Energy Efficiency Reimagined NASDAQ: TGEN Second Quarter 2019 Earnings Review August 13, 2019

Participants Benjamin Locke Chief Executive Officer President & Chief Operating Robert Panora Officer Bonnie Brown Chief Accounting Officer 2

Safe Harbor Statement This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 3

Earnings Call Agenda Benjamin Locke Tecogen Overview Q2 ‘19 Financial Overview Strategic Achievements Bonnie Brown Financial Review Robert Panora Ultera Emissions Update Benjamin Locke Closing comments Q&A 4

Advanced Modular Cogeneration Systems Heat, Power, and/or Cooling that is: Cheaper Industry leading efficiency and reduced exposure to expensive electricity Cleaner Proprietary near-zero emissions technology, GHG reductions More reliable Real-time monitoring, blackout protection, and improved grid resiliency All of Tecogen’s equipment is powered by efficient natural gas equipped with Tecogen’s patented Ultera Emission Control 5

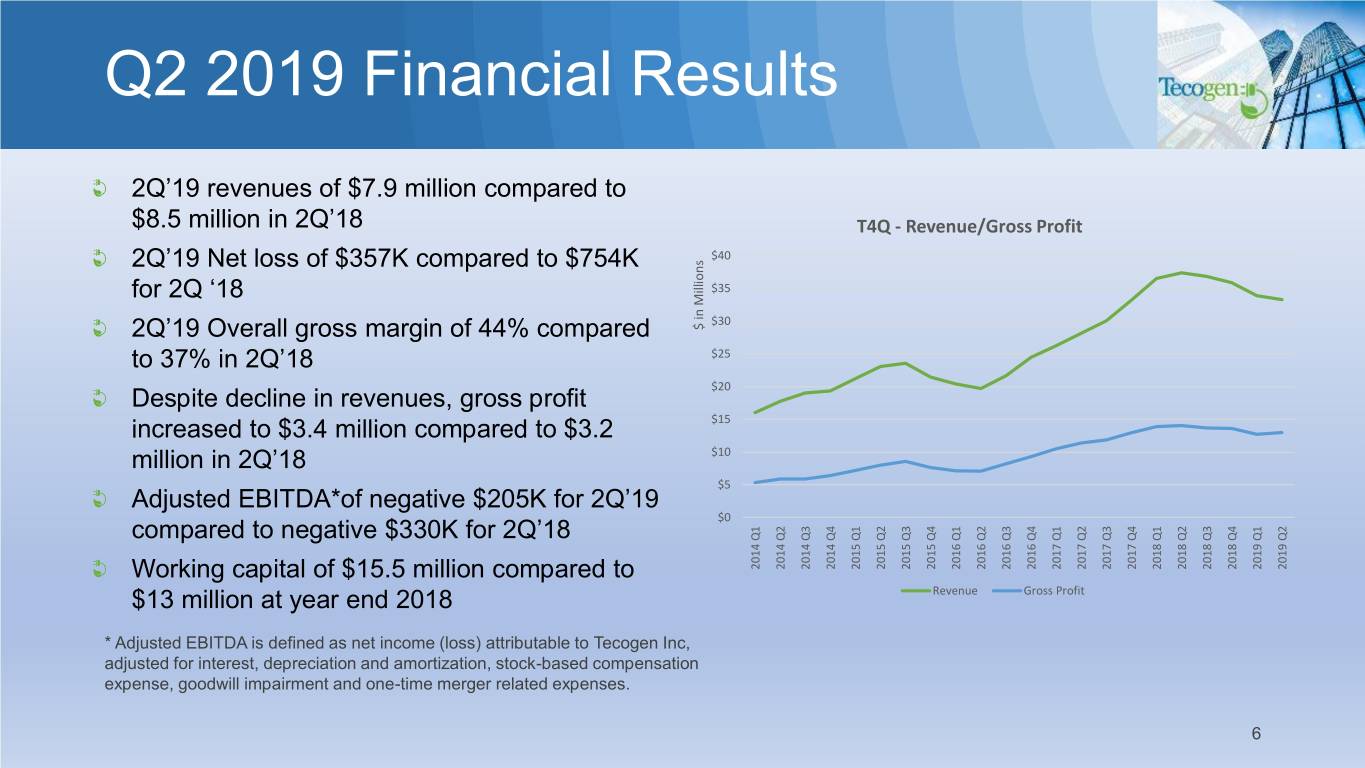

Q2 2019 Financial Results 2Q’19 revenues of $7.9 million compared to $8.5 million in 2Q’18 T4Q - Revenue/Gross Profit 2Q’19 Net loss of $357K compared to $754K $40 for 2Q ‘18 $35 $30 2Q’19 Overall gross margin of 44% compared in $ Millions to 37% in 2Q’18 $25 Despite decline in revenues, gross profit $20 increased to $3.4 million compared to $3.2 $15 million in 2Q’18 $10 $5 Adjusted EBITDA*of negative $205K for 2Q’19 compared to negative $330K for 2Q’18 $0 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Working capital of $15.5 million compared to Q1 2014 $13 million at year end 2018 Revenue Gross Profit * Adjusted EBITDA is defined as net income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, goodwill impairment and one-time merger related expenses. 6

