As filed with the Securities and Exchange Commission on June 23, 2022.

| | |

| Registration No. 333-_____ |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------------------

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

----------------------------------

TECOGEN INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 04-3536131 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer identification number) |

45 First Avenue, Waltham, MA 02451

(Address of principal executive offices and zip code)

----------------------------------

Tecogen Inc. 2022 Stock Incentive Plan

(Full title of the plan)

----------------------------------

John K. Whiting, IV, Esq.

General Counsel

Tecogen Inc.

45 First Avenue

Waltham, MA 02451

Telephone: (781) 466-6400

(Name, address and telephone number, including area code, of agent for service)

With a copy to:

Neil R.E. Carr

Somertons, PLLC

1025 Connecticut Avenue, N.W., Suite 1000

Washington, D.C. 20036

Telephone: (202) 459-4651

-------------------------------------

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer

Smaller reporting company Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY NOTE

This Registration Statement on Form S-8 (“Registration Statement”) is being filed by Tecogen Inc., a Delaware corporation (“Tecogen,” “Company,” “we,” “our,” or “us”) relating to 3,800,000 shares of common stock, $.001 par value per share (“common stock”), of Tecogen issuable upon exercise of stock options and stock grants awarded pursuant to the Tecogen Inc. 2022 Stock Incentive Plan (“2022 Plan”) and includes two separate prospectuses:

•Section 10(a) Prospectus: Items 1 and 2 of Part I, and the documents incorporated by reference in response to Item 3 of Part II, of this Registration Statement, constitute a prospectus meeting the requirements of Section 10(a) of the Securities Act of 1933, as amended (“Securities Act”), relating to up to 3,800,000 shares of our common stock issuable pursuant to the 2022 Plan.

•Reoffer Prospectus: The material that follows Item 2 of Part I, up to, but not including, Part II of this Registration Statement constitutes a “Reoffer Prospectus” prepared in accordance with the requirements of Part I of Form S-3 under the Securities Act. Pursuant to Instruction C of Form S-8, the Reoffer Prospectus may, in the future, be used for reoffers and resales, on a continuous or delayed basis, of shares of our common stock that are deemed “control securities” under the Securities Act and which will be acquired pursuant to grants or awards under the 2022 Plan by the selling shareholders named in the Reoffer Prospectus or in a supplement thereto and who are, or may be deemed to be, “affiliates” within the meaning set forth in Rule 405 under the Securities Act. Such selling shareholders may reoffer or resell all, a portion, or none of the shares that they may acquire pursuant to the 2022 Plan. Pursuant to Rule 424(b) under the Securities Act, we will supplement the Reoffer Prospectus with the number of shares of common stock, if any, to be reoffered or resold by such selling shareholders as that information becomes known.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

This Registration Statement on Form S-8 is being filed to register 3,800,000 shares of common stock of Tecogen which have been reserved for issuance under the 2022 Plan.

The documents containing the information specified in Part I, Items 1 and 2, of this Registration Statement have been or will be delivered to participants in the 2022 Plan in accordance with Form S-8 and Rule 428(b)(1) under the Securities Act. In accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) and the instructions to the Form S-8, such documents are not being filed with the SEC either as part of this Registration Statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

We will provide to each participant without charge, upon written or oral request, the documents incorporated by reference in Item 3 of Part II of this Registration Statement. These documents are incorporated by reference in the Section 10(a) prospectus. We will also provide without charge, upon written or oral request, all other documents required to be delivered to recipients pursuant to Rule 428(b) under the Securities Act. Any and all such requests shall be directed to the Company at its principal offices at 45 First Avenue, Waltham, Massachusetts 02451, attention General Counsel, or by calling our General Counsel; at (781) 466-6400.

TECOGEN INC.

