00015374352020FYfalseP3Yus-gaap:LiabilitiesCurrentAbstractus-gaap:LiabilitiesCurrentAbstractus-gaap:OperatingLeaseLiabilityNoncurrentus-gaap:OperatingLeaseLiabilityNoncurrent00015374352020-01-012020-12-31iso4217:USD00015374352020-06-30xbrli:shares00015374352021-03-0900015374352020-12-3100015374352019-01-012019-12-31tgen:customer0001537435us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001537435us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310001537435us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2020-01-012020-12-310001537435us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2019-01-012019-12-310001537435us-gaap:EmployeeStockOptionMembertgen:AmendnedStockOptionAndIncentivePlan2006Membersrt:ParentCompanyMember2020-12-310001537435us-gaap:EmployeeStockOptionMembertgen:AmendnedStockOptionAndIncentivePlan2006Membersrt:ParentCompanyMember2019-12-3100015374352019-12-31iso4217:USDxbrli:shares0001537435us-gaap:ProductMember2020-01-012020-12-310001537435us-gaap:ProductMember2019-01-012019-12-310001537435us-gaap:ServiceMember2020-01-012020-12-310001537435us-gaap:ServiceMember2019-01-012019-12-310001537435us-gaap:EnergyServiceMember2020-01-012020-12-310001537435us-gaap:EnergyServiceMember2019-01-012019-12-310001537435tgen:BenefitforIncomeTaxesMember2020-01-012020-12-310001537435us-gaap:CommonStockMember2018-12-310001537435us-gaap:AdditionalPaidInCapitalMember2018-12-310001537435us-gaap:RetainedEarningsMember2018-12-310001537435us-gaap:NoncontrollingInterestMember2018-12-3100015374352018-12-310001537435us-gaap:CommonStockMember2019-01-012019-12-310001537435us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001537435us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001537435us-gaap:RetainedEarningsMember2019-01-012019-12-310001537435us-gaap:CommonStockMember2019-12-310001537435us-gaap:AdditionalPaidInCapitalMember2019-12-310001537435us-gaap:RetainedEarningsMember2019-12-310001537435us-gaap:NoncontrollingInterestMember2019-12-310001537435us-gaap:CommonStockMember2020-01-012020-12-310001537435us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001537435us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001537435us-gaap:RetainedEarningsMember2020-01-012020-12-310001537435us-gaap:CommonStockMember2020-12-310001537435us-gaap:AdditionalPaidInCapitalMember2020-12-310001537435us-gaap:RetainedEarningsMember2020-12-310001537435us-gaap:NoncontrollingInterestMember2020-12-31tgen:segmentxbrli:pure0001537435srt:MinimumMember2020-01-012020-12-310001537435srt:MaximumMember2020-01-012020-12-310001537435us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001537435us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310001537435us-gaap:ProductMembertgen:ProductsandServicesMember2020-01-012020-12-310001537435tgen:EnergyProductionMemberus-gaap:ProductMember2020-01-012020-12-310001537435tgen:InstallationServicesMembertgen:ProductsandServicesMember2020-01-012020-12-310001537435tgen:EnergyProductionMembertgen:InstallationServicesMember2020-01-012020-12-310001537435tgen:InstallationServicesMember2020-01-012020-12-310001537435tgen:MaintenanceServiceMembertgen:ProductsandServicesMember2020-01-012020-12-310001537435tgen:EnergyProductionMembertgen:MaintenanceServiceMember2020-01-012020-12-310001537435tgen:MaintenanceServiceMember2020-01-012020-12-310001537435tgen:EnergyProductionMembertgen:ProductsandServicesMember2020-01-012020-12-310001537435tgen:EnergyProductionMembertgen:EnergyProductionMember2020-01-012020-12-310001537435tgen:EnergyProductionMember2020-01-012020-12-310001537435us-gaap:OperatingSegmentsMembertgen:ProductsandServicesMember2020-01-012020-12-310001537435us-gaap:OperatingSegmentsMembertgen:EnergyProductionMember2020-01-012020-12-310001537435us-gaap:ProductMembertgen:ProductsandServicesMember2019-01-012019-12-310001537435tgen:EnergyProductionMemberus-gaap:ProductMember2019-01-012019-12-310001537435tgen:InstallationServicesMembertgen:ProductsandServicesMember2019-01-012019-12-310001537435tgen:EnergyProductionMembertgen:InstallationServicesMember2019-01-012019-12-310001537435tgen:InstallationServicesMember2019-01-012019-12-310001537435tgen:MaintenanceServiceMembertgen:ProductsandServicesMember2019-01-012019-12-310001537435tgen:EnergyProductionMembertgen:MaintenanceServiceMember2019-01-012019-12-310001537435tgen:MaintenanceServiceMember2019-01-012019-12-310001537435tgen:EnergyProductionMembertgen:ProductsandServicesMember2019-01-012019-12-310001537435tgen:EnergyProductionMembertgen:EnergyProductionMember2019-01-012019-12-310001537435tgen:EnergyProductionMember2019-01-012019-12-310001537435us-gaap:OperatingSegmentsMembertgen:ProductsandServicesMember2019-01-012019-12-310001537435us-gaap:OperatingSegmentsMembertgen:EnergyProductionMember2019-01-012019-12-310001537435tgen:LightInstallationMember2020-01-012020-12-310001537435tgen:TurnkeyInstallationMember2020-01-012020-12-310001537435us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001537435us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001537435tgen:AmericanDgEnergyMember2017-05-182017-05-180001537435us-gaap:GeneralAndAdministrativeExpenseMember2018-01-012018-12-3100015374352018-01-012018-12-310001537435tgen:AmericanDgEnergyMember2017-05-1800015374352017-05-18tgen:sale00015374352019-01-012019-03-31tgen:site0001537435tgen:EnergyProductionMember2019-01-012019-12-310001537435tgen:EnergyProductionMember2020-03-310001537435tgen:EnergyProductionMember2019-01-012019-03-310001537435us-gaap:PatentsMembersrt:MinimumMember2020-01-012020-12-310001537435us-gaap:PatentsMembersrt:MaximumMember2020-01-012020-12-310001537435us-gaap:PatentsMember2020-01-012020-12-310001537435us-gaap:PatentsMember2019-01-012019-12-310001537435us-gaap:TrademarksMember2020-01-012020-12-310001537435us-gaap:TrademarksMember2019-01-012019-12-310001537435tgen:FavorableContractAssetMember2020-01-012020-12-310001537435tgen:FavorableContractAssetMember2019-01-012019-12-310001537435tgen:ProductCertificationMember2020-12-310001537435tgen:ProductCertificationMember2019-12-310001537435us-gaap:PatentsMember2020-12-310001537435us-gaap:PatentsMember2019-12-310001537435us-gaap:DevelopedTechnologyRightsMember2020-12-310001537435us-gaap:DevelopedTechnologyRightsMember2019-12-310001537435us-gaap:TrademarksMember2020-12-310001537435us-gaap:TrademarksMember2019-12-310001537435us-gaap:InProcessResearchAndDevelopmentMember2020-12-310001537435us-gaap:InProcessResearchAndDevelopmentMember2019-12-310001537435tgen:FavorableContractAssetMember2020-12-310001537435tgen:FavorableContractAssetMember2019-12-310001537435tgen:UnfavorableContractLiabilityMember2020-12-310001537435tgen:UnfavorableContractLiabilityMember2019-12-310001537435tgen:LongLivedAssetImpairmentMember2020-01-012020-12-310001537435tgen:ContractAssetandLiabilityMembertgen:NoncontractRelatedIntangibleAssetsMember2020-12-310001537435tgen:ContractAssetandLiabilityMemberus-gaap:ContractBasedIntangibleAssetsMember2020-12-310001537435tgen:ContractAssetandLiabilityMember2020-12-310001537435srt:MinimumMemberus-gaap:EnergyEquipmentMember2020-01-012020-12-310001537435srt:MaximumMemberus-gaap:EnergyEquipmentMember2020-01-012020-12-310001537435us-gaap:EnergyEquipmentMember2020-12-310001537435us-gaap:EnergyEquipmentMember2019-12-310001537435srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2020-01-012020-12-310001537435srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2020-01-012020-12-310001537435us-gaap:MachineryAndEquipmentMember2020-12-310001537435us-gaap:MachineryAndEquipmentMember2019-12-310001537435us-gaap:FurnitureAndFixturesMember2020-01-012020-12-310001537435us-gaap:FurnitureAndFixturesMember2020-12-310001537435us-gaap:FurnitureAndFixturesMember2019-12-310001537435us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MinimumMember2020-01-012020-12-310001537435us-gaap:ComputerSoftwareIntangibleAssetMembersrt:MaximumMember2020-01-012020-12-310001537435us-gaap:ComputerSoftwareIntangibleAssetMember2020-12-310001537435us-gaap:ComputerSoftwareIntangibleAssetMember2019-12-310001537435us-gaap:LeaseholdImprovementsMember2020-12-310001537435us-gaap:LeaseholdImprovementsMember2019-12-310001537435tgen:ProductsandServicesMember2018-12-310001537435tgen:EnergyProductionMember2018-12-310001537435tgen:ProductsandServicesMember2019-01-012019-12-310001537435tgen:ProductsandServicesMember2019-12-310001537435tgen:EnergyProductionMember2019-12-310001537435tgen:ProductsandServicesMember2020-01-012020-12-310001537435tgen:EnergyProductionMember2020-01-012020-12-310001537435tgen:ProductsandServicesMember2020-12-310001537435tgen:EnergyProductionMember2020-12-310001537435tgen:WebsterBusinessCreditCorporationMember2018-05-040001537435us-gaap:LondonInterbankOfferedRateLIBORMembertgen:WebsterBusinessCreditCorporationMember2018-05-042018-05-040001537435us-gaap:BaseRateMembertgen:WebsterBusinessCreditCorporationMember2018-05-042018-05-040001537435tgen:WebsterBusinessCreditCorporationMemberus-gaap:FederalFundsEffectiveSwapRateMember2018-05-042018-05-040001537435tgen:LendersBaseRateOneMonthLIBORMembertgen:WebsterBusinessCreditCorporationMember2018-05-042018-05-040001537435tgen:WebsterBusinessCreditCorporationMember2020-12-310001537435tgen:WebsterBusinessCreditCorporationMember2018-05-042018-05-040001537435tgen:WebsterBusinessCreditCorporationMember2019-12-310001537435tgen:WebsterBusinessCreditCorporationMember2020-05-112020-05-110001537435tgen:PPPLoanProgramMembertgen:WebsterBusinessCreditCorporationMember2020-04-17tgen:payment0001537435tgen:PPPLoanProgramMembertgen:WebsterBusinessCreditCorporationMember2020-04-172020-04-170001537435us-gaap:SubsequentEventMembertgen:PPPLoanProgramMembertgen:WebsterBusinessCreditCorporationMember2021-01-112021-01-110001537435us-gaap:SubsequentEventMembertgen:PPPLoanProgramMembertgen:WebsterBusinessCreditCorporationMember2021-01-110001537435us-gaap:SubsequentEventMembertgen:PPPLoanProgramMembertgen:WebsterBusinessCreditCorporationMember2021-02-020001537435us-gaap:SubsequentEventMembertgen:PPPLoanProgramMembertgen:WebsterBusinessCreditCorporationMember2021-02-050001537435us-gaap:SubsequentEventMembertgen:PPPLoanProgramMembertgen:WebsterBusinessCreditCorporationMember2021-02-052021-02-0500015374352020-07-092020-07-090001537435tgen:OfficeSpaceAndWarehouseFacilitiesMember2020-01-012020-12-310001537435tgen:OfficeSpaceAndWarehouseFacilitiesMember2019-01-012019-12-310001537435tgen:EurositePowerIncMember2020-12-3100015374352020-03-3100015374352013-02-130001537435srt:ParentCompanyMember2020-01-012020-12-310001537435srt:ParentCompanyMember2019-01-012019-12-310001537435us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:ParentCompanyMember2019-01-012019-12-310001537435srt:ParentCompanyMember2019-12-310001537435us-gaap:EmployeeStockOptionMembersrt:ParentCompanyMember2019-01-012019-12-310001537435srt:ParentCompanyMember2020-12-310001537435us-gaap:EmployeeStockOptionMembersrt:ParentCompanyMember2020-01-012020-12-310001537435tgen:EurositePowerIncMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001537435tgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001537435us-gaap:FairValueInputsLevel2Membertgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001537435us-gaap:FairValueInputsLevel3Membertgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001537435tgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMember2020-01-012020-12-310001537435us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001537435us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001537435us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001537435us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001537435us-gaap:FairValueMeasurementsRecurringMember2020-01-012020-12-310001537435tgen:EurositePowerIncMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001537435tgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310001537435us-gaap:FairValueInputsLevel2Membertgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001537435us-gaap:FairValueInputsLevel3Membertgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001537435tgen:EurositePowerIncMemberus-gaap:FairValueMeasurementsRecurringMember2019-01-012019-12-310001537435us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001537435us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310001537435us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001537435us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001537435us-gaap:FairValueMeasurementsRecurringMember2019-01-012019-12-310001537435us-gaap:CorporateAndOtherMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001537435us-gaap:OperatingSegmentsMember2020-01-012020-12-310001537435tgen:ProductsandServicesMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001537435tgen:EnergyProductionMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001537435us-gaap:CorporateAndOtherMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001537435us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001537435us-gaap:CorporateAndOtherMember2020-01-012020-12-310001537435us-gaap:CorporateAndOtherMember2020-12-310001537435us-gaap:CorporateAndOtherMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001537435us-gaap:OperatingSegmentsMember2019-01-012019-12-310001537435tgen:ProductsandServicesMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001537435tgen:EnergyProductionMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001537435us-gaap:CorporateAndOtherMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001537435us-gaap:IntersegmentEliminationMember2019-01-012019-12-310001537435us-gaap:CorporateAndOtherMember2019-01-012019-12-310001537435us-gaap:CorporateAndOtherMember2019-12-310001537435tgen:BenefitforIncomeTaxesMember2019-01-012019-12-310001537435us-gaap:InternalRevenueServiceIRSMember2020-12-310001537435us-gaap:StateAndLocalJurisdictionMember2020-12-310001537435tgen:AmericanDgEnergyMember2017-01-012017-12-310001537435tgen:AmericanDgEnergyMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| | | | | | | | |

