CREDIT AGREEMENT among TECOGEN INC. AND AMERICAN DG ENERGY INC. AND TTCOGEN LLC as Loan Parties and WEBSTER BUSINESS CREDIT CORPORATION, as Lender Effective Date: May 4, 2018 7501865_10.docx

TABLE OF CONTENTS Page 1. DEFINITIONS......................................................................................................... 1 1.1 Accounting Terms; References to the Loan Party and Credit Documents 1 1.2 Uniform Commercial Code Ternis........................................................... 2 1.3 General Definitions................................................................................... ,2 2. ADVANCES, PAYMENTS.................................................... ............................... ,24 2.1 Revolving Advances................... .............................................................. ,24 2.2 Procedure for Borrowing.......................................................................... ,24 2.3 Disbursement of Revolving Advance Proceeds........................................ .25 2.4 Maximum Revolving Advances............................................................... .25 2.5 Advance Requests..................................................................... ............... 25 2.6 Scheduled Payment of Advances and Other Obligations......................... 26 2.7 Voluntary Prepayments......................................................... .................... 26 2.8 Mandatory Prepayments........................................................................... 26 2.9 Application of Payments....................... ................................................... 27 2.10 Use of Proceeds..................................... ............. .................................... ,27 2.11 Statement of Account............................................................................... 28 2.12 Manner of Payment................................................................................. 28 2.13 Letters of Credit..................................................... ................................. 28 2.14 Reimbursement and Payments Obligations............................................. 32 3. INTEREST AND FEES........................................................................................... ,33 3.1 Interest...................................... 33 3.2 Continuations and Conversions 33 3.3 Closing Fee.............................. .34 3.4 Unused Line............................. .34 3.5 Letter of Credit Fee.................. 34 3.6 Collateral Evaluation Fee......... .34 3.7 Collateral Audit Fees............... .34 3.8 Computation of Interest and Fees; Collection Days .35 3.9 Maximum Charges.................................................. .35 3.10 Indemnification..................................................... .35 3.11 Increased Costs.............. .................................. .35 3.12 Additional Costs.................................... ............ 36 3.13 Capital Adequacy............................................... 36 3.14 Inadequate Basis For Determining LIBOR Rate 37 3.15 Yield Maintenance............................................. 37 3.16 Late Charges...................... ................................ 38 3.17 Facility Fee....................... .................................. .38 (i)

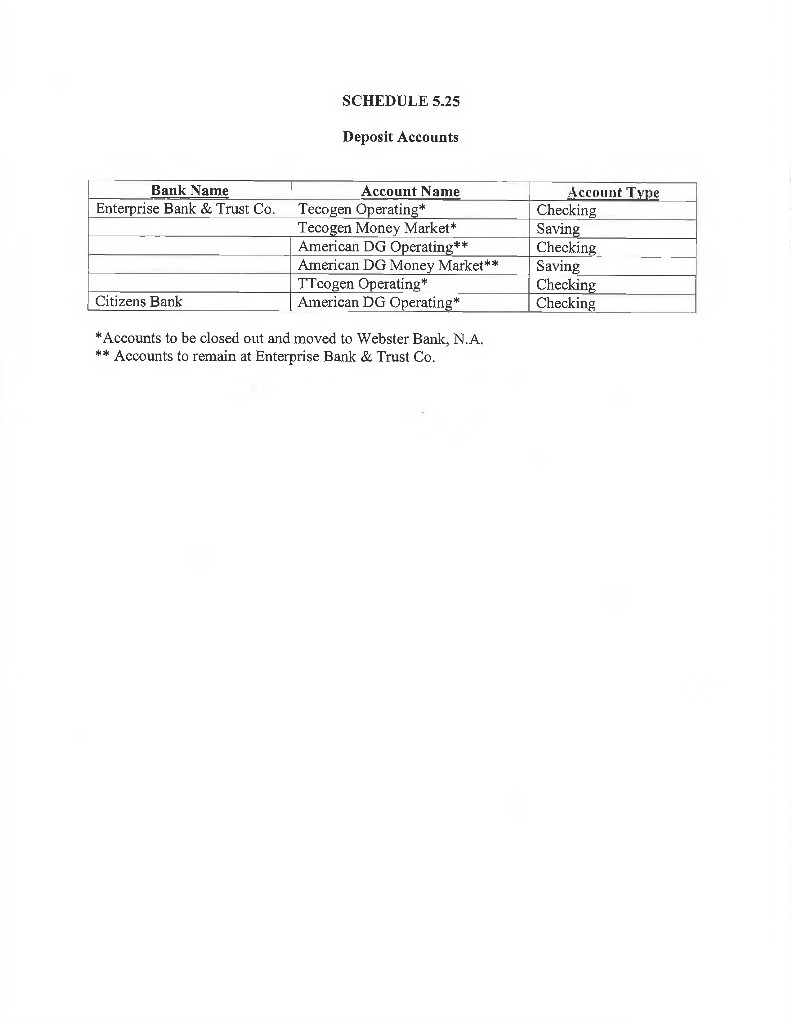

Page 4. CASH MANAGEMENT AGREEMENTS... 38 4.1 Lock-Box Accounts.......................... .38 4.2 Blocked Accounts............................. .39 4.3 Pledged Accounts.............................. 39 4.4 Receipt of Payments by Loan Parties .40 4.5 Application of Deposits.................... .40 4.6 Liens............................................ ..... ,41 4.7 Rights After an Event of Default...... ,41 5. REPRESENTATIONS AND WARRANTIES .41 5.1 Authority............................. ,41 5.2 Formation and Qualification .41 5.3 Tax Returns......................... 42 5.4 Financial Statements............................ ,42 5.5 Name.................................................... ,43 5.6 OSHA and Environmental Compliance 43 5.7 Solvency................................................ .43 5.8 Litigation.............................................. ,44 5.9 No Indebtedness.................................... ,44 5.10 No Violations.................................................. . 44 5.11 Patents, Trademarks, Copyrights and Licenses ,44 5.12 Licenses and Permits........................................ ,45 5.13 No Default of Indebtedness............................ 45 5.14 No Other Defaults....................................... . 45 5.15 No Burdensome Restrictions........................... ,45 5.16 No Labor Disputes........................................... ,45 5.17 Margin Regulations.......................................... 45 5.18 Investment Company Act................................ ,45 5.19 Disclosure........................................................ ,45 5.20 No Conflicting Agreements or Orders............. ,46 5.21 Application of Certain Laws and Regulations.. .46 5.22 Business and Property of Loan Parties............ ,46 5.23 Hedge Contracts............................................... 46 5.24 Real Property.............................................. . ,46 5.25 Deposit Accounts............................................. ,46 5.26 OF AC............................................................... .46 5.27 Brokers............................................................. .46 5.28 No Other Financing Statements....................... ,47 5.29 Inactive Subsidiary............................................ ,47 6. AFFIRMATIVE COVENANTS............................................................. 47 6.1 Payment of Fees......................................................................... ,47 6.2 Conduct of Business and Maintenance of Existence and Assets ,47 6.3 Requirements of Law................................................................. 47 6.4 Government Receivables........................................................... ,48 (ii)

