Energy Efficiency Reimagined

NASDAQ: TGEN

Spring 2018 Investor Presentation

Safe Harbor Statement

2

This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or

other non-historical matters, or projected revenues, income, returns or other financial measures, that may include words such as

"believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and

similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and

unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by

such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any

forward-looking statements.

In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”,

among the factors that could cause actual results to differ materially from past and projected future results are the following:

fluctuations in demand for our products and services, competing technological developments, issues relating to research and

development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory

environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on

favorable terms to fund existing operations and anticipated growth.

In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA

which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business

operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the

underlying operating performance of our current business and enables investors to better understand and evaluate our historical and

prospective operating performance by eliminating items that vary from period to period without correlation to our core operating

performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures.

Retired President and Vice Chairman of the board of

directors of Thermo Electron Corp. (now Thermo

Fisher Scientific)

Developed Thermo’s famous ‘spinout’ strategy,

resulting in the spinout of 24 public companies from

the parent

Raised nearly $5B from 1990 – 1998 as Thermo’s

CFO for the parent company and it’s various spinout

subsidiaries

Board of Directors of the American Stock Exchange

from 1994 – 2000

Former “Member of the Corporation” of Northeastern

University

John Hatsopoulos Co-Founder,

Chairman Emeritus, and Director

3

Heat, Power, and/or Cooling that is

Advanced Modular

Cogeneration Systems

Cheaper

Industry leading efficiency

Cleaner

Lower emissions thanks to efficiency and emissions technology

More reliable

Real time monitoring enables prompt service

All of Tecogen’s equipment is powered by internal combustion

engines that use clean, abundant natural gas and is equipped with

Tecogen’s patented Ultera emissions system

4

Market Leading Products

Cogeneration

electricity and hot water

Chillers

hot and cold water

Water Heaters

up to 200% efficiency

Energy

Production

On-site utility

Emissions

Reduction

criteria pollutant elimination

5

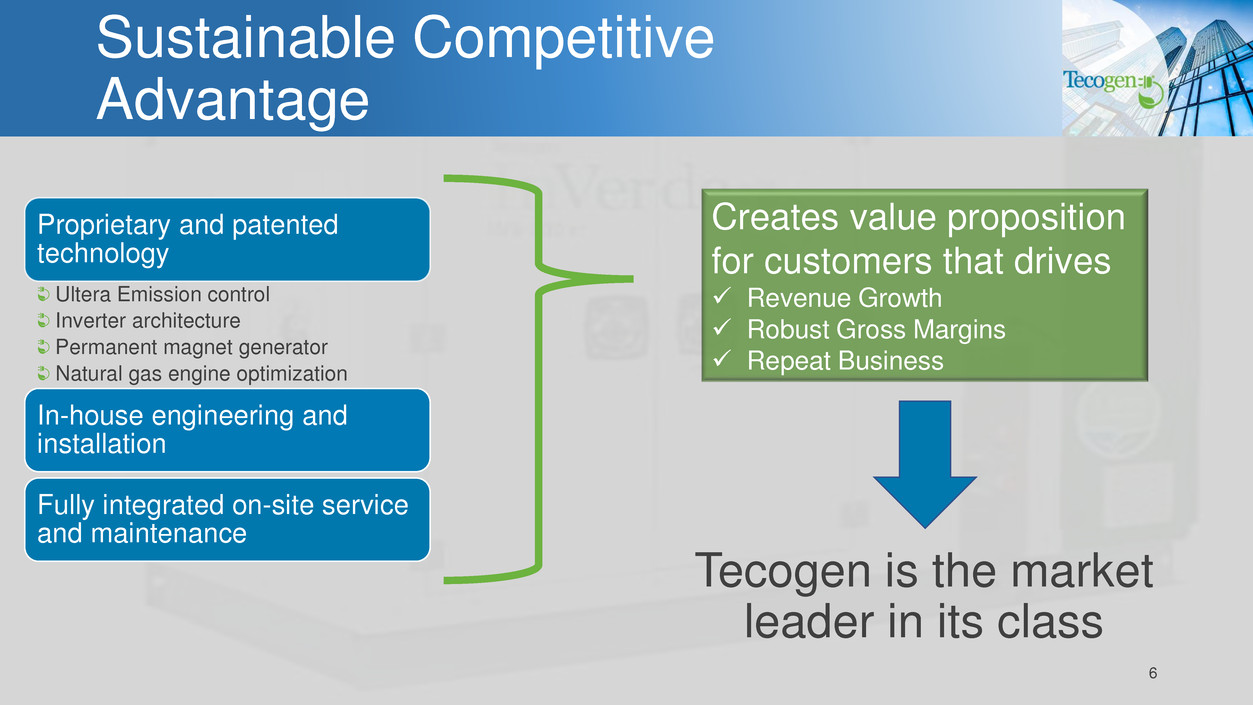

Sustainable Competitive

Advantage

Proprietary and patented

technology

Ultera Emission control

Inverter architecture

Permanent magnet generator

Natural gas engine optimization

In-house engineering and

installation

Fully integrated on-site service

and maintenance

Creates value proposition

for customers that drives

✓ Revenue Growth

✓ Robust Gross Margins

✓ Repeat Business

Tecogen is the market

leader in its class

6

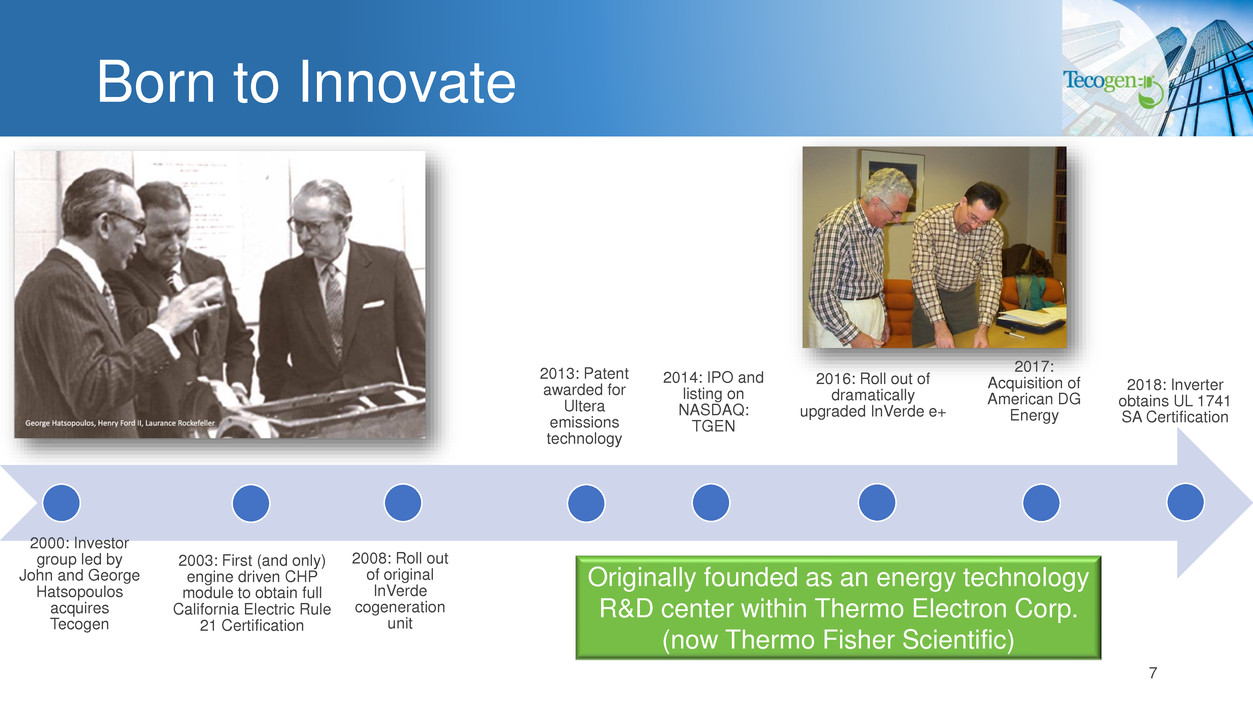

Born to Innovate

2000: Investor

group led by

John and George

Hatsopoulos

acquires

Tecogen

2003: First (and only)

engine driven CHP

module to obtain full

California Electric Rule

21 Certification

2008: Roll out

of original

InVerde

cogeneration

unit

2013: Patent

awarded for

Ultera

emissions

technology

2014: IPO and

listing on

NASDAQ:

TGEN

2016: Roll out of

dramatically

upgraded InVerde e+

2017:

Acquisition of

American DG

Energy

2018: Inverter

obtains UL 1741

SA Certification

Originally founded as an energy technology

R&D center within Thermo Electron Corp.

(now Thermo Fisher Scientific)