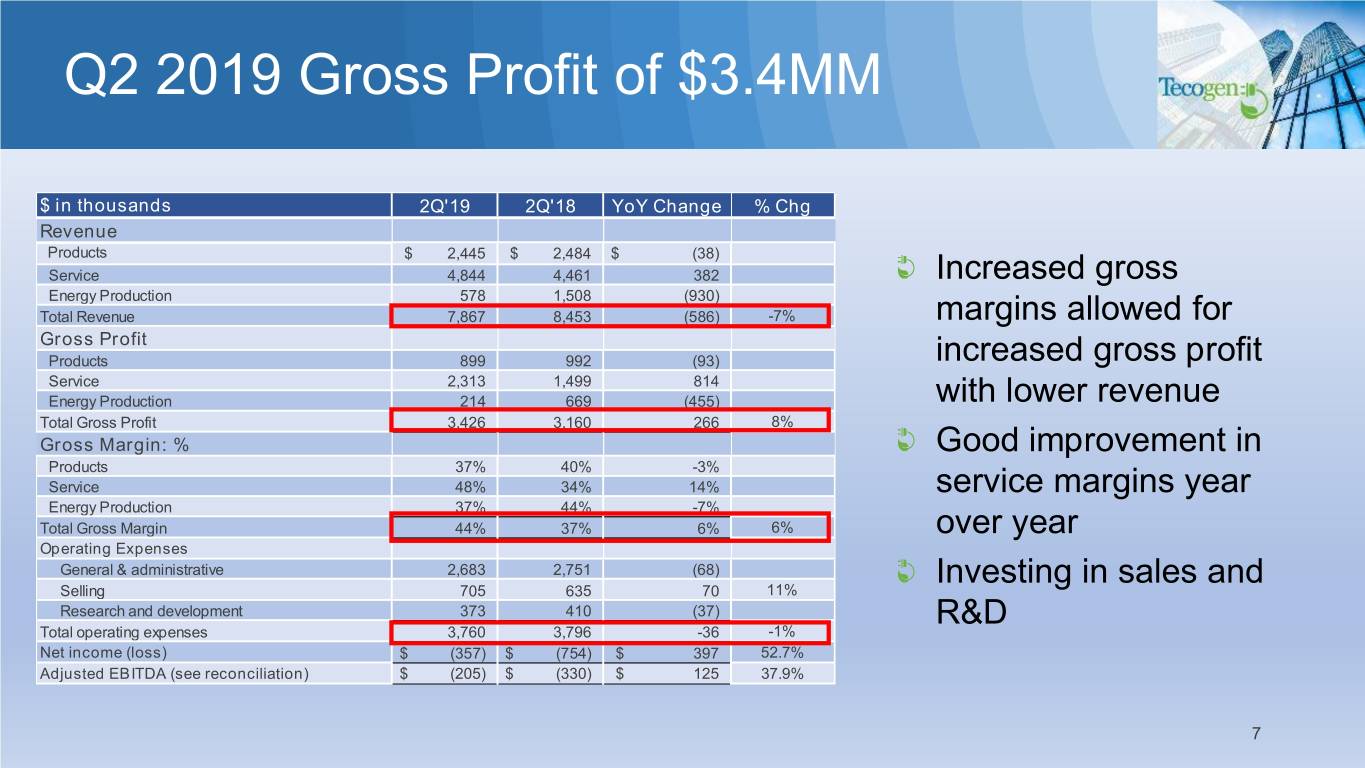

Q2 2019 Gross Profit of $3.4MM $ in thousands 2Q'19 2Q'18 YoY Change % Chg Revenue Products $ 2,445 $ 2,484 $ (38) Service 4,844 4,461 382 Increased gross Energy Production 578 1,508 (930) Total Revenue 7,867 8,453 (586) -7% margins allowed for Gross Profit Products 899 992 (93) increased gross profit Service 2,313 1,499 814 Energy Production 214 669 (455) with lower revenue Total Gross Profit 3,426 3,160 266 8% Gross Margin: % Good improvement in Products 37% 40% -3% Service 48% 34% 14% service margins year Energy Production 37% 44% -7% Total Gross Margin 44% 37% 6% 6% over year Operating Expenses General & administrative 2,683 2,751 (68) Investing in sales and Selling 705 635 70 11% Research and development 373 410 (37) R&D Total operating expenses 3,760 3,796 -36 -1% Net income (loss) $ (357) $ (754) $ 397 52.7% Adjusted EBITDA (see reconciliation) $ (205) $ (330) $ 125 37.9% 7