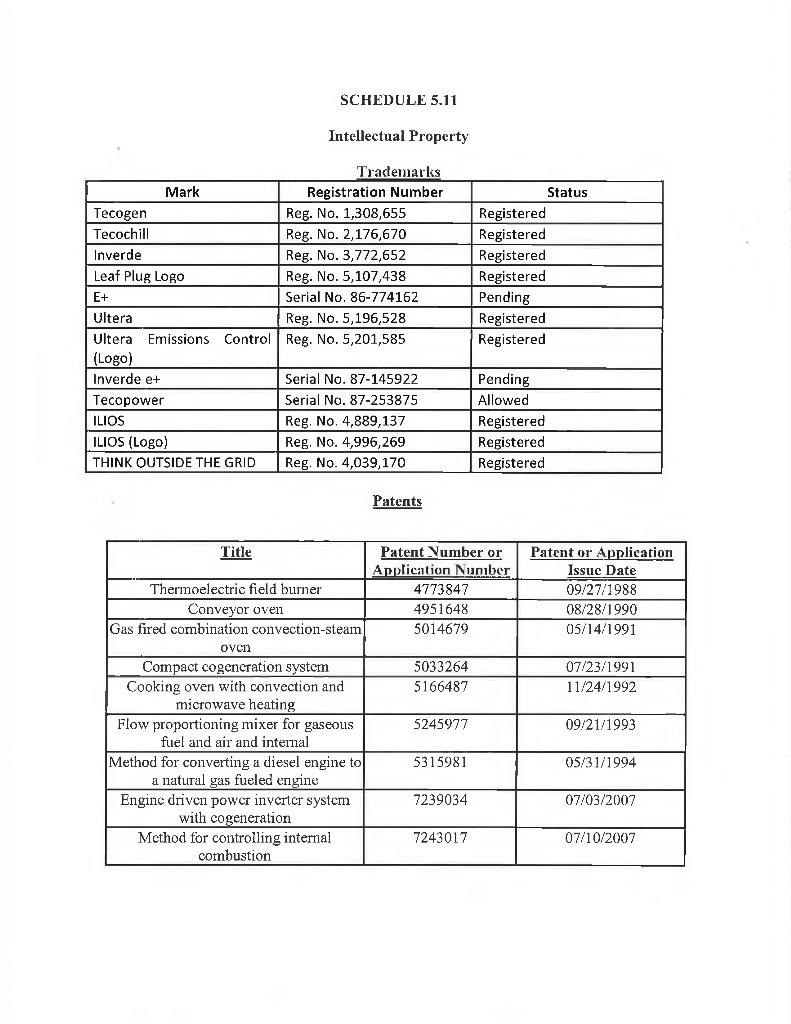

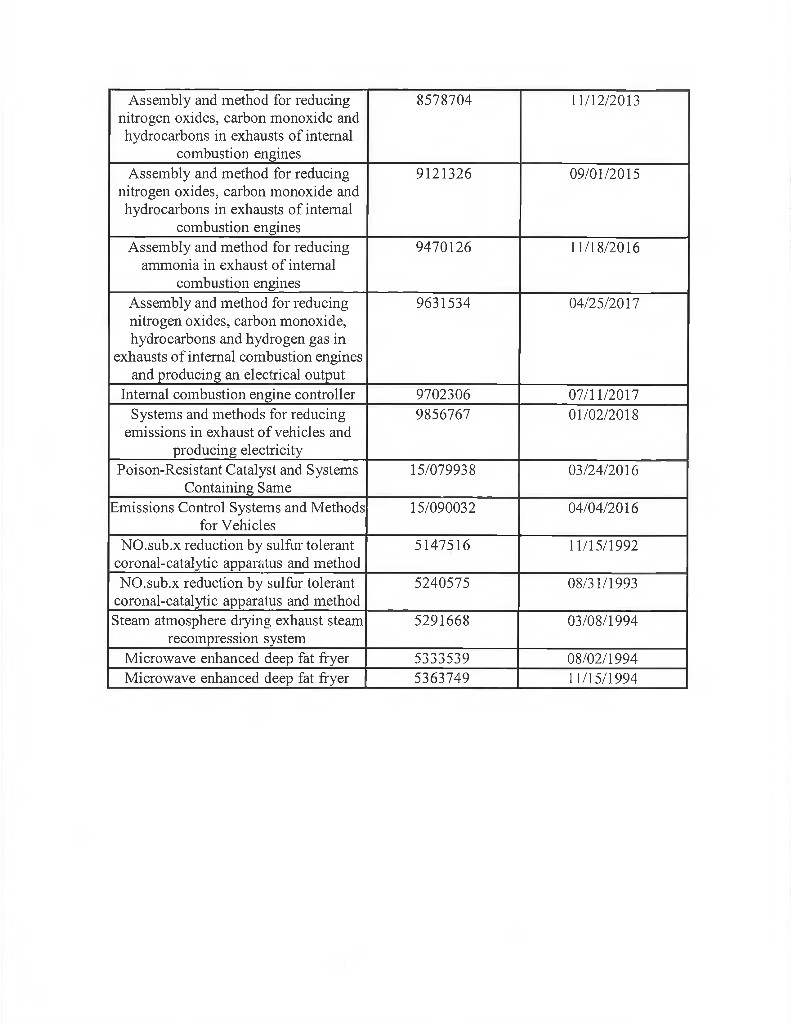

Page 6.5 Taxes............................................................................................................... 48 6.6 Payment of Indebtedness.............................. ................................................. ,48 6.7 Standards of Financial Statements.................... ............................................. ,48 6.8 Environmental Matters.................................................................................... ,48 6.9 Books and Records; Inspection Rights........................................................... ,50 6.10 Field Examinations....................................................................................... 51 6.11 Perfection of Security Interests................ .................................................... 51 7. NEGATIVE COVENANTS......................................................................................... 51 7.1 Merger, Consolidation and Acquisitions......... .............................................. ,51 7.2 Sales of Assets........................................ ...... ................................................ 51 7.3 Creation of Liens........................................ .................................................... 52 7.4 Guarantees...................................................................................................... ,52 7.5 Investments....................... ............................................................................. 52 7.6 Loans......................... .......................... .......................................................... 52 7.7 Dividends.......................................... ............................................................. 53 7.8 Indebtedness.................................................................................................... 53 7.9 Nature of Business.......................................................................................... 53 7.10 Transactions with Affiliates................................................. ........................ 53 7.11 Subsidiaries............................... .................................................................... 53 7.12 Fiscal Year and Accounting Changes................................................... ........ 54 7.13 Pledge of Credit............................................................................................. ,54 7.14 Amendment of Documents........................................................................... 54 7.15 Prepa5mient of Indebtedness................................................... ...................... ,54 7.16 Deposit Accounts................................ ......................................................... ,54 7.17 Equity Interests.............................................................................................. ,54 7.18 Minimum Excess Availability....................................................................... 54 8. FINANCIAL COVENANTS......................................................................................... 54 8.1 Fixed Charge Coverage Ratio...................... .......... ........................................ ,54 8.2 Unfmanced Capital Expenditures......................... .......................................... 54 9. INFORMATION COVENANTS.................................................................................. 55 9.1 Disclosure of Material Matters........................................................................ 55 9.2 Schedules and Reports..................................................................................... 55 9.3 Litigation.......................................................................................................... 55 9.4 Notice of Adverse Events............................................................................... ,55 9.5 Other Material Occurrences..................................... ....................................... ,56 9.6 Government Receivables.................................. .............. ............................... 56 9.7 Annual Financial Statements........................................................................... 56 9.8 Quarterly Financial Statements, Cash Flow Projections and Borrowing Base Certificates.................................................................................................. 57 9.9 Projections; Operating Budgets........................................................................ 58 9.10 Variances From Operating Budget................................................................ 58 9.11 Intellectual Property....................................................................................... 58 (iii)

Page 9.12 Public Reports........................................................... 58 9.13 Additional Information............................................. 58 9.14 Additional Documents................................ ............. 59 10. CONDITIONS PRECEDENT................................................ 59 10.1 Conditions to the Initial Advance............................. 59 10.2 Conditions to Each Advance................................ . 62 11. EVENTS OF DEFAULT........................................................ 63 11.1 Obligations................................................................. 63 11.2 Misrepresentations.................................................... 63 11.3 Financial Infomiation................................................ 63 11.4 Liens..................... ..................................................... 64 11.5 Covenants................................................................... .64 11.6 Judgments.................................................................. 64 11.7 Voluntary Bankruptcy.................... ..................... . 64 11.8 Involuntary Bankruptcy............................................ 64 11.9 Material Adverse Changes....................... ................ 64 11.10 Lender’s Liens......................................... ........... . 64 11.11 Subordinated Debt.................................................. 64 11.12 Cross Default.......................................................... 64 11.13 Guaranty................................................................... .65 11.14 Subordination Agreement........................................ 65 11.15 Change of Control................................................. . 65 11.16 Invalidity.................................................................. 65 11.17 Takings..................................................................... .65 11.18 Seizures.................................................................... 65 11.19 Cessation of Operations..................................... ..... 65 11.20 Criminal Charges..................................................... 66 12. LENDER’S RIGHTS AND REMEDIES AFTER DEFAULT 66 12.1 Rights and Remedies............................................ ..... 66 12.2 Application of Proceeds............................................. 67 12.3 Lender’s Discretion.................................................... 67 12.4 Setoff....................................... ................................... 67 12.5 Receiver...................................................................... 67 12.6 Rights and Remedies not Exclusive..................... . 67 13. WAIVERS AND JUDICIAL PROCEEDINGS...................... .67 13.1 Waiver of Notice........................................................ 67 13.2 Delay........................................................................... 68 13.3 Jury Waiver......................... ....................................... .68 14. EFFECTIVE DATE AND TERMINATION.......................... 68 14.1 Term; Early Tennination Fee..................................... 68 14.2 Tennination............ .................................................... ,69 (iv)

Page 15. ADDITION OF BORROWERS; MULTIPLE BORROWERS 69 15.1 Addition of Borrowers................................................ .69 15.2 Multiple Borrowers..................................................... 69 15.3 Waiver of Subrogation.............................................. . 70 16. MISCELLANEOUS................................................................. 71 16.1 GOVERNING LAW.................................................... .71 16.2 Entire Understanding...................................... ......... . 71 16.3 Advice of Counsel....................................................... 72 16.4 Successors and Assigns; Participations; New Lender. 72 16.5 Application of Payments............................................. 73 16.6 Indemnity........................................................... ......... .73 16.7 Notice.......................................................................... 73 16.8 Survival....................................................................... 74 16.9 Severability................................................................. 74 16.10 Expenses................................................................... .74 16.11 Right to Cure............................... .............................. 75 16.12 Injunctive Relief........................................................ 75 16.13 CONSEQUENTIAL DAMAGES...................... ...... 75 16.14 Third Party Beneficiaries............................. ............. .75 16.15 Captions............................................ ........................ .75 16.16 Counterparts; Signatures............................ .............. 76 16.17 Construction................................. ............................. 76 16.18 Confidentiality........................................................... ,76 16.19 Publicity..................................................................... 76 16.20 Survival of Representations and Warranties.............. 76 16.21 Certain Matters of Construction................................. 77 16.22 Destruction of Invoices.............................................. 77 16.23 Time........................................................... ................ .77 16.24 Patriot Act.................................................................. .77 16.25 No Tax Advice................................... ....................... 77 16.26 Completion of Blanks................................................ 78 16.27 Exculpation of Lender................................................ 78 16.28 Electronic Transmission............................................. 78 (V)

