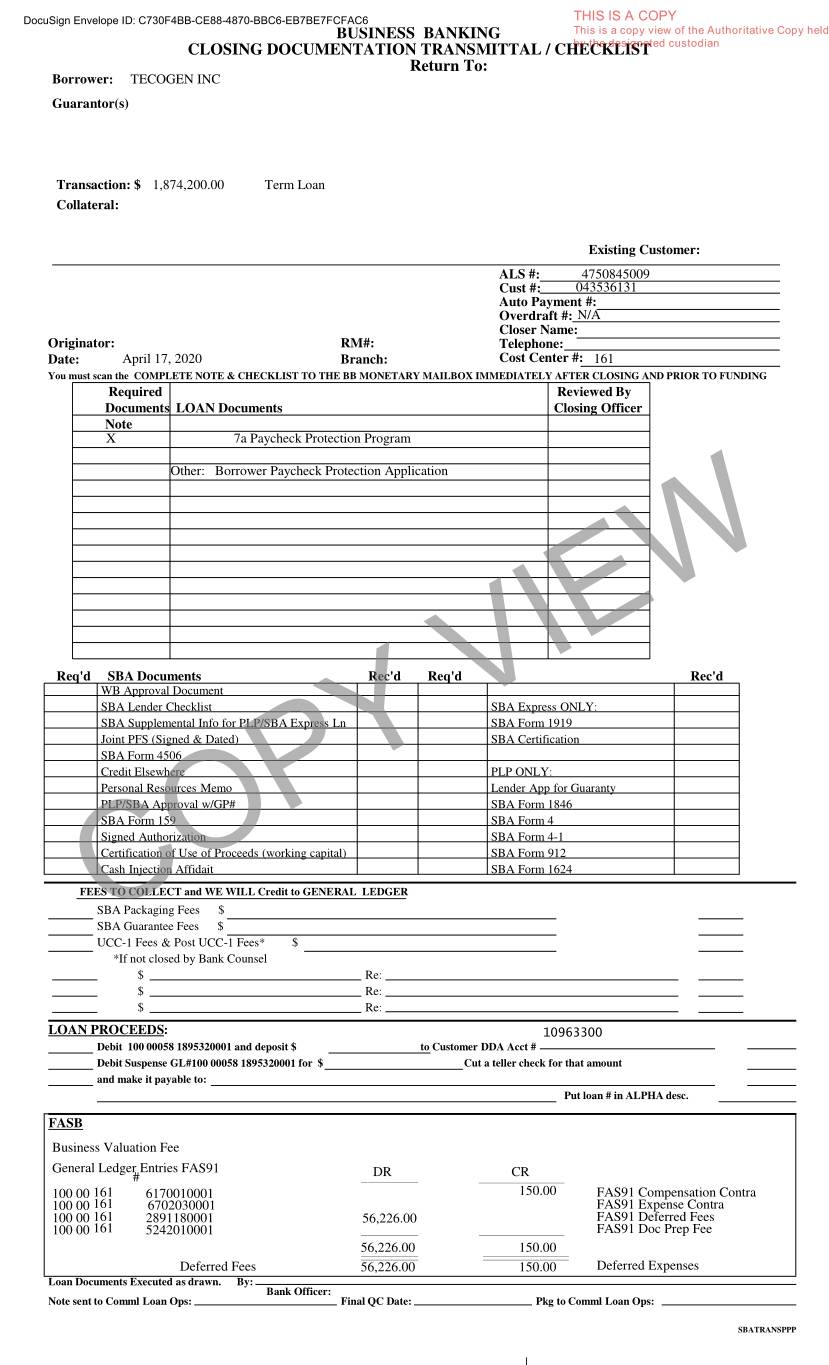

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY BUSINESS BANKING This is a copy view of the Authoritative Copy held CLOSING DOCUMENTATION TRANSMITTAL / CHECKLISTby the designated custodian Return To: Borrower: TECOGEN INC Guarantor(s) Transaction: $ 1,874,200.00 Term Loan Collateral: Existing Customer: ALS #: 4750845009 Cust #: 043536131 Auto Payment #: Overdraft #: N/A Closer Name: Originator: RM#: Telephone: Date: April 17, 2020 Branch: Cost Center #: 161 You must scan the COMPLETE NOTE & CHECKLIST TO THE BB MONETARY MAILBOX IMMEDIATELY AFTER CLOSING AND PRIOR TO FUNDING Required Reviewed By Documents LOAN Documents Closing Officer Note X 7a Paycheck Protection Program Other: Borrower Paycheck Protection Application Req'd SBA Documents Rec'd Req'd Rec'd WB Approval Document SBA Lender Checklist SBA Express ONLY: SBASupplementalInfoforPLP/SBAExpressLn SBAForm1919 Joint PFS (Signed & Dated) SBA Certification SBA Form 4506 Credit Elsewhere PLP ONLY: Personal Resources Memo Lender App for Guaranty PLP/SBA Approval w/GP# SBA Form 1846 SBA Form 159 SBA Form 4 Signed Authorization SBA Form 4-1 CertificationofUseofProceeds(workingcapital) SBAForm 912 Cash Injection Affidait SBA Form 1624 FEES TO COLLECT and WE WILL Credit to GENERAL LEDGER SBA Packaging Fees $ SBACOPY Guarantee Fees $ VIEW UCC-1 Fees & Post UCC-1 Fees* $ *If not closed by Bank Counsel $ Re: $ Re: $ Re: LOAN PROCEEDS : 10963300 Debit 100000581895320001anddeposit$ toCustomerDDAAcct # DebitSuspenseGL#100000581895320001for$ Cutatellercheck for that amount and make it payable to: Put loan # in ALPHA desc. FASB Business Valuation Fee General Ledger Entries FAS91 # DR CR 100 00 161 6170010001 150.00 FAS91 Compensation Contra 100 00 161 6702030001 FAS91 Expense Contra 100 00 161 2891180001 56,226.00 FAS91 Deferred Fees 100 00 161 5242010001 FAS91 Doc Prep Fee 56,226.00 150.00 Deferred Fees 56,226.00 150.00 Deferred Expenses Loan Documents Executed as drawn. By: Bank Officer: Note sent to Comml Loan Ops: Final QC Date: Pkg to Comml Loan Ops: SBATRANSPPP