| ☑ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

or

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-36103

TECOGEN INC.

(Exact name of Registrant as specified in its charter)

| | | | | |

| Delaware | 04-3536131 |

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

| | | | | |

| 45 First Avenue | |

Waltham, Massachusetts 02451 | (781) 466-6400 |

| (Address of Principal Executive Offices) | Registrant's telephone number, including area code |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer o

Non–Accelerated Filer ☒ Smaller reporting company ☒

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes ☐ No ý

As of June 30, 2020, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates was: $25,611,519. Solely for purposes of this disclosure, shares of common stock held by executive officers and directors of the registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of executive officers and directors as affiliates is not necessarily a conclusive determination for any other purposes.

As of March 9, 2021, 24,850,261 shares of common stock, $.001 par value per share, of the registrant were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”), the Private Securities Litigation Reform Act of 1995 and other federal securities laws that involve a number of risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “anticipates,” “believes,” “contemplates,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “predicts,” “pro forma,” “potential” “seeks,” “should,” “target,” or other variations thereof (including their use in the negative), or by discussions of strategies, plans or intentions. All statements, other than statements of historical fact, included in this report regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management are forward-looking statements.

The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other factors that may cause us, our customers’ or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements to differ. See "Item 1A. Risk Factors," "Item 7.Management's Discussion and Analysis of Financial Condition and Results of Operations," and"Item 1.Business," as well as other sections in this report that discuss some of the factors that could contribute to these differences.

In addition, such forward-looking statements are necessarily dependent upon assumptions and estimates that may prove to be incorrect. Although we believe that the assumptions and estimates reflected in such forward-looking statements are reasonable, we cannot guarantee that our plans, intentions, or expectations will be achieved. The information contained in this report, including the section discussing risk factors, identify important factors that could cause such differences.

The cautionary statements made in this report are intended to be applicable to all related forward-looking statements wherever they appear in this report. The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date of which the statements are made. Except as required by law, we undertake no obligation to update or release any forward-looking statements as a result of new information, future events, or otherwise, and assume no obligation to update the reasons why actual results could differ materially from those anticipated in such forward-looking statements.