7

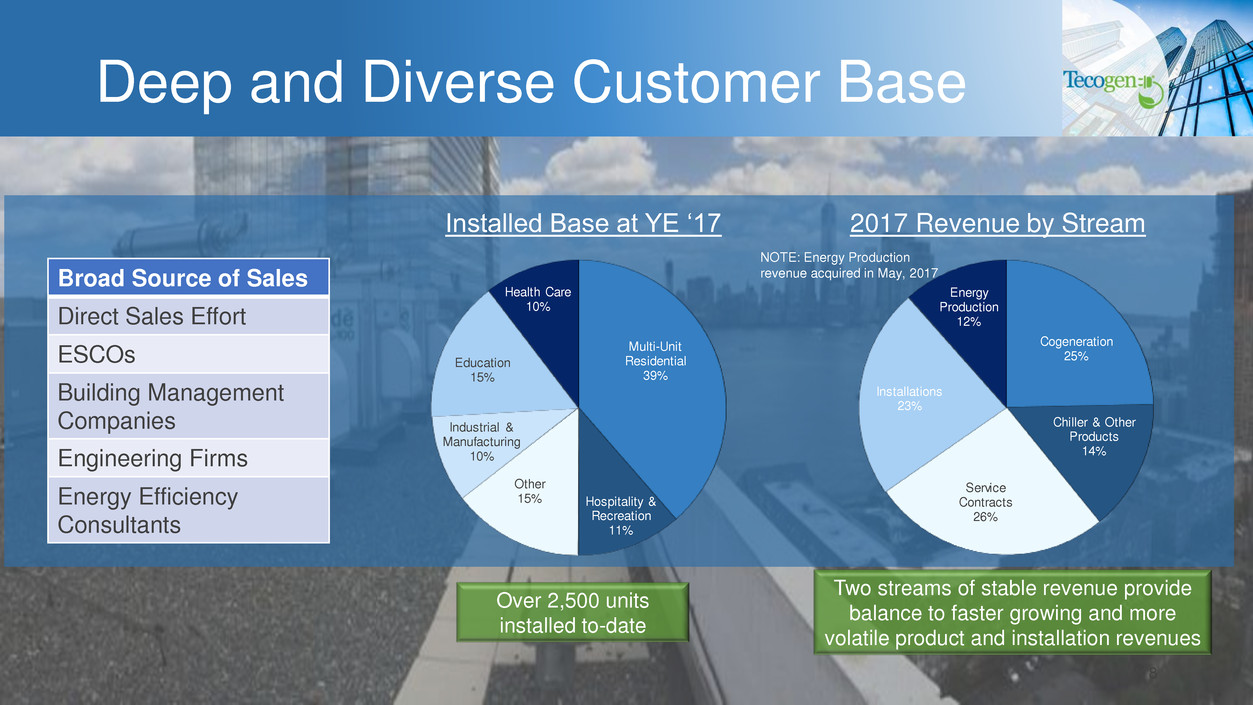

Deep and Diverse Customer Base

Cogeneration

25%

Chiller & Other

Products

14%

Service

Contracts

26%

Installations

23%

Energy

Production

12%

2017 Revenue by StreamInstalled Base at YE ‘17

Over 2,500 units

installed to-date

Two streams of stable revenue provide

balance to faster growing and more

volatile product and installation revenues

NOTE: Energy Production

revenue acquired in May, 2017Broad Source of Sales

Direct Sales Effort

ESCOs

Building Management

Companies

Engineering Firms

Energy Efficiency

Consultants

8

Multi-Unit

Residential

39%

Hospitality &

Recreation

11%

Other

15%

Industrial &

Manufacturing

10%

Education

15%

Health Care

10%

Substantial Growth Opportunities

Untapped potential for application of

emissions technology to automotive

and fork truck industriesEvolving market

conditions

encourage

adaption

Inexpensive

and

abundant

natural gas

Improving

regulatory

environment

Direct cash

incentives

Federal

investment

tax credit

Demand

response

incentives

and demand

charge

avoidance

Grid

resiliency

and blackout

protection

$40+ billion market potential for CHP*

9

*Global Market Insights: Global Combined

Heat and Power Market Report. April, 2017

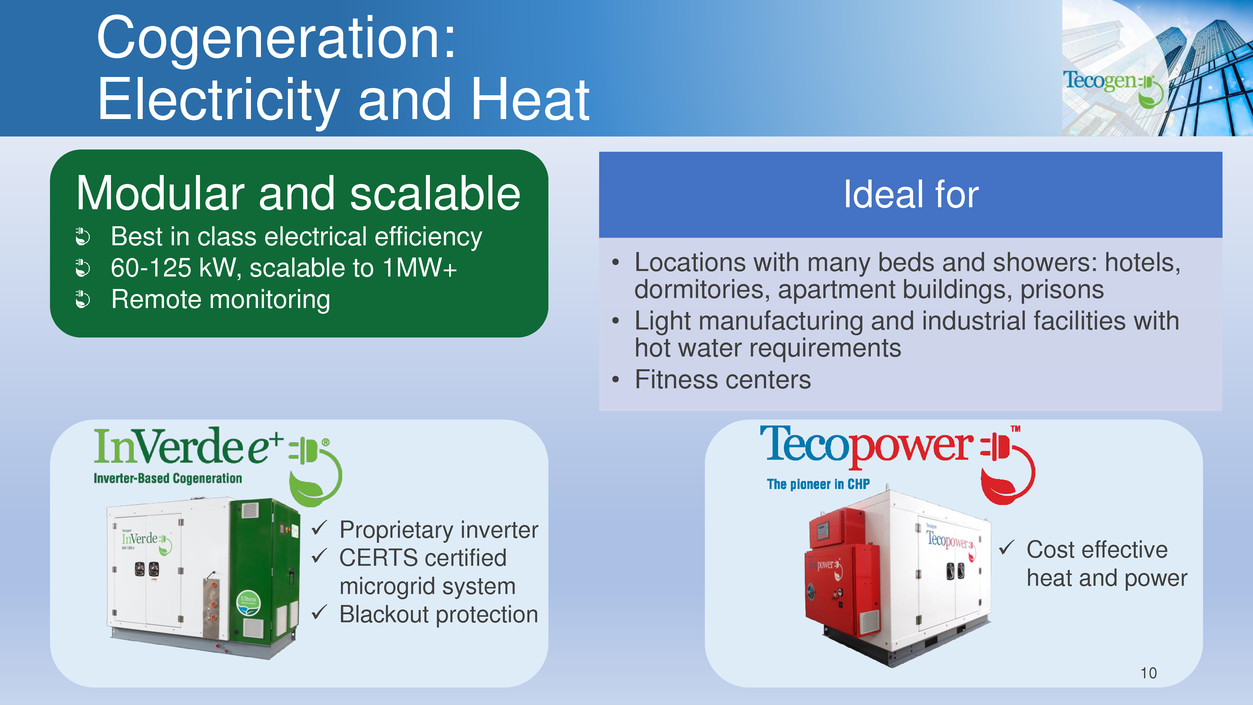

Cogeneration:

Electricity and Heat

Modular and scalable

Best in class electrical efficiency

60-125 kW, scalable to 1MW+

Remote monitoring

✓ Proprietary inverter

✓ CERTS certified

microgrid system

✓ Blackout protection

✓ Cost effective

heat and power

Ideal for

• Locations with many beds and showers: hotels,

dormitories, apartment buildings, prisons

• Light manufacturing and industrial facilities with

hot water requirements

• Fitness centers

10

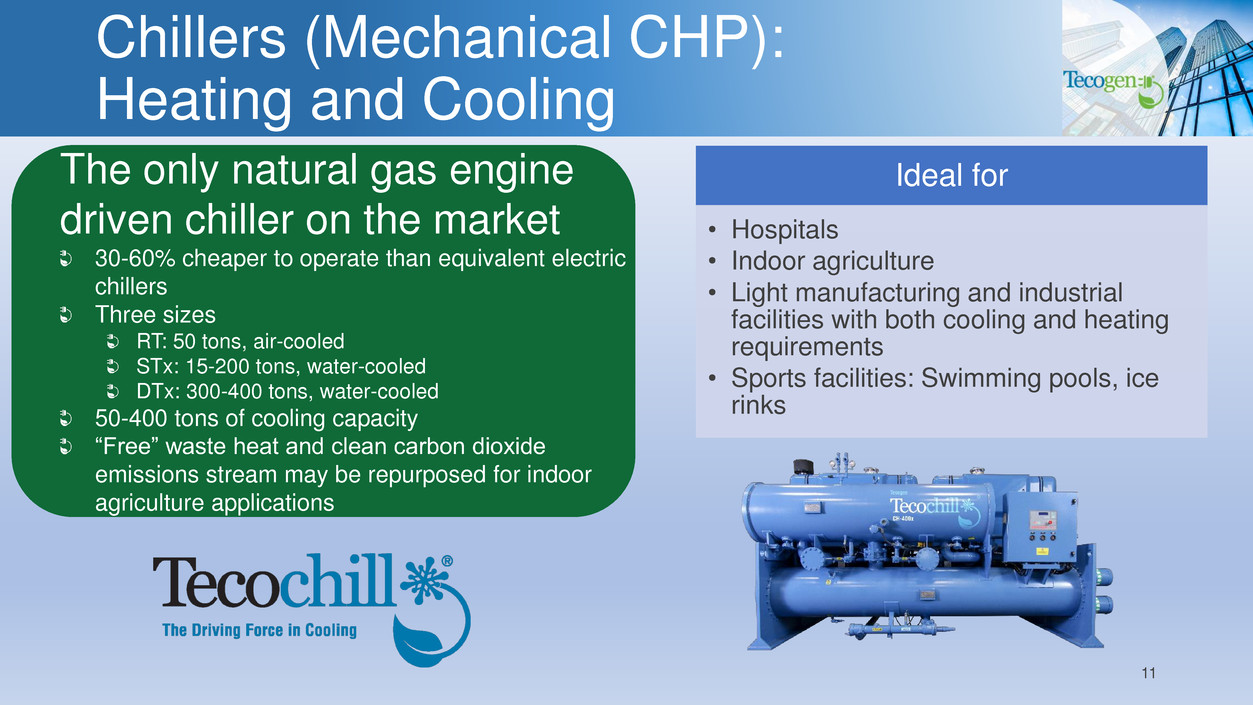

Chillers (Mechanical CHP):

Heating and Cooling

Ideal for

• Hospitals

• Indoor agriculture

• Light manufacturing and industrial

facilities with both cooling and heating

requirements

• Sports facilities: Swimming pools, ice

rinks

The only natural gas engine

driven chiller on the market

30-60% cheaper to operate than equivalent electric

chillers

Three sizes

RT: 50 tons, air-cooled

STx: 15-200 tons, water-cooled

DTx: 300-400 tons, water-cooled

50-400 tons of cooling capacity

“Free” waste heat and clean carbon dioxide

emissions stream may be repurposed for indoor

agriculture applications

11

Water Heaters:

Up to 300% Efficiency

Ideal for

• Customers with high

natural gas prices

• Food and beverage

processing facilities

• Nursing homes, spas,

apartment buildings

The world’s most efficient

water heater

2-3x the efficiency of a conventional boiler cuts

energy consumption and carbon dioxide

emissions in half

Compact natural gas or propane fueled heat

pump

Creates both hot and chilled water

simultaneously

Available in three configurations

Water-source

Air-source

Air-source “split system:” enables remote

installation of air-source evaporator

12

Energy Production:

On-site Utility

Sells heat, power, and/or

cooling directly to customer

Stable source of revenue with robust margins

Future contracted revenue of over $50 million

(undiscounted)

Acquired on May 18, 2017

Acquisition creates a vertically integrated clean technology company with a complete end-to-end

distributed generation offering – design, manufacturing, financing, installation, and maintenance.

13

Emissions Reduction:

Criteria Pollutant Elimination

Non-invasive emissions system

Reduces criteria pollutants (Nox, NMOG, CO) to near zero

fuel-cell equivalent levels

Patent protected and insured

Installed on virtually all Tecogen equipment

Simple retrofit to existing engines with no performance

loss

Proven in Tecogen, Ford, GM, Caterpillar, Generac, etc.

14

South Coast Air Quality Management District (SCAQMD) of southern California has reset its

Best Available Control Technology (BACT) standard for non-emergency engine-driven

generators to a level that rich-burn engines can only achieve when equipped with Ultera

Fork trucks that operate indoors must meet strict

emissions standards

Affordability, distribution network, and power profile

make propane the fuel of choice

Batteries and fuel cells greatly compromise performance

Funded in part by the Propane education & research

Council (PERC)

Test of retrofitted fork truck exceptionally successful

Propane powered

fork trucks

Successful Phase 1 and 2 testing validated proof of

concept

Contract in place with research institute to optimize

catalyst formations for gasoline powered engines

Future phases to focus on development of a

commercially viable prototype

Gasoline powered

passenger and

light duty vehicles

Wholly-owned subsidiary charged with the effort to commercialize Ultera for non-stationary applications

Ultera Technologies, Inc.