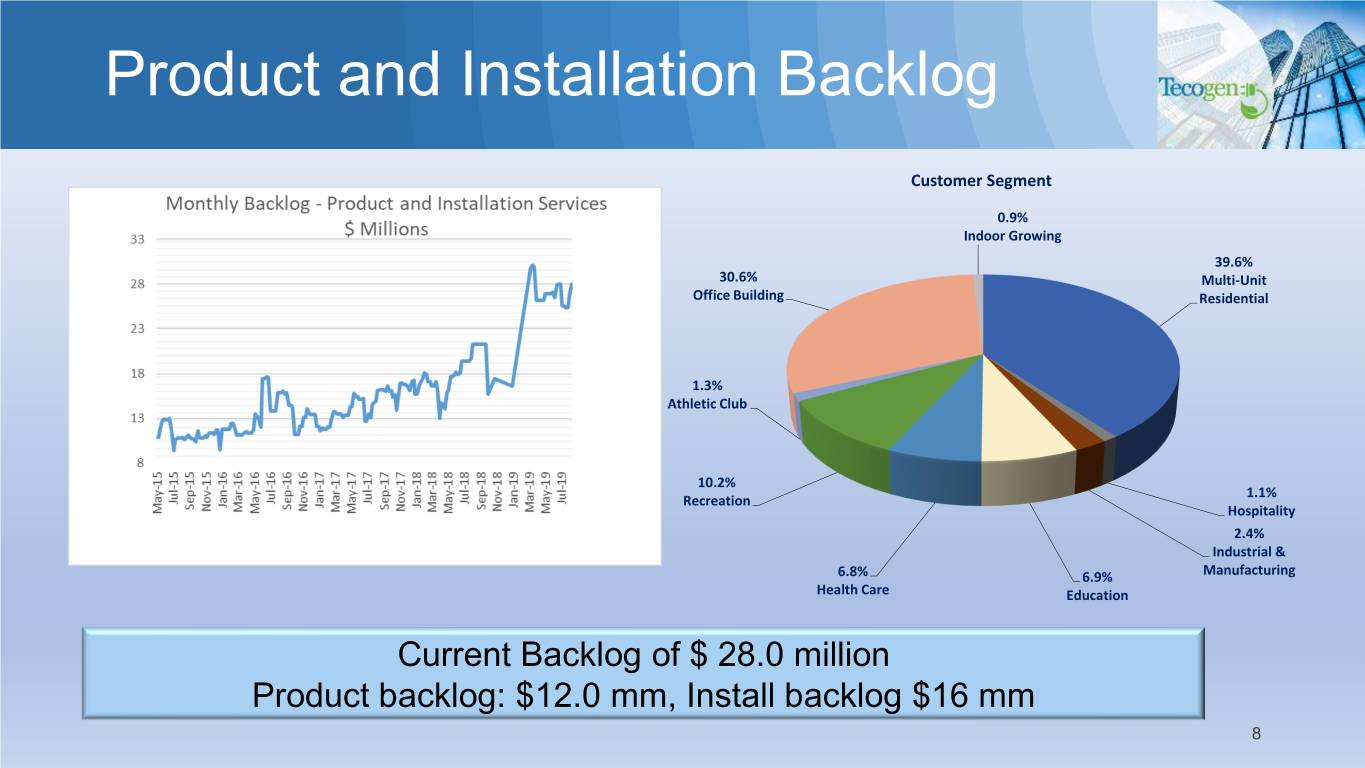

Product and Installation Backlog Customer Segment 0.9% Indoor Growing 39.6% 30.6% Multi-Unit Office Building Residential 1.3% Athletic Club 10.2% 1.1% Recreation Hospitality 2.4% Industrial & 6.8% 6.9% Manufacturing Health Care Education Current Backlog of $ 28.0 million Product backlog: $12.0 mm, Install backlog $16 mm 8