This report also contains or may contain market data related to our business and industry any such market data may include projections that are based on certain assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result, our markets may not grow at the rates projected by this data, or at all. The failure of these markets to grow at these projected rates may have a material adverse effect on our business, results of operations, financial condition, and the market price of our common stock.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020

TABLE OF CONTENTS

| | | | | | | | |

PART I |

Item 1. | Business. | |

| Item 1A. | Risk Factors. | |

| Item 1B. | Unresolved Staff Comments. | |

| Item 2. | Properties. | |

| Item 3. | Legal Proceedings. | |

| Item 4. | Mine Safety Disclosures. | |

| | |

| PART II |

| | |

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |

| Item 6. | Selected Financial Data. | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | |

| Item 8. | Financial Statements and Supplementary Data. | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | |

| Item 9A. | Controls and Procedures. | |

| Item 9B. | Other Information. | |

| | |

| PART III |

| | |

| Item 10. | Directors, Executive Officers and Corporate Governance. | |

| Item 11. | Executive Compensation. | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | |

| Item 14. | Principal Accounting Fees and Services. | |

| | | |

| PART IV |

| | | |

| Item 15. | Exhibits and Financial Statement Schedules. | |

| Item 16. | Form 10-K Summary. | |

| | |

| SIGNATURES | | |

Item 1. Business

The Company

Tecogen Inc. (together with its subsidiaries, “we,” “our,” or “us,” or “Tecogen”) designs, manufactures, markets, and maintains high efficiency, ultra-clean cogeneration products including natural gas engine-driven combined heat and power, air conditioning systems, and water heaters for residential, commercial, recreational and industrial use. We are known for cost efficient, environmentally friendly and reliable products for distributed power generation that, through patented technology, nearly eliminate criteria pollutants and significantly reduce a customer’s carbon footprint. We were incorporated in the State of Delaware on September 15, 2000.

We have one wholly-owned subsidiary American DG Energy, Inc. ("ADGE"), and we own a 51% interest in American DG New York, LLC ("ADGNY"), a joint venture. ADGE and ADGNY distribute, own, and operate clean, on-site energy systems that produce electricity, hot water, heat and cooling. ADGE owns the equipment that it installs at a customer’s facility and sells the energy produced by its systems to the customer on a long-term contractual basis. We are also developing ultra-low emissions technologies using our patented Ultera® technology for the automotive market and other mobile applications,including forklifts. See "Our Products - Ultera Low-Emissions Technology" below for a more in-depth discussion of our Ultera emissions technology.

Our operations are comprised of two business segments:

•our Products and Services segment, which designs, manufactures and sells industrial and commercial cogeneration systems at our customers’ facilities; and

•our Energy Production segment, which sells energy in the form of electricity, heat, hot water and cooling to our customers under long-term sales agreements we enter into with customers.

Recent Developments

COVID-19 Update

During the first quarter of fiscal 2020, a novel strain of coronavirus (“COVID-19”) began spreading rapidly throughout the world, prompting governments and businesses to take unprecedented measures in response. Such measures included restrictions on travel and business operations, temporary closures of businesses, and quarantines and shelter-in-place orders. The COVID-19 pandemic has significantly curtailed global economic activity and caused significant volatility and disruption in global financial markets. The COVID-19 pandemic and the measures taken by U.S. Federal, state and local governments in response have materially adversely affected and could in the future materially adversely impact our business, results of operations, financial condition and stock price. The impact of the pandemic remains uncertain and will depend on the growth in the number of infections, fatalities, the duration of the pandemic, steps taken to combat the pandemic, and the development and availability of effective treatments.

Significant portions of our business are deemed “essential services” under various state shelter-in-place orders, and we have been able to maintain critical manufacturing and service operations. We have made every effort to keep our employees who operate our business safe and minimize unnecessary risk of exposure to the virus, and as part of our pandemic response plan, during a relatively short period in April our sales, engineering, and select administrative functions were operated remotely while our manufacturing team continued to function at our manufacturing facility. Our service centers continued to operate due to our essential services designation, however from time to time our service personnel have been unable to perform maintenance services for customers that temporarily ceased or reduced operations at facilities served by our equipment, and certain customers closed their operations, reducing the amount of energy produced and sold to customers during these periods. During the pandemic we have also experienced slower payments from certain customers. These business interruptions resulted in reductions in service and installation revenue, energy production revenue, and margins in the affected portions of our business.

Payroll Protection Loans

On April 17, 2020, we obtained a loan in the amount of $1,874,200 under the Paycheck Protection Program pursuant to the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) through Webster Bank. The loan is guaranteed by the United States Small Business Administration (“SBA”) and, subject to certain limitations, to the extent that the loan is used for payroll, rent, or utilities during the applicable Covered Period following the disbursement of the loan, the loan may be forgiven by the SBA.

On January 19, 2021, we received a letter dated January 12, 2021 from Webster Bank, NA confirming that the Paycheck Protection Program Loan granted to us pursuant to the CARES Act in the original principal amount of $1,874,200 together with all accrued interest thereon was forgiven in full as of January 11, 2021.

On February 5, 2021, we obtained a Paycheck Protection Program Second Draw unsecured loan through Webster Bank, N.A. in the amount of $1,874,269 in connection with the Paycheck Protection Program pursuant to the CARES Act. The loan is guaranteed by the SBA. We intend to use the loan proceeds for payroll, rent, utilities and other operating expenses, and expect to apply for forgiveness of the loan balance as permitted under the CARES Act. See Note 10. Note Payable and Revolving Line of Credit, Bank.

Energy Sales Agreements

On December 14, 2018, we entered into agreements relating to the sale of two energy purchase agreements and related energy production systems for $2 million and on March 5, 2019 entered into agreements relating to the sale of six energy purchase agreements and related energy production systems for $5 million. In connection with the sale, we entered into agreements to provide billing and asset management services and operations and maintenance services for agreed fees for the duration of the energy purchase agreements, pursuant to which we guarantee certain minimum collections and are entitled to receive fifty percent of the excess of collections over agreed minimum thresholds.

ADGE Merger

On May 18, 2017, our stockholders approved the acquisition of ADGE in a stock for stock merger together with the issuance of the stock by us in the transaction (“Merger”). As a result of the Merger, we acquired 100% of the outstanding common shares of ADGE and ADGE became our wholly-owned subsidiary. See Note 4. "Acquisition of American DG Energy, Inc." of the Notes to the Consolidated Financial Statements for further information.

Overview of Our Business

We design, manufacture, market and maintain high efficiency, ultra-clean cogeneration products including natural gas engine-driven combined heat and power, air conditioning systems, refrigeration compressors, and water heaters for residential, commercial, recreational and industrial use. We provide cost efficient, environmentally friendly and reliable products for distributed power generation that, through patented technologies, nearly eliminate criteria pollutants and significantly reduce a customer’s carbon footprint. Our products are expected to run on Renewable Natural Gas (RNG) as it is introduced into the US gas pipeline infrastructure.

Our natural gas-powered cogeneration systems (also known as combined heat and power or “CHP”) are efficient because they drive electric generators or compressors, which reduce the amount of electricity purchased from the utility while recovering the engine’s waste heat for water heating, space heating, and/or air conditioning at the customer’s building.

We manufacture four types of CHP products:

•Cogeneration units that supply electricity and hot water;

•Chillers that provide air-conditioning and hot water marketed under the TECOCHILL® brand name;

•Refrigeration compressors with natural gas engine drives; and

•High-efficiency water heaters marketed under the Ilios® brand name.

All of these are standardized, modular, CHP products that reduce energy costs, carbon emissions, and dependence on the electric grid. Tecogen’s products allow customers to produce power on-site in parallel with the electric grid or stand alone when no utility grid is available via an inverter-based black-start capability. Because our CHP systems also produce clean, usable heat energy, they provide economic advantages to customers who can benefit from the use of hot water, chilled water, air conditioning and heating.

We also sell energy in the form of electricity, heat, hot water and cooling to customers under long-term energy sales agreements (with standard terms of 10 to 15 years). The typical sales model is to install and own energy systems in customers' buildings and sell the energy produced by those systems back to the customers at a cost set by a negotiated formula in customer contracts. We call this our "On-Site Utility" business, or our Energy Production segment.