Applying Ultera to Mobile Vehicles

15

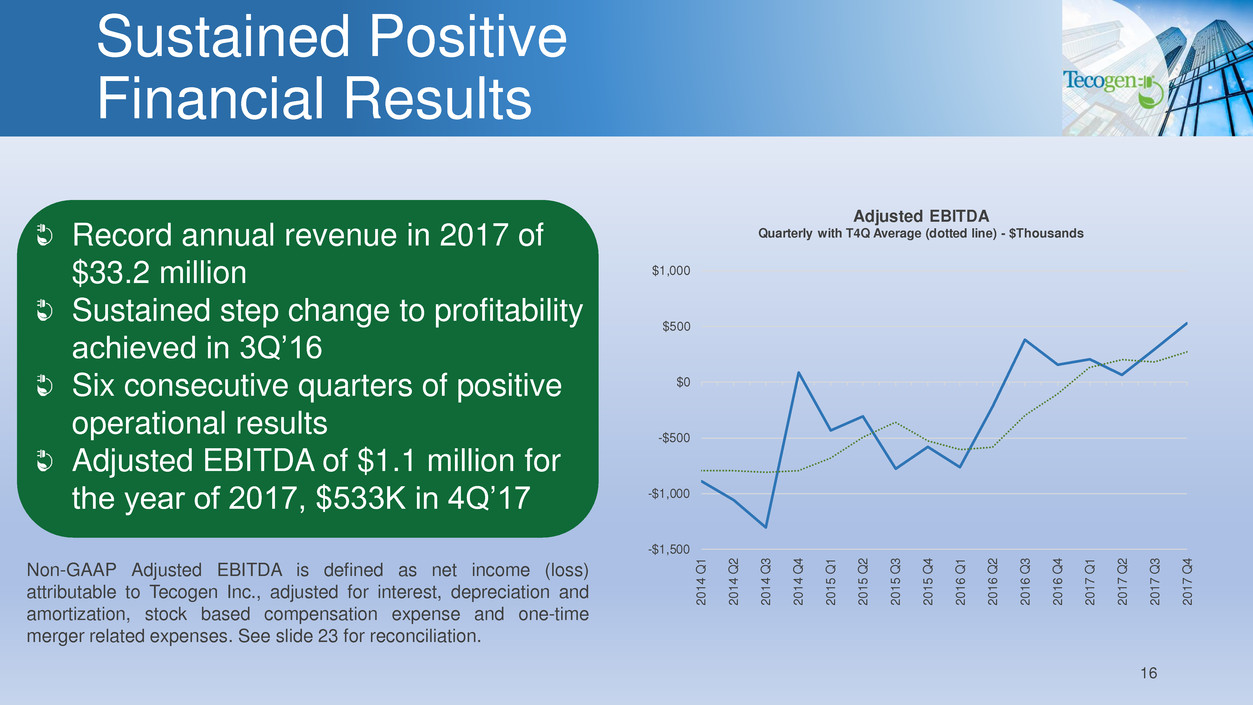

Sustained Positive

Financial Results

16

Record annual revenue in 2017 of

$33.2 million

Sustained step change to profitability

achieved in 3Q’16

Six consecutive quarters of positive

operational results

Adjusted EBITDA of $1.1 million for

the year of 2017, $533K in 4Q’17

Non-GAAP Adjusted EBITDA is defined as net income (loss)

attributable to Tecogen Inc., adjusted for interest, depreciation and

amortization, stock based compensation expense and one-time

merger related expenses. See slide 23 for reconciliation.

-$1,500

-$1,000

-$500

$0

$500

$1,000

20

14

Q1

20

14

Q2

20

14

Q3

20

14

Q4

20

15

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

16

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

17

Q1

20

17

Q2

20

17

Q3

20

17

Q4

Adjusted EBITDA

Quarterly with T4Q Average (dotted line) - $Thousands

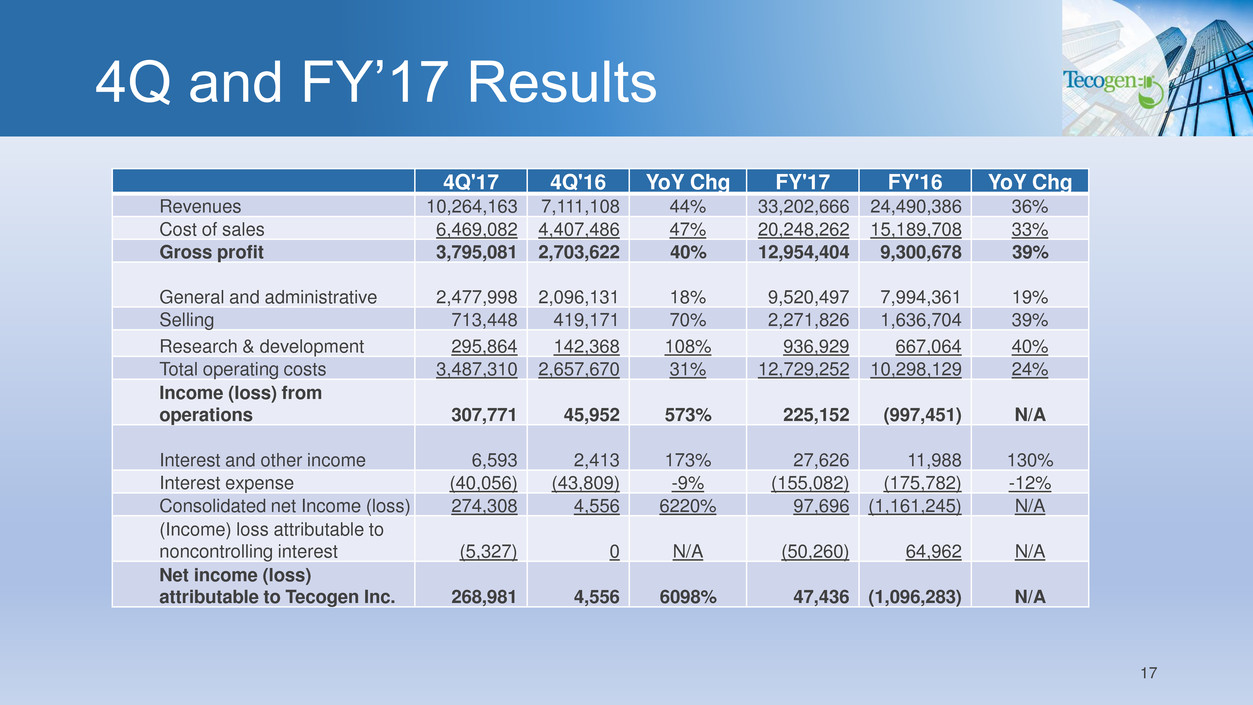

4Q and FY’17 Results

4Q'17 4Q'16 YoY Chg FY'17 FY'16 YoY Chg

Revenues 10,264,163 7,111,108 44% 33,202,666 24,490,386 36%

Cost of sales 6,469,082 4,407,486 47% 20,248,262 15,189,708 33%

Gross profit 3,795,081 2,703,622 40% 12,954,404 9,300,678 39%

General and administrative 2,477,998 2,096,131 18% 9,520,497 7,994,361 19%

Selling 713,448 419,171 70% 2,271,826 1,636,704 39%

Research & development 295,864 142,368 108% 936,929 667,064 40%

Total operating costs 3,487,310 2,657,670 31% 12,729,252 10,298,129 24%

Income (loss) from

operations 307,771 45,952 573% 225,152 (997,451) N/A

Interest and other income 6,593 2,413 173% 27,626 11,988 130%

Interest expense (40,056) (43,809) -9% (155,082) (175,782) -12%

Consolidated net Income (loss) 274,308 4,556 6220% 97,696 (1,161,245) N/A

(Income) loss attributable to

noncontrolling interest (5,327) 0 N/A (50,260) 64,962 N/A

Net income (loss)

attributable to Tecogen Inc. 268,981 4,556 6098% 47,436 (1,096,283) N/A

17

Company Information

Tecogen, Inc.

