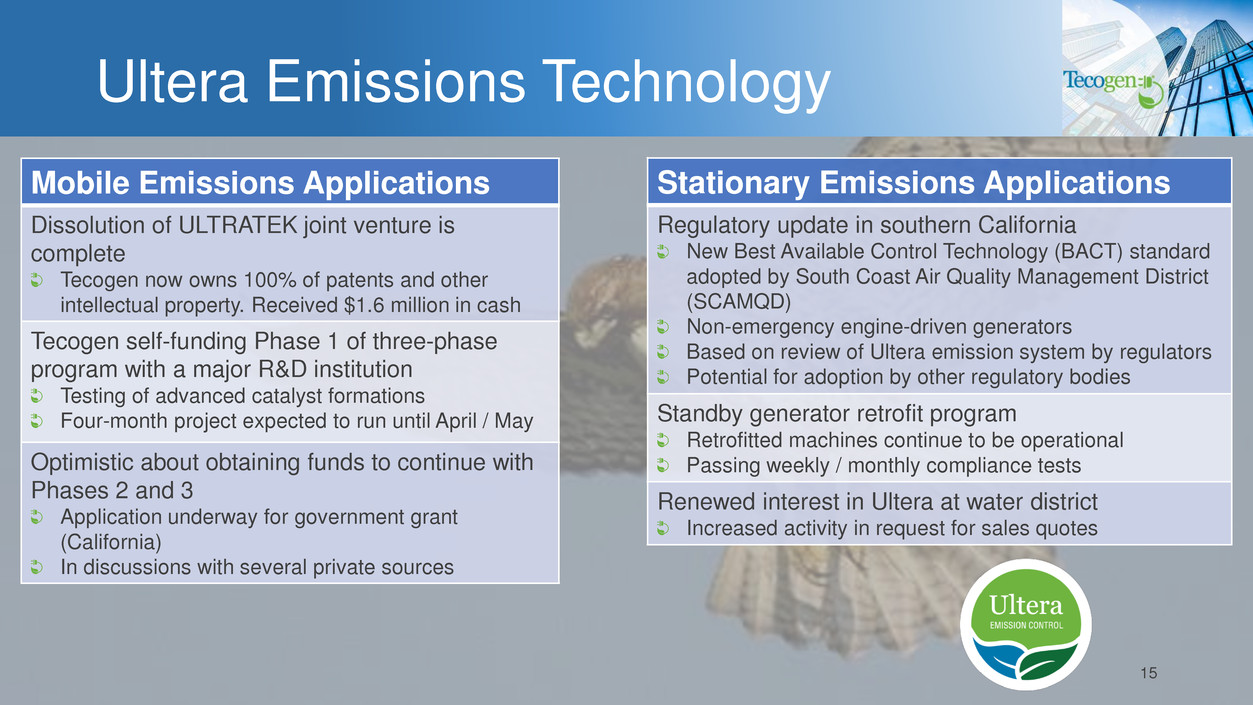

Ultera Emissions Technology

15

Mobile Emissions Applications

Dissolution of ULTRATEK joint venture is

complete

Tecogen now owns 100% of patents and other

intellectual property. Received $1.6 million in cash

Tecogen self-funding Phase 1 of three-phase

program with a major R&D institution

Testing of advanced catalyst formations

Four-month project expected to run until April / May

Optimistic about obtaining funds to continue with

Phases 2 and 3

Application underway for government grant

(California)

In discussions with several private sources

Stationary Emissions Applications

Regulatory update in southern California

New Best Available Control Technology (BACT) standard

adopted by South Coast Air Quality Management District

(SCAMQD)