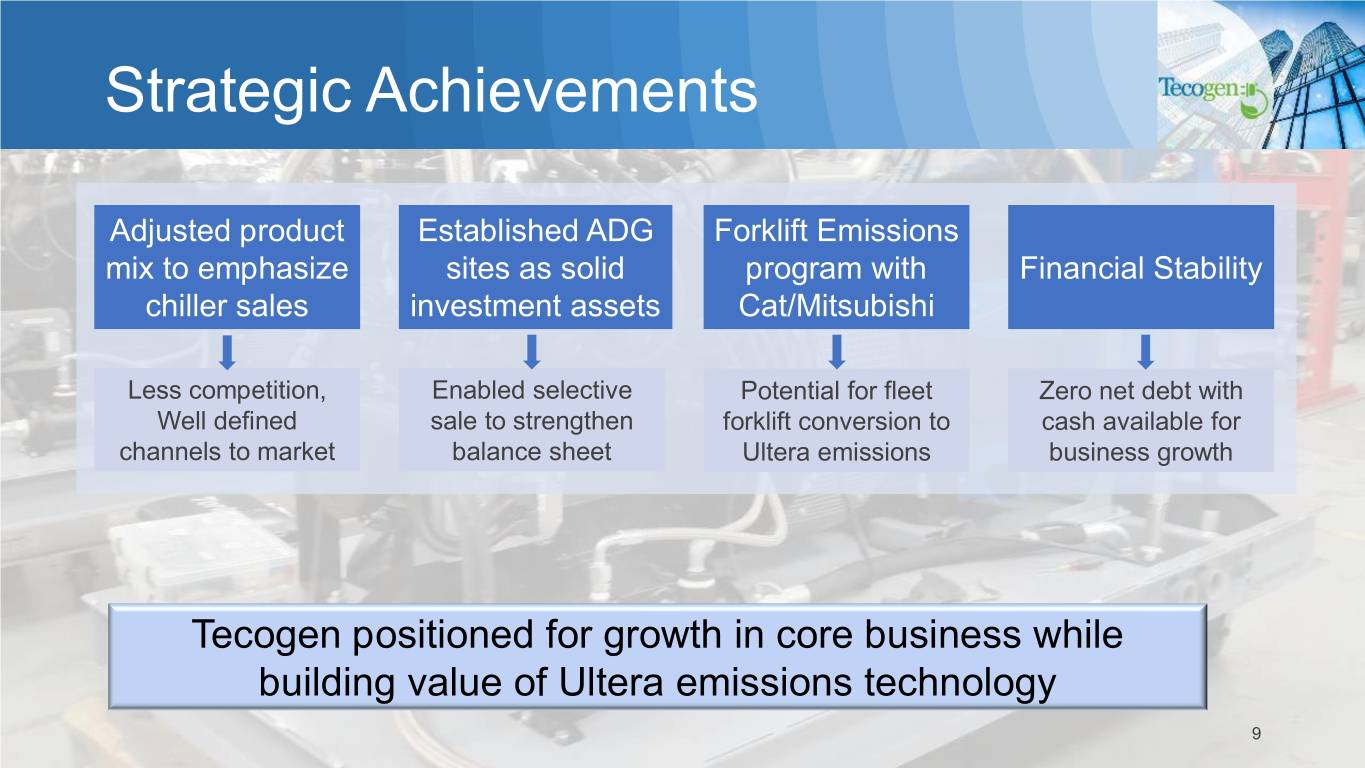

Strategic Achievements Adjusted product Established ADG Forklift Emissions mix to emphasize sites as solid program with Financial Stability chiller sales investment assets Cat/Mitsubishi Less competition, Enabled selective Potential for fleet Zero net debt with Well defined sale to strengthen forklift conversion to cash available for channels to market balance sheet Ultera emissions business growth Tecogen positioned for growth in core business while building value of Ultera emissions technology 9