45 First Ave

Waltham, MA 02451

NASDAQ: TGEN

www.tecogen.comContact

John Hatsopoulos, Chairman Emeritus

781.622.1120

John.Hatsopoulos@Tecogen.com

Jeb Armstrong, Director of Capital Markets

781.466.6413

Jeb.Armstrong@Tecogen.com

Contact Information

Energy Efficiency Reimagined

18

Management team

Board of Directors

Detailed financial information

Cogeneration InVerde e+ data

Cogeneration savings case study

Tecochill chiller data

Indoor agriculture

Ilios water heater data

Ultera emission technology diagram

Emission reduction comparison chart

Standby generator emissions test results

AVL car emissions test results

Fork truck emissions test results

Appendix

19

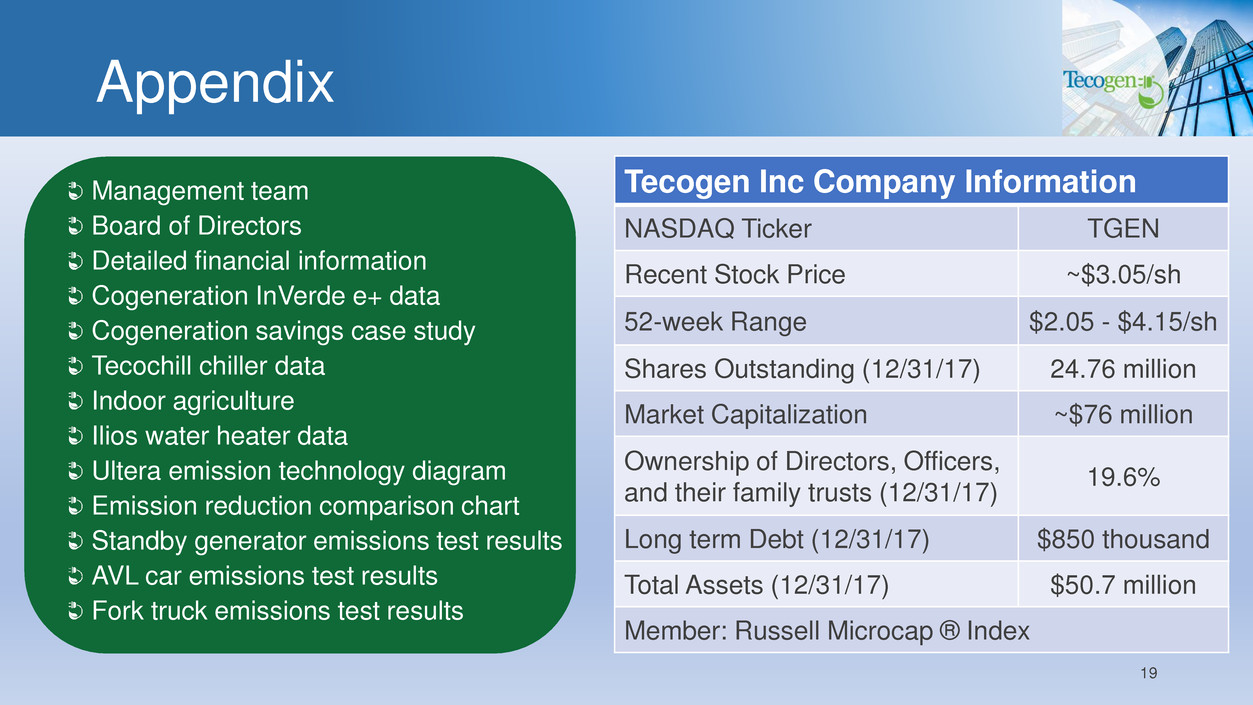

Tecogen Inc Company Information

NASDAQ Ticker TGEN

Recent Stock Price ~$3.05/sh

52-week Range $2.05 - $4.15/sh

Shares Outstanding (12/31/17) 24.76 million

Market Capitalization ~$76 million

Ownership of Directors, Officers,

and their family trusts (12/31/17) 19.6%

Long term Debt (12/31/17) $850 thousand

Total Assets (12/31/17) $50.7 million

Member: Russell Microcap ® Index

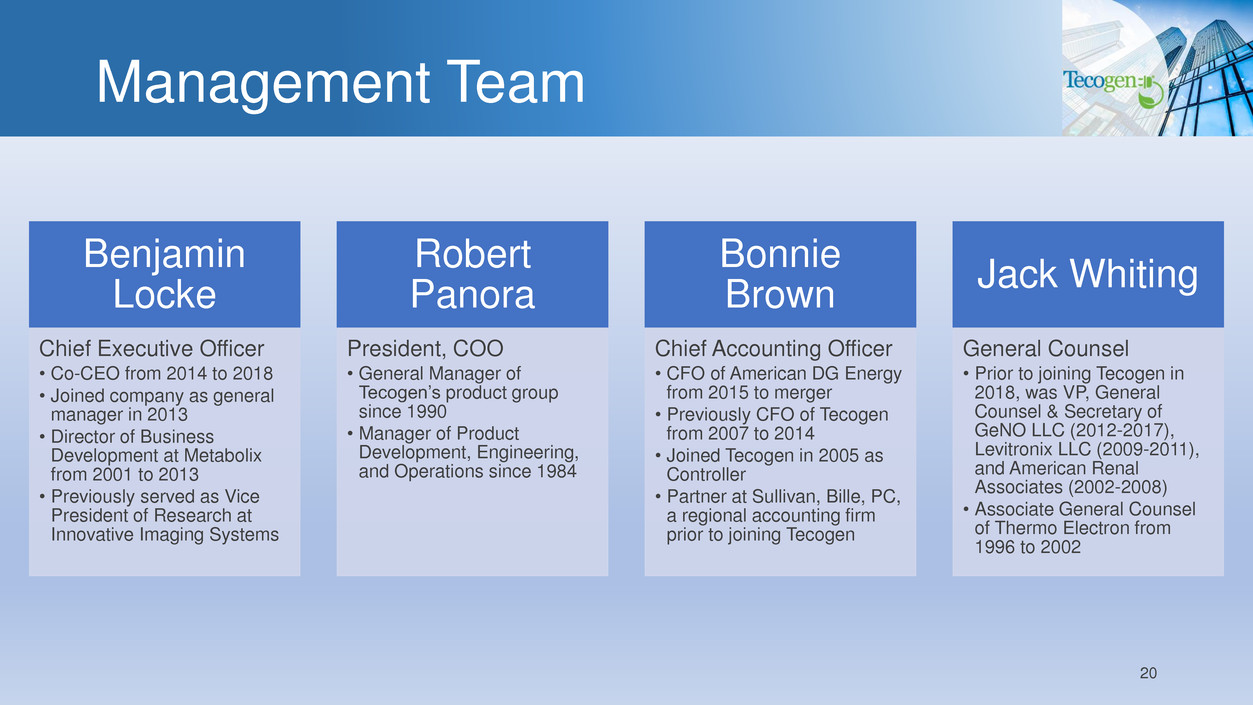

Management Team

20

Benjamin

Locke

Chief Executive Officer

• Co-CEO from 2014 to 2018

• Joined company as general

manager in 2013

• Director of Business

Development at Metabolix

from 2001 to 2013

• Previously served as Vice

President of Research at

Innovative Imaging Systems

Robert

Panora

President, COO

• General Manager of

Tecogen’s product group

since 1990

• Manager of Product

Development, Engineering,

and Operations since 1984

Bonnie

Brown

Chief Accounting Officer

• CFO of American DG Energy

from 2015 to merger

• Previously CFO of Tecogen

from 2007 to 2014

• Joined Tecogen in 2005 as

Controller

• Partner at Sullivan, Bille, PC,

a regional accounting firm

prior to joining Tecogen

Jack Whiting

General Counsel

• Prior to joining Tecogen in

2018, was VP, General

Counsel & Secretary of

GeNO LLC (2012-2017),

Levitronix LLC (2009-2011),

and American Renal

Associates (2002-2008)

• Associate General Counsel

of Thermo Electron from

1996 to 2002

Board of Directors

21

Angelina Galiteva

Director, Board Chairwoman

▪ Chair of the Company since 2005

▪ Founder and Chair of the Board for the

Renewables 100 Policy Institute, a non-

profit entity dedicated to the global

advancement of renewable energy

solutions since 2008

▪ Chairperson at the World Council for

Renewable Energy and Board member of

the Governors of the California ISO

John Hatsopoulos

Director, Chairman Emeritus

▪ CEO and Director since the Company‘s

organization in 2000

▪ Co-Founder for Thermo Electron Corp.,

now Thermo Fisher Scientific (NYSE:

TMO)

▪ As Thermo Electron CFO, grew company

from a market capitalization of ~$100

million in 1980 to over $2.5 billion

Charles Maxwell

Director, Chair of Audit Committee

▪ Company Director since 2001

▪ 40 years of energy sector specific

experience with major oil companies and

investment banking firms

▪ Former Senior Energy Analyst with

Weeden & Co.

▪ Board Chairman of American DG Energy,

Inc.

Keith Davidson

Director

▪ Company Director since 2016

▪ President of DE Solutions, a consulting and

engineering firm serving the distributed

energy markets

▪ Former Director of the Gas Research

Institute and past President of the

American Cogeneration Association

▪ 25 years of experience in energy and

environmental technology development

and implementation

Ahmed Ghoniem

Director

▪ Company Director since 2008

▪ Ronald C. Crane Professor of Mechanical

Engineering at MIT

▪ Director of the Center for 21st Century

Energy and Head of Energy Science and

Engineering at MIT

▪ Associate Fellow of the American Institute

of Aeronautics and Astronautics

Deanna Peterson

Director

▪ Company Director since 2017

▪ Chief Business Officer of AVROBIO since

2016

▪ Vice President of Business Development at

Shire Pharmaceuticals from 2009 to 2015

▪ Led development, priorization and

execution of Shire‘s overall corporate and

business development strategies

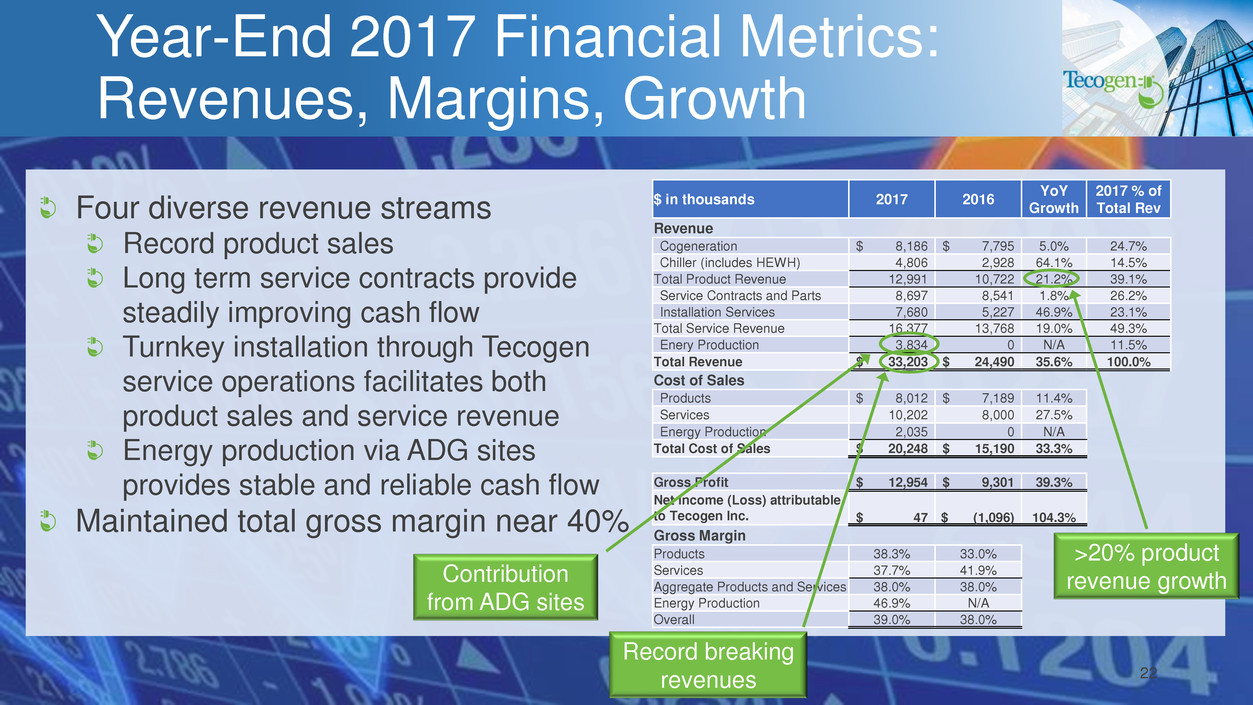

Year-End 2017 Financial Metrics:

Revenues, Margins, Growth

Four diverse revenue streams

Record product sales

Long term service contracts provide

steadily improving cash flow

Turnkey installation through Tecogen

service operations facilitates both

product sales and service revenue

Energy production via ADG sites

provides stable and reliable cash flow

Maintained total gross margin near 40%

22

$ in thousands 2017 2016

YoY

Growth

2017 % of

Total Rev

Revenue

Cogeneration $ 8,186 $ 7,795 5.0% 24.7%

Chiller (includes HEWH) 4,806 2,928 64.1% 14.5%

Total Product Revenue 12,991 10,722 21.2% 39.1%

Service Contracts and Parts 8,697 8,541 1.8% 26.2%

Installation Services 7,680 5,227 46.9% 23.1%

Total Service Revenue 16,377 13,768 19.0% 49.3%

Enery Production 3,834 0 N/A 11.5%

Total Revenue $ 33,203 $ 24,490 35.6% 100.0%

Cost of Sales

Products $ 8,012 $ 7,189 11.4%

Services 10,202 8,000 27.5%

Energy Production 2,035 0 N/A

Total Cost of Sales $ 20,248 $ 15,190 33.3%

Gross Profit $ 12,954 $ 9,301 39.3%

Net Income (Loss) attributable

to Tecogen Inc. $ 47 $ (1,096) 104.3%

Gross Margin

Products 38.3% 33.0%

Services 37.7% 41.9%

Aggregate Products and Services 38.0% 38.0%

Energy Production 46.9% N/A

Overall 39.0% 38.0%

>20% product

revenue growth

Record breaking

revenues

Contribution

from ADG sites

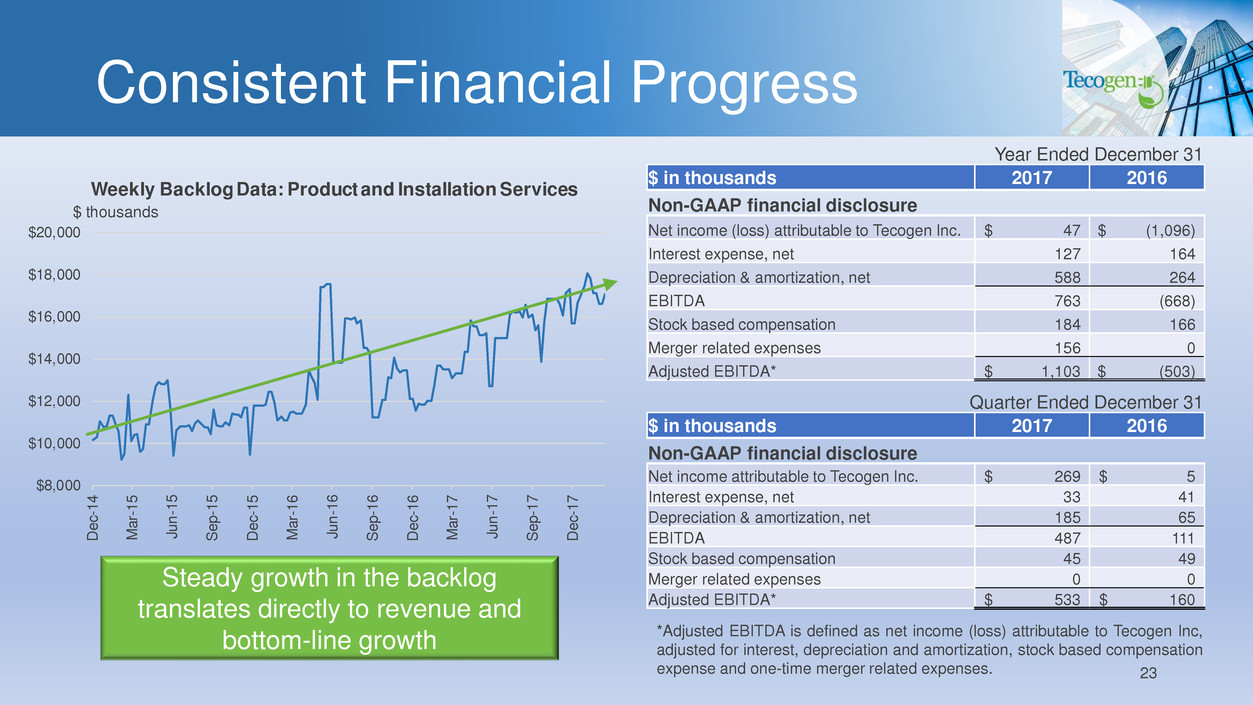

Consistent Financial Progress

*Adjusted EBITDA is defined as net income (loss) attributable to Tecogen Inc,

adjusted for interest, depreciation and amortization, stock based compensation

expense and one-time merger related expenses.

Steady growth in the backlog

translates directly to revenue and

bottom-line growth

23

Year Ended December 31

$ in thousands 2017 2016

Non-GAAP financial disclosure

Net income (loss) attributable to Tecogen Inc. $ 47 $ (1,096)

Interest expense, net 127 164

Depreciation & amortization, net 588 264

EBITDA 763 (668)

Stock based compensation 184 166

Merger related expenses 156 0

Adjusted EBITDA* $ 1,103 $ (503)

Quarter Ended December 31

$ in thousands 2017 2016

Non-GAAP financial disclosure

Net income attributable to Tecogen Inc. $ 269 $ 5

Interest expense, net 33 41

Depreciation & amortization, net 185 65

EBITDA 487 111

Stock based compensation 45 49

Merger related expenses 0 0

Adjusted EBITDA* $ 533 $ 160

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

De

c-1

4

Ma

r-1

5

Jun

-

15

Se

p-1

5

De

c-1

5

Ma

r-1

6

Jun

-

16

Se

p-1

6

De

c-1

6

Ma

r-1

7

Jun

-

17

Se

p-1

7

De

c-1

7

Weekly BacklogData: Product and Installation Services

$ thousands

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

20

14

Q1

20

14

Q2

20

14

Q3

20

14

Q4

20

15

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

16

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

17

Q1

20

17

Q2

20

17

Q3

20

17

Q4

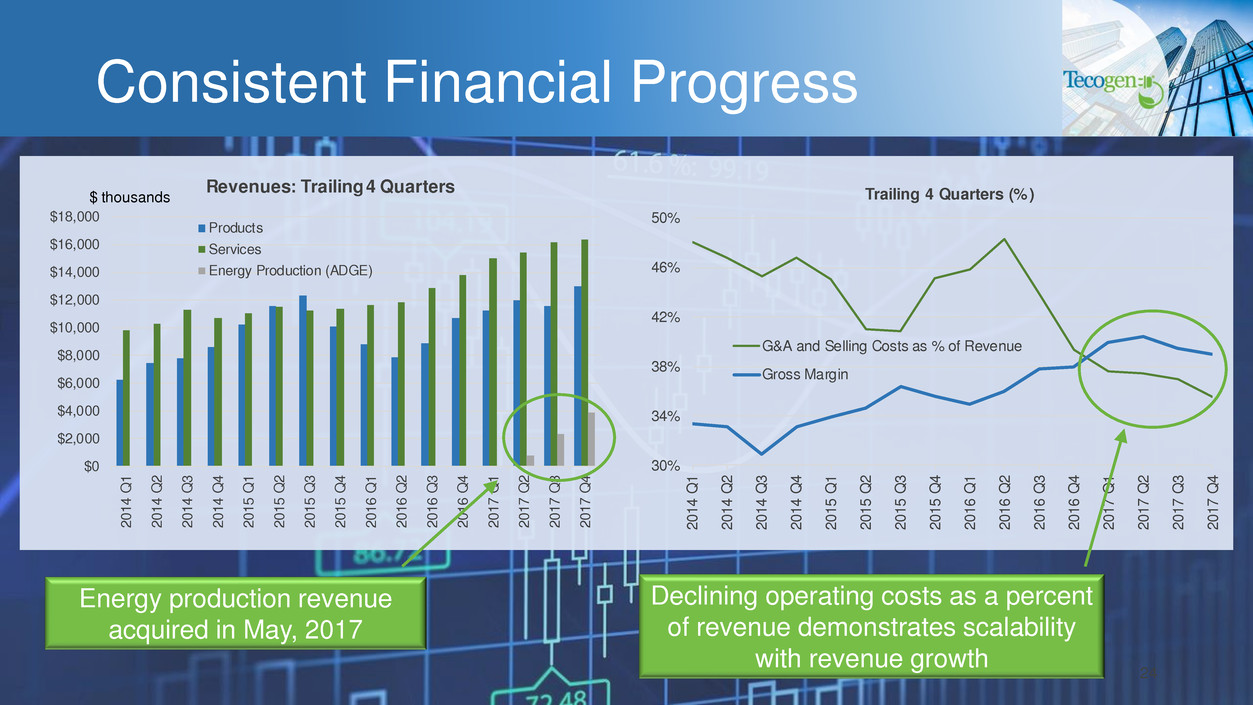

Revenues: Trailing 4 Quarters

Products

Services

Energy Production (ADGE)

$ thousands

30%

34%

38%

42%

46%

50%

20

14

Q1

20

14

Q2

20

14

Q3

20

14

Q4

20

15

Q1

20

15

Q2

20

15

Q3

20

15

Q4

20

16

Q1

20

16

Q2

20

16

Q3

20

16

Q4

20

17

Q1

20

17

Q2

20

17

Q3

20

17

Q4

Trailing 4 Quarters (%)

G&A and Selling Costs as % of Revenue

Gross Margin

Consistent Financial Progress

Energy production revenue

acquired in May, 2017

Declining operating costs as a percent

of revenue demonstrates scalability

with revenue growth 24

InVerde e+ Data

25

Best in class efficiency: 33% electrical, 94% overall (LHV)

Ideal for markets with commercial electric rates over $0.12/kWh

Variable speed operation from 10kW to 125 kW with superior part-

load efficiency

Fully scalable to multi-MW system

Cloud-based real-time performance monitoring

Indoor and outdoor installation

Dimensions (indoor 7’6”x4’0”x5’9” / outdoor 7’10”x4’11”x6’4”)

Weight (indoor 4,300 lbs / outdoor 4,800 lbs)

Acoustic Level: 69 dBa @ 20’

Operating Temperature Range: -4⁰ to 104⁰ F (-20⁰ to 40⁰ C)

Smart Inverter Technology

UL 1741 certified

Unique CERTS-Microgrid capability enables grid-independent

operation

Only inverter-based CHP system that meets NFPA’s Type 10

Emergency Power Supply System rapid blackstart standard

Demand Response capable for automatic dispatching

Energy savings can pay

back initial investment in

as few as 2-5 years

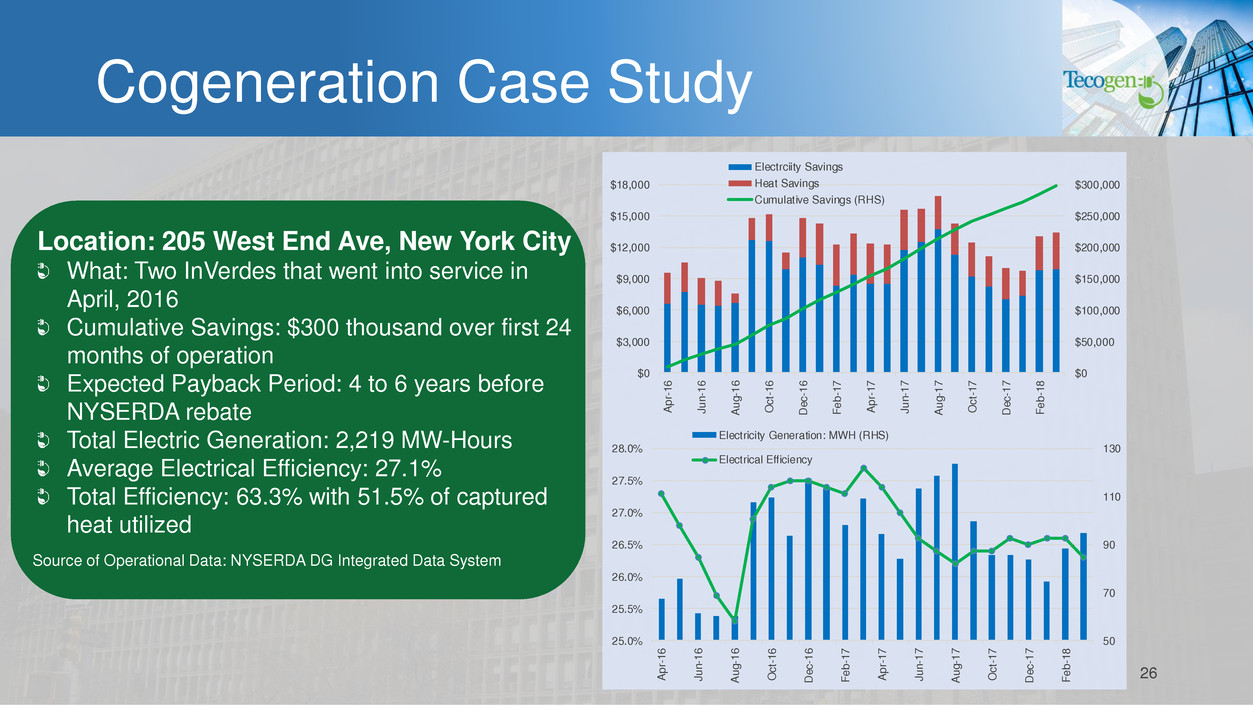

Cogeneration Case Study

26

Location: 205 West End Ave, New York City

What: Two InVerdes that went into service in

April, 2016

Cumulative Savings: $300 thousand over first 24

months of operation

Expected Payback Period: 4 to 6 years before

NYSERDA rebate

Total Electric Generation: 2,219 MW-Hours

Average Electrical Efficiency: 27.1%

Total Efficiency: 63.3% with 51.5% of captured

heat utilized

50

70

90

110

130

25.0%

25.5%

26.0%

26.5%

27.0%

27.5%

28.0%

Apr-

16

Jun

-

16

Aug

-

16

Oct

-

16

Dec-

16

Feb

-

17

Apr-

17

Jun

-

17

Aug

-

17

Oct

-

17

Dec-

17

Feb

-

18

Electricity Generation: MWH (RHS)