Common Stock

REOFFER PROSPECTUS

Up to 3,800,000 shares of common stock

This reoffer prospectus relates to up to 3,800,000 shares of Tecogen Inc.’s (“Tecogen,” “Company,” “we,” “our,” or “us”) common stock that may be reoffered or resold from time to time by certain selling shareholders as described under the caption “Selling Shareholders.” The selling shareholders consist of our current or former employees, directors, officers, and consultants who acquired, or will acquire, the shares of our common stock upon the vesting and exercise of incentive or non-qualified stock options, or upon the grant, vesting and/or exercise of certain awards of our common stock issued pursuant to our 2022 Stock Incentive Plan as it may be amended from time to time (“2022 Plan”). The selling shareholders are, or may be deemed to be, our “affiliates” and the shares to be reoffered or resold by the selling shareholders are or may be deemed to be “control securities” under the Securities Act of 1933, as amended (“Securities Act”).

We have not granted any awards under the 2022 Plan as of the date of this prospectus. We expect to supplement this prospectus from time to time with the names of the selling shareholders and the amounts of the shares to be offered for sale by them as selling shareholders.

This prospectus has been prepared for the purposes of allowing for future sales by selling shareholders of the shares on a continuous or delayed basis to the public. Currently, selling shareholders who are our “affiliates” may not sell an amount of shares which exceeds in any three-month period the amount specified in Rule 144(e) under the Securities Act. Each selling shareholder that sells shares pursuant to this prospectus and any broker or dealer through whom the shares may be resold may be deemed an “underwriter” within the meaning set forth in the Securities Act. In addition, any commissions received by a broker or dealer in connection with resales of the shares may be deemed to be underwriting commissions or discounts under the Securities Act.

The common stock offered by this prospectus may be reoffered or resold from time to time by the selling shareholders or their pledgees, donees, transferees or other successors-in-interest in transactions on the OTC Markets LLC’s OTCQX, or any other market or exchange on which the shares are quoted or listed, in negotiated transactions, at fixed prices which may be changed, at market prices at the time of sale, at prices related to market prices or negotiated prices, or by a combination of these methods.

All of the proceeds of the resale of the shares offered hereby will be received by the selling shareholders. However, if options are exercised in order to purchase shares of our common stock covered by this prospectus, we will receive proceeds from payment of the option exercise price which we expect to use for general working capital purposes. The selling shareholders will bear all sales commissions and similar expense. All costs associated with the registration of the shares under the Securities Act will be borne by us.

Our common stock is currently quoted on the OTC Markets LLC’s OTCQX under the symbol “TGEN.” On June 17, 2022, the closing bid price of our common stock was $1.25.

Investing in our securities involves a high degree of risk. See “Risk Factors” contained herein for more information on these risks.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus or any accompanying prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 23, 2022.

TABLE OF CONTENTS

About this Reoffer Prospectus 3

Where You Can Find Additional Information 4

Incorporation of Documents by Reference 4

Cautionary Note Regarding Forward-Looking Statements 5

Prospectus Summary 6

Risk Factors 12

Use of Proceeds 12

Selling Shareholders 12

Plan of Distribution 13

Legal Matters 14

Experts 14

Disclosure of Commission Position on Indemnification 14

You should rely only on information contained, or incorporated by reference, in this prospectus. We have not authorized anyone to provide you with information different from that contained, or incorporated by reference, in this prospectus. The selling shareholders may offer to sell, and seek offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

ABOUT THIS REOFFER PROSPECTUS

We have filed with the SEC a registration statement on Form S-8 under the Securities Act (“Registration Statement”) with respect to the shares of common stock registered for reoffer and resale hereby. It is important that you read and consider all of the information contained in or incorporated by reference into this reoffer prospectus and any applicable reoffer prospectus supplement before making any decision to invest in our common stock. This reoffer prospectus incorporates by reference important business and financial information about us that is not included in or delivered with this document. You should also read and consider the additional information contained in the documents that we have incorporated by reference into this reoffer prospectus, as described in “Where You Can Find Additional Information” and “Incorporation of Documents by Reference.”

We may add, update or change any of the information contained in this reoffer prospectus or in any accompanying reoffer prospectus supplement we may authorize to be delivered to you. You should not assume that the information contained in this reoffer prospectus or any applicable prospectus supplement is accurate on any date subsequent to the date of this prospectus or that any information we have incorporated herein by reference is correct on any date subsequent to the date of the document incorporated by reference (as our business, financial condition, results of operations and prospects may have changed since that date), even though this prospectus or any applicable prospectus supplement is delivered or securities are sold on a later date.