Traditional customers for our cogeneration and chiller systems include hospitals, nursing homes, schools, universities, health clubs, spas, hotels and motels, office and retail buildings, food and beverage processors, multi-unit residential buildings, laundries, ice rinks, swimming pools, factories, municipal buildings, indoor agriculture, and military installations; however, the economic feasibility of using our systems is not limited to these customer types. Our refrigeration compressors are applied primarily to industrial applications that include cold storage, wineries, dairies, ice rinks and food processing. Market drivers include the price of natural gas, local electricity rates, environmental regulations, and governmental energy policies, as well as customers’ desire to become more environmentally responsible.

Through our factory service centers in California, Connecticut, Florida, Massachusetts, Michigan, New Jersey, New York, and Toronto, Canada, our specialized technical staff maintains our products via long-term service contracts. To date we have shipped over 3,000 units, some of which have been operating for almost 35 years. We established a service center in Toronto, Canada in August 2020 to support our existing population of chillers and cogeneration units and 26 units sold in the area during 2020 to serve public housing facilities.

Our CHP technology uses low-cost, mass-produced engines, which we modify to run on natural gas. In the case of our mainstay cogeneration and chiller products, the engines have proven to be cost-effective and reliable. In 2009, in response to the changing regulatory requirements for stationary engines, our research team developed an economically feasible process for removing air pollutants from the engine exhaust. This technology's U.S. and foreign patents were granted beginning in October 2013 with other domestic and foreign patents granted or applications pending. Branded Ultera®, the ultra-clean emissions technology repositions our engine driven products in the marketplace, making them comparable environmentally with other technologies such as fuel cells, but at a much lower cost and greater efficiency. Because of this breakthrough design for emissions control, multiple Tecogen natural gas-fueled CHP modules fitted with the patented Ultera control technology have been permitted to the current regulatory limits in the Los Angeles area. In 2018, a group of natural gas engine-generators up fitted with the Ultera system were successfully permitted in the same Los Angeles region to unrestricted operation, the first natural gas engines to do so without operating time limits or other exemption. These engines were permitted to levels matching the California Air Resources Board ("CARB") stringent 2007 emissions requirements, the same emissions standard used to certify fuel cells, and the same emissions levels as a state-of-the-art central power plant. We now offer our Ultera emissions control technology as an option on all our products or as a stand-alone application for the retrofitting of other rich-burn spark-ignited reciprocating internal combustion engines such as the engine-generators described above.

Our products are designed as compact modular units that are intended to be installed in multiples when utilized in larger CHP plants. The majority of our CHP modules are installed in multi-unit sites with applications ranging up to 12 units. This approach has significant advantages over utilizing single larger units, allowing building placement in constrained urban settings and redundancy to mitigate service outages. Redundancy is particularly relevant in regions where the electric utility has formulated tariff structures that include high “peak demand” charges. Such tariffs are common in many areas of the country, and are applied by such utilities as Southern California Edison, Pacific Gas and Electric, Consolidated Edison of New York, and National Grid of Massachusetts. Because these tariffs are assessed based on customers’ peak monthly demand charge over a very short interval, typically only 15 minutes, a brief service outage for a system comprised of a single unit can create a high demand charge, and therefore be highly detrimental to the monthly savings of the system. For multiple unit sites, the likelihood of a full system outage that would result in a high demand charge is dramatically reduced, consequently, these customers have a greater probability of capturing peak demand savings.

Our CHP products are sold directly to customers by our in-house marketing team, and by established sales agents and representatives.

We install, own, operate and maintain complete distributed generation, or DG systems (or energy systems), and other complementary systems at customer sites, and sell electricity, hot water, heat and cooling energy under long-term contracts at prices guaranteed to the customer to be below conventional utility rates. As of December 31, 2020 we had 34 operational energy systems, representing an aggregate of approximately 2,220 kilowatts of electrical capacity from cogeneration units and 880 cooling ton capacity from chillers (kilowatts is a measure of electric power capacity of our cogeneration machines; tonnage is a measure of the cooling capacity of our chillers). The capacity of both system categories has been reduced from 2019 because of the sale of approximately 30% of the our DG fleet in late 2018 and early 2019 and, the reduction in customer sites due to contract expirations, permanent customer site closings and reduced energy consumption by certain customers due to temporary facilities closings due to COVID-19 impact.

Our operations are comprised of two business segments. Our Products and Services segment designs, manufactures and sells industrial and commercial cogeneration systems as described above. Our Energy Production segment sells energy in the form of electricity, heat, hot water and cooling to our customers under long-term sales agreements.

Products and Services

Our Products and Services segment which designs, manufactures and sells industrial and commercial cogeneration systems as described above, represented 93.5% and 90.6% of our consolidated revenues for the years ended December 31, 2020 and 2019, respectively. See Note 17 "Segments" of the Notes to the Consolidated Financial Statements. Our products and services are described below.

Our Products

We manufacture natural gas engine-driven cogeneration systems, heat pumps, and chillers, all of which are CHP products that deliver more than one form of energy. Our cogeneration products are all standard, modular units that come pre-packaged from our factory for ease of installation at a customer’s site. The package incorporates the engine, generator, heat-recovery equipment, system controls, electrical switchgear, emission controls, and a data controller for remote monitoring and data transmission; minimizing the cost and complexity of installing the equipment at a site. This packaged, modular system simplifies CHP technology for small to mid-sized customers who typically are less experienced with the implementation and benefits of a CHP system.

Traditionally, our cogeneration systems and most of our chillers have utilized the same engine, the TecoDrive 7400 model. This is an engine modified by us to use natural gas fuel. In 2017, we introduced a new, slightly larger engine into certain products with advanced features, including improved efficiency and an advanced ignition system. The CHP products utilizing the new engine are the InVerde e+® and the TecoPower® models CM-60 and CM-75. The new engine and the older TecoDrive model share custom features that enhance durability and efficiency, many of which date from our extensive research with engine manufacturers and the gas industry, including the Gas Research Institute. For the Ilios water heater, we introduced a technologically advanced Ford engine that is enhanced for industrial applications.

Our commercial product lines include:

•the InVerde e+® and TecoPower® cogeneration units;

•TECOCHILL® air-conditioning and refrigeration chillers;

•Tecofrost® gas engine-driven refrigeration compressors;

•Ilios® high-efficiency water heaters; and

•Ultera® emissions control technology.

InVerde Cogeneration Units

Our premier cogeneration product has been the InVerde, a 100-kW CHP system that not only provides electricity and hot water, but also satisfies the growing customer demand for operation during a utility outage, commonly referred to as “black-start” capability. Our exclusively licensed microgrid technology (see “Intellectual Property” below) enables our InVerde CHP products to provide backup power in the event of power outages that may be experienced by local, regional, or national grids. In 2017, we introduced an extensively redesigned version of the unit, the InVerde e+, which includes a state of the art power conversion system, more effective acoustic treatment, and the larger, more efficient engine. The InVerde e+ includes variations with power ratings from 50kW to 125kW.

The InVerde e+ incorporates an inverter, which converts direct current, or DC, electricity to alternating current, or AC. With an inverter, the engine and generator can run at variable speeds, which maximizes efficiency at varying loads. The inverter then converts the generator’s variable output to the constant-frequency power required by customers in 50 or 60 Hertz.

This inverter technology was developed originally for solar and wind power generation. We believe that the InVerde is the first commercial engine-based CHP system to use an inverter. Electric utilities accept inverter technology as “safe” by virtue of its certification to the Underwriters Laboratory interconnection standard 1741. Our InVerde has earned this certification which qualifies our product for a much simpler permitting process nationwide and is mandatory in some areas such as New York City and California, a feature we consider to be a competitive advantage. The inverter also improves the CHP system’s efficiency at partial load, when less heat and power are needed by the customer.

In 2018, the InVerde e+ was certified to the more technically advanced UL 1741SA. The “SA” or “smart inverter” certification is for systems incorporating more advanced safety features and operating modes which can help support the grid on demand when strained. Upcoming SA requirements will require additional certification primarily involving standard communication protocols which will be available to the utility when enlisting grid support. We believe future utility programs which involve command and control of smart inverter assets on their grid will be an important change in how distributed generation is valued by utilities and may offer additional revenue to our customers.