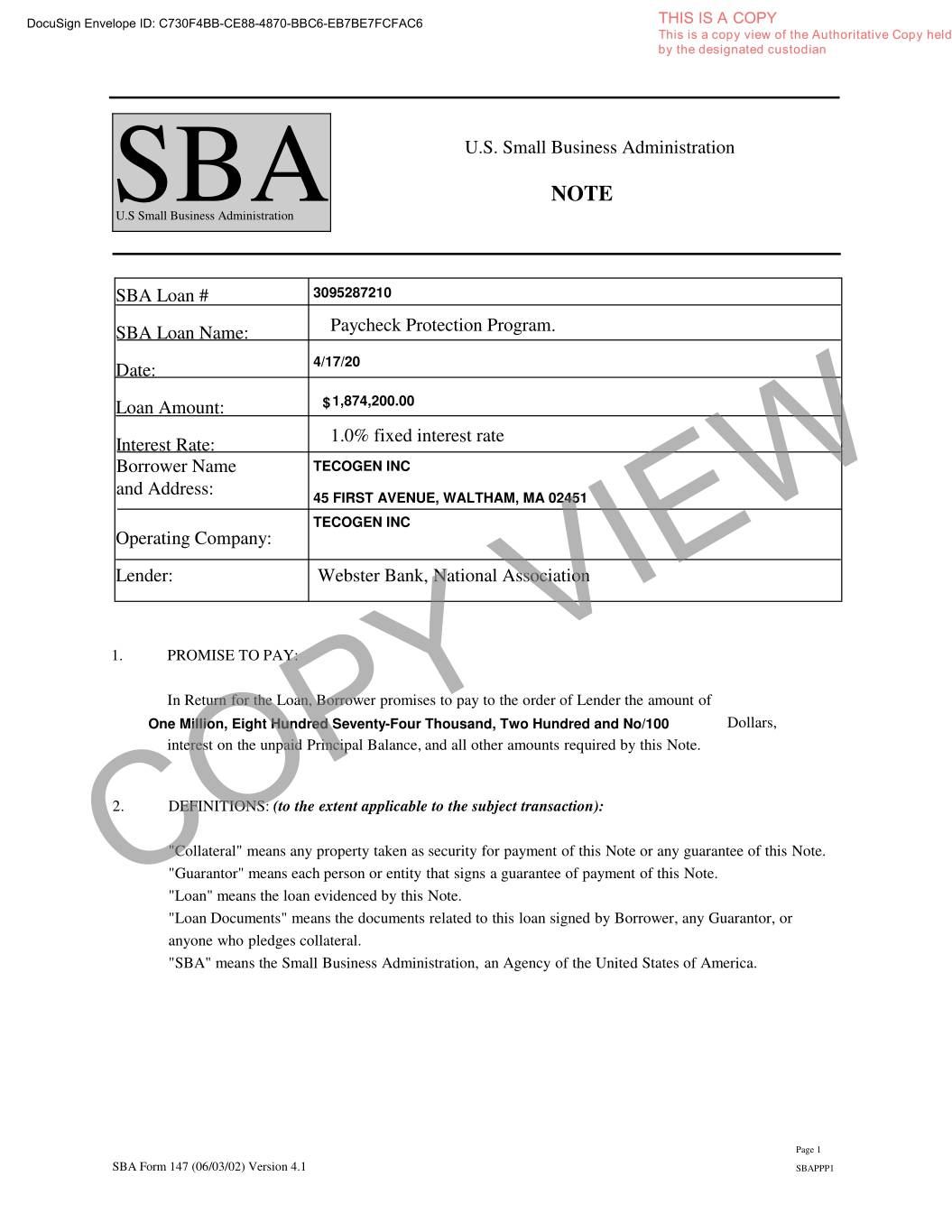

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian U.S. Small Business Administration NOTE SBAU.S Small Business Administration SBA Loan # 3095287210 SBA Loan Name: Paycheck Protection Program. Date: 4/17/20 Loan Amount: $ 1,874,200.00 Interest Rate: 1.0% fixed interest rate Borrower Name TECOGEN INC and Address: 45 FIRST AVENUE, WALTHAM, MA 02451 TECOGEN INC Operating Company: Lender: Webster Bank, National Association 1. PROMISETOPAY: In Return for the Loan, Borrower promises to pay to the order of Lender the amount of One Million, Eight Hundred Seventy-Four Thousand, Two Hundred and No/100 Dollars, interest on the unpaid Principal Balance, and all other amounts required by this Note. 2. DEFINITIONS: (to the extent applicable to the subject transaction): "Collateral" means any property taken as security for payment of this Note or any guarantee of this Note. "Guarantor" means each person or entity that signs a guarantee of payment of this Note. COPY"Loan" means the loan evidenced by this Note. VIEW "Loan Documents" means the documents related to this loan signed by Borrower, any Guarantor, or anyone who pledges collateral. "SBA" means the Small Business Administration, an Agency of the United States of America. Page 1 SBA Form 147 (06/03/02) Version 4.1 SBAPPP1