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any accompanying prospectus supplement that we may authorize to be provided to you. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus or an accompanying prospectus supplement that we may authorize to be provided to you. This prospectus and any prospectus supplement, if any, do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus or the prospectus supplement, if any, constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You should note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

As permitted by the rules and regulations of the SEC, the Registration Statement, of which this prospectus forms a part, includes additional information not contained in this prospectus. You may read the Registration Statement and the other reports we file with the SEC at the SEC’s web site or at the SEC’s offices described below under the heading “Where You Can Find Additional Information.”

In this prospectus, unless the context otherwise requires, references to “Tecogen,” “Company,” “we,” “our,” or “us,” refer to Tecogen Inc. and its subsidiaries. Our logo, trademarks and service marks are the property of Tecogen. Other trademarks or service marks appearing in this prospectus are the property of their respective holders.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed with the SEC the Registration Statement with respect to the securities offered hereby. This prospectus, which is a part of the Registration Statement does not contain all the information included in the Registration Statement and the exhibits and schedules thereto. The Registration Statement, including the exhibits thereto, contains additional relevant information about us. The rules and regulations of the SEC allow us to omit some information included in the Registration Statement from this prospectus. For further information with respect to us and the securities offered hereby, reference is made to the Registration Statement and the exhibits and schedules filed therewith.

You may read and copy the Registration Statement as well as our reports, proxy statements, and other information, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the Public Reference Room. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s Internet site can be found at http://www.sec.gov. You can also obtain copies of materials we file with the SEC from our website found at www.tecogen.com. Information on our website does not constitute a part of, nor is it incorporated in any way, into this prospectus and should not be relied upon in connection with making an investment decision.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC permits us to “incorporate by reference” into this reoffer prospectus information in other documents we file with the SEC. This means we can disclose important information to you by referring you to other documents that contain that information. The information we incorporate by reference is considered to be part of this prospectus. Information contained in this prospectus and information we file with the SEC in the future and that we incorporate by reference in this prospectus automatically updates and supersedes previously filed information. We incorporate by reference the documents listed below and any future filings we make after the date of the initial filing of the Registration Statement of which this prospectus is a part with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (“Securities Exchange Act”), until the offering of the securities covered by this prospectus is completed or terminated:

| | | | | |

• | Our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 10, 2022 |

• | Our Proxy Statement for our 2022 Annual Meeting of Stockholders filed with the SEC on April 25, 2022 |

• | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 12, 2022 |

• | A description of our securities incorporated by reference from Exhibit 4.4 to our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on March 12, 2020 |

A statement contained in a document incorporated by reference into this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, any prospectus supplement or in any other subsequently filed document which is incorporated in this prospectus modifies or replaces such statement. Any statements so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You may request a copy of these documents, which will be provided to you at no cost, by writing to or telephoning: General Counsel, Tecogen Inc., 45 First Avenue, Waltham, Massachusetts 02451, telephone: (781) 466-6400.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This reoffer prospectus and the documents incorporated herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Securities Exchange Act, and the Private Securities Litigation Reform Act of 1995 and other federal securities laws that involve a number of risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “intends, “plans,” “should,” “seeks,” “pro forma,” “anticipates,” “estimates,” “continues,” or other variations thereof (including their use in the negative), or by discussions of strategies, plans or intentions. All statements, other than statements of historical fact, included in this prospectus regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management are forward-looking statements.

In addition, such forward-looking statements are necessarily dependent upon assumptions and estimates that may prove to be incorrect. Although we believe that the assumptions and estimates reflected in such forward-looking statements are reasonable, we cannot guarantee that our plans, intentions or expectations will be achieved. The information contained in this prospectus, including the section discussing risk factors, identifies important factors that could cause such differences.

The cautionary statements made in this reoffer prospectus are intended to be applicable to all related forward-looking statements wherever they appear in this reoffer prospectus. We assume no obligations to update such forward-looking statements or to update the reasons why actual results could differ materially from those anticipated in such forward-looking statements.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere or incorporated by reference into this reoffer prospectus. It may not contain all the information that may be important to you. You should read this entire prospectus, including all documents incorporated herein by reference carefully, especially the “Risk Factors” contained in this prospectus or any supplement hereto and under similar headings in the other documents that are incorporated by reference into this prospectus, and our financial statements and related notes incorporated by reference into this prospectus before making an investment decision with respect to our securities. Please see the sections titled “Where You Can Find Additional Information” and “Incorporation of Documents by Reference” in this prospectus.