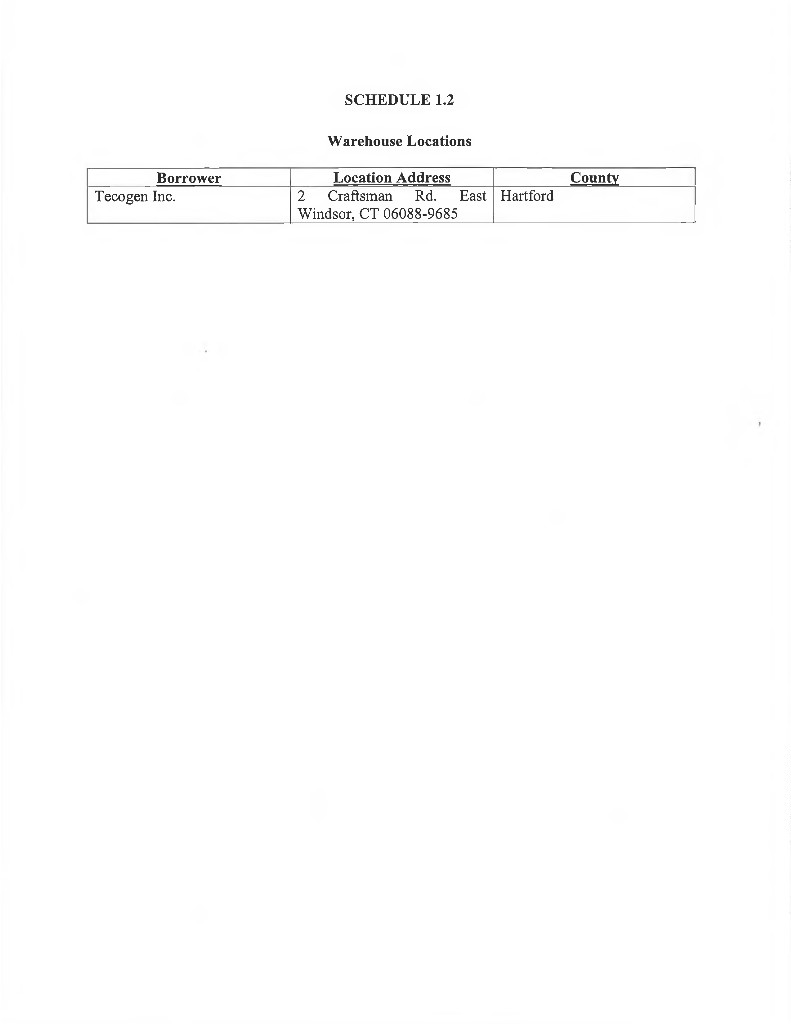

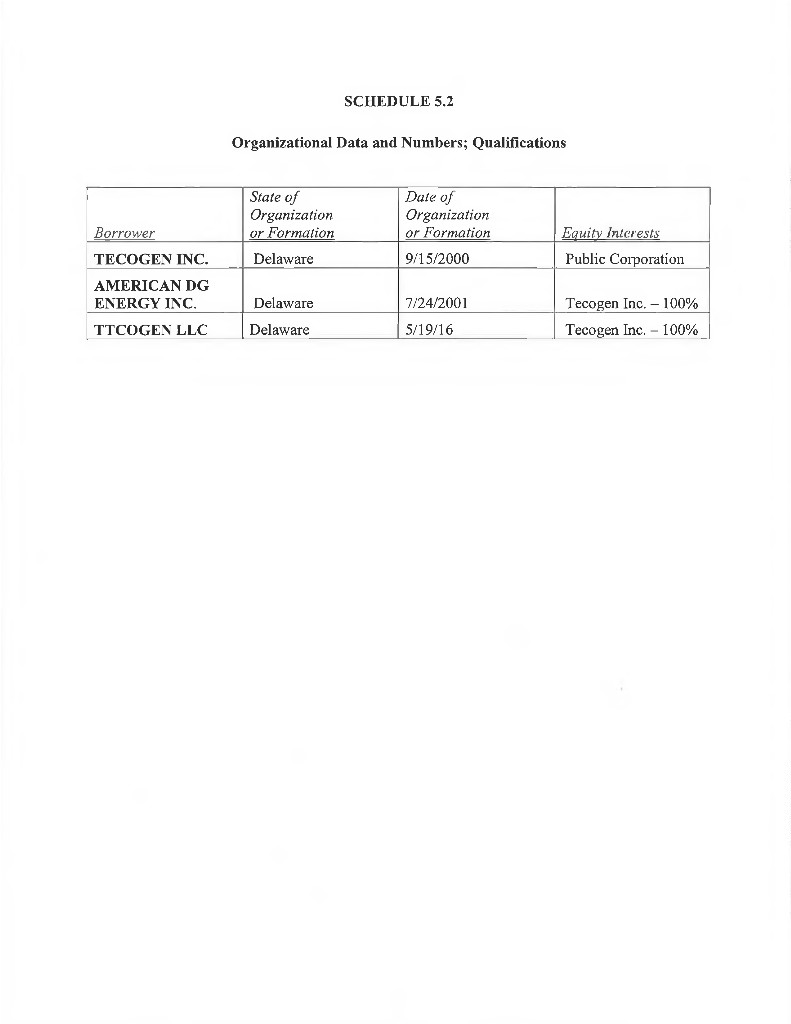

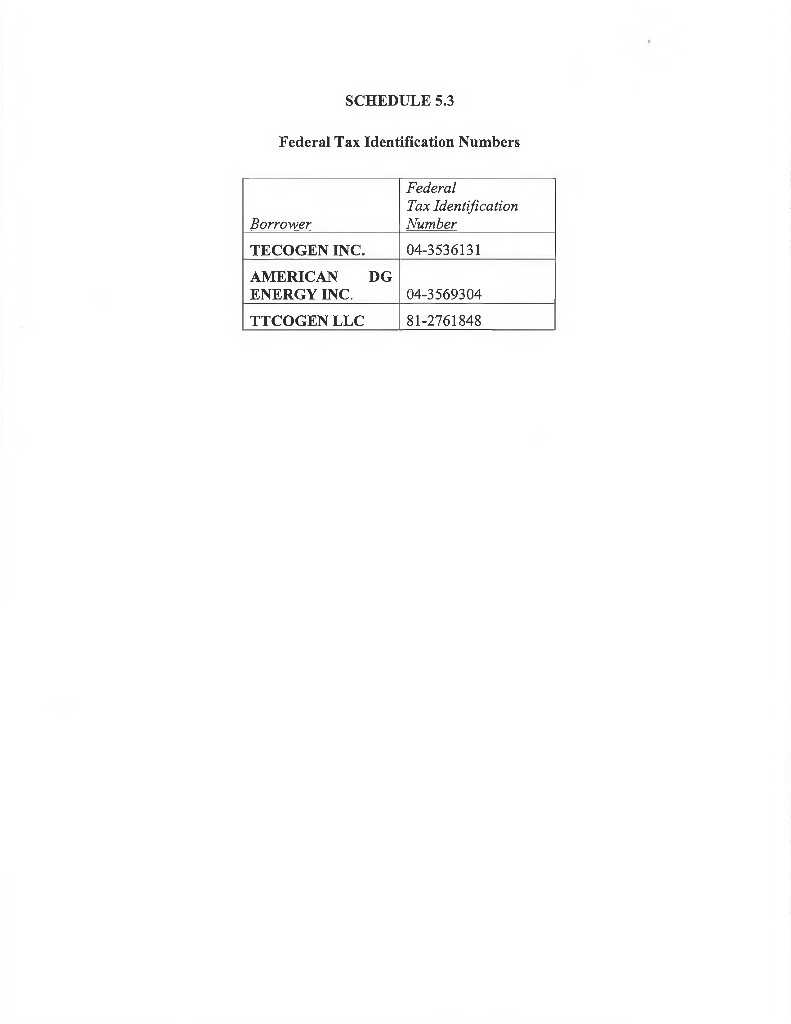

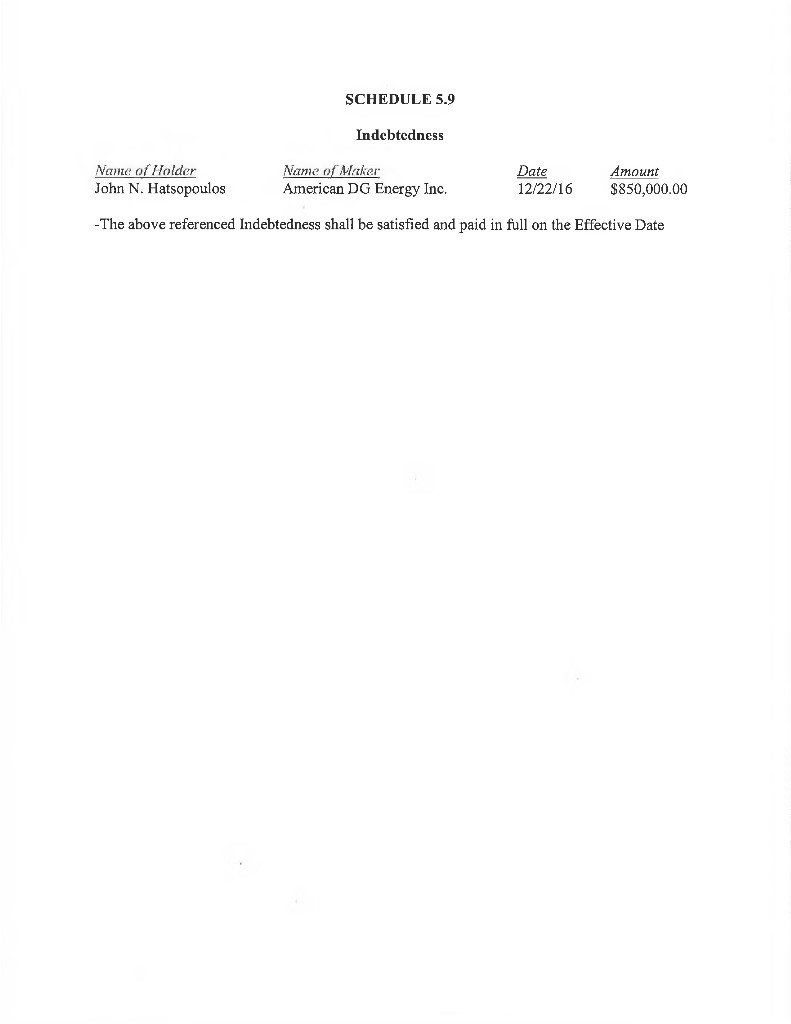

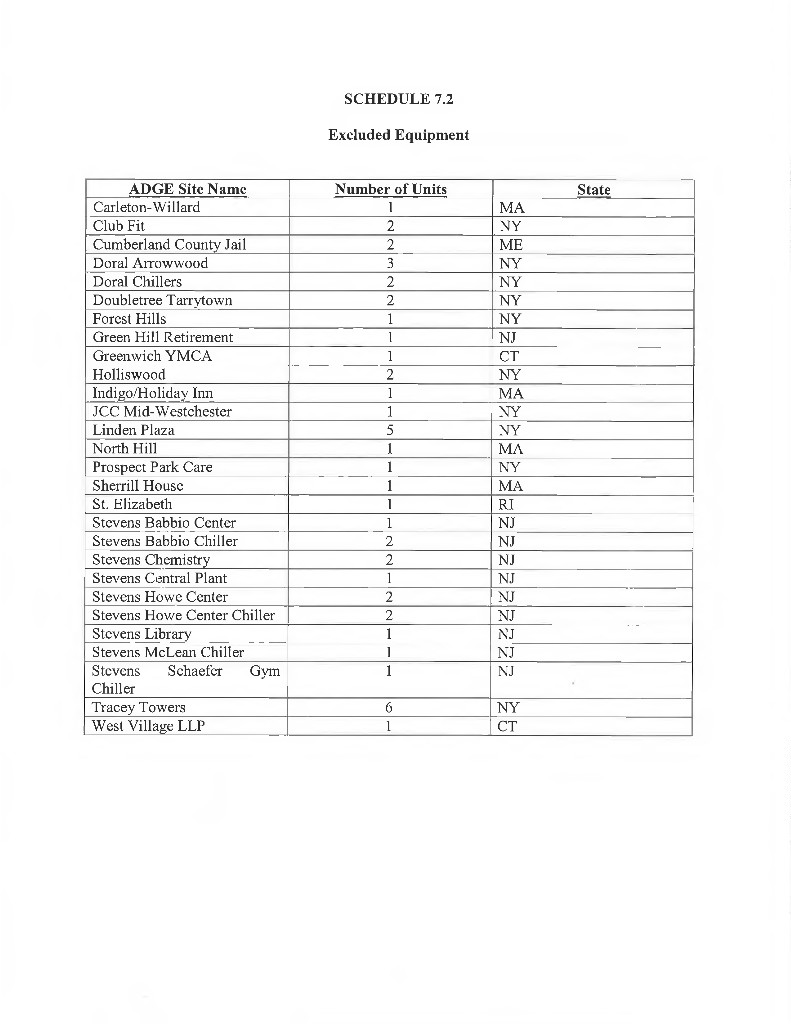

List of Exhibits and Schedules Exhibits Exhibit 1.3 Borrower Addendum Exhibit 2.1 Revolving Credit Note Schedules Schedule 1.1 Leased Locations Schedule 1.2 Warehouse Locations Schedule 5.2 Organizational Data and Numbers; Qualifications Schedule 5.3 Federal Tax Identification Numbers Schedule 5.5 Prior Names Schedule 5.6 OSHA and Environmental Compliance Schedule 5.8 Litigation Schedule 5.9 Indebtedness Schedule 5.10 Violations Schedule 5.11 Intellectual Property Schedule 5.24 Real Property Schedule 5.25 Deposit Accounts Schedule 7.2 Excluded Equipment (Vi)