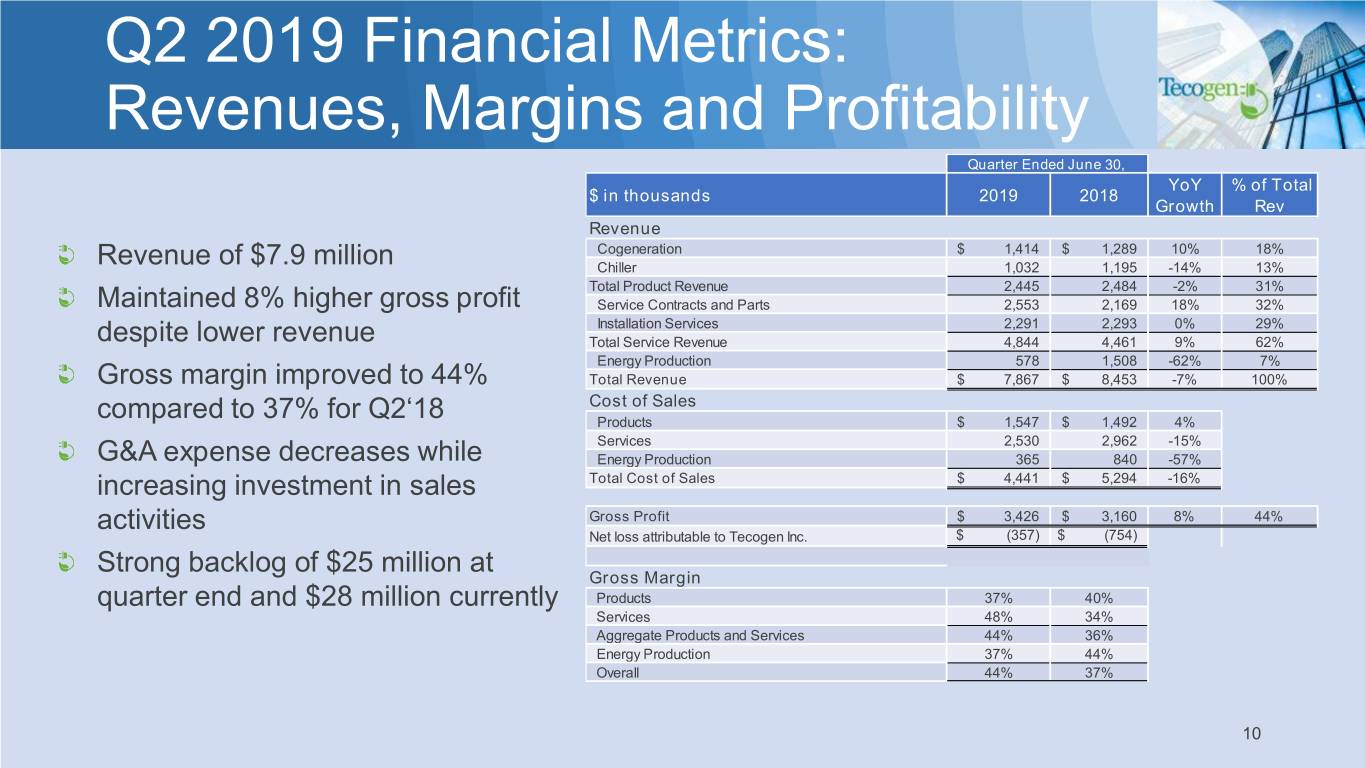

Q2 2019 Financial Metrics: Revenues, Margins and Profitability Quarter Ended June 30, YoY % of Total $ in thousands 2019 2018 Growth Rev Revenue Cogeneration $ 1,414 $ 1,289 10% 18% Revenue of $7.9 million Chiller 1,032 1,195 -14% 13% Total Product Revenue 2,445 2,484 -2% 31% Maintained 8% higher gross profit Service Contracts and Parts 2,553 2,169 18% 32% Installation Services 2,291 2,293 0% 29% despite lower revenue Total Service Revenue 4,844 4,461 9% 62% Energy Production 578 1,508 -62% 7% Gross margin improved to 44% Total Revenue $ 7,867 $ 8,453 -7% 100% Cost of Sales compared to 37% for Q2‘18 Products $ 1,547 $ 1,492 4% Services 2,530 2,962 -15% G&A expense decreases while Energy Production 365 840 -57% increasing investment in sales Total Cost of Sales $ 4,441 $ 5,294 -16% activities Gross Profit $ 3,426 $ 3,160 8% 44% Net loss attributable to Tecogen Inc. $ (357) $ (754) Strong backlog of $25 million at Gross Margin quarter end and $28 million currently Products 37% 40% Services 48% 34% Aggregate Products and Services 44% 36% Energy Production 37% 44% Overall 44% 37% 10