Overview of Tecogen

Tecogen Inc. (together with its subsidiaries, “we,” “our,” or “us,” or “Tecogen”) designs, manufactures, markets, and maintains high efficiency, ultra-clean cogeneration products. These include natural gas engine driven combined heat and power (CHP) systems, chillers and heat pumps for multi-family residential, commercial, recreational and industrial use. We are known for products that provide customers with substantial energy savings, resiliency from utility power outages and for significantly reducing a customer’s carbon footprint. Our products are sold with our patented Ultera® emissions technology which nearly eliminates all criteria pollutants such as NOx and CO. We are also developing Ultera® for other applications including stationary engines and forklifts. See " Ultera Low-Emissions Technology" for a more in-depth discussion of our Ultera emissions technology.

We have wholly-owned subsidiaries American DG Energy, Inc. ("ADGE") and Tecogen CHP Solutions, Inc., and we own a 51% interest in American DG New York, LLC ("ADGNY"), a joint venture. ADGE and ADGNY distribute, own, and operate clean, on-site energy systems that produce electricity, hot water, heat and cooling. ADGE owns the equipment that it installs at a customer’s facility and sells the energy produced by its systems to the customer on a long-term contractual basis.

Our operations are comprised of three business segments:

•our Products segment, which designs, manufactures and sells industrial and commercial cogeneration systems at our customers’ facilities;

•our Services segment, which provides operations and maintenance ("O&M") services and turn-key installation for our products under long term service contracts and

•our Energy Production segment, which sells energy in the form of electricity, heat, hot water and cooling to our customers under long-term energy sales agreements.

Recent Developments

COVID-19 Update

During the first quarter of fiscal 2020, a novel strain of coronavirus (“COVID-19”) began spreading rapidly throughout the world, prompting governments and businesses to take unprecedented measures in response. Such measures included restrictions on travel and business operations, temporary closures of businesses, and quarantines and shelter-in-place orders. The COVID-19 pandemic has significantly impacted supply chains, curtailed global economic activity, and caused significant volatility and disruption in global markets. The COVID-19 pandemic and the measures taken by U.S. Federal, state and local governments in response have materially adversely affected and could in the future materially impact our business, results of operations, financial condition and stock price. The impact of the pandemic remains uncertain and will depend on the growth in the number of infections, fatalities, the duration of the pandemic, steps taken to combat the pandemic, and the development and availability of effective treatments. We have made every effort to keep our employees who operate our business safe and minimize unnecessary risk of exposure to the virus.

Paycheck Protection Program Loan

On April 17, 2020, we obtained an unsecured loan in the principal amount of $1,874,200 from Webster Bank, NA ("Webster") under the Paycheck Protection Program adopted pursuant to the Coronavirus Aid, Relief and Economic Recovery Act, as amended ("CARES Act"). The loan was forgivable if the proceeds were utilized by us for payroll, utilities, and rent expenses. On January 19, 2021 we received confirmation from Webster that the Paycheck Protection Program Loan in the original principal amount of $1,874,200 together with accrued interest of $13,659 was forgiven in full effective as of January 11, 2021. The loan forgiveness of $1,887,859 was accounted for as a debt extinguishment and is reported as a separate component of other income (expense), net in our condensed consolidated statement of operations.

Paycheck Protection Program Second Draw Loan

On February 5, 2021, we obtained a Paycheck Protection Program Second Draw unsecured loan through Webster in the amount of $1,874,269 in connection with the Paycheck Protection Program pursuant to the CARES Act. On September 20, 2021, we received a letter dated September 13, 2021 from Webster Bank, NA confirming that the Paycheck Protection Program Second Draw Loan issued to us pursuant to the CARES Act in the original principal amount of $1,874,269 together with accrued interest of $11,386 was forgiven in full as of September 8, 2021. The loan forgiveness of $1,885,655 was accounted for as debt extinguishment and is reported as a separate component of other income (expense), net in our condensed consolidated statement of operations.