Electrical Efficiency

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$0

$3,000

$6,000

$9,000

$12,000

$15,000

$18,000

Apr

-16

Jun

-

16

Aug

-

16

Oct

-

16

Dec

-16

Feb

-

17

Apr

-

17

Jun

-

17

Aug

-

17

Oct

-

17

Dec-

17

Feb

-

18

Electrciity Savings

Heat Savings

Cumulative Savings (RHS)

Source of Operational Data: NYSERDA DG Integrated Data System

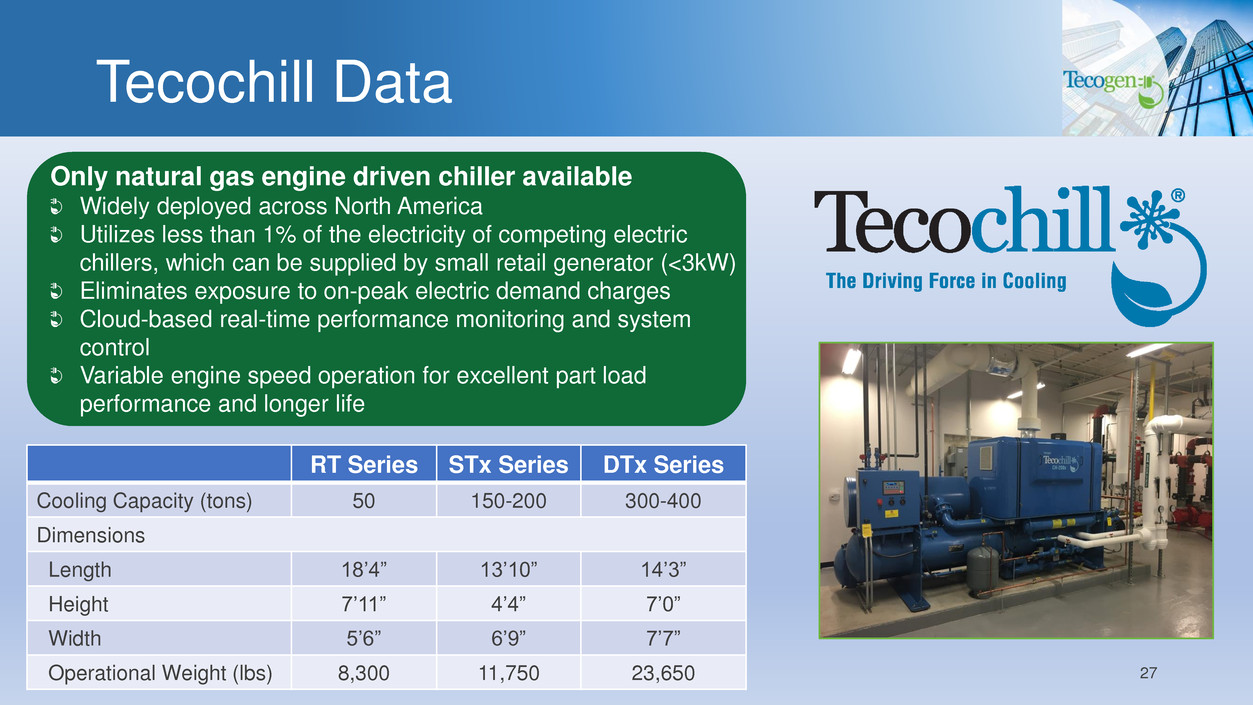

Tecochill Data

27

Only natural gas engine driven chiller available

Widely deployed across North America

Utilizes less than 1% of the electricity of competing electric

chillers, which can be supplied by small retail generator (<3kW)

Eliminates exposure to on-peak electric demand charges

Cloud-based real-time performance monitoring and system

control

Variable engine speed operation for excellent part load

performance and longer life

RT Series STx Series DTx Series

Cooling Capacity (tons) 50 150-200 300-400

Dimensions

Length 18’4” 13’10” 14’3”

Height 7’11” 4’4” 7’0”

Width 5’6” 6’9” 7’7”

Operational Weight (lbs) 8,300 11,750 23,650

Indoor Agriculture

28

Tecochill natural gas

powered chillers provide a

unique value proposition

for indoor farming

Rapidly growing market poised

for exponential growth

To grow 5x over five years according to Agrilyst

Cannabis is primary near-term driver

Leafy greens, herbs, and tomatoes are also

attracting capital

Typically located near urban centers

Often have older infrastructure and higher

electricity rates

Tecochill chillers virtually eliminate need to

upgrade electrical infrastructure

Removes heat generated by lighting and

dehumidifies the air

Virtually pure carbon dioxide exhaust can be

utilized to help speed plant growth

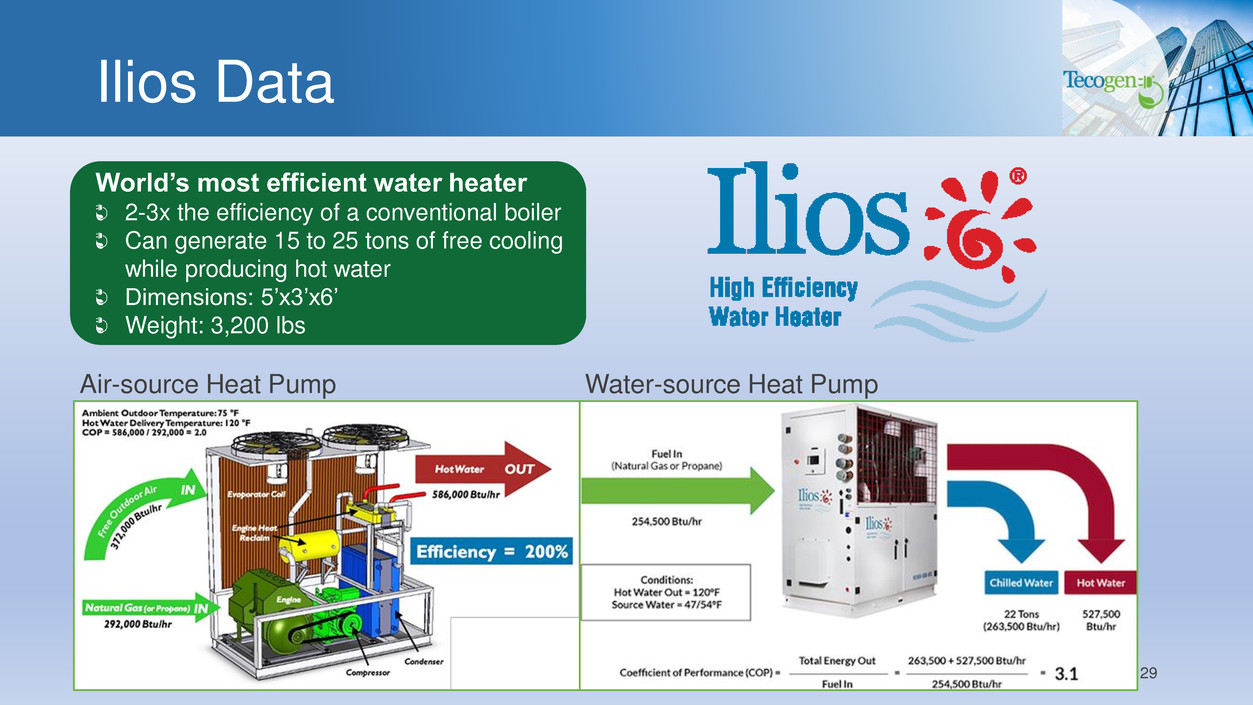

Ilios Data

29

World’s most efficient water heater

2-3x the efficiency of a conventional boiler

Can generate 15 to 25 tons of free cooling

while producing hot water

Dimensions: 5’x3’x6’

Weight: 3,200 lbs

Air-source Heat Pump Water-source Heat Pump

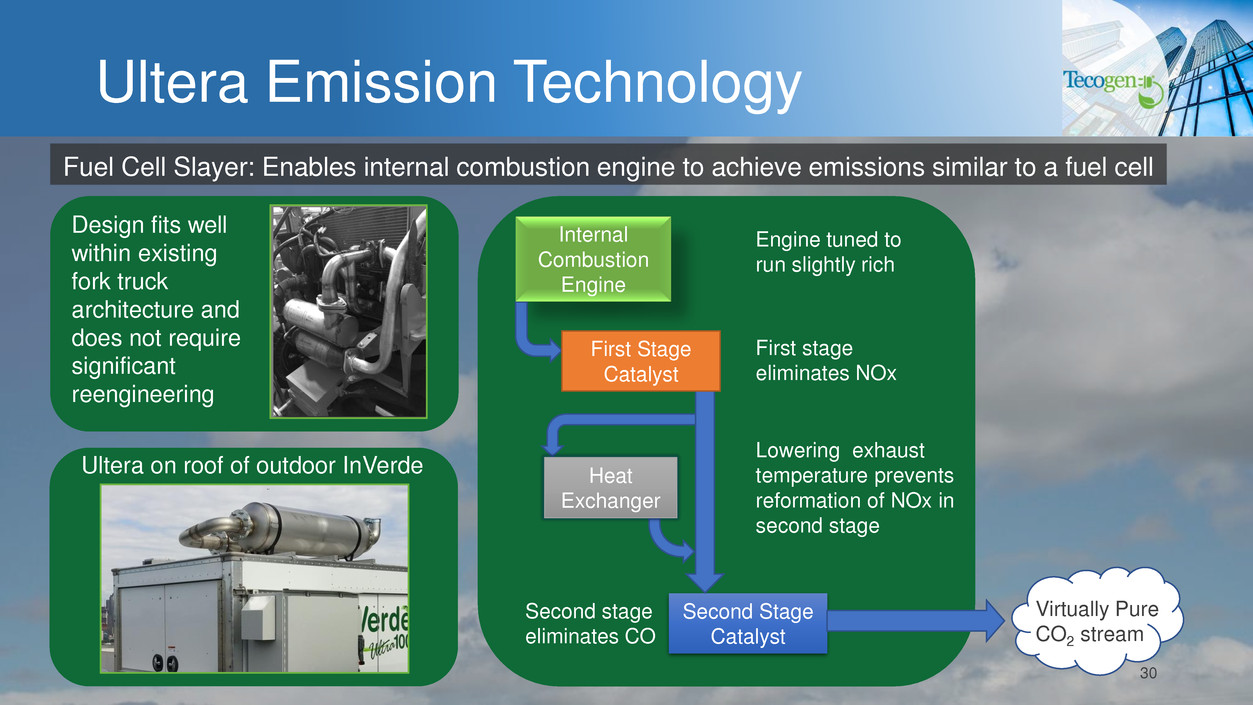

Ultera Emission Technology

30

Second Stage

Catalyst

Virtually Pure

CO2 stream

First stage

eliminates NOx

Second stage

eliminates CO

Lowering exhaust

temperature prevents

reformation of NOx in

second stage

Fuel Cell Slayer: Enables internal combustion engine to achieve emissions similar to a fuel cell