The InVerde`s black-start feature addresses a crucial demand from commercial and institutional customers who are increasingly concerned about utility grid blackouts and brownouts, natural disasters, security threats, and antiquated utility infrastructure. Multiple InVerde units can operate collectively as a stand-alone microgrid, which is a group of interconnected loads served by one or more power sources. The InVerde is equipped with software that allows a cluster of units to seamlessly share the microgrid load without complex controls; a proprietary cost advantage for multiple modules at a single location.

The InVerde CHP system was developed in 2007 and began shipping in 2008. Our largest InVerde installation utilizes 12 units, which supply 1.2 MW of on-site power and about 8.5 million Btu/hr of heat (700,000 Btu/hr per unit).

TECOGEN Cogeneration Units

Our TECOGEN cogeneration system is the original model introduced in the 1980s. It is available in sizes of 60 kW and 75 kW and is capable of producing up to 500,000 Btu/hr of hot water. This technology is based on a conventional single-speed generator. It is meant only for grid-connected operation and is not universally accepted by utilities for interconnection, in contrast to the InVerde. Although this cogeneration product has the longest legacy and largest installed population, much of its production volume has been supplanted by the InVerde and its broader array of product features. In 2017, we introduced an upgraded version of the 60kW and 75kW models under the new name TecoPower. The key features of the TecoPower models are the larger engine with improved efficiency, advanced ignition system, more effective acoustic aftertreatment, and the ability to operate even at the very low gas supply pressures in New York City with a pressure booster.

TECOCHILL Chillers

Our TECOCHILL natural gas engine-driven chillers are available in capacities ranging from 25 to 400 tons, with the smaller units air-cooled and the larger ones water-cooled. The engine drives a compressor that makes chilled water, while the engine’s free waste heat can be recovered to satisfy the building’s needs for heat or hot water. This process is sometimes referred to as “mechanical” cogeneration, as it generates no electrical power, and the equipment does not have to be connected to the utility grid.

A gas-fueled chiller provides enough air conditioning to avoid most of the utility’s seasonal peak charges for electric usage and capacity. In summer, when electric rates are at their highest, natural gas is “off-peak” and quite affordable, allowing TECOCHILL® customers to avoid typically higher summer-time “peak-usage” electric rates. Gas-fueled chillers also free up the building’s existing electrical capacity to use for other loads and can operate on minimal electric load in case of electric grid blackout; a key feature for customers concerned about load demand on backup power generators.

Tecofrost Gas Engine Refrigeration Compressors

In 2019, we introduced the Tecofrost line of gas-engine driven refrigeration compressors. This product was developed in collaboration with an established manufacturer of conventional electric-driven refrigeration compressors, the Vilter division of the Emerson Electric Company. Under our agreement with Vilter, their factory supplies the basic compressor skid to Tecogen whereby we add the engine-drive, controls and heat recovery systems which we sell. In industrial settings, the common method of cooling, especially in sub-freezing spaces and processes, utilizes several of these compressors arrayed in groups that distribute compressed ammonia through the facility in piping networks. These applications include cold storage, bottling operations, ice making, wineries, and many industrial processes. The Tecofrost product offers the same benefits as our Tecochill chillers, a substantially reduced operating cost in supplanting low cost natural gas for expensive electricity while providing hot water at no additional cost for onsite processes. With the waste heat utilization, the carbon footprint of the process is substantially reduced from the conventional electric alternative.

The low-emissions capability of Ultera and the dramatic increase in natural gas availability and reduction in pricing in recent years has significantly improved the viability of the Tecofrost product line much like our chillers.

Ilios High-Efficiency Water Heaters

We have developed several heat pumps under the Ilios brand name including a High Efficiency ("HE") Air-Source Water Heater, HE Water-Sourced Water Heater, and HE Air-Sourced “Split System” Water Heater. Our water heater products operate like an electric heat pump, but use a natural gas engine instead of an electric motor to power the system. The Ilios® high-efficiency water heater uses a heat pump which captures warmth from outdoor air even if it is moderately cool outside. Heat pumps work somewhat like a refrigerator, but in reverse. Refrigerators extract heat from inside the refrigerator and move it outside the refrigerator while heat pumps extract heat from outside and move it indoors.

The gas engine’s waste heat is recovered and used in the process, unlike its electric counterpart, which runs on power that has already lost its waste heat. This means that the heat being captured from outdoors is supplemented by the engine’s waste heat, which increases the efficiency of the process. The net effect is that an Ilios heat pump’s efficiency surpasses that of conventional boilers for water heating. Gas engine heat pumps can deliver efficiencies in excess of 200%.

Similarly, if used for space heating, the engine-powered heat pump is more efficient than an electric heat pump because heat is recovered and used for other building processes. The product’s higher efficiency translates directly to lower fuel consumption and, for heavy use customers, significantly lowers operating costs when compared with conventional equipment.

In 2013, a water-sourced model of the heat pump was added to our product line. This heat pump captures heat from a water source such as a geothermal well or from a pre-existing chilled water loop in the facility; the latter configuration provides simultaneous heating and cooling benefits, doubling the effect.

Following on the success of the water-sourced model, in early 2015 a 'split system' Ilios model was introduced. The new split system offers increased flexibility because its air-source evaporator package can be installed remotely. The engine driven heat pump, which is contained in a small acoustic enclosure, can be located within a building's mechanical space while the quiet air-source evaporator package can be installed on a roof or in any outdoor space. The outdoor evaporator component is connected to the indoor heat pump via refrigerant lines, therefore eliminating all freeze protection issues in colder climates. All of the water being heated remains inside the conditioned space, eliminating the need for a costly isolation heat exchanger and additional pumps, which simplifies installation and increases efficiency because it can operate at a lower delivery temperature.

The heat pump water heater serves as a boiler, producing hot water for drinking and washing, space heating, swimming pools, or other building loads. Energy cost savings to the customer depend on the climate. Heat pumps in general, whether gas or electric, perform best in moderate weather conditions although the performance of the Ilios water-source heat pump is not impacted by weather or climate conditions. In a typical building, the Ilios heat pump is added on to an existing heating or water heating system and operates as many hours as possible. The conventional boiler is left in place but serves mainly as a backup when the heat pump’s engine is down for maintenance or when the heat pump cannot meet the building’s peak heating load. In areas where low electric rates make CHP less economical, the Ilios heat pump may be a financially attractive alternative because its economics depend only on natural gas rates. In some areas with high electric rates, the Ilios option may have advantages over CHP; for example, where it is hard to connect to the utility grid or where the building’s need for electricity is too low for CHP to be economically advantageous.

Ultera Low-Emissions Technology

All of our CHP products are available with the patented Ultera® low-emissions technology as an equipment option. This breakthrough technology was developed in 2009 and 2010 as part of a research effort partially funded by the California Energy Commission and Southern California Gas Company. The objective was to bring our natural-gas engines into compliance with California’s stringent air quality standards.