Employee Retention Credit

On March 27, 2020, the CARES Act was signed into law providing numerous tax incentives and other stimulus measures, including an employee retention credit (“ERC”), which is a refundable tax credit against certain employment taxes. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 and the American Rescue Plan Act of 2021 extended and expanded the availability of the ERC. The ERC was available with respect to periods through October 1, 2021 and was equal to 70% of qualified wages (which includes employer qualified health plan expenses) paid to employees. In addition, the availability of the ERC was permitted to entities that received a Paycheck Protection Loan subject to certain conditions. During each quarter in 2021, a maximum of $10,000 in qualified wages for each employee was eligible for the ERC. Therefore, the maximum tax credit that can be claimed by an eligible employer in 2021 is $7,000 per employee per calendar quarter. Section 2301(c)(2)(B) of the CARES Act permits an employer to use an alternative quarter to calculate gross receipts and the employer may determine if the decline in gross receipts tests is met for a calendar quarter in 2021 by comparing its gross receipts for the immediately preceding calendar quarter with those for the corresponding calendar quarter in 2019. Accordingly, for the first quarter of 2021, we elected to use our gross receipts for the fourth calendar quarter of 2020 compared to our gross receipts for the fourth calendar quarter of 2019. As a result of our election to use an alternative quarter, we qualified for the ERC in the first, second and third quarters of 2021 because our gross receipts decreased by more than 20% from the first, second and third quarters of 2019. As a result of averaging 500 or fewer full-time employees in 2019, all wages paid to employees in the first, second and third quarters of 2021 were eligible for the ERC. Note, wages used towards PPP loan forgiveness cannot be used as qualified wages for purposes of the ERC. During the year ended December 31, 2021 we recorded ERC benefits of $1,276,021 shown in other income (expense), net in our condensed consolidated statements of operations and such claimed ERCs are disclosed within accounts receivable in our consolidated balance sheet.

Air Cooled Chiller Development

In Q3 2021 we began development on a hybrid air-cooled chiller. We recognized that there were many applications where the customer wanted an easy to install roof top chiller. Using the inverter design from our InVerde e+ cogeneration module, we developed the novel concept of a hybrid chiller. This system can simultaneously take two inputs, one from the grid or a renewable energy source and one from our natural gas engine. This allows a customer to have the optimum blend of operational cost savings and greenhouse gas benefits while providing added resiliency from two power sources. We expect to have a prototype operational by Q4 2022 and to

see incremental revenue by the early part of 2023. A provisional patent based on this concept has been filed with the US Patent and Trademark Office.

Energy Sales Agreements

On December 14, 2018, we entered into agreements relating to the sale of two energy purchase agreements and related energy production systems for $2 million and on March 5, 2019 entered into agreements relating to the sale of six energy purchase agreements and related energy production systems for $5 million. In connection with these sales, we entered into agreements to provide billing and asset management services and operations and maintenance services for agreed fees for the duration of the energy purchase agreements, pursuant to which we guarantee certain minimum collections and are entitled to receive fifty percent of the excess of collections over agreed minimum thresholds. In October 2021 the minimum guarantee with respect to one of the energy purchase agreements was modified by reducing the guaranteed minimum collections by $35,000 per year, the guaranteed minimum collection amount associated with one site that was sold by the customer.

ADGE Merger

On May 18, 2017, our stockholders approved the acquisition of ADGE in a stock for stock merger together with the issuance of the stock by us in the transaction (“Merger”). As a result of the Merger, we acquired 100% of the outstanding common shares of ADGE and ADGE became our wholly-owned subsidiary.

Overview of Our Business

Tecogen products offer customers energy savings, resiliency and a cleaner environmental footprint. Our cogeneration, chiller and heat pump systems use an engine to generate electricity or shaft work and recover the waste heat from the engine. Our systems are greater than 88% efficient compared to typical electrical grid efficiencies of 40% to 50%. As a result, our greenhouse gas (GHG) emissions are typically half that of the electrical grid. Our systems generate electricity and hot water or in the case of our Tecochill product, both chilled water and hot water. Our products are expected to run on Renewable Natural Gas (RNG) as it is introduced into the US gas pipeline infrastructure.