Design fits well

within existing

fork truck

architecture and

does not require

significant

reengineering

Ultera on roof of outdoor InVerde

Engine tuned to

run slightly rich

Heat

Exchanger

First Stage

Catalyst

Internal

Combustion

Engine

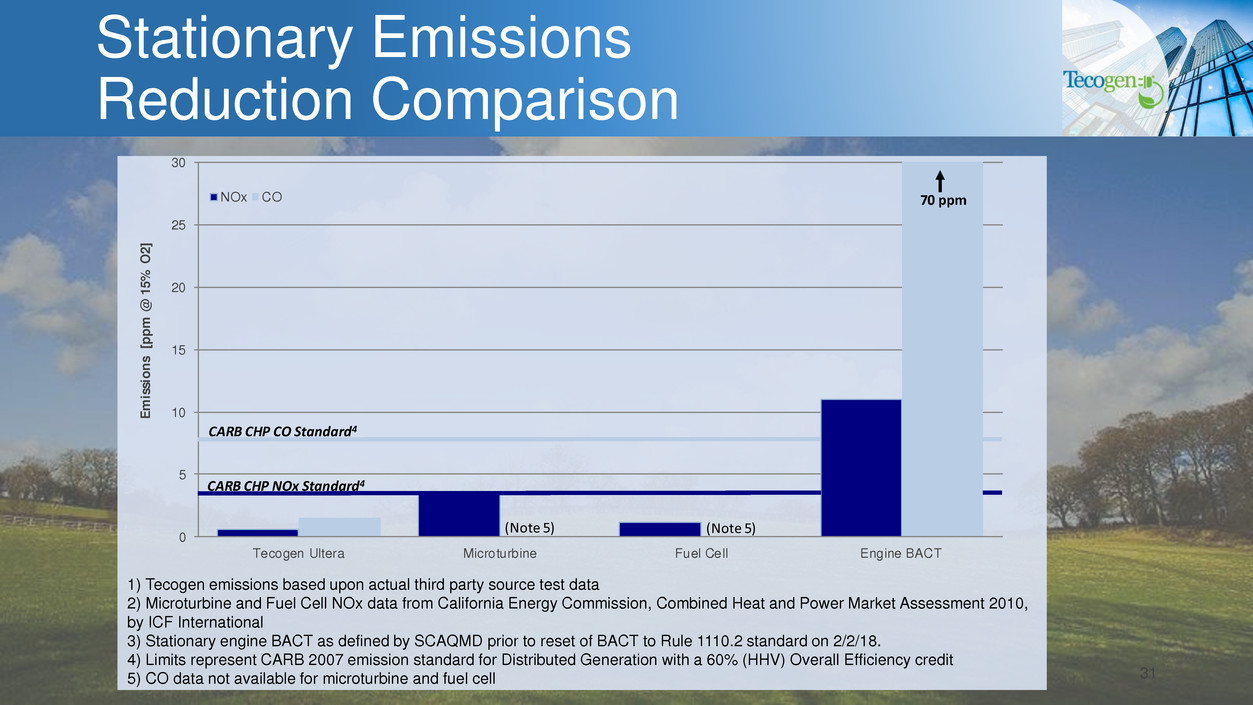

Stationary Emissions

Reduction Comparison

31

1) Tecogen emissions based upon actual third party source test data

2) Microturbine and Fuel Cell NOx data from California Energy Commission, Combined Heat and Power Market Assessment 2010,

by ICF International

3) Stationary engine BACT as defined by SCAQMD prior to reset of BACT to Rule 1110.2 standard on 2/2/18.

4) Limits represent CARB 2007 emission standard for Distributed Generation with a 60% (HHV) Overall Efficiency credit

5) CO data not available for microturbine and fuel cell

0

5

10

15

20

25

30

Tecogen Ultera Microturbine Fuel Cell Engine BACT

Em

is

si

on

s

[p

pm

@

1

5%

O

2]

NOx CO

CARB CHP NOx Standard4

CARB CHP CO Standard4

70 ppm

(Note 5) (Note 5)

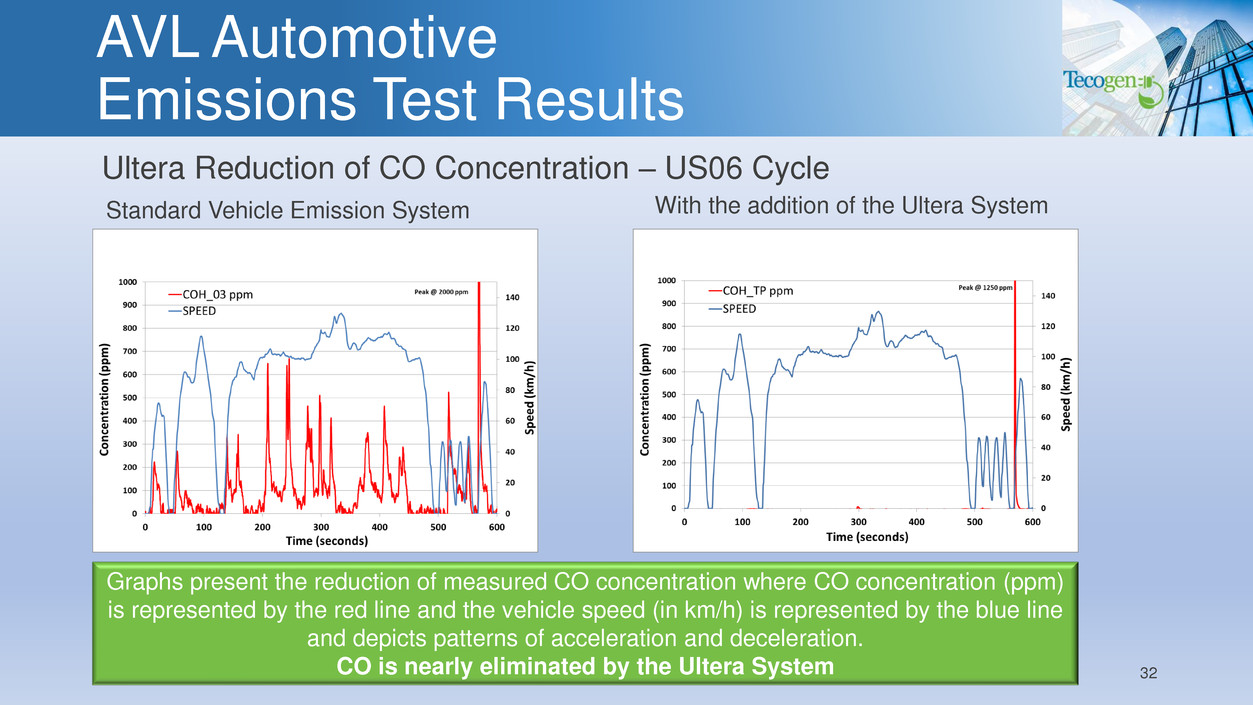

AVL Automotive

Emissions Test Results

32

Ultera Reduction of CO Concentration – US06 Cycle

Standard Vehicle Emission System With the addition of the Ultera System

Graphs present the reduction of measured CO concentration where CO concentration (ppm)

is represented by the red line and the vehicle speed (in km/h) is represented by the blue line

and depicts patterns of acceleration and deceleration.

CO is nearly eliminated by the Ultera System

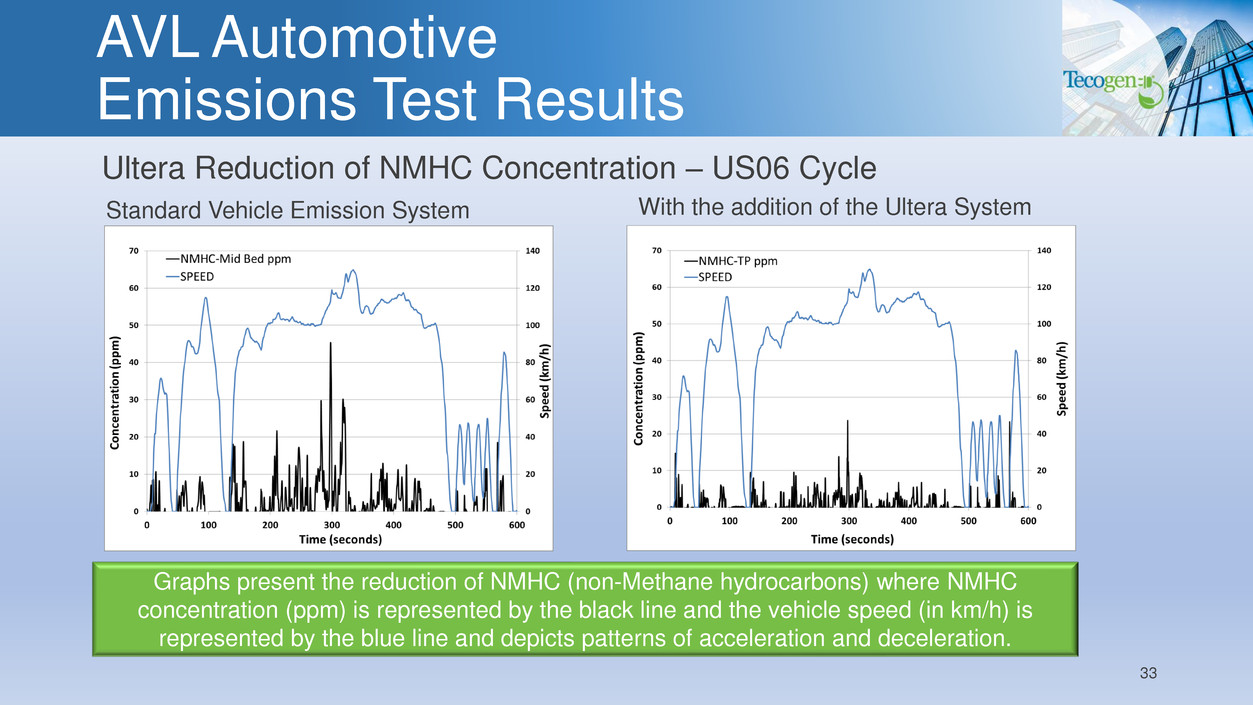

AVL Automotive

Emissions Test Results

33

Ultera Reduction of NMHC Concentration – US06 Cycle

Standard Vehicle Emission System With the addition of the Ultera System

Graphs present the reduction of NMHC (non-Methane hydrocarbons) where NMHC

concentration (ppm) is represented by the black line and the vehicle speed (in km/h) is

represented by the blue line and depicts patterns of acceleration and deceleration.