CREDIT AGREEMENT CREDIT AGREEMENT (this "'Agreemenf'), dated as of May 4, 2018 (the ""Effective Date"'), among TECOGEN INC., a Delaware corporation {""Tecogen"') AMERICAN DG ENERGY INC., a Delaware corporation {""ADGE') and TTCOGEN EEC, a Delaware corporation {""TTCogen'\ and collectively with Tecogen and ADGE, each, a ""Borrower'" and, collectively, the ‘"Borrowers”), and WEBSTER BUSINESS CREDIT CORPORATION, a New York corporation {""WBCC"), individually, as lender hereunder and, collectively, as agent for itself and each other Eender Party (as hereinafter defined) (WBCC, acting in both such capacities, herein called ""Lender”). RECITALS I. Capitalized tenns used in these Recitals shall have the meanings ascribed to such terms in the preamble to this Agreement or in Section 1.3. II. The Borrowers have applied to WBCC for financing to refinance the Existing Eoans, to pay closing costs associated herewith, to supplement their working capital needs on an ongoing basis and for the other purposes described in this Agreement. III. WBCC, as Eender hereunder, has agreed to provide this financing to the Borrowers, subject however, to the terms, covenants and conditions hereinafter set forth. NOW, THEREFORE, IN CONSIDERATION of the mutual covenants and undertakings herein contained, the receipt and sufficiency of which are mutually acknowledged, the Borrowers and Eender, each intending to be legally bound hereby, hereby covenant and agree as follows: 1. DEFINITIONS, 1.1 Accounting Terms; References to the Loan Party and Credit Documents, (a) As used in this Agreement, any Note, or any certificate, report or other Credit Document, accounting terms not defined in Section 1.3 or elsewhere in this Agreement shall have the respective meanings given to them under GAAP; provided, however, whenever such accounting terms are used for the purposes of detenuining compliance with the Financial Covenants in this Agreement, such accounting terms shall be defined in accordance with GAAP as applied in preparation of the Historical Financial Statements; (b) unless otherwise specifically stated, all references in this Agreement and the other Credit Documents to the term “Borrower” shall mean and refer to all of the Borrowers and (c) unless otherwise specifically stated, all references in this Agreement and any other Credit Document to this Agreement and any Credit Document shall mean and include this Agreement and such other Credit Document, as amended, modified or supplemented from time to time. Notwithstanding anything to the contrary provided in this Agreement, in the event of a change under GAAP (or the application thereof) requiring all leases to be capitalized, only those leases that would result or would have resulted in a Capital Eease or Capitalized Eease Obligation on the Closing Date (assuming for purposes hereof that such lease(s) was in existence on the date hereof) hereunder shall be considered capital leases

hereunder and all calculations and deliverables under this Agreement or any other Credit Document shall be made in accordance therewith. 1.2 Uniform Commercial Code Terms. Unless defined herein, all terais used herein and defined in the Unifonn Commercial Code shall have the meanings given them therein. 1.3 General Definitions. "Accountants" shall mean Wolf & Company, P.C. or a firni of independent certified public accountants selected by Borrowers, and acceptable to Lender, in its Penuitted Discretion. ''Advances shall mean and include any loans, advances or other financial accommodations made under, pursuant to or in connection with this Agreement or any other Credit Document, including the Revolving Advances and any Letters of Credit. "Affiliate" of any Person shall mean (a) any Person which, directly or indirectly, is in Control of, is Controlled by, or is under common Control with such Person, or (b) any Person who is a, director or officer (i) of such Person, (ii) of any Subsidiary of such Person or (iii) of any Person described in clause (a) above. As used hereinabove and elsewhere in this Agreement “Control” of a Person shall mean the power, direct or indirect to direct or cause the direction of the management and policies of such Person whether through the ability to exercise voting power, by contract or otherwise. Any Unrestricted Affiliate shall not constitute an Affiliate of any Borrower. "Agreement" shall have the meaning set forth in the preamble to this Agreement. "Applicable Advance Rates" shall mean the advance rates, expressed as percentages for the applicable collateral, set forth in the definition of “Borrowing Base.” "Applicable Margin" shall mean, at any time and from time to time with respect to the Revolving Advances: Domestic Rate Loans: 1.50% LIBOR Loans: 3.00% "Application Date" shall have the meaning set forth in Section 4.5. "Auto-Extension Letter of Credit" shall have the meaning set forth in Section 2.13tbf "Authority" shall have the meaning set forth in Section 6.8fdl. "Available Collateral Value" shall mean, at any date of determination, the amount of the Borrowing Base on such date. "Availability Period" shall mean the period from the Closing Date through the Business Day immediately preceding the Revolving Maturity Date. -2-

''Availability Reserves"' shall mean such reserves as Lender, in its Pennitted Discretion, may elect to impose from time to time in respect of borrowing availability. Without limiting the generality of the foregoing, the following reserves, if imposed, shall be deemed an exercise of Lender’s Pennitted Discretion: (a) reserves for damages; (b) reserves for accrued but unpaid ^ valorem, excise and personal property tax liabilities; (c) reserves for amounts then due, or coming due, to other creditors (including judgment creditors); (d) Bank Product reserves; (e) reserves for past due accrued, unpaid interest and fees; (f) reserves for federal government claims or offsets; (g) reserves for any other matter that has a negative impact on the value of the Collateral; (h) rent reserves for three months’ rent for each Leased Location and Warehouse Location and, if applicable, any other locations leased by any Loan Party or warehouses where any Loan Party stores inventory, in each case, unless and until the Lender receives, as applicable, an acceptable landlord agreement from the landlord of a Leased Location and an access or comparable agreement from the owner or operator of a Warehouse Location, and (i) reserves for any changes in the tenns of any Loan Party’s trade credit including, without limitation, dilution, credit limits and repayment tenns. ''Bank" shall mean Webster Bank, National Assoeiation, together with its suecessors and assigns. "Bank Products" shall mean, collectively, (a) any cash management service, including through the use of any Lock-Box Account, Blocked Account or Concentration Aceount, (b) any Hedge Contract, (c) any derivative product or (d) any similar (or dissimilar) bank product or service offered by the Bank or any Affiliate of the Bank (including Lender) to any Borrower from time to time. "Bankruptcy Action" shall mean, with respect to any Person, that it shall (a) apply for, consenl to or suffer the appointment of or the taking of possession by a receiver, custodian, trustee, liquidator or similar fiduciary of itself or of all or a substantial part of its property, (b) make a general assignment for the benefit of ereditors, (c) commence or have commenced against it, a case under any state or federal bankruptcy laws (as now or hereafter in effect), (d) be adjudicated a bankrupt or insolvent, (e) admit in writing its inability, or be generally unable, to pay its debts as they become due or cease operations of its present business, (f) file a petition seeking to take advantage of any other law providing for the relief of debtors, or (g) take, consent to, or acquiesce in, any action for the purpose of effecting any of the foregoing. "Base Rate" on any day, shall mean a rate per annum equal to the highest of (a) the Federal Funds Rate plus 14 of 1%, (b) the Prime Rate, and (c) the LIBOR Rate for a one month Interest Period plus 2.75%. Blocked Account" shall have the meaning set forth in Section 4.2. Blocked Account Agreement" shall have the meaning set forth in Section 4.2. Blocked Account Bank" shall have the meaning set forth in Section 4.2. "Borrower" or "Borrowers" shall mean the Persons, described in the preamble of this Agreement and each other Person that becomes a party to this Agreement by executing a Loan Party Addendum and shall extend to all penuitted successors and assigns of such Persons. -3 -

''Borrower Addendum'' shall mean an Addendum, duly completed and executed by each of Borrowing Representative and the applicable new Loan Party, in substantially the fonu attached hereto as Exhibit 1.3. "Borrower Reports" shall mean any reports (whether financial, with respect to Collateral, as to operating condition or otherwise) required to be delivered to Lender pursuant hereto or to any other Credit Document, including, particularly, pursuant to Article 9. Borrowers’ Account" shall have the meaning set forth in Section 2,11. 'Borrowing Base" shall mean the sum of the following: (a) eighty five percent (85%) of the Value of all Eligible Receivables; plus (b) the lesser of (i) the Eligible Inventory Sublimit, and (ii) fifty percent (50%) of the Value of all Eligible Inventory, in each case consisting of Raw Materials and Finished Goods, minus (c) the Availability Reserves. "Borrowing Base Certificate" shall have the meaning set forth in Section 9.8(b), "Borrowing Representative" shall mean such Person as Loan Parties, collectively between or among themselves, may elect as their representative hereunder from time to time pursuant to Article 15. subject to Lender’s prior approval. On the Closing Date, the Borrowing Representative is Tecogen. "Business Day" shall mean with respect to LIBOR Rate Loans or any day on which commercial banks are open for domestic and international business, including dealings in Dollar deposits in London, England and New York, New York and with respect to all other matters, any day other than a day on which commercial banks in New York or Connecticut are authorized or required by law to close. "Capital Expenditures" shall mean all expenditures (or commitments to make expenditures) of Loan Parties on a Consolidated and Consolidating basis for fixed or capital assets (including any made or committed to be made pursuant to capitalized leases) which, in accordance with GAAP, constitute capital expenditures in the period made. "Capital Lease" shall mean any lease of Equipment or Real Property by a Loan Party or any of its Subsidiaries that, in accordance with GAAP, is or should be reflected as a liability on the balance sheet of such Loan Party or such Subsidiary. "Capitalized Lease Obligations" shall mean any Indebtedness represented by obligations under a Capital Lease, and the amount of such Indebtedness shall be the capitalized amount of such obligations determined in accordance with GAAP. "CERCLA" shall mean the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. §§9601 ^ seq. -4_