Our natural gas-powered cogeneration systems (also known as combined heat and power or “CHP”) are efficient because they drive electric generators or compressors, which reduce the amount of electricity purchased from the utility while recovering the engine’s waste heat for water heating, space heating, and/or air conditioning at the customer’s building.

Our commercial product lines include:

•the InVerde e+® and TecoPower® cogeneration units; these systems supply electricity and hot water;

•Tecochill® air-conditioning and refrigeration chillers; these systems produce chilled water and hot water;

•Tecofrost® gas engine-driven refrigeration compressors; these systems circulate refrigerant and provide hot water as a byproduct;

•Ilios® high-efficiency water heaters; these provide hot water at a significantly higher efficiency than a conventional boiler (250% vs 75%);

•Ultera® emissions control technology.

Traditional customers for our InVerde and Tecopower products have a simultaneous need for electrical power and hot water. These include hospitals, nursing homes, schools, universities, health clubs, spas, hotels and motels, office and multi-unit residential buildings. Conversely our Tecochill product benefits customers who have a simultaneous need for cooling and hot water which is typical in sites such as hospitals, ice rinks, indoor agriculture

and food processing. Our Tecofrost refrigeration compressors are applied primarily to industrial applications that include cold storage, wineries, dairies, ice rinks and food processing. Market drivers include the price of natural gas, local electricity rates, environmental regulations, and governmental energy policies, as well as customers’ desire to become more environmentally responsible.

Our cooling and refrigeration products provide both cooling and high grade waste heat. This is of particular advantage in facilities that control both temperature and humidity. In such facilities, climate control is achieved by cooling the facility to remove humidity and then reheating to the required temperature. Using engine waste heat to perform the reheat while utilizing natural gas to generate the cooling provides significant economic and environmental benefits. As a result our product has significant competitive advantages in applications that operate year round such as controlled environment agriculture, indoor ice rinks, and hospitals.

Through our factory service centers in California, Connecticut, Florida, Massachusetts, Michigan, New Jersey, New York, and Toronto, Canada, our specialized technical staff maintains our products via long-term service contracts. To date we have shipped over 3,000 units, some of which have been operating for almost 35 years. We established a service center in Toronto, Canada in August 2020 to support our existing population of chillers and cogeneration units including 26 cogeneration units sold in this territory during 2020 to serve public housing facilities.

In 2009, in response to the changing regulatory requirements for stationary engines, our research team developed an economically feasible process for removing air pollutants from engine exhaust. This technology's U.S. and foreign patents were granted beginning in October 2013 and other domestic and foreign patents granted or applications are pending. Branded Ultera®, the ultra-clean emissions technology repositions our engine driven products in the marketplace, making them comparable environmentally with other technologies such as fuel cells, but at a much lower cost and greater efficiency. In 2018, a group of natural gas engine-generators fitted with the Ultera system were successfully permitted in the Los Angeles region for unrestricted operation, the first natural gas engines to do so without operating time limits or other exemption. These engines were permitted to levels matching the California Air Resources Board ("CARB") stringent 2007 emissions requirements, the same emissions standard used to certify fuel cells, and the same emissions levels as a state-of-the-art central power plant. We now offer our Ultera emissions control technology as an option on all our products or as a stand-alone application for retrofitting other rich-burn spark-ignited reciprocating internal combustion engines such as the engine-generators described above.

Our products are designed as compact modular units that are intended to be installed in multiples. This approach has significant advantages over utilizing a single larger cogeneration or chiller unit, allowing placement in constrained urban settings and redundancy to mitigate service outages. Redundancy is particularly relevant in regions where the electric utility has formulated tariff structures that include high “peak demand” charges. Such tariffs are common in many areas of the country, and are applied by such utilities as Southern California Edison, Pacific Gas and Electric, Consolidated Edison of New York, and National Grid of Massachusetts. Because these tariffs are assessed based on customers’ peak monthly demand charge over a very short interval, typically only 15 minutes, a brief service outage for a system comprised of a single unit can create a high demand charge, and therefore be highly detrimental to the monthly savings of the system. For multiple unit sites, the likelihood of a full system outage that would result in a high demand charge is dramatically reduced, consequently, these customers have a greater probability of capturing peak demand savings.