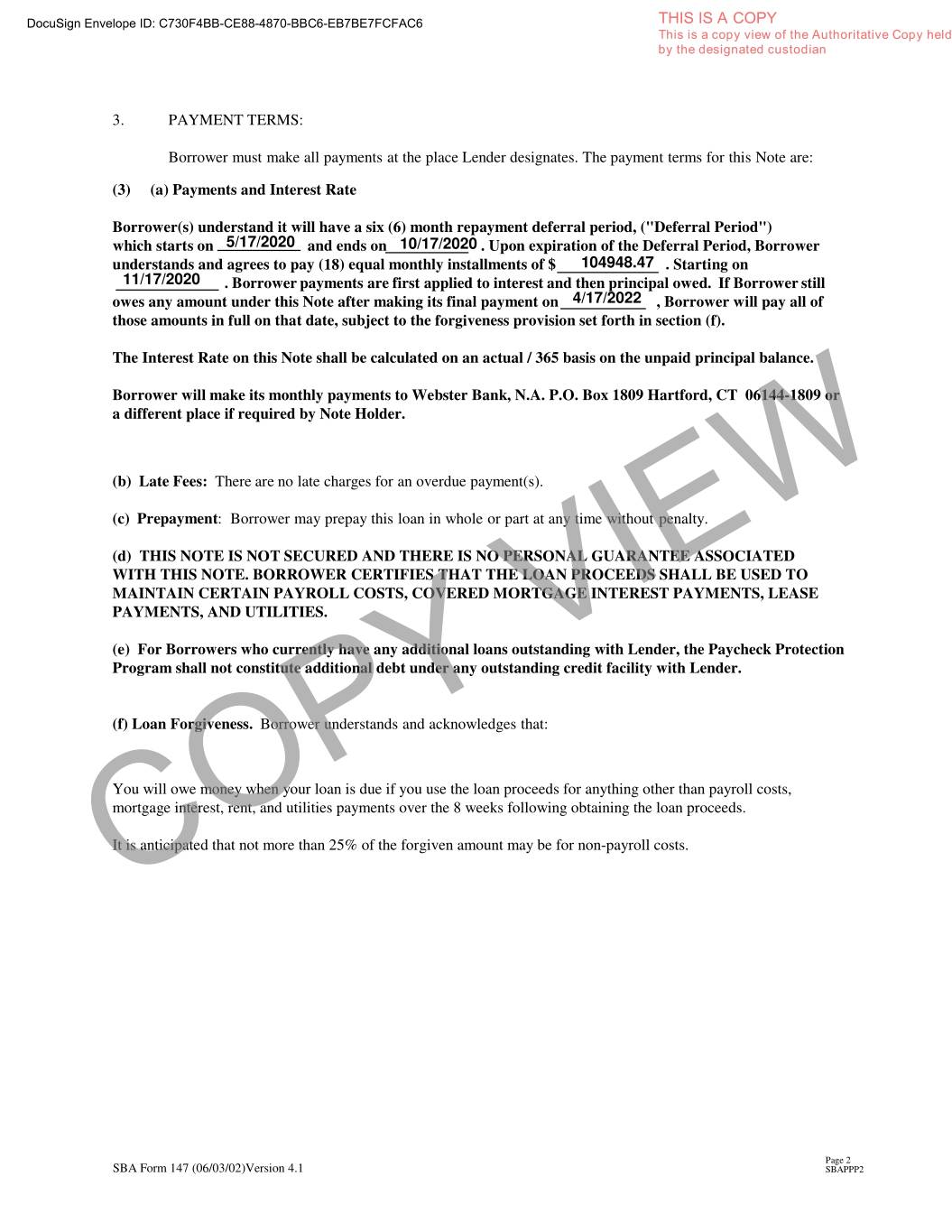

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian 3. PAYMENTTERMS: Borrower must make all payments at the place Lender designates. The payment terms for this Note are: (3) (a) Payments and Interest Rate Borrower(s) understand it will have a six (6) month repayment deferral period, ("Deferral Period") which starts on 5/17/2020 and ends on 10/17/2020 . Upon expiration of the Deferral Period, Borrower understands and agrees to pay (18) equal monthly installments of $ 104948.47 . Starting on 11/17/2020 . Borrowerpayments are first applied to interest and then principal owed. If Borrower still owes any amount under this Note after making its final payment on 4/17/2022 , Borrower will pay all of those amounts in full on that date, subject to the forgiveness provision set forth in section (f). The Interest Rate on this Note shall be calculated on an actual / 365 basis on the unpaid principal balance. Borrower will make its monthly payments to Webster Bank, N.A. P.O. Box 1809 Hartford, CT 06144-1809 or a different place if required by Note Holder. (b) Late Fees: There are no late charges for an overdue payment(s). (c) Prepayment : Borrower may prepay this loan in whole or part at any time without penalty. (d) THIS NOTE IS NOT SECURED AND THERE IS NO PERSONAL GUARANTEE ASSOCIATED WITH THIS NOTE. BORROWER CERTIFIES THAT THE LOAN PROCEEDS SHALL BE USED TO MAINTAIN CERTAIN PAYROLL COSTS, COVERED MORTGAGE INTEREST PAYMENTS, LEASE PAYMENTS, AND UTILITIES. (e) For Borrowers who currently have any additional loans outstanding with Lender, the Paycheck Protection Program shall not constitute additional debt under any outstanding credit facility with Lender. (f) Loan Forgiveness. Borrower understands and acknowledges that: You will owe money when your loan is due if you use the loan proceeds for anything other than payroll costs, mortgage interest, rent, and utilities payments over the 8 weeks following obtaining the loan proceeds. It is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs. COPY VIEW Page 2 SBA Form 147 (06/03/02)Version 4.1 SBAPPP2