Change of ControF shall mean that: (a) any Person or group of persons within the meaning of § 13(d)(3) of the Securities Exchange Act of 1934 becomes the beneficial owner, directly or indirectly, of 50% or more of the outstanding Equity Interests of Tecogen; or (b) Tecogen shall cease to own and control, directly or indirectly, of record and beneficially 100% of each class of outstanding Equity Interests of the other Borrowers and the Guarantors free and clear of all Liens (except Liens created by the Collateral Documents); or (c) any merger or consolidation of any Loan Party occurs in which either such Loan Party or another Loan Party is not the survivor; or (d) a sale of all or substantially all of the property or assets of any Loan Party shall occur, except with Lender’s prior written consent; or (e) any Equity Interests of any Loan Party is, or becomes the subject of, any consensual Lien except in favor of (or assigned to) Lender pursuant hereto; or (f) any Subsidiary of a Loan Party is not, or ceases to be, owned and Controlled by a Loan Party; or (g) each of the Guarantors is not, or ceases to be. Controlled directly or indirectly by Tecogen. Charges shall mean all taxes, charges, fees, imposts, levies or other assessments, including, without limitation, all net income, gross income, gross receipts, sales, use, ad valorem, value added, transfer, franchise, profits, inventory. Equity Interests, license, withholding, payroll’ employment, social security, unemployment, excise, severance, stamp, occupation and property taxes, custom duties, fees, assessments, liens, claims and charges of any kind whatsoever, together with any interest and any penalties, additions to tax or additional amounts, imposed by any taxing or other authority, domestic or foreign (including, without limitation, the Pension Benefit Guaranty Corporation or any environmental agency or superfiind), upon any Collateral, any Loan Party or any of its Affiliates. '"Closing Date'' shall mean the date on which the Initial Advance is made, which date may be on the Effective Date but, unless otherwise approved by Lender, shall not be later than ten (10) days after the Effective Date. "Code" shall mean the Internal Revenue Code of 1986, as amended from time to time and the regulations promulgated thereunder. "CollateraF shall have the meaning set forth in the Security Agreement. "Commitment” shall mean the total commitment of Lender to make Advances under this Agreement as in effect on the Closing Date, as such commitment may be increased or decreased fi-om time to time hereafter in accordance with the terms hereof -5-

''Commodity Exchange AcC shall mean the Commodity Exchange Act (7.U.S.C. Section 1, ^ seq.), as amended from time to time, and any successor statute. "Concentration AccounC shall mean a Deposit Account with the Bank into which collections from Receivables and other Collateral are and will be deposited, remitted and concentrated prior to, and in facilitation of, their applications to the Obligations. "Consents'" shall mean all filings and all licenses, permits, consents, approvals, authorizations, qualifications and orders of Governmental Bodies and other third parties, domestic or foreign, (a) necessary to carry on any Loan Party’s business, including, without limitation, any consents required under all applicable federal, state or other applicable law, and (b) required to effectuate the transactions and agreements contemplated in this Agreement and the other Credit Documents. “Consolidated and Consolidating Basis" shall mean, with respect to the Loan Parties and their Subsidiaries, the consolidation, in accordance with GAAP, of the accounts or other items of the Loan Parties and their Subsidiaries on a consolidated basis. Contract Rate" shall mean the rates of interest set forth in Section 3.Ua~). "ControF shall have the meaning set forth in the definition of'AJfiliate". "Credit Documents" shall mean this Agreement, together with the Note, the Issuer Documents, any Guaranty, the Security Agreement, any Subordination Agreement, and any and all other agreements, instruments and documents, including, without limitation, guaranties, pledges, powers of attorney, consents, and all other writings heretofore, now or hereafter executed by any Loan Party and/or delivered to Lender or any other Lender Party, in respect of the transactions contemplated by this Agreement. The term "Credit Documents" includes, without limitation, all those documents to which any Borrower or any Guarantor is a party described in Section 10.1. "Customer" shall mean and include the account debtor with respect to any Receivable and/or the prospective purchaser of goods, services or both with respect to any contract or contract right, and/or any party who enters into or proposes to enter into any contract or other arrangement with any Loan Party, pursuant to which such Loan Party is to deliver any personal property or perform any services. “D&O Insurer” shall mean Federal Insurance Company. "Default" shall mean an event which, with the giving of notice or passage of time or both, would constitute an Event of Default. "Default Rate" shall have the meaning set forth in Section 3.1('bL "Deposit Account" shall mean any checking account, savings account, time deposit account, certificate of deposit, investment account or other account (howsoever denominated), in which from time to time any cash of any Loan Party is or may be deposited. -6-

"'Designated Officer'" shall mean the chief executive officer, chief financial officer or chief operating officer of a Loan Party (regardless of title), or such other officer, lender or representative of a Loan Party which Lender may, at such Loan Party’s request, penuit to be a "Designated Officer" from time to time. "Dollars" and the sign "$" shall mean lawful money of the United States of America. "Domestic Rate Loan" shall mean any Advance that bears interest based upon the Base Rate. "Domestic Subsidiary" shall mean a Subsidiary organized under the laws of the United States or any political subsidiary thereof Early Termination Date" shall have the meaning set forth in Section 14.1fbL Early Termination Fee" shall have the meaning set forth in Section H.lfbl. EBITDA" shall mean, for any fiscal period of the Borrowers, the sum of; (a) net income (or loss) of the Loan Parties on a Consolidated and Consolidating basis (as applicable) for such period (excluding extraordinary gains and losses), plus (b) to the extent deducted in detenuining such net income (or loss) of the Loan Parties on a Consolidated and Consolidating basis, the following; (i) all interest expense of the Loan Parties on a Consolidated and Consolidating basis for such period; (ii) all charges against income of the Loan Parties on a Consolidated and Consolidating basis for such period for federal, state and local taxes paid or accrued during such period; (iii) depreciation expenses of the Loan Parties on a Consolidated and Consolidating basis for such period; and (iv) amortization expenses of the Loan Parties on a Consolidated and Consolidating basis for such period, and provided however, in no event shall EBITDA include, for any purpose, net income from any Unrestricted Subsidiary or any Unrestricted Affiliate. "E-Fax" shall mean any system used to receive or transmit fees electronically. "Effective Date" shall have the meaning set forth in the preamble to this Agreement. "Electronic Transmission" shall mean each document, instruction, authorization, file, information and any other communication transmitted, posted or otherwise made or communicated by e-mail or E-Fax, or otherwise to or from an E-System or other equivalent service. "Eligible Inventory" shall mean and include, with respect to each Loan Party, Inventory consisting of Raw Materials and Finished Goods owned by and in the possession of a Loan Party and located in the United States of America, which Lender, in its Penuitted Discretion, shall determine to be Eligible Inventory. Without limitation. Inventory shall not be deemed Eligible Inventory unless such Inventory is subject to Lender’s first priority perfected security interest -7-

and no other Lien (other than Pennitted Encumbrances). In addition, no Inventory shall be Eligible Inventory if: (a) it does not confonn in all material respects to all Requirements of Law pertaining to its manufacturers; (b) it consists of display items, showroom samples, “seconds,” packaging, shipping materials, supplies or catalysts; (c) it constitutes Inventory in-transit to or from a Loan Party (while in-transit); (d) it is subject to any licensing or similar contractual arrangement limiting the resale thereof by a Loan Party or by Lender as its attomey-in-fact; (e) any covenant, representation or warranty contained herein with respect to such Inventory has been breached in any material respect; (f) it is obsolete, unsaleable, shop-worn, damaged, defective, slow-moving or umuerchantable; (g) it has been consigned to a Loan Party or to any third party for sale; (h) it is not subject to a perpetual inventory reporting system acceptable to Lender; (i) it is in the possession or control of any processor, finisher or other third party besides a Loan Party or is otherwise situated at any public or private warehouse or upon any leased property unless such processor, finisher, warehouse operator, landlord or other third party has waived any lien or claim thereon, in a manner satisfactory to Lender; G) it consists of Hazardous Substances; (k) it is not covered by casualty insurance maintained as required under the Security Agreement; or (1) it is Inventory owned by any Unrestricted Affiliate or any Unrestricted Subsidiary; or (m) it is not otherwise satisfactory to Lender in the exercise of its Pennitted Discretion. ""Eligible Inventory Sublimif' shall mean Two Million and 00/100 Dollars ($2,000,000). ""Eligible Receivables'' shall mean and include, with respect to each Loan Party, each Receivable of such Loan Party arising in the ordinary course of such Loan Party’s business which Lender, in its Permitted Discretion, shall determine to be an Eligible Receivable. Without limitation, a Receivable shall not be deemed to be an Eligible Receivable unless such Receivable is subject to Lender’s first priority perfected security interest and no other Lien (other than -8-

Pennitted Encumbrances), and is evidenced by an invoice or other documentary evidence satisfactory to Lender. In addition, no Receivable shall be an Eligible Receivable if; (a) it arises out of a sale made by any Loan Party to an Affiliate of any Loan Party or to a Person Controlled by an Affiliate of any Loan Party; (b) it is due or unpaid more than one hundred twenty (120) days from the original invoice date, or includes any aged credit balanees outstanding for more than one hundred twenty (120) days from the original invoice date; (c) fifty percent (50%) or more of the Receivables from the Customer are not deemed Eligible Receivables hereunder by application thereto of clause fbl above; (d) the Receivables of any one Customer (or group of Affiliated Customers) exceeds twenty five pereent (25%) of otherwise then Eligible Receivables, to the extent of such excess; (e) any covenant, representation or warranty contained in this Agreement with respect to such Receivable has been breached; (f) the Customer shall be the subject of any Bankruptcy Action; (g) the sale is to a Customer which is located outside, or has its prineipal place of business or substantially all of its assets outside, the continental United States of America; (h) the sale to the Customer is on a “bill-and-hold”, “guaranteed sale”, “sale-and- retum”, “sale on approval”, “eonsignment” or any other repurchase or return basis; (i) such Receivable arises from an invoice for a deposit, a rebill of amounts previously credited or other similar contra account; a) such Receivable arises in respect of a “COD” or “CBD” sale; (k) such Receivable is evideneed by an instrument or chattel paper; (1) such Receivable represents, or includes, a progress billing or retainage; (m) such Receivable consists of an interest billing, finance charge, warranty eharge or other non-trade amount; (n) Lender believes, in its Permitted Discretion, that collection of such Receivable is insecure or that such Receivable may not be paid by reason of the Customer’s fmaneial inability to pay; (0) the Customer is the United States of America, any state or any department, agency or instrumentality of any of them, unless any Loan Party assigns its right to payment of such Receivable to Lender pursuant to the Assignment of Claims Act of 1940, as amended (31 U.S.C. Section 3727, ^ seq. and 41 U.S.C. Section 15, ^ seq.) or has otherwise complied with other applicable statutes or ordinances; -9-