Our products are sold directly to customers by our in-house marketing team, and by established sales agents and representatives.

Our operations are comprised of three business segments. Our Products segment designs, manufactures and sells industrial and commercial cogeneration systems as described above. Our Services segment provides O&M services for our products under long term service contracts. Our Energy Production segment sells energy in the form of electricity, heat, hot water and cooling to our customers under long-term sales agreements.

Ultera Low-Emissions Technology

All of our CHP products are available with the patented Ultera® low-emissions technology as an equipment option. This breakthrough technology was developed in 2009 and 2010 as part of a research effort partially funded by the California Energy Commission and Southern California Gas Company.

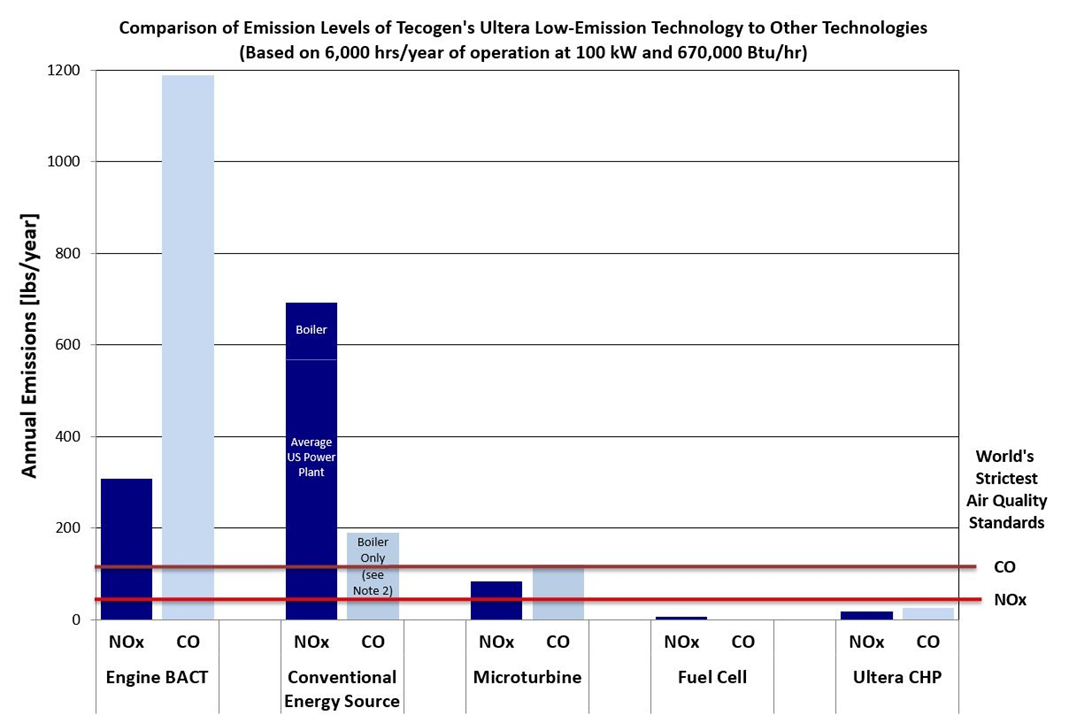

The chart below compares emission levels of our Ultera technology to other technologies. As of December 31, 2021, our Ultera CHP and fuel cell technologies are the only technologies that we know of which comply with California's air quality standards for CO and NOx, represented in the chart by the colored horizontal lines, shown as the world's strictest air quality standards on the lower right of the chart. We believe that as environmental regulation becomes more stringent in the United States, our emissions technology may be used in markets including generators, fork trucks and biogas engines.

(1) California has the strictest air quality standards for engines in the world. Stationary Engine BACT as defined by SCAQMD.