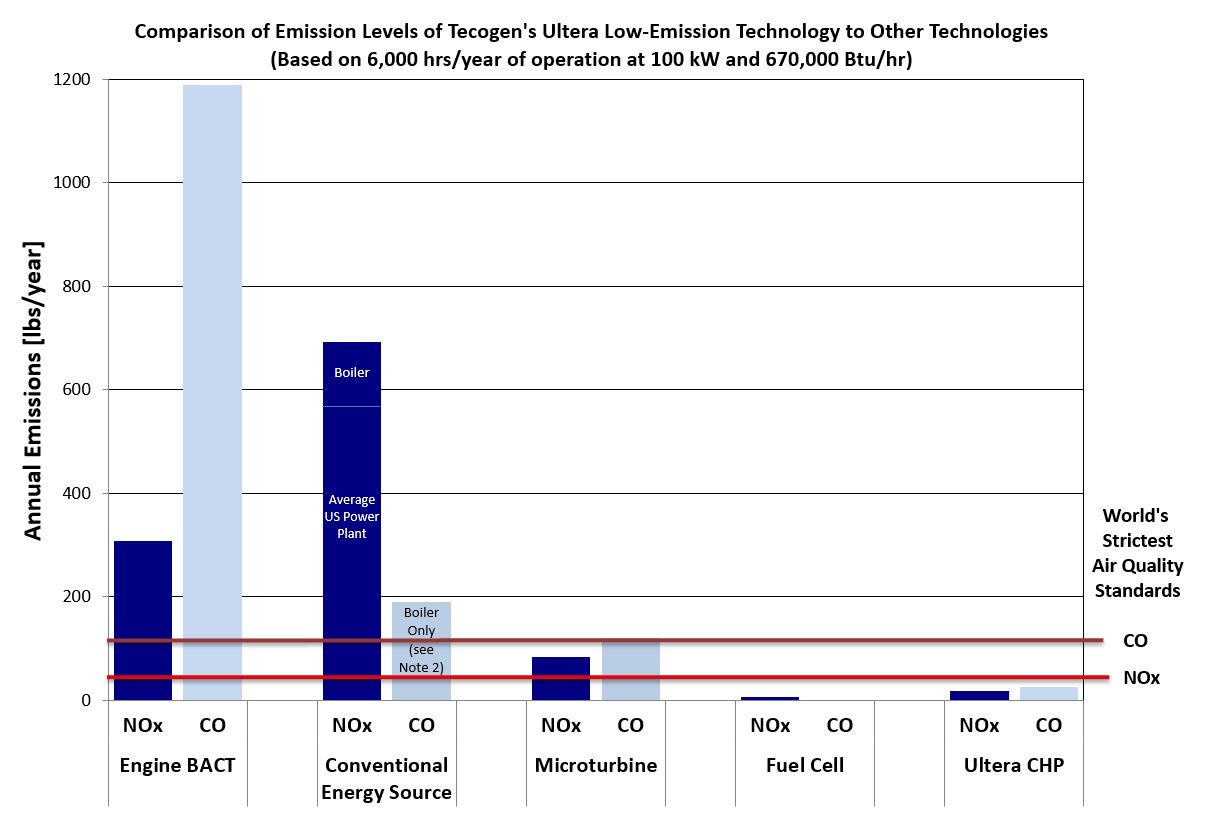

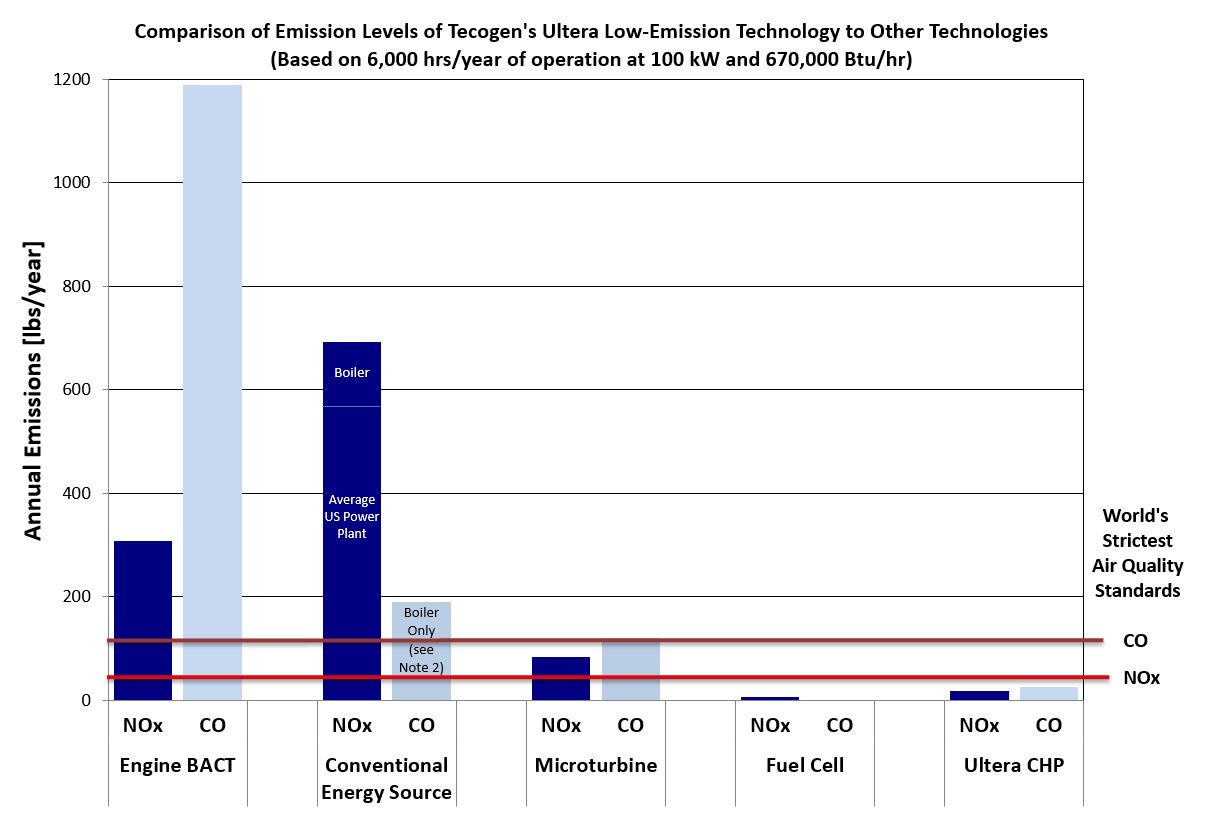

The chart below compares emission levels of our Ultera technology to other technologies. As of December 31, 2020, our Ultera CHP and fuel cell technologies are the only technologies that we know of which comply with California's air quality standards for CO and NOx, represented in the chart by the colored horizontal lines, shown as the world's strictest air quality standards on the lower right of the chart.

(5) (2) (4) (4) (3) (1)

(1) California has the strictest air quality standards for engines in the world

(2) Conventional Energy Source is U.S. power plant and gas boiler. Average U.S. power plant NOx emission rate of 0.9461 lb/MWh from (USEPA eGrid 2012),

CO data not available. Gas boiler efficiency of 78% (www.eia.gov) with emissions of 20 ppm NOx @ 3% O2 (California Regulation SCAQMD Rule 1146.2

and <50 ppmv CO @ 3% O2 (California Regulation SCAQMD BACT).

(3) Tecogen emissions based upon actual third party source test data.

(4) Microturbine and Fuel Cell emissions from EPA CHP Partnership - Catalog of CHP Technologies- March 2015.

(5) Stationary Engine BACT as defined by SCAQMD.

Through development of a two-stage catalyst emission treatment system, we were able to meet or exceed the strict air quality regulations with a solution that is cost-effective, robust, and reliable. Inclusion of the patent-protected Ultera low-emissions technology as an option keeps our CHP systems compliant with air quality regulations. The first commercial CHP units equipped with Ultera low-emissions technology shipped to a California utility in 2011. We conducted three validation programs for this technology:

1.Third-party laboratory verification. The AVL California Technology Center, a long-standing research and technology partner with the international automotive industry, confirmed our results in their state-of-the-art dynamometer test cell, which was outfitted with sophisticated emissions measurement equipment.

2.Verifying longevity and reliability in the field. By equipping one of our 75 kW units, already operating at a customer location in Southern California with the Ultera low-emissions technology and a device to continuously monitor emissions we verified longevity and reliability. The Ultera low-emissions system operated successfully for more than 25,000 hours, approximately 3.5 years, and consistently complied with California’s stringent emission standards over the entire field testing period.

3.Additional independent tests. During the field test, two companies licensed in California to test emissions each verified our results at different times. The results from one of these tests, obtained in August 2011, enabled us to

qualify for New Jersey’s fast-track permitting. Virtually every state nationwide requires some kind of permit related to local air quality, but New Jersey allows an exemption for systems such as ours that demonstrate superior emissions performance. This certification was granted in November 2011, and since then we have sold Ultera low-emissions systems to customers in this territory.

In 2012, a 75 kW CHP unit equipped with the Ultera system became our first unit to obtain a conditional air permit (i.e., pending a third party source test to verify compliance) in Southern California since the strict regulations went into effect in 2009. A state-certified source test, administered in January 2013, verified that our emissions levels were well below the new permitting requirements, and the final permit was approved in August 2013.

Standby Generators

After successfully developing the Ultera technology for our own equipment, our research and development team began exploring other possible emissions control applications in an effort to expand the market for the ultra-clean emissions system. Retrofit kits were developed in 2014 for other stationary engines and in 2015 the Ultera Retrofit Kit was applied successfully to natural gas stand-by generators from other manufacturers, including Generac and Caterpillar.