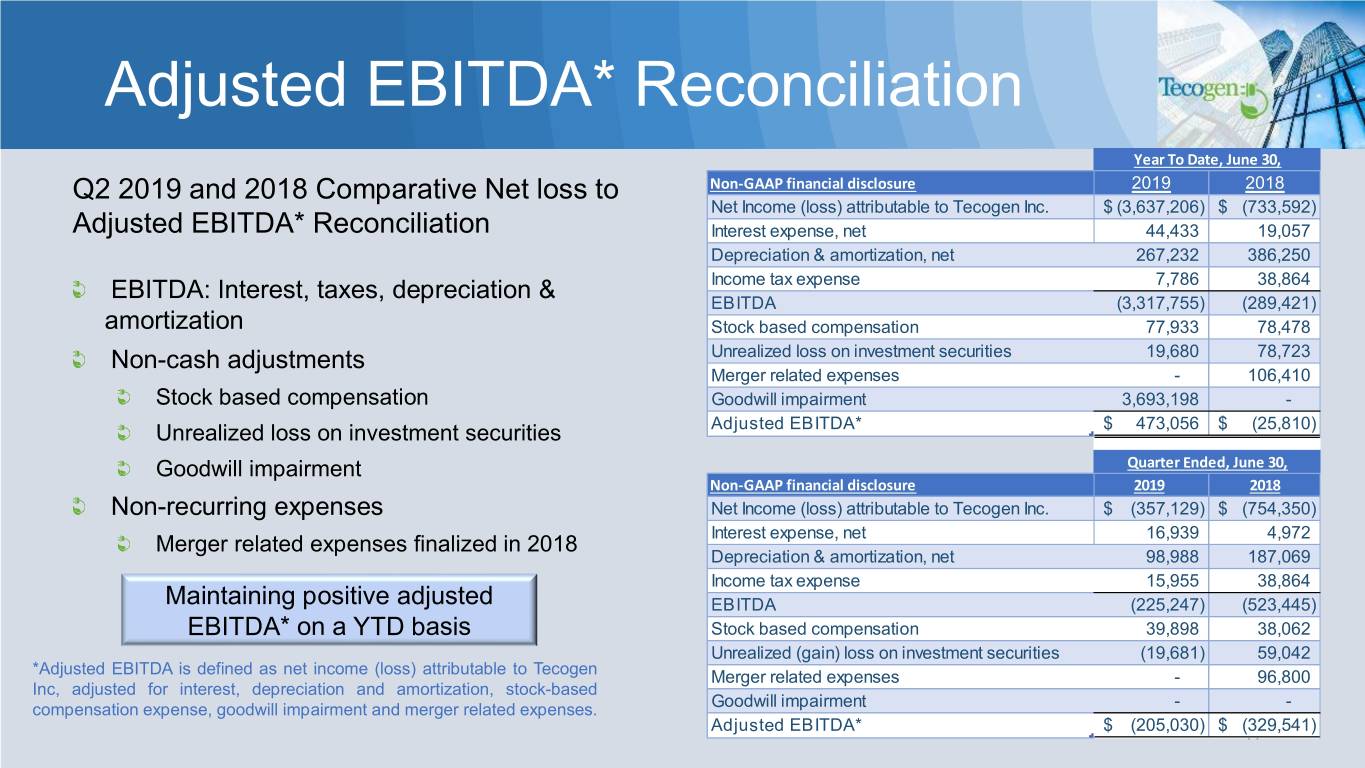

Adjusted EBITDA* Reconciliation Year To Date, June 30, Q2 2019 and 2018 Comparative Net loss to Non-GAAP financial disclosure 2019 2018 Net Income (loss) attributable to Tecogen Inc. $ (3,637,206) $ (733,592) Adjusted EBITDA* Reconciliation Interest expense, net 44,433 19,057 Depreciation & amortization, net 267,232 386,250 EBITDA: Interest, taxes, depreciation & Income tax expense 7,786 38,864 EBITDA (3,317,755) (289,421) amortization Stock based compensation 77,933 78,478 Non-cash adjustments Unrealized loss on investment securities 19,680 78,723 Merger related expenses - 106,410 Stock based compensation Goodwill impairment 3,693,198 - Unrealized loss on investment securities Adjusted EBITDA* $ 473,056 $ (25,810) Goodwill impairment Quarter Ended, June 30, Non-GAAP financial disclosure 2019 2018 Non-recurring expenses Net Income (loss) attributable to Tecogen Inc. $ (357,129) $ (754,350) Interest expense, net 16,939 4,972 Merger related expenses finalized in 2018 Depreciation & amortization, net 98,988 187,069 Income tax expense 15,955 38,864 Maintaining positive adjusted EBITDA (225,247) (523,445) EBITDA* on a YTD basis Stock based compensation 39,898 38,062 Unrealized (gain) loss on investment securities (19,681) 59,042 *Adjusted EBITDA is defined as net income (loss) attributable to Tecogen Merger related expenses - 96,800 Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, goodwill impairment and merger related expenses. Goodwill impairment - - Adjusted EBITDA* $ (205,030) $ (329,541)11