Non-emergency engine-driven generators

Based on review of Ultera emission system by regulators

Potential for adoption by other regulatory bodies

Standby generator retrofit program

Retrofitted machines continue to be operational

Passing weekly / monthly compliance tests

Renewed interest in Ultera at water district

Increased activity in request for sales quotes

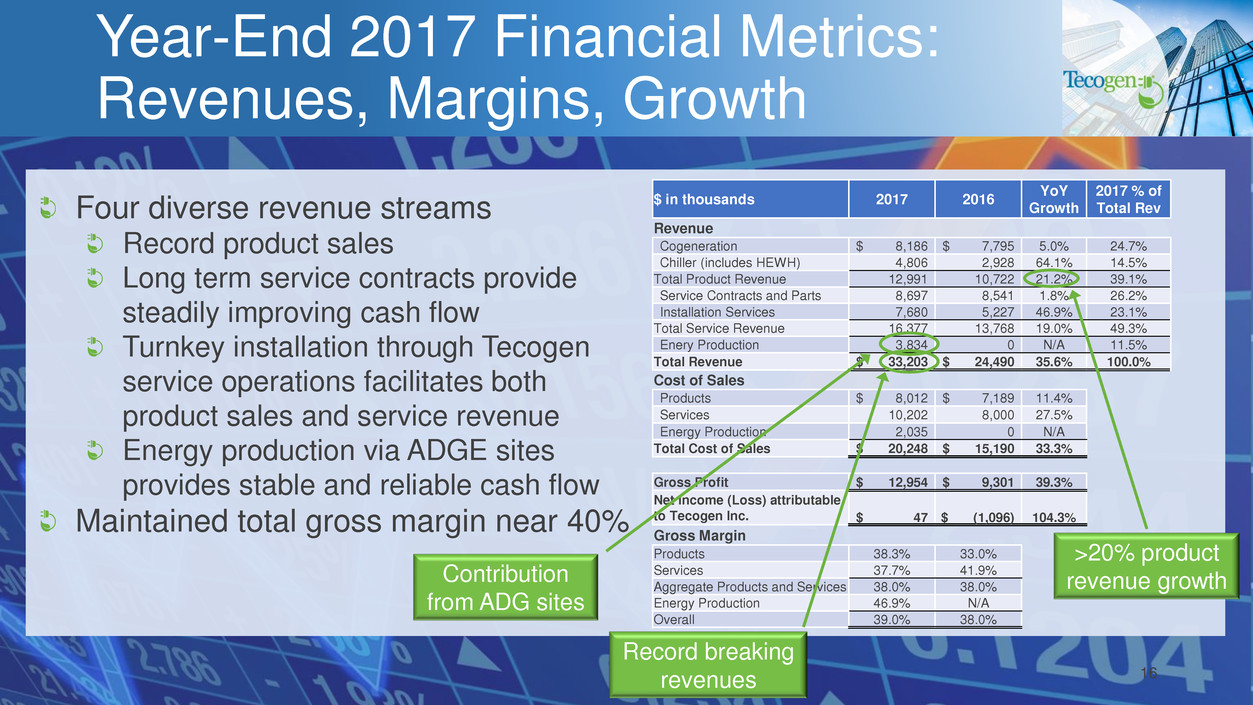

Year-End 2017 Financial Metrics:

Revenues, Margins, Growth

Four diverse revenue streams

Record product sales

Long term service contracts provide

steadily improving cash flow

Turnkey installation through Tecogen

service operations facilitates both

product sales and service revenue

Energy production via ADGE sites

provides stable and reliable cash flow

Maintained total gross margin near 40%

16

$ in thousands 2017 2016

YoY

Growth

2017 % of

Total Rev

Revenue

Cogeneration $ 8,186 $ 7,795 5.0% 24.7%

Chiller (includes HEWH) 4,806 2,928 64.1% 14.5%

Total Product Revenue 12,991 10,722 21.2% 39.1%

Service Contracts and Parts 8,697 8,541 1.8% 26.2%

Installation Services 7,680 5,227 46.9% 23.1%

Total Service Revenue 16,377 13,768 19.0% 49.3%

Enery Production 3,834 0 N/A 11.5%

Total Revenue $ 33,203 $ 24,490 35.6% 100.0%

Cost of Sales

Products $ 8,012 $ 7,189 11.4%

Services 10,202 8,000 27.5%

Energy Production 2,035 0 N/A

Total Cost of Sales $ 20,248 $ 15,190 33.3%

Gross Profit $ 12,954 $ 9,301 39.3%

Net Income (Loss) attributable

to Tecogen Inc. $ 47 $ (1,096) 104.3%

Gross Margin

Products 38.3% 33.0%

Services 37.7% 41.9%

Aggregate Products and Services 38.0% 38.0%

Energy Production 46.9% N/A

Overall 39.0% 38.0%

>20% product

revenue growth

Record breaking

revenues

Contribution

from ADG sites

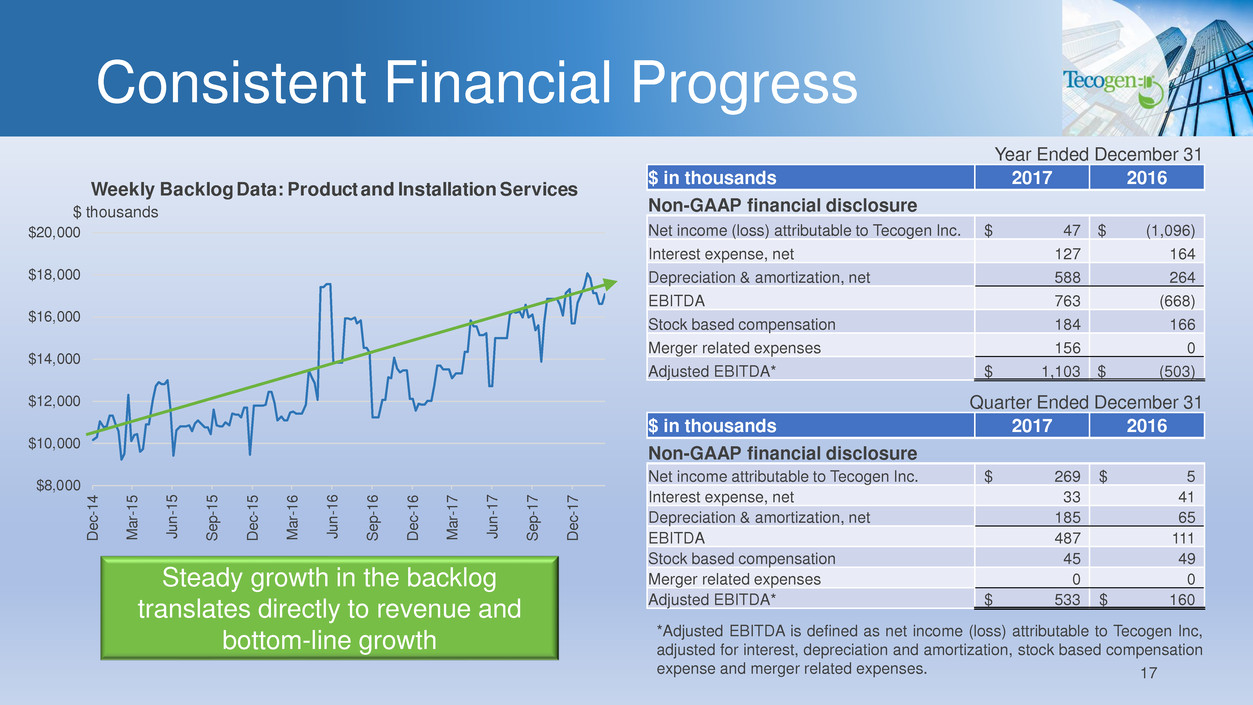

Consistent Financial Progress

*Adjusted EBITDA is defined as net income (loss) attributable to Tecogen Inc,

adjusted for interest, depreciation and amortization, stock based compensation

expense and merger related expenses.

Steady growth in the backlog

translates directly to revenue and

bottom-line growth

17

Year Ended December 31

$ in thousands 2017 2016

Non-GAAP financial disclosure

Net income (loss) attributable to Tecogen Inc. $ 47 $ (1,096)

Interest expense, net 127 164

Depreciation & amortization, net 588 264

EBITDA 763 (668)

Stock based compensation 184 166

Merger related expenses 156 0

Adjusted EBITDA* $ 1,103 $ (503)