Historically, standby generators have not been subjected to the strict air quality emissions standards of traditional power generation. However, generators which run for more than 200 hours per year or run for non-emergency purposes (other than routine scheduled maintenance) in some territories are subject to compliance with the same stringent regulations applied to a typical electric utility. As demand response programs become more economically attractive and air quality regulations continue to become more stringent, there could be strong demand for retrofitting standby generators with our Ultera® emissions control technology, thus providing a cost-effective solution to keeping the installed base of standby generators operational and in compliance.

In 2017, a group of generators owned by a single customer in Southern California were supplied Ultera kits because of their particular requirement to exceed the 200-hour annual limit. These units are now operational and have been tested by the customer and shown to be compliant with the local pollution limits which we believe to be the strictest anywhere in the United States, and potentially the world. Our CHP products have been permitted to this same standard. However, CHP products are given a heat credit which effectively increases the allowable limit. In 2018, permitting was completed making these certification levels the lowest we have achieved. We believe no other engines have been certified to these levels since the latest regulations in the Los Angeles region became effective ten years ago.

It is noteworthy that these engine-generators were applied to powering dispersed loads in a fire-prone area where frequent de-energizing of the electric overhead power lines is required for safety. The company believes this application to be a new and significant application for the Ultera technology in California in light of the widely publicized widespread outages in California in 2019 and 2020 for precisely this same reason.

Biogas

The Ultera emissions control technology developed by our engineering team applies specifically to rich-burn, spark-ignited, internal combustion engines. While originally intended for natural gas-powered engines, we believe that our technology may be adapted for other fuel types as long as the engine meets the rich-burn criteria.

In 2015, the Ultera system was applied to a biogas powered engine operating at the Eastern Municipal Water District’s (EMWD) Moreno Valley Region Water Reclamation Facility in Perris, California. The demonstration project was a result of an ongoing collaboration between Tecogen, the EMWD and various other partners, and successfully applied an Ultera Retrofit Kit to a 50-liter Caterpillar engine fueled by biogas extracted from an anaerobic digester.

Biogas is a significant byproduct of wastewater treatment plants. Considered to be a renewable source of fuel, it is becoming an increasingly important resource for power generation. According to the American Biogas Council, nationwide there are over 1,100 engines fueled by wastewater-derived biogas, over 600 fueled by landfill-generated biogas, and over 100 running on biogas from agricultural waste. This represents a significant potential market for the Ultera Retrofit Kit application as these biogas engines become subject to the same air quality standards as traditional power generation sources.

Automotive Emissions Control

In October 2015, following revelations of wide-scale problems with vehicle emissions compliance and testing, we formed an Emissions Advisory Committee to examine the potential application of Ultera to the automotive gasoline market. According to the U.S. EPA, 50 percent of nitrogen oxides (NOx) and 60 percent of all carbon monoxide (CO) emissions in the United States come from vehicle exhaust. The Ultera® emission control system is designed to target both NOx and CO. After a

thorough investigative process on the part of the Emissions Advisory Committee and various industry expert consultants, the group recommended that we pursue a funded initiative to develop the technology for gasoline vehicles.

In December 2015, we formed a joint venture company with a group of strategic investors, Ultra Emissions Technologies, Ltd. ("Ultratek"), to advance the Ultera near-zero emissions technology for adaptation to transportation applications powered by spark-ignited rich-burn engines in the automobile and truck categories. We granted Ultratek an exclusive license for the development of its patented emissions-related intellectual property for the vehicle market.

Initially, Ultratek's focus was on preliminary research, testing, and verification that the Ultera technology can in fact be applied to gasoline engines while maintaining similar near-zero emission results as have been demonstrated in other use cases. After we completed multiple phases of testing at AVL's California Technology Center, the Ultratek team verified the viability of the Ultera technology for gasoline automotive use.

On October 24, 2017, Ultratek was dissolved due to varying opinions regarding next steps toward potential commercialization. Upon dissolution, Ultratek's remaining cash was disbursed in accordance with the joint venture agreement, first to a return of our cash investment of $2,000,000, with the remainder distributed on a pro rata basis to the strategic investors. Additionally, the license we originally granted to Ultratek reverted back to us, and we purchased all of the remaining Ultratek assets and intellectual property that Ultratek had created for a total purchase price of $400,000.

On November 28, 2017, we formed Ultera Technologies, Inc. as a wholly owned subsidiary to continue the effort toward commercialization that was begun by Ultratek. Ultera Technologies Inc. was dissolved in 2018 and we continue the research and development relating to prototypes for commercialization within Tecogen. If successfully developed, the market for automotive emissions control could be a source of future growth for us; although it could take years to realize that goal, and there is no assurance that such efforts will be successful.

Fork-Truck Research

In October 2016, we were awarded a Propane Education & Research Council (“PERC”) research grant funding our proposal to develop the Ultera ultra-clean emissions control technology for the propane powered fork truck market.

Electric fork trucks have been making significant in-roads in the fork truck industry, in part, because of their green image and indoor air quality benefit. The primary benefit of the Ultera-equipped ultra-clean propane fork truck will be fuel cell like emissions with a robust indoor air quality advantage without compromising vehicle performance. The project will assess the adaption of the Ultera near-zero emissions technology for the fork truck category and demonstrate the technical performance on popular propane fork truck models. In 2018, the PERC funded portion of the project concluded successfully and Mitsubishi Caterpillar Forklift America (“MCFA”), a major supplier in North and South America, which provided technical and marketing support and supplied a test truck, reviewed the results and decided to move forward with the program. In 2019, engineers from MCFA collaborated with our research staff to finalize the engine tuning for optimization of the Ultera process. This work was successful with the end-result demonstrating highly improved emissions levels for the fork truck, which we expect to be capable of reaching our goal of obtaining California’s “Near-Zero” certification. Currently, we are preparing with MCFA for third party engine testing of a base engine to prove that the retuning performance works equally well in the test protocol required for certification (forklift engines are certified by dynamic testing of the base engine on a dynamometer rather than by operation in an actual fork truck). PERC has agreed to fund this step, a precursor to actual certification, which, if successful we hope will lead to achievement of the our ultimate goal, commercialization of the Ultera system by MCFA.

Management believes that approximately 70,000 propane powered fork trucks are sold annually in the United States. Successful completion of this project could open a new emissions control market to us.

Other Ultera Applications

According to a 2013 Massachusetts Institute of Technology study, the U.S. experiences 200,000 early deaths each year due to emissions from heavy industry, transportation, and commercial and residential heating. As climate change and air quality continue to develop as areas of focus for government regulators, emissions restrictions are expected to become increasingly stringent around the world. These tightening regulations could open up new markets and applications for the Ultera near-zero emissions control technology. These opportunities may include:

•commercial and industrial natural gas fueled engines from other manufacturers;

•natural gas and biogas powered vehicle fleets - such as municipal bus fleets; and

•gensets for non-emergency applications such as forced utility outages for fire safety.

Product Service

We provide long-term maintenance contracts, parts sales, and turnkey installation for our products through a network of eleven well-established field service centers in California, the Midwest, the Northeast, the Southeast and in Ontario, Canada. These centers are staffed by our full-time technicians, working from local leased facilities. The facilities provide office and warehouse space for inventory. We encourage our customers to provide internet connections to our units so that we may maintain remote monitoring and communications with the installed equipment. For connected installations, the machines are contacted daily to download their status and provide regular operational reports (daily, monthly, and quarterly) to our service managers. This communications link is used to support the diagnostic efforts of our service staff, and to send messages to pre-programmed phones if a unit has experienced an unscheduled shutdown. In many cases, communications received by service technicians from connected devices allow for proactive maintenance, minimizing equipment downtime and improving operating efficiency for the customer.

The work of our service managers, supervisors, and technicians focuses on our products. Because we manufacture our own equipment, our service technicians bring hands-on experience and competence to their jobs. They are trained at our corporate headquarters and primary manufacturing facility in Waltham, Massachusetts.

Most of our service revenue is in the form of annual service contracts, which are typically of an all-inclusive “bumper-to-bumper” type, with billing amounts proportional to the equipment's achieved operating hours for the period. Customers are thus invoiced in level, predictable amounts without unforeseen add-ons for such items as unscheduled repairs or engine replacements. We strive to maintain these contracts for many years, and work to maintain the integrity and performance of our equipment.