(P) the goods giving rise to such Receivable have not been shipped and delivered to and accepted by the Customer or the services giving rise to such Receivable have not been perfomied by the applicable Loan Party and accepted by the Customer or such Receivable otherwise does not represent a final sale (subject to returns in the Ordinary Course of Business); (q) the Receivables of the Customer exceed a credit limit determined by Lender, in its Permitted Discretion, to the extent such Receivable exceeds such limit; (r) such Receivable is subject to any offset, deduction, defense, dispute, or counterclaim, the Customer is also a creditor or supplier of a Loan Party or such Receivable is contingent in any respect or for any reason; (s) the applicable Loan Party has made any agreement with any Customer for any deduction therefrom, except for discounts or allowances made in the Ordinary Course of Business for prompt payment, all of which discounts or allowances are reflected in the calculation of the face value of each respective invoice related thereto; (t) any return, rejection or repossession of the merchandise giving rise to such Receivable has occurred; (u) such Receivable is not payable to a Loan Party; (V) such Receivable is owed by a Customer located in any State that requires a creditor to file a business activity report or similar document, or to qualify to do business in such State, in order to bring suit to recover on such Receivables in such State, unless (i) Loan Party has qualified to do business in such State or (ii) Loan Party has filed a business activity report or such other similar required document in such jurisdiction, or (iii) to Customer is doing business in, or otherwise is subject to the jurisdiction of, any other State; (w) such Receivable is payable in any currency other than Dollars; (X) such Receivable is issued in respect of partial payment, including “debit memos and “charge-backs”; (y) such Receivable is owing by a Sanctioned Person; or (z) such Receivable is owned by any Unrestricted Affiliate or any Unrestricted Subsidiary. ''Environmental Complaint shall have the meaning set forth in Section 6.8(dl. "Environmental Laws'' shall mean all federal, state and local environmental, land use, zoning, health, chemical use, safety and sanitation laws, statutes, ordinances and codes relating to the protection of the environment and/or governing the use, storage, treatment, generation, transportation, processing, handling, production or disposal of Hazardous Substances and the rules, regulations, policies, guidelines, interpretations, decisions, orders and directives of federal, state and local governmental agencies and authorities with respect thereto. - 10-

"'Equipment shall mean and include, as to each Loan Party, all of such Loan Party’s goods (other than Inventory) whether now owned or hereafter acquired and wherever located including, without limitation, all equipment, machinery, motor vehicles, forklifts, fittings, furniture, furnishings, fixtures, parts, attachments and accessories, and all replacements and substitutions therefor or accessions thereto. ""Equity Interests'" as to any Person, shall mean all shares, interests, partnership interests, limited liability company interests or units, membership interests, participations, rights in or other equivalents (however designated) of such Person’s equity (however designated including, without limitation, common and preferred shares and interests) and any rights, warrants or options exchangeable for or convertible into such shares, interests, participations, rights or other equity. ""E-System" shall mean any electronic system, including Intralinks®, The Debt Exchange - DebtX®, Sageworks® and any other internet or extranet-based site, whether sueh electronic system is owned, operated or hosted by Lender, any Lender Party or any other Person, providing for aeeess to data proteeted by passcodes or other security system. ""Event of Default" shall mean the occurrence and continuance of any of the events set forth in Article 11. ""Excess Availability" shall mean, at the time of determination, the difference between (a) the maximum amount of advances which can be made to Loan Party in accordance with this Agreement and the other Credit Documents at such time, and (b) the sum of (i) the aggregate amount of advances (and the undrawn face amount of Letters of Credit) under this Agreement and the other Credit Documents (including advances to be made and Letters of Credit to be issued) at such time, plus (ii) all trade indebtedness of Loan Party which is outstanding beyond normal trade terms at such time, plus (iii) fees and expenses for which Loan Party is responsible and which have not yet been charged to Loan Party’s account or otherwise paid by Loan Party at such time. ""Existing Lender" shall mean John N. Hatsopoulos, a Director of Tecogen and any other creditor of a Loan Party holding Funded Indebtedness on the Closing Date whieh is being refinanced pursuant to the Initial Advance made pursuant hereto. ""Existing Loans" shall mean all Indebtedness owing by Loan Parties to the Existing Lender on the Closing Date, whether seeured or unsecured. ""Excluded Equipment" shall mean the units of equipment referred to in Schedule 7.2 hereto, which, as of the date hereof, are (a) owned by ADGE and (b) located at the sites listed in such Schedule 7.2. The defined term “Excluded Equipmenf’ shall not include any Receivables arising out of or in connection with any of the equipment referred to in Schedule 7.2. ""Extraordinary Receipts" shall mean any cash proceeds received by a Loan Party or any of its Subsidiaries not in the Ordinary Course of Business (other than from the issuance of Equity Interests, the incurrenee of Indebtedness, the disposition of Collateral or any insured casualty loss), including, without limitation, (a) foreign. United States, state or local tax refunds, (b) pension plan reversions, (e) judgments, proceeds of settlements or other consideration of any - 11 -

kind in connection with any cause of action, (d) condemnation awards (and payments in lieu thereof), (e) indemnity payiuents and (f) any adjustment received in connection with any purchase price in respect of an acquisition. "'Federal Funds Rate"" shall mean, for any day, the rate per annum equal to the weighted average of the rates on overnight Federal funds transactions with members of the Federal Reserve System arranged by Federal funds brokers on such day, as published by the Federal Reserve Bank of New York on the Business Day next succeeding such day; provided that (a) if such day is not a Business Day, the Federal Funds Rate for such day shall be such rate on such transactions on the next preceding Business Day as so published on the next succeeding Business Day, and (b) if no such rate is so published on such next succeeding Business Day, the Federal Funds Rate for such day shall be the average rate (rounded upward, if necessary, to a whole multiple of 1/100 of 1%) charged to the Bank on such day on such transactions as determined by the Lender. Notwithstanding the foregoing, if the Federal Funds rate shall be less than zero, such rate shall be deemed to be zero for purposes of this Agreement. Financial Covenants"" shall mean the Financial Covenants set forth in Section 8.1 and Section 8.2. "Finished Goods"" shall mean finished goods held for sale by a Loan Party in the Ordinary Course of its Business. "Fiscal Year"" shall mean Loan Parties’ Fiscal Year as in effect on the Effective Date; and the tenus "Fiscal Quarter"" and "Fiscal Month"" shall have correlative meanings. "Fixed Charge Coverage Ratio"" shall mean and include, (subject to the proviso at the end of this definition) with respect to any twelve consecutive Fiscal Month period of the Loan Parties ending on the last day of each Fiscal Quarter, the ratio of: (a) EBITDA of the Loan Parties on a Consolidated and Consolidating basis for such period, minus (b) the sum of (i) any Unfmanced Capital Expenditures of the Loan Parties on a Consolidated and Consolidating basis made during such period, (ii) all charges against income of the Loan Parties on a Consolidated and Consolidating basis for such period for federal, state and local taxes actually paid during such period, and (iii) any dividends or other distributions to Shareholders of the Loan Parties made during such period, to (b) Fixed Charges for such twelve month period. "Fixed Charges"" shall mean and include, with respect to any twelve consecutive Fiscal Month period of the Loan Parties ending on the last day of any Fiscal Quarter, the sum (without duplication) of: (a) all scheduled payments (excluding mandatory prepayments) of principal paid or payable on Funded Indebtedness of the Loan Parties on a Consolidated and Consolidating basis outstanding during such period (excluding Revolving Advances), and, in the case of Permitted Subordinated Debt, any such payments actually made in such period, if not otherwise scheduled to be made therein, plus - 12 -

(b) all interest expense of the Loan Parties on a Consolidated and Consolidating basis (including Revolving Advances) during such period, plus (c) all payments on Capitalized Leases of the Loan Parties on a Consolidated and Consolidating basis made during such period. '"Foreign Subsidiary’" shall mean any Subsidiary which is not a Domestic Subsidiary. "Funded Indebtedness"" shall mean (without duplication) all Indebtedness: (a) for money borrowed, including the Advances, (b) which is evidenced by notes, drafts, bonds, debentures, credit documents or similar instruments. (c) for the deferred payment for a term of one (1) year or more of the purchase price of any asset. (d) consisting of Capital Lease Obligations, (e) consisting of reimbursement and other outstanding obligations (whether or not contingent) with respect to letters of credit and bankers’ acceptances, and (f) consisting of guaranties of any Indebtedness of the foregoing types owing by another Person. "GAAF" shall mean generally accepted accounting principles in the United States of America in effect from time to time. "Governmental Body"" shall mean any nation or government, any state or other political subdivision thereof or any entity exercising the legislative, judicial, regulatory or administrative functions of or pertaining to a government. "Guarantor"" shall mean any Person (other than a Loan Party) who may hereafter guarantee payment or performance of the whole or any part of the Obligations. On the Closing Date, there are no Guarantors. "Guaranty"" shall mean any guaranty of the payment or performance of the whole or any part of the Obligations, in whole or in part, executed at any time by a Guarantor in favor of Lender for the ratable benefit of the Lender Parties. "Hazardous Discharge"" shall have the meaning set forth in Section 6.8(d). "Hazardous Substance"" shall mean, without limitation, any flammable explosives, radon, radioactive materials, asbestos, urea formaldehyde foam insulation, polychlorinated biphenyls, petroleum and petroleum products, methane, hazardous materials. Hazardous Wastes, hazardous or Toxic Substances or related materials as defined in CERCLA, the Hazardous Materials Transportation Act, as amended (49 U.S.C. Section 1801, ^ ^.), RCRA, Articles 15 - 13 -

and 27 of the New York State Environmental Conservation Law or any other applicable Enviromnental Law and in the regulations adopted pursuant thereto. '"Hazardous Wastes'" shall mean all waste materials subject to regulation under CERCLA, RCRA or applicable state law, and any other applicable Federal and state laws now in force or hereafter enacted relating to hazardous waste disposal. "Hedge Contract shall mean any “hedge,” “swap,” “collar,” “cap” or similar agreement between a Loan Party and any other financial institution, including, without limitation. Bank or any other Affiliate of WBCC, intended to fix the relative amount of such Loan Party’s risk in respect of changes in interest rates and foreign currency exchange. ""Historical Financial Statements'' shall have the meaning set forth in Section 5.4fa). ""Indebtedness" of a Person at a particular date, shall mean all obligations of such Person which in accordance with GAAP would be classified upon a balance sheet as liabilities (except Equity Interests and surplus earned or otherwise) and in any event, without limitation by reason of enumeration, shall include all indebtedness, debt and other similar monetary obligations of such Person whether direct or guaranteed, and all premiums, if any, due at the required prepayment dates of such indebtedness, and all indebtedness secured by a Lien on assets owned by such Person, whether or not such indebtedness actually shall have been created, assumed or incurred by such Person. Any indebtedness of such Person resulting from the acquisition by such Person of any assets subject to any Lien shall be deemed, for the purposes hereof, to be the equivalent of the creation, assumption and incurring of the indebtedness secured thereby, whether or not actually so created, assumed or incurred. ""Initial Advance" shall mean the initial Advance (or series of initial Advances) to be made on the Closing Date. ""Interest Payment Date" shall mean (a) as to any Domestic Rate Loan, the first day of each calendar month commencing on the first of such days to occur after the Closing Date, (b) as to any LIBOR Rate Loan, the last day of the Interest Period applicable thereto and, if such Interest Period is longer than three months in duration, each day which is three months, or a whole multiple thereof, after the first day of such Interest Period and the last day of such Interest Period, and (c) as to all Revolving Advances, the Revolving Maturity Date. ""Interest Period" shall mean as to each LIBOR Rate Loan, the period commencing on, as the case may be, the date on which such LIBOR Rate Loan is made or into which a Loan is converted with respect thereto and ending one month thereafter; provided, however, that (a) if any Interest Period would otherwise end on a day which is not a Business Day, such Interest Period shall be extended to the next succeeding Business Day unless the result of such extension would be to carry such Interest Period into another calendar month, in which event such Interest Period shall end on the immediately preceding Business Day, in which event, the next Interest Period for such LIBOR Loan shall begin on such date or, if no election shall have been made to continue such LIBOR Loan, such LIBOR Loan shall on such date become a Domestic Rate Loan and (b) any Interest Period which begins on the last Business Day of a calendar month (or on a day for which there is no numerically corresponding day in the calendar month at the end of such - 14-