Quarter Ended December 31

$ in thousands 2017 2016

Non-GAAP financial disclosure

Net income attributable to Tecogen Inc. $ 269 $ 5

Interest expense, net 33 41

Depreciation & amortization, net 185 65

EBITDA 487 111

Stock based compensation 45 49

Merger related expenses 0 0

Adjusted EBITDA* $ 533 $ 160

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

De

c-1

4

Ma

r-1

5

Jun

-

15

Se

p-1

5

De

c-1

5

Ma

r-1

6

Jun

-

16

Se

p-1

6

De

c-1

6

Ma

r-1

7

Jun

-

17

Se

p-1

7

De

c-1

7

Weekly BacklogData: Product and Installation Services

$ thousands

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

20

14

Q1

20

14

Q2

20

14

Q3

20

14

Q4

20

15

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

16

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

17

Q1

20

17

Q2

20

17

Q3

20

17

Q4

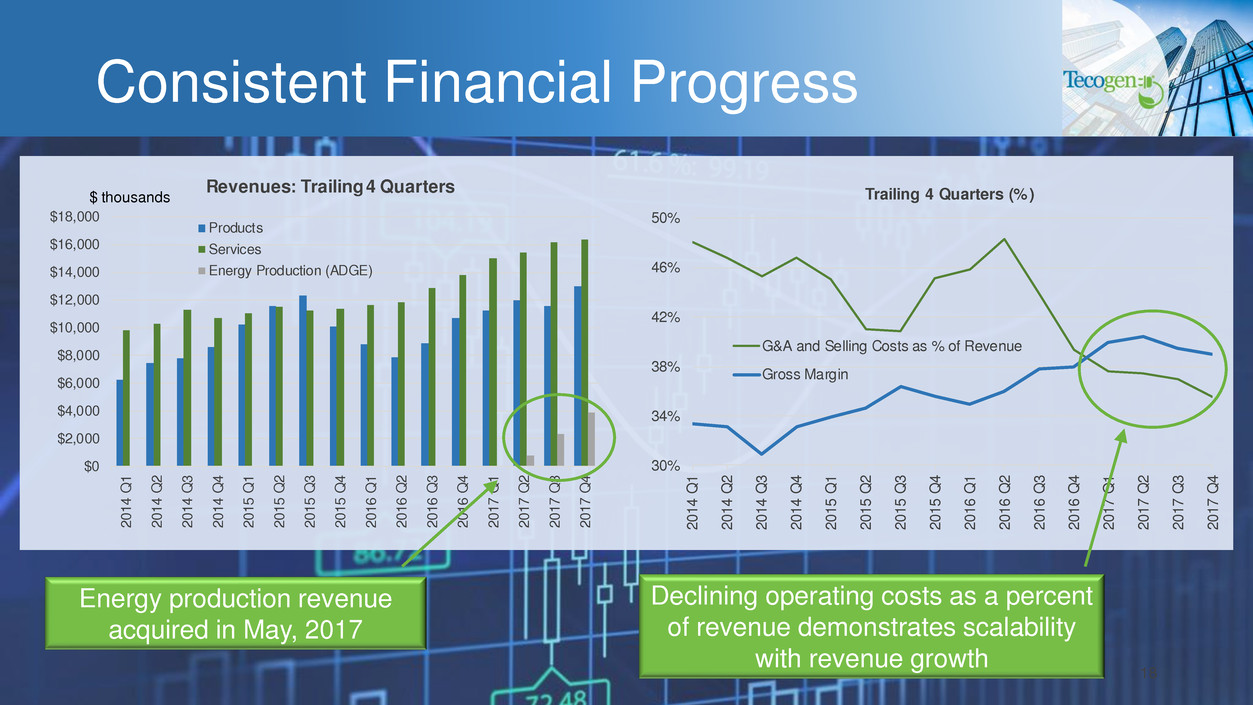

Revenues: Trailing 4 Quarters

Products

Services

Energy Production (ADGE)

$ thousands

30%

34%

38%

42%

46%

50%

20

14

Q1

20

14

Q2

20

14

Q3

20

14

Q4

20

15

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

16

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

17

Q1

20

17

Q2

20

17

Q3

20

17

Q4

Trailing 4 Quarters (%)

G&A and Selling Costs as % of Revenue

Gross Margin

Consistent Financial Progress

Energy production revenue

acquired in May, 2017

Declining operating costs as a percent

of revenue demonstrates scalability

with revenue growth 18

2018 Outlook

Continue to reinvest cash flow in the core

business to drive revenue and gross profit

growth

Consider various financing opportunities to

accelerate growth

Move forward with development of Ultera

technology, focusing initially on fork trucks

Open to opportunistic acquisitions

Take proactive advantage of evolving utility

environment

Energy Efficiency Reimagined

19

Q&A

Company Information

Tecogen, Inc

45 First Ave

Waltham, MA 02451

www.Tecogen.com

Contact information

John Hatsopoulos, Co-CEO

781.622.1122

John.Hatsopoulos@Tecogen.com

Jeb Armstrong, Director of Capital Markets

781.466.6413

Jeb.Armstrong@Tecogen.com

20