Our products have a long history of reliable operation. Since 1995, we have had a remote monitoring system in place that connects to hundreds of units daily and reports their “availability,” which is the amount of time a unit is running or is ready to run. More than 80% of the units operate above 90% availability, with the average being 93.8%. Our factory service agreements have directly impacted these positive results and represent an important long-term annuity-like stream of revenue for us.

New equipment sold beginning in 2016 and select upgrades to the existing installed equipment fleet include an industrial internet solution which enables Tecogen to collect, analyze, and manage valuable asset data continuously and in real-time. This provides the service team with improved insight into the functionality of our installed CHP fleet. Specifically, it enables the service department to perform remote monitoring and diagnostics and to view system results in real time via a computer, smart phone or tablet. Consequently, we can better utilize monitoring data ensuring customers are capturing maximum possible savings and efficiencies from their installation. Through constant monitoring and analysis of equipment data, Tecogen expects to enhance the performance of installed equipment by ensuring machinery consistently operates at peak performance and is available to deliver maximum potential value for customers. In 2018 we migrated our cloud based system from the General Electric's Company's Equipment Insight product to our in-house developed system that we have trade named CHP Insight®. CHP insight stores operating data on the cloud like the GE system but we have added improved user interface features specific to CHP operation as well as sophisticated data analysis tools. Management believes that similar monitoring solutions are available from other alternative sources.

Energy Production

Our Energy Production segment sells energy in the form of electricity, heat, hot water and cooling to our customers under long-term sales agreements which represented 6.5% and 9.4% of our consolidated revenues for the years ended December 31, 2020 and 2019, respectively. See Note 17 "Segments" of the Notes to the Consolidated Financial Statements

On-Site Utility

We distribute, own and operate clean, on-site energy systems that produce electricity, hot water, heat, and cooling. Our business model is to own the equipment that we install at customers' facilities and to sell the energy produced by these systems to customers on a long-term contractual basis. We call this business the “On-Site Utility” and offer natural gas-powered cogeneration systems that are reliable and energy efficient. We utilize energy equipment we supply or that are supplied by other cogeneration manufacturers. Our cogeneration systems produce electricity from an internal combustion engine driving a generator, while the heat from the engine and exhaust is recovered and typically used to produce heat and hot water for use on-site. Also, we distribute and operate water chiller systems for building cooling applications that operate in a similar manner, except that the engines in the water chiller systems drive a large air-conditioning compressor while recovering heat for hot water.

Cogeneration systems reduce the amount of electricity that a customer must purchase from the local utility and produce valuable heat and hot water on-site to use as required. By simultaneously providing electricity, hot water and heat,

cogeneration systems also have a significant positive impact on the environment by reducing the carbon dioxide, or CO2, produced by replacing a portion of the traditional energy supplied by the electric grid and conventional hot water boilers. Distributed generation of electricity, or DG, often referred to as cogeneration systems or combined heat and power systems, or CHP, is an attractive option for reducing energy costs and increasing the reliability of available energy. DG has been successfully implemented by others in large industrial installations over 10 Megawatts ("MW"), where the market has been growing for a number of years and is increasingly being accepted in smaller sized units because of technology improvements, increased energy costs, and better DG economics. We believe that our target market for DG, users of up to 1 MW, has been barely penetrated and that the reduced reliability of the utility grid, increasing cost pressures experienced by energy users, advances in new, low cost technologies, and DG-favorable legislation and regulation at the state and federal level will drive our near-term growth and penetration of this market.

We believe that the primary opportunity for DG energy and equipment sales is in regions of the U.S. where commercial electricity rates exceed $0.12 per kW hour, or kWh, which is predominantly in the Northeast and California. Attractive DG economics are currently attainable in applications that include hospitals, nursing homes, multi-tenant residential housing, hotels, schools, colleges, recreational facilities, food processing plants, dairies, and other light industrial facilities. We also believe that the largest number of potential DG users in the U.S. require less than 1 MW of electric power and less than 1,200 tons of cooling capacity. We are able to design our systems to suit a particular customer's needs because of our ability to place multiple units at a site. This approach is part of what allows our products and services to meet changing power and cooling demands throughout the day (also from season-to-season) and greatly improves efficiency.

Sales & Distribution

Our products are sold directly to end-users by our sales team and by established sales agents and representatives. We have agreements with 23 distributors and outside sales representatives who are compensated by commissions for designated territories and product lines. For each of the fiscal years ended December 31, 2020 and 2019, we had a customer relationship accounting for more than 10% of our total revenue, though not the same customer.

Our product sales cycle exhibits typical seasonality for the HVAC industry with sales of chillers generally stronger in the warmer months while heat pump sales are stronger in the cooler months. Our products are sold directly to end-users by our sales team and by established sales agents and representatives. We have entered into various agreements with distributors and outside sales representatives who are compensated on a commission basis for certain territories and product lines. Our product sales cycle exhibits typical seasonality for the HVAC industry with sales of chillers generally stronger in the warmer months while heat pump sales are stronger in the cooler months.

Markets and Customers

Worldwide, stationary power generation applications vary from huge central stationary generating facilities (traditional electric utility providers) to back-up generators as small as 2 kW. Historically, power generation in most developed countries such as the United States has been part of a regulated central utility system utilizing high-temperature steam turbines powered by fossil-fuels. This turbine technology, though steadily refined over the years, reached a maximum efficiency (where efficiency means electrical energy output per unit of fuel energy input) of approximately 40%.

A number of developments related primarily to the deregulation of the utility industry as well as significant technological advances have now broadened the range of power supply choices available to all types of customers. CHP, which harnesses waste energy from power generation processes and puts it to work for other uses on-site, can boost the energy conversion efficiency to nearly 90%, a better than two-fold improvement over the average efficiency of a fossil fuel plant. This distributed generation, or power generated on-site at the point of consumption rather than power generated centrally, eliminates the cost, complexity, and inefficiency associated with electric transmission and distribution. The implications of the CHP distributed generation approach are significant. Management believes that if CHP were applied on a large scale, global fuel usage might be dramatically curtailed and the utility grid made far more resilient.

Our CHP products address the inherent efficiency limitation of central power plants by siting generation close to the loads being served. This allows customers with energy-intensive buildings or processes to reduce energy costs and operate with a lower carbon footprint. Furthermore, with technology we have introduced, like the Ultera low-emissions technology, our products can now contribute to better air quality at the local level while complying with the strictest air quality regulations in the United States.

Cogeneration and chiller products can often reduce the customer’s operating costs (for the portion of the facility loads to which they are applied) by approximately 30% to 60% based on our estimates, which provides an excellent rate of return on the equipment’s capital cost in many areas of the country with high electricity rates. Our chillers are especially suited to regions where utilities impose extra charges during times of peak usage, commonly called “demand” charges. In these cases, the gas-fueled chiller reduces the use of electricity during the summer, the costliest time of year.

On-site CHP not only eliminates the loss of electric power during transmission, but also offsets the capital expense of upgrading or expanding the utility infrastructure. The national electric grids of many developed countries are already challenged to keep up with existing power demand. In addition, the transmission and distribution network is operating at capacity in a majority of urban areas. Decentralizing power generation by installing equipment at customer sites not only relieves the capacity burden on existing power plants, but also lessens the burden on transmission and distribution lines. This ultimately improves the grid’s reliability and reduces the need for costly upgrades.

Increasingly favorable economic conditions may improve our business prospects domestically and abroad. Specifically, we believe that natural gas prices are expected to increase from their historically depressed values, but only modestly, while electric rates are expected to continue to rise over the long-term as utilities pay for grid expansion, better emission controls, efficiency improvements, and the integration of renewable power sources.

Most potential new customers in the U.S. require less than 1 MW of electric power and less than 1,200 tons of cooling capacity. We are targeting customers in states with high electricity rates in the commercial sector, such as California, Connecticut, Massachusetts, New Hampshire, New Jersey, and New York. Most of these states also have high peak demand rates, which favor utilization of our modular units in groups so as to assure redundancy and peak demand savings. Governmental agencies in some of these regions may also provide generous rebates that can improve the economic viability of our systems.