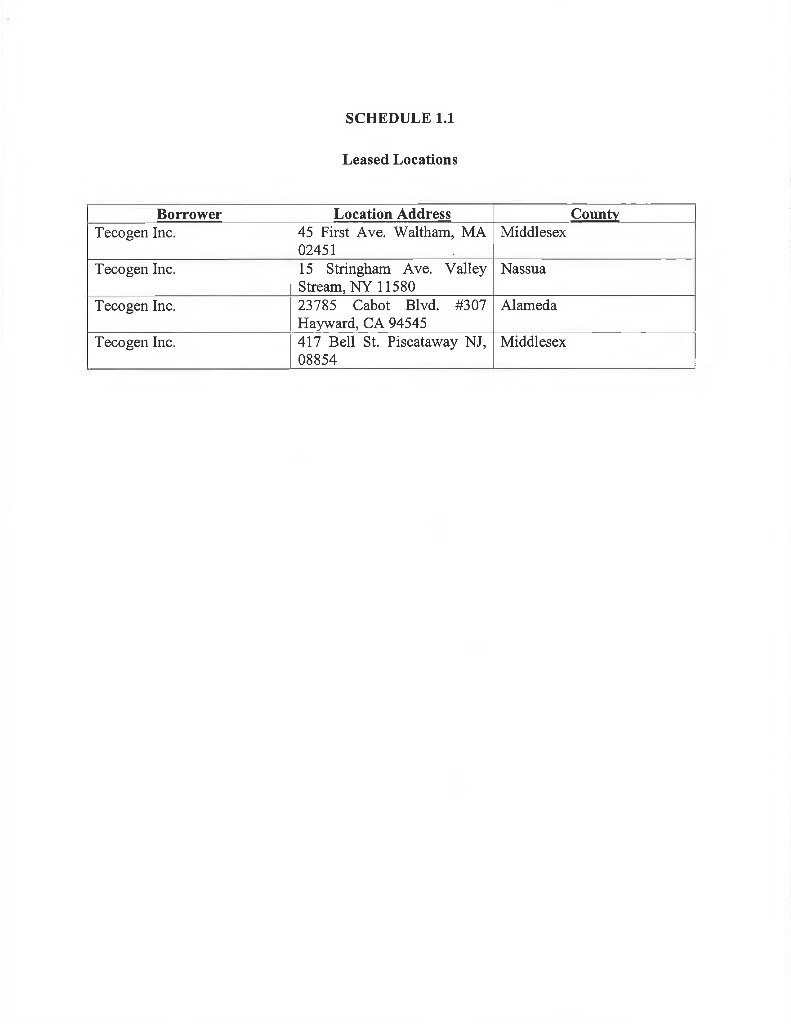

Interest Period) shall end on the last Business Day of a calendar month. Interest Periods shall be subject to the provisions of Sections 2,2 and 3.2. “/P Security Agreement Supplement'" shall mean a seeurity agreement, to be in registrable fonn and otherwise to be in form and substance satisfactory to Lender pursuant to whieh Lender may give notice of record of its Lien on trademarks, patents and copyrights owned by a Loan Party and registered with the United States govermnent. ''IRS” shall mean the Internal Revenue Service of the United States Treasury, and any successor thereto. "Issuer” shall mean any Person who issues a Letter of Credit and/or accepts a draft pursuant to the terms thereof which, in all cases, shall be the Bank, unless otherwise required by the Bank or approved by Lender and the Loan Parties. "Issuer Documents” shall mean with respect to any Letter of Credit, the Letter Credit Application, the Letter of Credit Agreement, and any other document, agreement and instrument entered into by the Issuer and any Loan Party or in favor of the Issuer and relating to any such Letter of Credit. "Leased Locations” shall mean the locations listed in Schedule 1.1 which are leased by the Loan Party and at which the Loan Party stores Inventory. "Leasehold Interests” shall mean all of each Loan Party’s right, title and interest in and to any Real Property owned by a Person other than Loan Party, whether as tenant, lessee, licensee, operator or otherwise. "Lender” shall have the meaning set forth in the preamble to this Agreement and shall include each Person which becomes a transferee, successor or assign of Lender. "Lender Party” shall mean Lender, the Bank, any Issuer (other than the Bank), any Purehasing Lender and any Participant, together with each other holder from time to time of any interest in any of the Obligations. "Letter of Credit Agreement” shall mean an agreement for the issuanee of letters of credit, dated on or after the date of this Agreement, between (or among) Loan Parties, Borrowing Representative and Lender and the Bank, concerning the issuance of Letters of Credit. "Letter of Credit Application” shall mean an application for the issuance or amendment of a Letter of Credit in the form from time to time in use by the Issuer. "Letter of Credit Fee' has the meaning set forth in Section 3.5. "Letter of Credit Obligations” shall mean the sum (without duplication) of (a) the undrawn amount of all Letters of Credit outstanding at any time plus (b) all amounts drawn under Letters of Credit but unreimbursed to Lender at such time. - 15 -

''Letter of Credit SublimiC shall mean the sum of Five Hundred Thousand and 00/100 Dollars ($500,000), or such higher (or lower) sum as Lender may pennit or impose from time to time. The Letter of Credit Sublimit is a sublimit of the Revolving Commitment. "Letters of Credit' shall have the meaning set forth in the Letter of Credit Agreement. "LLBOR Rate" shall mean a rate of interest per annum, as determined by Lender, equal to the rate for deposits in Dollars based upon the one (1) month London Interbank Offered Rate quoted by the ICE Benchmark Administration two (2) Business Days prior to the interest reset date for the offering by Lender to prime commercial banks in the London interbank market of Dollar deposits in an amount approximately equal to the principal amount of the applicable Loan. Any change in the interest rate resulting from a change in the LIBOR Rate shall become effective immediately upon the date on which such change in the LIBOR Rate shall be adopted by Lender, as adjusted for, without limitation, basic, supplemental, marginal and emergency reserves) under any regulation promulgated by the Board of Governors of the Federal Reserve System (or any other Governmental Body having jurisdiction over the Lender) as in effect from time to time, dealing with reserve requirements prescribed for Eurocurrency funding including any reserve requirements with respect to “Eurocurrency liabilities” under Regulation D of the Board of Governors of the Federal Reserve System. If the LIBOR Rate shall be discontinued or does not reflect the cost of funds of Lender or for any other reason shall not be available for detenuining the LIBOR Rate, then Lender shall select a substitute method of determining the LIBOR Rate and shall notify maker of such selection, which method shall, in Lender’s reasonable estimation, yield a rate of return to Lender substantially equivalent to the rate of return that Lender would have expected to receive if the LIBOR Rate still had been available for that purpose. In the event that the LIBOR Rate shall be less than zero, such rate shall be deemed to be zero for the purposes of this Agreement. 'LLBOR Rate Loan" shall mean an Advance at any time that bears interest based on the LIBOR Rate. "Lien" shall mean any mortgage, deed of trust, pledge, hypothecation, assignment, security interest, lien (whether statutory or otherwise). Charge, claim or encumbrance, or preference, priority or other security agreement or preferential arrangement held or asserted in respect of any asset of any kind or nature whatsoever including, without limitation, any conditional sale or other title retention agreement, any lease having substantially the same economic effect as any of the foregoing, and the filing of, or agreement to give, any financing statement under the Unifonu Commercial Code or comparable law of any jurisdiction. "Loan" shall mean a Domestie Rate Loan or a LIBOR Rate Loan. Loan Parties" shall mean the Borrowers and Guarantors. Lock-Box Account" shall have the meaning set forth in Section 4.1. Lock-Box Agreement" shall have the meaning set forth in Section 4.1. Lock-Box Bank" shall have the meaning set forth in Section 4.1. - 16-

'"Material Adverse Effect shall mean a material adverse effect on (a) the financial condition, operations, assets, or business of the applicable Person or Persons, (b) Loan Parties’ ability to pay the Obligations in accordance with the tenns thereof, (c) the value of the Collateral, or Lender’s Liens on the Collateral or the priority of any such Lien or (d) the practical realization of the benefits of Lender’s rights and remedies under this Agreement and the other Credit Documents. "Material Agreements'" shall mean and include, in the case of each Loan Party, any of the following having monetary obligations equal to or greater than the Materiality Threshold: (a) any lease of Real Property, (b) any lease of personal property, (c) any license agreement for the use of any intellectual property necessary for, or material to, to the operation of its business, (d) any agreement evidencing, pertaining to or securing the payment of, any Indebtedness, (e) any labor or union contract, (f) any employment contracts with executive officers of Loan Parties, (g) any long-term purchase or supply contracts, any vendor agreements, any distributorship agreements filed by Borrower with the Securities and Exchange Commission as material agreements in accordance with applicable laws and regulations, and (h) any other contract or agreement the tennination of which (without its contemporaneous replacement) would reasonably be expected to have a Material Adverse Effect. Materiality Threshold" shall mean Two Hundred Fifty Thousand Dollars ($250,000). Maximum Revolving Advance Amount" shall have the meaning set forth in Section 2.1(a). Net Proceeds" shall mean: (a) in respect of the issuance of Equity Interests, cash proceeds (including cash proceeds as and when received in respect of non-cash proceeds received or receivable in connection with such issuance), net of underwriting discounts and reasonable out-of-pocket costs and expenses paid or incurred in connection therewith in favor of any Person not an Affiliate of any Loan Party; (b) in respect of the incurrence of any Indebtedness, cash proceeds (including cash proceeds as and when received in respect of non-cash proceeds received or receivable in connection with such issuance), net of underwriting discounts, commissions, fees, and reasonable out-of-pocket costs and expenses paid or incurred in connection therewith in favor of any Person not an Affiliate of any Loan Party; (c) in respect of the sale or other disposition of any Collateral, the cash proceeds of the sale or disposition of assets (including by way of merger), net of (i) any Permitted Purchase Money Debt secured by assets being sold in such transaction required to be paid from such proceeds, (ii) income taxes that, as estimated by Loan Parties in good faith, will be required to be paid by Loan Parties (or its stockholders or members) or any of their respective Subsidiaries in cash as a result of such sale or disposition, and within one hundred eighty (180) days (provided that any such amounts that are not actually paid in taxes within such period shall automatically become Net Proceeds), (iii) reasonable reserves for liabilities, indemnification, escrows and purchase price adjustments resulting from the sale of assets, (iv) transfer, sales, use - 17-