Emissions Technology Update – MCFA Forklift Review from Last Call: Test results through two engine tuning iterations NOx emissions reduced to 20% of factory system, CO emissions 12% of factory system Levels consistent with program goal of near-zero certification Further improvement possible with refinement of engine tuning Our recommendation in May to MCFA Complete refinements interactively during engine “Near Zero” certification Current Plan (recommendation of MCFA’s corporate parent) Dispatch engineers from engine supplier (Mitsubishi affiliate) to Tecogen Work interactively to refine tuning on prototype Visit scheduled for last week of September Collaboration expected to be highly beneficial to the project 12

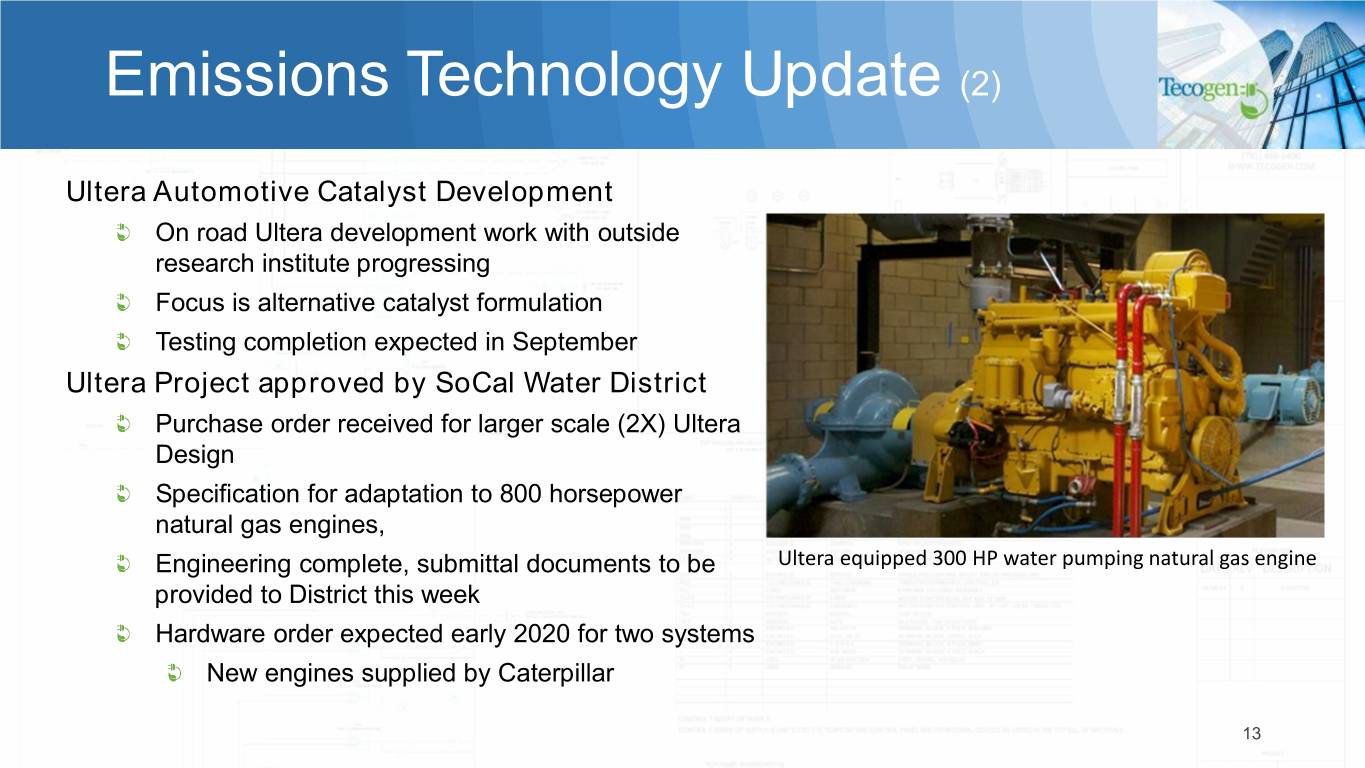

Emissions Technology Update (2) Ultera Automotive Catalyst Development On road Ultera development work with outside research institute progressing Focus is alternative catalyst formulation Testing completion expected in September Ultera Project approved by SoCal Water District Purchase order received for larger scale (2X) Ultera Design Specification for adaptation to 800 horsepower natural gas engines, Engineering complete, submittal documents to be Ultera equipped 300 HP water pumping natural gas engine provided to District this week Hardware order expected early 2020 for two systems New engines supplied by Caterpillar 13