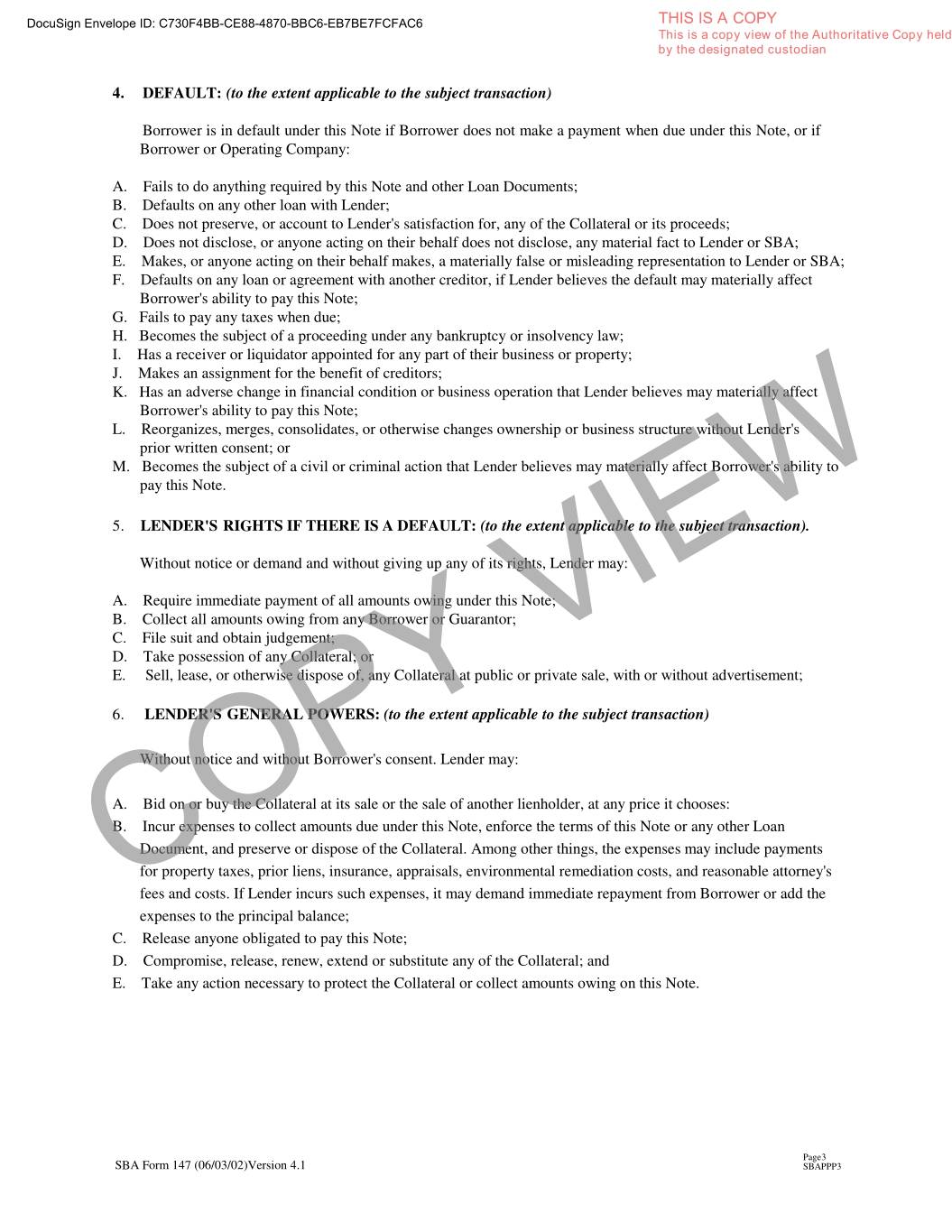

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian 4. DEFAULT: (to the extent applicable to the subject transaction) Borrower is in default under this Note if Borrower does not make a payment when due under this Note, or if Borrower or Operating Company: A. Fails to do anything required by this Note and other Loan Documents; B. Defaults on any other loan with Lender; C. Does not preserve, or account to Lender's satisfaction for, any of the Collateral or its proceeds; D. Does not disclose, or anyone acting on their behalf does not disclose, any material fact to Lender or SBA; E. Makes, or anyone acting on their behalf makes, a materially false or misleading representation to Lender or SBA; F. Defaults on any loan or agreement with another creditor, if Lender believes the default may materially affect Borrower's ability to pay this Note; G. Fails to pay any taxes when due; H. Becomes the subject of a proceeding under any bankruptcy or insolvency law; I. Has a receiver or liquidator appointed for any part of their business or property; J. Makes an assignment for the benefit of creditors; K. Has an adverse change in financial condition or business operation that Lender believes may materially affect Borrower's ability to pay this Note; L. Reorganizes, merges, consolidates, or otherwise changes ownership or business structure without Lender's prior written consent; or M. Becomes the subject of a civil or criminal action that Lender believes may materially affect Borrower's ability to pay this Note. 5. LENDER'S RIGHTS IF THERE IS A DEFAULT: (to the extent applicable to the subject transaction). Without notice or demand and without giving up any of its rights, Lender may: A. Require immediate payment of all amounts owing under this Note; B. Collect all amounts owing from any Borrower or Guarantor; C. File suit and obtain judgement; D. Take possession of any Collateral; or E. Sell, lease, or otherwise dispose of, any Collateral at public or private sale, with or without advertisement; 6. LENDER'S GENERAL POWERS: (to the extent applicable to the subject transaction) Without notice and without Borrower's consent. Lender may: A. Bid on or buy the Collateral at its sale or the sale of another lienholder, at any price it chooses: B. Incur expenses to collect amounts due under this Note, enforce the terms of this Note or any other Loan Document, and preserve or dispose of the Collateral. Among other things, the expenses may include payments for property taxes, prior liens, insurance, appraisals, environmental remediation costs, and reasonable attorney's COPY fees and costs. If Lender incurs such expenses, it may demand immediateVIEW repayment from Borrower or add the expenses to the principal balance; C. Release anyone obligated to pay this Note; D. Compromise, release, renew, extend or substitute any of the Collateral; and E. Take any action necessary to protect the Collateral or collect amounts owing on this Note. Page3 SBA Form 147 (06/03/02)Version 4.1 SBAPPP3