and other similar taxes payable in connection with such sale or disposition, and (v) all reasonable commissions, fees and other expenses of Loan Parties or any of their respective Subsidiaries payable in connection with such sale or disposition; (d) in respect of an insured loss in respect of any Collateral, any and all proceeds of casualty insurance or condemnation received by Loan Parties or any their respective Subsidiaries in connection with a casualty or condemnation event, net of fees and expenses incurred in the collection thereof; and (e) in respect of Extraordinary Receipts, net of fees and expenses incurred in the collection thereof ''Note'' shall mean the Revolving Note and any other promissory note at any time evidencing any other portion of the Obligations. "Obligations" shall mean and include any and all of each Loan Party’s Indebtedness and/or liabilities to Lender and each other Lender Party, of every kind, nature and description, direct or indirect, secured or unsecured, joint, several, joint and several, absolute or contingent, due or to become due, now existing or hereafter arising, contractual or tortious, liquidated or unliquidated, regardless of how such Indebtedness or liabilities arise or by what agreement or instrument they may be evidenced or whether evidenced by any agreement or instrument, including interest accruing after any bankruptcy or insolvency proceeding whether or not allowed or allowable on any such proceeding and including, without limitation, any and all of any Loan Party’s Indebtedness and/or liabilities to Lender and each other Lender Party, under this Agreement, the other Credit Documents, any Bank Product or under any other agreement between Lender and each other Lender Party and any Loan Party, and all obligations of any Loan Party to Lender and each other Lender Party to perform acts or refrain from taking any action. The term "Obligations" further includes, without limitation, all Letter of Credit Obligations. "OFAC' shall mean the U.S. Department of the Treasury Office of Foreign Assets Control, and its successors. "Ordinary Course of Business" shall mean the ordinary course of business of Loan Parties conducted as of the Closing Date. "Organic Documents" shall mean: (a) for a corporation, its articles (or certificate) of incorporation and bylaws; (b) for a partnership, its articles of organization (if any) and partnership agreement; and (c) for a limited liability company, its articles (or certificate) of organization and any operating agreement; together with, for each such entity and any other entity not described above, such other, similar documents as are integral to its fonuation or the conduct of its business operations. "Overadvance" shall have the meaning set forth in Section 2.8tal. "Participant" shall mean each Person who shall be granted the right by Lender to participate in any of the Advances and who shall have entered into a participation agreement in fonu and substance satisfactory to Lender. - 18-

'Payment Office'" shall mean, initially, the office of Lender located at 360 Lexington Avenue, Fifth Floor, New York, New York 10017; thereafter, such other office of Lender, if any, which it may designate by notice to Borrowing Representative to be the Payment Office. ""Perfection Certificate" shall mean, collectively, the Perfection Certificate for each Loan Party and the responses thereto provided by such Loan Party and delivered to Lender on the Closing Date. ""Permitted Capitalized Lease Obligations" shall mean any Indebtedness represented by Capitalized Lease Obligations, and the amount of such Indebtedness shall be the capitalized amount of such obligations determined in accordance with GAAP and not to exceed the amount set forth in Section 7.8(b). ""Permitted Discretion" shall mean a determination made by Lender in good faith and in the exercise of its credit judgment from the standpoint of a secured, asset-based lender making loans of similar type and size, based on the facts and circumstances then presented to it without regard to any prior course of dealing. ""Permitted Encumbrances" shall mean: (a) Liens in favor of Lender for the benefit of itself and each other Lender Party which, in each case, secure Obligations; (b) Liens for taxes, assessments or other governmental charges not delinquent or being contested in good faith and by appropriate proceedings and with respect to which proper reserves have been taken by Loan Party; provided, however, that (i) the Lien has no effect on the priority of the Liens in favor of Lender and a stay of enforcement of any such Lien shall be in effect, (ii) the amount of such charges, individually or in the aggregate, does not exceed the Materiality Threshold, or (iii) the full amount of such charges (and any penalties thereon) have been reserved against the Borrowing Base; (c) deposits or pledges to secure obligations under worker’s compensation, social security or similar laws, or under unemployment insurance; (d) judgment Liens which do not otherwise constitute an Event of Default under Section 11.6. that have been (and remain) stayed or bonded and are being contested in good faith by the applicable Loan Party, and provided that adequate reserves have been posted therefor; (e) deposits or pledges to secure bids, tenders, contracts (other than contracts for the payment of money), leases, statutory obligations, surety and appeal bonds and other obligations of like nature arising in the ordinary course of any Loan Party’s business; (f) mechanic’s, worker’s, materialmen’s or other like Liens arising in the ordinary course of any Loan Party’s business with respect to obligations which are not due or which are being contested in good faith by the applicable Loan Party and adequate reserves have been posted therefor; - 19-

(g) Purchase Money Liens provided that (i) any such Purchase Money Lien shall not encumber any other property of Loan Parties, except the Real Property or Equipment acquired with the proceeds of Pennitted Purchase Money Debt; and (ii) such Liens shall be released as and when the Permitted Purchase Money Debt corresponding thereto is fully paid and satisfied; (h) Liens in the nature of ownership interests of lessors of real and personal property; (i) Liens in favor of a lessor under a Capital Lease, provided that any such Lien shall not encumber any property of Loan Parties, except the Real Property or the Equipment subject to such Capital Lease; and (ii) such Liens shall be released as and when the Capital Lease Obligations corresponding thereto are fully paid and satisfied; and G) other Liens incidental to the conduct of Loan Parties’ business or the ownership of their respective property and assets which were not incurred in connection with the borrowing of money or the obtaining of advances or credit, and which do not in the aggregate materially detract from Lender’s rights in and to the Collateral or the value of Loan Parties’ property or assets or which do not materially impair the use thereof in the operation of Loan Parties’ business. For avoidance of any doubt, any Liens constituting Permitted Encumbrances shall be considered to be Permitted Encumbrances only so long as such Liens were validly granted or obtained, have attached and remain duly perfected under the applicable law in which they arose, and no holder of any such Lien shall have any right vis-a-vis any Lender Party to claim the status of such Lien as a Permitted Encumbrance in any event notwithstanding its inclusion therein. "'Permitted Purchase Money Debf shall mean Indebtedness incurred to fund the purchase of Equipment or Real Property by a Loan Party or any Subsidiary for use in its business operations (not to exceed, in aggregate amount as to all Loan Parties and their Subsidiaries, the amount set forth in Section 7.8(b)), and the Indebtedness incurred does not exceed one hundred percent (100%) of the purchase price of such Equipment or Real Property and not to exceed the amount set forth in Section 7.8(b). "Permitted Subordinated Debf shall mean indebtedness of the Loan Party that is unsecured, bears interest and has terms and conditions acceptable to the Lender and is subordinated to all Obligations of the Loan Parties pursuant to a Subordination Agreement. "Person” shall mean any individual, sole proprietorship, partnership, corporation, business trust, joint stock company, trust, unincorporated organization, association, limited liability company, institution, public benefit corporation, joint venture, entity or government (whether Federal, state, county, city, municipal or otherwise, including any instrumentality, division, agency, body or department thereof). "Pledged Account” shall have the meaning set forth in Section 4.3. "Pledged Account Agreement” shall have the meaning set forth in Section 4.3. "Prime Rate” shall mean the base commercial lending rate of the Bank as publicly announced to be in effect from time to time, such rate to be adjusted automatically, without -20-

notice, on the effective date of any change in such rate. This rate of interest is detennined from time to time by the Bank as a means of pricing some loans to its customers and is neither tied to any external rate of interest or index nor does it necessarily reflect the lowest rate of interest actually charged by the Bank to any particular class, or category of customers of the Bank. ""Projections'" shall have the meaning set forth in Section 9.9. ""Purchase Money Liens" shall mean Liens granted by a Loan Party or any Subsidiary on Equipment or Real Property acquired with the proceeds of Permitted Purchase Money Debt. ""Purchasing Lender" shall have the meaning set forth in Section Ih.dtcV "Raw Materials" shall mean goods held by a Loan Party for use in the production of Finished Goods or to serviee, repair or maintain Finished Goods sold by a Loan Party in the Ordinary Course of its Business. ""RCRA" shall mean the Resource Conservation and Recovery Act, 42 U.S.C. §§ 6901, ^ seq.' as same may be amended from time to time. ""Real Property" shall mean all of each Loan Party’s right, title and interest in and to its owned and leased premises, existing on or after the Closing Date, including, particularly, the real property identified on Schedule 5.24 ""Receivables" shall mean and include, as to each Loan Party, all of such Loan Party’s accounts, contract rights, instruments (including those evidencing indebtedness owed to Loan Parties by their respective Affiliates), doeuments, chattel paper (including electronic chattel paper), general intangibles relating to accounts, drafts and acceptances (including payment intangibles), and all other forms of obligations owing to such Loan Party arising out of or in connection with the sale or lease of Inventory or the rendition of services, all guarantees and other security therefor, whether seeured or unsecured, now existing or hereafter created, and whether or not specifically sold or assigned to Lender hereunder. ""Release" shall have the meaning set forth in Section 5.6(c)(i). ""Requirements of Law" shall mean all federal, state, provincial and local laws, rules, regulations, orders, decrees or other determinations of an arbitrator, court or other Governmental Body, including all disclosure and other requirements of ERISA, the requirements of Environmental Laws and environmental pennits, the requirements of the Federal Occupational Safety and Health Act, the requirements of the United States Department of Labor, and margin requirements, in each case applicable to or binding upon such Person or any of its property or to which such Person or any of its property is subject. "Revolving Advances" shall mean Advances made under the Revolving Commitment. "Revolving Commitment" shall mean the sum of Ten Million Dollars ($10,000,000). -21 -