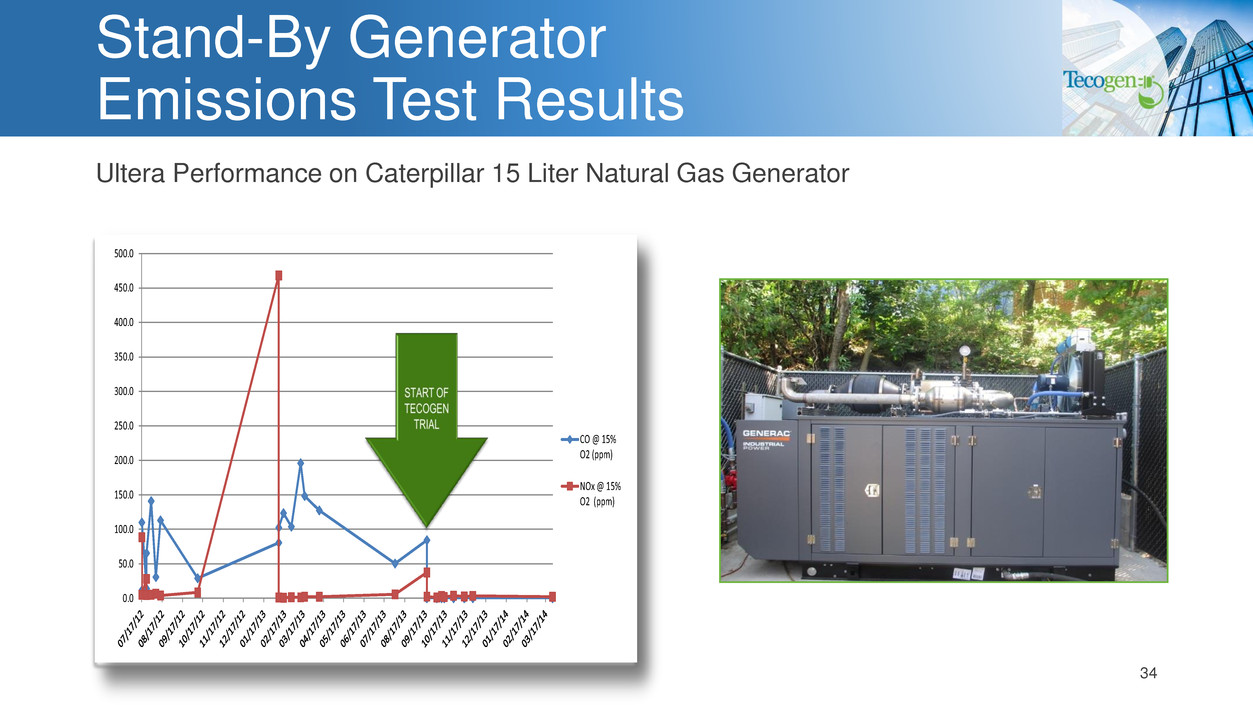

Stand-By Generator

Emissions Test Results

34

0.0

50.0

100.0

150.0

200.0

250.0

300.0

350.0

400.0

450.0

500.0

CO @ 15%

O2 (ppm)

NOx @ 15%

O2 (ppm)

Ultera Performance on Caterpillar 15 Liter Natural Gas Generator

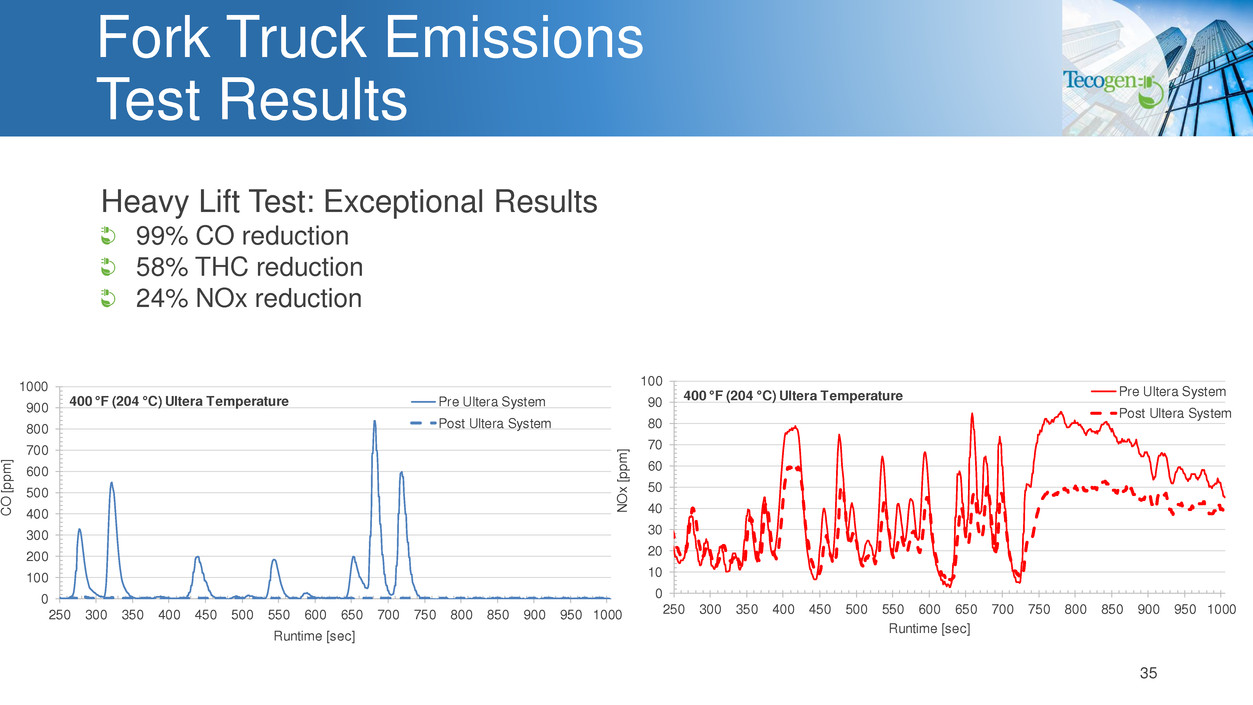

Fork Truck Emissions

Test Results

35

0

100

200

300

400

500

600

700

800

900

1000

250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1000

CO

[pp

m

]

Runtime [sec]

Pre Ultera System

Post Ultera System

400 F (204 C) Ultera Temperature

0

10

20

30

40

50

60

70

80

90

100

250 30 350 40 4 0 50 550 60 650 70 750 80 850 900 950 1000

NO

x

[pp

m

]

Runtime [sec]

Pre Ultera System

Post Ultera System

400 F (204 C) Ultera T mperature

Heavy Lift Test: Exceptional Results

99% CO reduction

58% THC reduction

24% NOx reduction

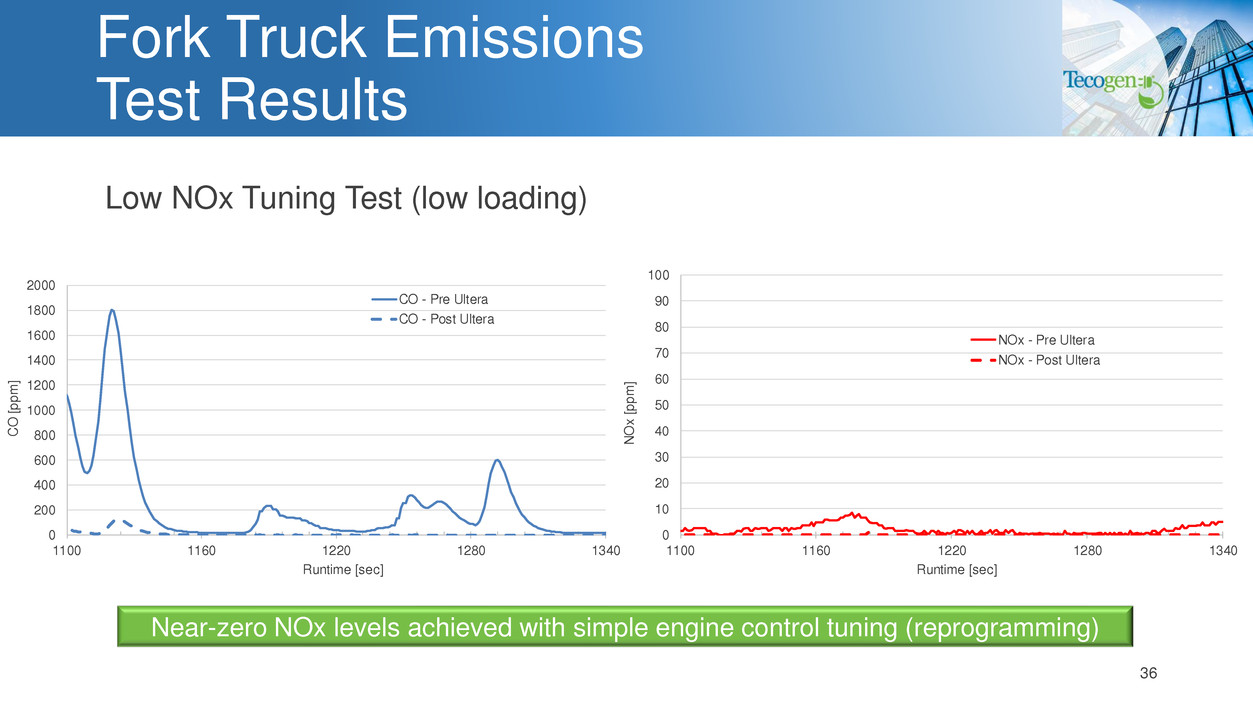

Fork Truck Emissions

Test Results

36

0

200

400

600

800

1000

1200

1400

1600

1800

2000

1100 1160 1220 1280 1340

CO

[pp

m

]

Runtime [sec]

CO - Pre Ultera

CO - Post Ultera

Low NOx Tuning Test (low loading) 0

10

20

30

40

50

60

70

80

90

100

1100 1160 1220 1280 1340

NO

x

[pp

m

]

Runtime [sec]

NOx - Pre Ultera

NOx - Post Ultera

Near-zero NOx levels achieved with simple engine control tuning (reprogramming)