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian 7. WHEN FEDERAL LAW APPLIES: When SBA is the holder, this Note will be interpreted and enforced under federal law, including SBA regulations. Lender or SBA may use state or local procedures for filing papers, recording documents, giving notice, foreclosing liens, and other purposes. By using such procedures, SBA does not waive any federal immunity from state or local control, penalty, tax, or liability. As to this Note, Borrower may not claim or assert against SBA any local or state law to deny any obligation, defeat any claim of SBA, or preempt federal law. 8. SUCCESSORS AND ASSIGNS: Under this Note, Borrower and Operating Company include the successors of each, and Lender includes its successors and assigns. 9. GENERAL PROVISIONS: (to the extent applicable to the subject transaction) A. All individuals and entities signing this Note are jointly and severally liable. B. Borrower waives all suretyship defenses. C. Borrower must sign all documents necessary at any time to comply with the Loan Documents and to enable Lender to acquire, perfect, or maintain Lender's liens on Collateral. D. Lender may exercise any of its rights separately or together, as many times and in any order it chooses. Lender may delay or forgo enforcing any of its rights without giving up any of them. E. Borrower may not use an oral statement of Lender or SBA to contradict or alter the written terms of this Note. F. If any part of this Note is unenforceable, all other parts remain in effect. G. To the extent allowed by law, Borrower waives all demands and notices in connection with this Note, including presentment, demand, protest, and notice of dishonor. Borrower also waives any defenses based upon any claim that Lender did not obtain any guarantee; did not obtain, perfect, or maintain a lien upon Collateral; impaired Collateral; or did not obtain the fair market value of Collateral at a sale. COPY VIEW Page 4 SBA Form 147 (06/03/02)Version 4.1 SBAPPP4

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian 10. Giving of Notices: Any notice that must be given to Borrower under this Note will be given by delivering it or by mailing it by first class mail addressed to Borrower at the address above. A notice will be delivered or mailed to Borrower at a different address if Borrower gives the Note Holder a notice of a different address. Any notice that must be given to the Note Holder under this Note will be given by mailing it by first class mail addressed to the Note Holder at the address stated in Section 3 above. A notice will be mailed to the Note Holder at a different address if Borrower is given a notice of that different address. 11. GOVERNING LAW: Borrower understands and agrees that Lender is a national bank headquartered in Connecticut, Lender's decision to make (or not make) any Loan to Borrower occurs in Connecticut, and the Loan will be disbursed by Lender from Connecticut. Consequently, the provisions of this Agreement will be governed by federal law and (to the extent not preempted by federal law) the laws of the State of Connecticut, without regard to conflict of law rules. 12. Changes to Agreement: Except as otherwise indicated in this Agreement, no term or provision of this Agreement may be changed unless agreed to in writing by both Lender and Borrower. 13. Communicating with Borrower: To the extent permitted by applicable law, and without limiting any other rights you may have, Borrower expressly consents and authorizes Lender, and its affiliates or agents, and any subsequent holder or servicer of the Loan to communicate with it, in connection with the Application or the Loan, and in connection with all other current or future loans, using any phone number or email address that Borrower provided in the Application, or using any phone number or email address that Borrower provides in the future. Lender, and its affiliates or agents, and any subsequent holder or servicer of the Loan, may communicate with Borrower using any current or future means of communication, including, but not limited to, automated telephone dialing equipment, artificial or pre-recorded voice messages, SMS text messages, email directed to me at a mobile telephone service, or email otherwise directed to me, for any purpose other than telemarketing communications. BORROWER AUTHORIZES THE USE OF SUCH MEANS OF COMMUNICATION EVEN IF BORROWER WILL INCUR COSTS TO RECEIVE SUCH PHONE MESSAGES, TEXT MESSAGES, OR EMAILS. 14. Electronic Signatures and Records. If Borrower executed this Agreement using an electronic signature, Borrower intends: (i) the electronic signature to be an electronic signature under applicable federal and state law, (ii) to conduct business with the Lender using electronic records and electronic signatures. If Borrower has signed this Agreement on paper and scanned the signed Agreement for electronic transmission and delivery to Lender (via facsimile, electronic mail or otherwise), then Borrower has consented to the use of electronic signatures and records in connection with this Agreement, and the provisions of this paragraph apply. Borrower agrees that this Agreement, any printout of Lender's electronic record of this Agreement and related notices to be an original document any related document or notice, and any related signature may not be denied legal effect or enforceability solely because the record or signature is in electronic form. Any transfer of the obligations of this Agreement set forth herein will be subject to Article 9 of the Uniform CommercialCOPY Code. VIEW 15. COMMUNICATIONS UNDER THE FEDERAL BANKRUPTCY CODE . Any communication with you required or permitted under the Federal Bankruptcy Code must be in writing, must include my account number and must be sent to Webster Bank, N.A. PO Box 30, Waterbury CT 06720-0030. 16. Severability. If any provision of this Agreement is held invalid or unenforceable by a court having jurisdiction, the remaining provisions of this Agreement shall not be affected, and this Agreement shall be construed as if such invalid or unenforceable provisions had not been included in this Agreement. Page 5 SBA Form 147 (06/03/02)Version 4.1 SBAPPP5

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian By signing below, each individual or entity becomes obligated under this Note as Borrower. By: BENJAMIN LOCKE By: Name: TECOGEN INC Name: TECOGEN INC Title: CEO Title: Date: April 17, 2020 4/17/2020 | 8:58 AM PDT Date: April 17, 2020 COPY VIEW Page 6 SBA Form 147 (06/03/02)Version 4.1 SBAPPP6