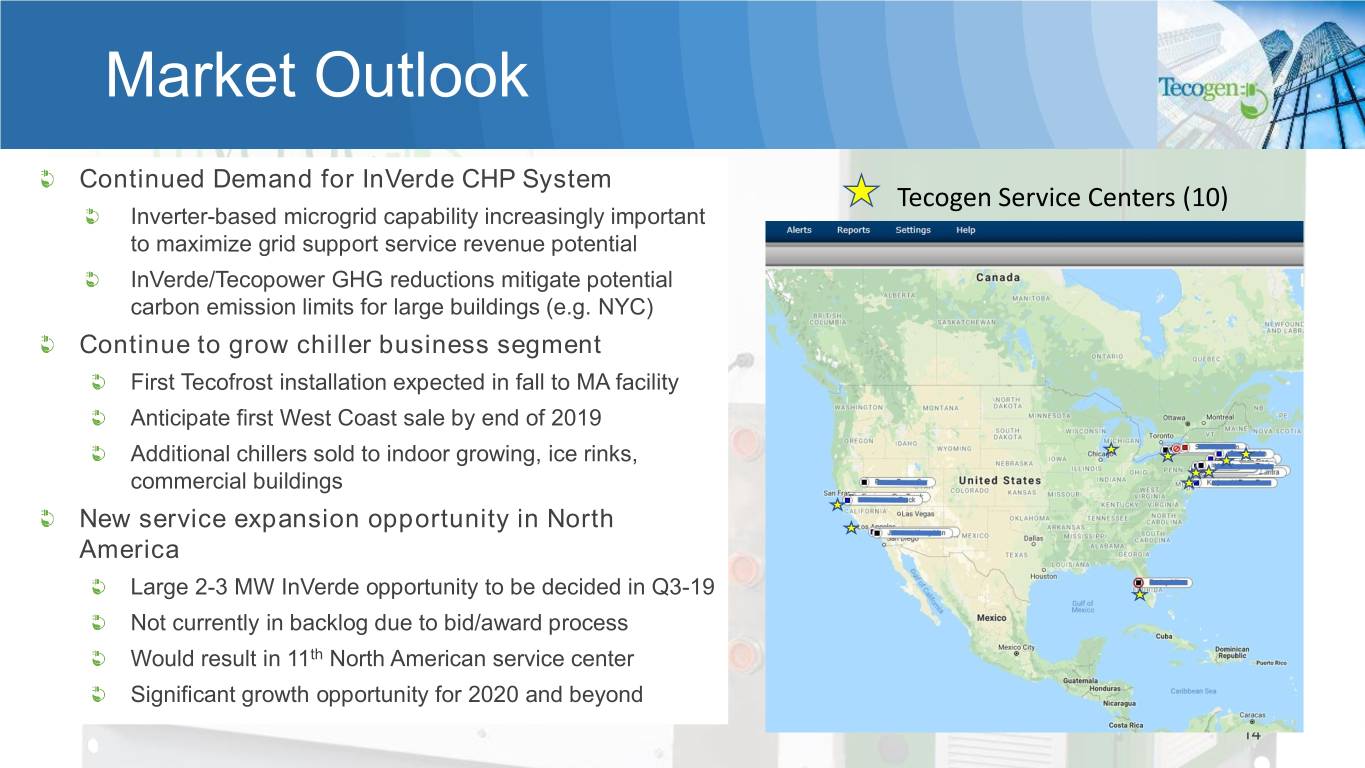

Market Outlook Continued Demand for InVerde CHP System Tecogen Service Centers (10) Inverter-based microgrid capability increasingly important to maximize grid support service revenue potential InVerde/Tecopower GHG reductions mitigate potential carbon emission limits for large buildings (e.g. NYC) Continue to grow chiller business segment First Tecofrost installation expected in fall to MA facility Anticipate first West Coast sale by end of 2019 Additional chillers sold to indoor growing, ice rinks, commercial buildings New service expansion opportunity in North America Large 2-3 MW InVerde opportunity to be decided in Q3-19 Not currently in backlog due to bid/award process Would result in 11th North American service center Significant growth opportunity for 2020 and beyond 14

Closing Comments Tecogen Key Value Proposition Remains: Use pipeline gas efficiently and cleanly to meet energy and resiliency needs of large facilities Differentiate Tecogen products and factory service capabilities in key growth markets and geographies Maximize margin and profitability of core business while maintaining key R&D and IP projects Demonstrate Ultera emissions technology as a commercially viable cost-effective means for obtaining near-zero emissions from any gas engine system. 15

Q&A Company Information Tecogen Inc. 45 First Ave Waltham, MA 02451 www.Tecogen.com Contact information Benjamin Locke, CEO 781.466.6402 Benjamin.Locke@Tecogen.com 16