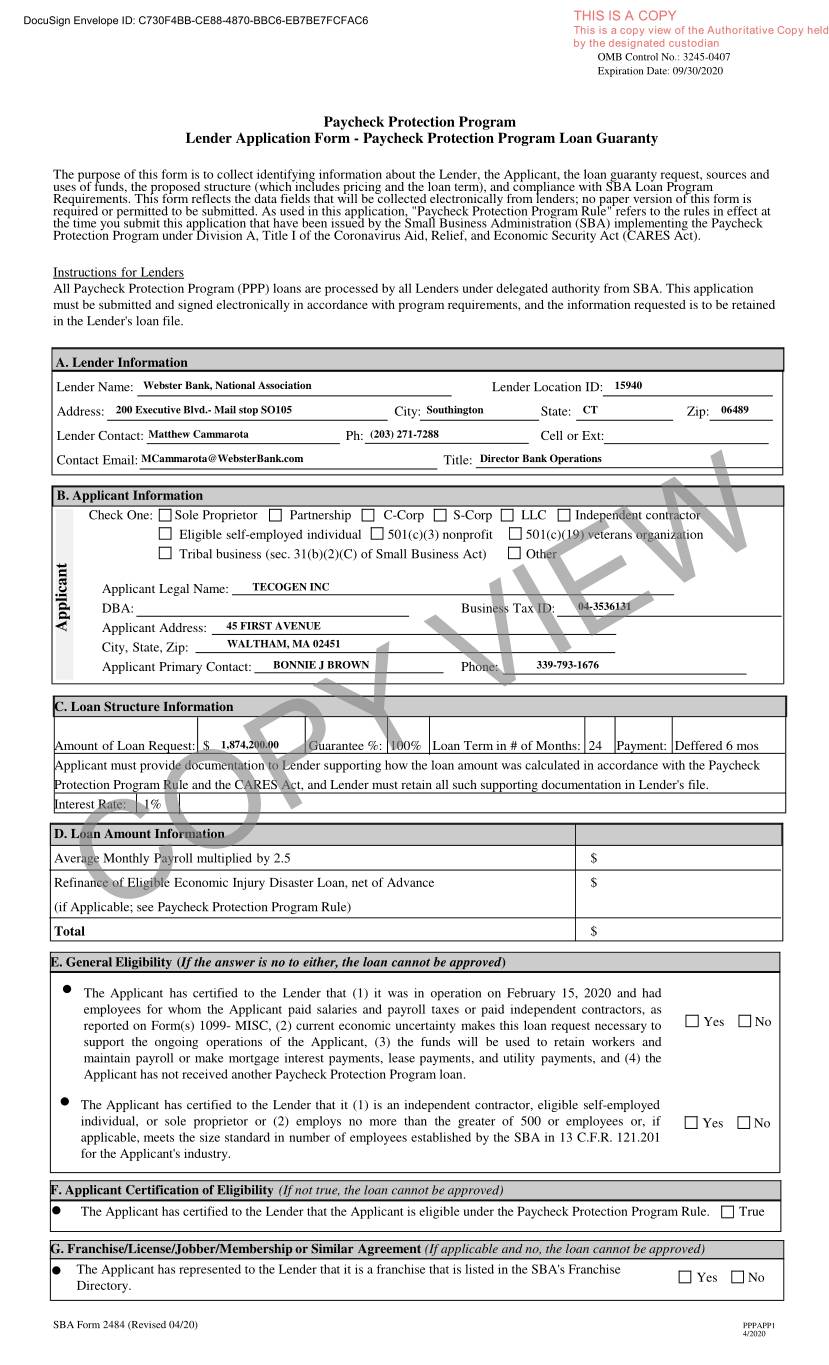

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian OMB Control No.: 3245-0407 Expiration Date: 09/30/2020 Paycheck Protection Program Lender Application Form - Paycheck Protection Program Loan Guaranty The purpose of this form is to collect identifying information about the Lender, the Applicant, the loan guaranty request, sources and uses of funds, the proposed structure (which includes pricing and the loan term), and compliance with SBA Loan Program Requirements. This form reflects the data fields that will be collected electronically from lenders; no paper version of this form is required or permitted to be submitted. As used in this application, "Paycheck Protection Program Rule" refers to the rules in effect at the time you submit this application that have been issued by the Small Business Administration (SBA) implementing the Paycheck Protection Program under Division A, Title I of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Instructions for Lenders All Paycheck Protection Program (PPP) loans are processed by all Lenders under delegated authority from SBA. This application must be submitted and signed electronically in accordance with program requirements, and the information requested is to be retained in the Lender's loan file. A. Lender Information Lender Name: Webster Bank, National Association Lender Location ID: 15940 Address: 200 Executive Blvd.- Mail stop SO105City: Southington State: CT Zip: 06489 Lender Contact:Matthew Cammarota Ph: (203) 271-7288 Cell or Ext: Contact Email: MCammarota@WebsterBank.com Title: Director Bank Operations B. Applicant Information Check One: Sole Proprietor Partnership C-Corp S-Corp LLC Independent contractor Eligible self-employed individual 501(c)(3) nonprofit 501(c)(19) veterans organization Tribal business (sec. 31(b)(2)(C) of Small Business Act) Other Applicant Legal Name: TECOGEN INC DBA: Business Tax ID: 04-3536131 45 FIRST AVENUE Applicant Applicant Address: City, State, Zip: WALTHAM, MA 02451 Applicant Primary Contact:BONNIE J BROWN Phone: 339-793-1676 C. Loan Structure Information AmountofLoanRequest: $1,874,200.00 Guarantee%: 100% LoanTermin#ofMonths: 24 Payment: Deffered 6 mos Applicant must provide documentation to Lender supporting how the loan amount was calculated in accordance with the Paycheck Protection Program Rule and the CARES Act, and Lender must retain all such supporting documentation in Lender's file. Interest Rate: 1% D. Loan Amount Information Average Monthly Payroll multiplied by 2.5 $ Refinance of Eligible Economic Injury Disaster Loan, net of Advance $ (if Applicable; see Paycheck Protection Program Rule) Total COPY VIEW$ E. General Eligibility (If the answer is no to either, the loan cannot be approved ) . The Applicant has certified to the Lender that (1) it was in operation on February 15, 2020 and had employees for whom the Applicant paid salaries and payroll taxes or paid independent contractors, as reported on Form(s) 1099- MISC, (2) current economic uncertainty makes this loan request necessary to Yes No support the ongoing operations of the Applicant, (3) the funds will be used to retain workers and maintain payroll or make mortgage interest payments, lease payments, and utility payments, and (4) the Applicant has not received another Paycheck Protection Program loan. . The Applicant has certified to the Lender that it (1) is an independent contractor, eligible self-employed individual, or sole proprietor or (2) employs no more than the greater of 500 or employees or, if Yes No applicable, meets the size standard in number of employees established by the SBA in 13 C.F.R. 121.201 for the Applicant's industry. F. Applicant Certification of Eligibility (If not true, the loan cannot be approved) . The Applicant has certified to the Lender that the Applicant is eligible under the Paycheck Protection Program Rule. True G. Franchise/License/Jobber/Membership or Similar Agreement (If applicable and no, the loan cannot be approved) The Applicant has represented to the Lender that it is a franchise that is listed in the SBA's Franchise . Yes No Directory. SBA Form 2484 (Revised 04/20) PPPAPP1 4/2020

DocuSign Envelope ID: C730F4BB-CE88-4870-BBC6-EB7BE7FCFAC6 THIS IS A COPY This is a copy view of the Authoritative Copy held by the designated custodian H. Character Determination (If no, the loan cannot be approved) . The Applicant has represented to the Lender that neither the Applicant (if an individual) nor any Yes No individual owning 20% or more of the equity of the Applicant is subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction, or is presently incarcerated, or on probation or parole. . The Applicant has represented to the Lender that neither the Applicant (if an individual) nor any individual owning 20% or more of the equity of the Applicant has within the last 5 years, for any felony: Yes No 1) been convicted; 2) pleaded guilty; 3) pleaded nolo contendere; 4) been placed on pretrial diversion; or 5) been placed on any form of parole or probation (including probation before judgment). I. Prior Loss to Government/Delinquent Federal Debt (If no, the loan cannot be approved) . The Applicant has certified to the Lender that neither the Applicant nor any owner (as defined in the Applicant's SBA Form 2483) is presently suspended, debarred, proposed for debarment, declared Yes No ineligible, voluntarily excluded from participation in this transaction by any Federal department or agency, or presently involved in any bankruptcy. The Applicant has certified to the Lender that neither the Applicant nor any of its owners, nor any . business owned or controlled by any of them, ever obtained a direct or guaranteed loan from SBA or Yes No any other Federal agency that is currently delinquent or has defaulted in the last 7 years and caused a loss to the government. J. U.S. Employees (If no, the loan cannot be approved) . The Applicant has certified that the principal place of residence for all employees included in the Yes No Applicant's payroll calculation is the United States. K. Fees (If yes, Lender may not pass any agent fee through to the Applicant or offset or pay the fee with the proceeds of this loan) . Is the Lender using a third party to assist in the preparation of the loan application or application Yes No materials, or to perform other services in connection with this loan? SBA Certification to Financial Institution under Right to Financial Privacy Act (12 U.S.C. 3401) By signing SBA Form 2483, Borrower Information Form in connection with this application for an SBA-guaranteed loan, the Applicant certifies that it has read the Statements Required by Law and Executive Orders, which is attached to Form 2483. As such, SBA certifies that it has complied with the applicable provisions of the Right to Financial Privacy Act of 1978 (12 U.S.C. 3401) and, pursuant to that Act, no further certification is required for subsequent access by SBA to financial records of the Applicant/Borrower during the term of the loan guaranty. Lender Certification On behalf of the Lender, I certify that: . The Lender has complied with the applicable lender obligations set forth in paragraphs 3.b(i)-(iii) of the Paycheck Protection Program Rule. . The Lender has obtained and reviewed the required application (including documents demonstrating qualifying payroll amounts) of the Applicant and will retain copies of such documents in the Applicant's loan file. I certify that: . Neither the undersigned Authorized Lender Official, nor such individual's spouse or children, has a financial interest in the Applicant.COPY VIEW 4/17/20 Authorized Lender Official: Date: Matthew Cammarota Director Bank Operations Type or Print Name: Title: NOTE: According to the Paperwork Reduction Act, you are not required to respond to this collection of information unless it displays a currently valid OMB Control Number. The estimated burden for completing this form, including time for reviewing instructions, gathering data needed, and completing and reviewing the form is 25 minutes per response. Comments or questions on the burden estimates should be sent to U.S. Small Business Administration, Director, Records Management Division, 409 3rd St., SW, Washington DC 20416, and/or SBA Desk Officer, Office of Management and Budget, New Executive Office Building, Rm. 10202, Washington DC 20503. PLEASE DO NOT SEND FORMS TO THESE ADDRESSES. PPPAPP2 4/2020 SBA Form 2484 (Revised 04/20)

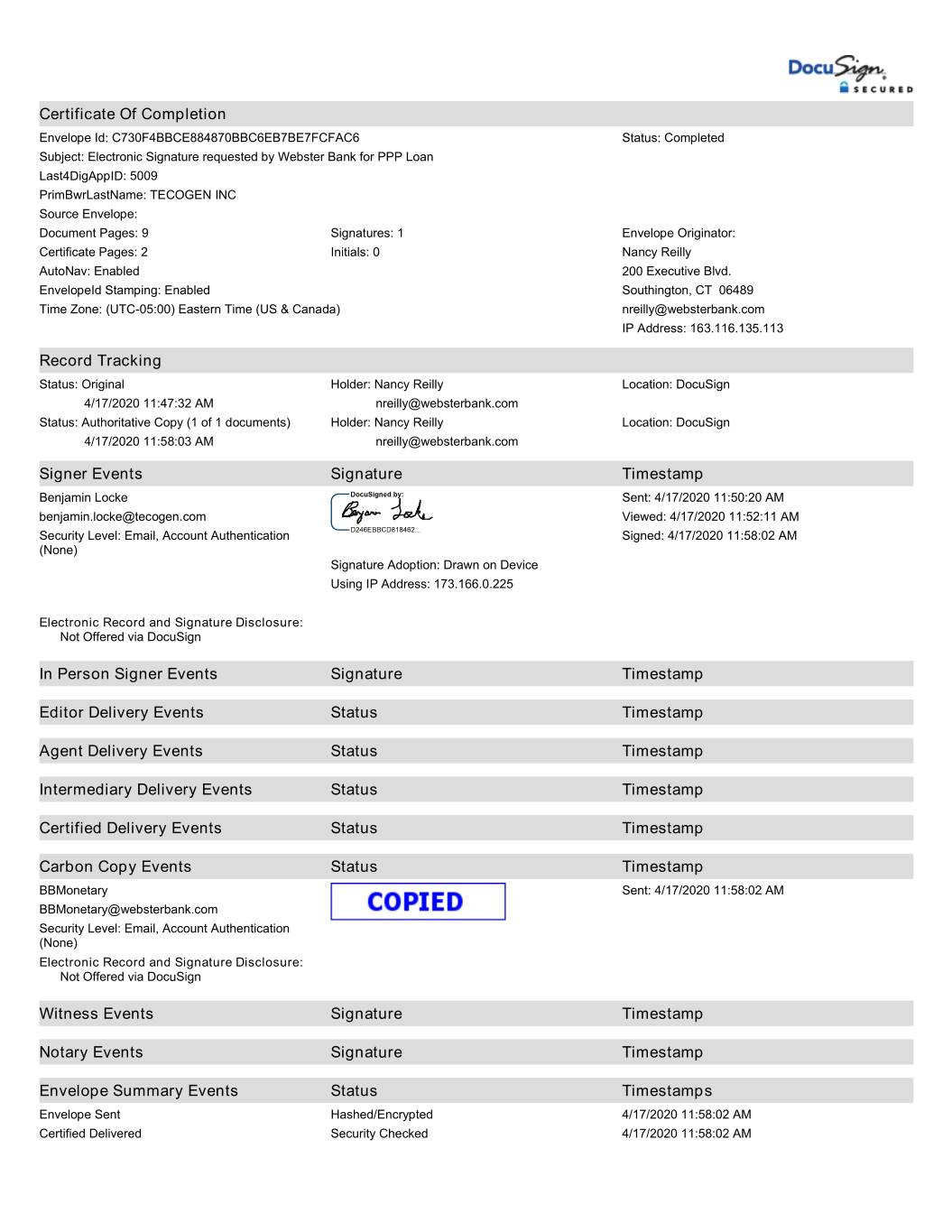

Certificate Of Completion Envelope Id: C730F4BBCE884870BBC6EB7BE7FCFAC6 Status: Completed Subject: Electronic Signature requested by Webster Bank for PPP Loan Last4DigAppID: 5009 PrimBwrLastName: TECOGEN INC Source Envelope: Document Pages: 9 Signatures: 1 Envelope Originator: Certificate Pages: 2 Initials: 0 Nancy Reilly AutoNav: Enabled 200 Executive Blvd. EnvelopeId Stamping: Enabled Southington, CT 06489 Time Zone: (UTC-05:00) Eastern Time (US & Canada) nreilly@websterbank.com IP Address: 163.116.135.113 Record Tracking Status: Original Holder: Nancy Reilly Location: DocuSign 4/17/2020 11:47:32 AM nreilly@websterbank.com Status: Authoritative Copy (1 of 1 documents) Holder: Nancy Reilly Location: DocuSign 4/17/2020 11:58:03 AM nreilly@websterbank.com Signer Events Signature Timestamp Benjamin Locke Sent: 4/17/2020 11:50:20 AM benjamin.locke@tecogen.com Viewed: 4/17/2020 11:52:11 AM Security Level: Email, Account Authentication Signed: 4/17/2020 11:58:02 AM (None) Signature Adoption: Drawn on Device Using IP Address: 173.166.0.225 Electronic Record and Signature Disclosure: Not Offered via DocuSign In Person Signer Events Signature Timestamp Editor Delivery Events Status Timestamp Agent Delivery Events Status Timestamp Intermediary Delivery Events Status Timestamp Certified Delivery Events Status Timestamp Carbon Copy Events Status Timestamp BBMonetary Sent: 4/17/2020 11:58:02 AM BBMonetary@websterbank.com Security Level: Email, Account Authentication (None) Electronic Record and Signature Disclosure: Not Offered via DocuSign Witness Events Signature Timestamp Notary Events Signature Timestamp Envelope Summary Events Status Timestamps Envelope Sent Hashed/Encrypted 4/17/2020 11:58:02 AM Certified Delivered Security Checked 4/17/2020 11:58:02 AM

Envelope Summary Events Status Timestamps Signing Complete Security Checked 4/17/2020 11:58:02 AM Completed Security Checked 4/17/2020 11:58:02 AM Payment Events Status Timestamps