(2) Conventional Energy Source is U.S. power plant and gas boiler. Average U.S. power plant NOx emission rate of 0.9461 lb/MWh from (USEPA eGrid 2012), CO data not available. Gas boiler efficiency of 78% (www.eia.gov) with emissions of 20 ppm NOx @ 3% O2 (California Regulation SCAQMD Rule 1146.2 and <50 ppmv CO @ 3% O2 (California Regulation SCAQMD BACT).

(3) Microturbine and Fuel Cell emissions from EPA CHP Partnership - Catalog of CHP Technologies- March 2015.

(4) Tecogen Ultera emissions based upon actual third-party source test data.

After successfully developing the Ultera technology for our own equipment, our research and development team began exploring other possible emissions control applications in an effort to expand the market for the ultra-clean emissions system. Retrofit kits were developed in 2014 for other stationary engines and in 2015 the Ultera Retrofit Kit was applied successfully to natural gas stand-by generators from other manufacturers, including Generac and Caterpillar.

Historically, standby generators have not been subjected to the strict air quality emissions standards of traditional power generation. However, generators which run for more than 200 hours per year or run for non-emergency purposes (other than routine scheduled maintenance) in some territories are subject to compliance with the same stringent regulations applied to a typical electric utility. As demand response programs become more economically attractive and air quality regulations continue to become more stringent, there could be increased demand for retrofitting standby generators with our Ultera® emissions control technology, thus providing a cost-effective solution to keeping the installed base of standby generators operational and in compliance with regulatory requirements.

In 2017, a group of generators owned by a single customer in Southern California were supplied Ultera kits because of their particular requirement to exceed the 200-hour annual limit. These units are now operational and have been tested by the customer and shown to be compliant with the local pollution limits which we believe to be the strictest anywhere in the United States, and potentially the world. Our CHP products have been permitted to this same standard. However, CHP products are given a heat credit which effectively increases the allowable limit. In 2018, permitting was completed making these certification levels the lowest we have achieved. We believe no other engines have been certified to these levels since the current regulations in the Los Angeles region became effective.

It is noteworthy that these engine-generators have been used in California to power dispersed loads in a fire-prone area where frequent de-energizing of the electric overhead power lines is required for safety. We believe this application to be a new and significant application for the Ultera technology in light of the widely publicized widespread outages in California in 2019 and 2020.

Biogas

The Ultera emissions control technology developed by our engineering team applies specifically to rich-burn, spark-ignited, internal combustion engines. While originally intended for natural gas-powered engines, we believe that our technology may be adapted for other fuel types as long as the engine meets the rich-burn criteria.

In 2015, the Ultera system was applied to a biogas powered engine operating at the Eastern Municipal Water District’s (EMWD) Moreno Valley Region Water Reclamation Facility in Perris, California. The demonstration project was a result of an ongoing collaboration between Tecogen, the EMWD and various other partners, and successfully applied an Ultera Retrofit Kit to a 50-liter Caterpillar engine fueled by biogas extracted from an anaerobic digester.

Biogas is a significant byproduct of wastewater treatment plants. Considered to be a renewable source of fuel, it is becoming an increasingly important resource for power generation. According to the American Biogas Council, nationwide there are over 1,100 engines fueled by wastewater-derived biogas, over 600 fueled by landfill-generated biogas, and over 100 running on biogas from agricultural waste. This represents a significant potential market for the Ultera Retrofit Kit application as these biogas engines become subject to the same air quality standards as traditional power generation sources.

Fork-Truck Research

In October 2016, we were awarded a Propane Education & Research Council (“PERC”) research grant funding our proposal to develop the Ultera ultra-clean emissions control technology for the propane powered fork truck market.

Electric fork trucks have been making significant in-roads in the fork truck industry, in part, because of their green image and indoor air quality benefit. The primary benefit of the Ultera-equipped ultra-clean propane fork truck will be fuel cell like emissions with a robust indoor air quality advantage without compromising vehicle performance. In 2018, the PERC funded portion of the project concluded successfully. Mitsubishi Caterpillar Forklift America (“MCFA”), a major supplier in North and South America, provided technical and marketing support and supplied a test truck. In 2019, engineers from MCFA collaborated with our research staff to finalize the engine tuning for optimization of the Ultera process. This work successfully demonstrated highly improved emissions levels for the fork truck.

Services

We provide long-term maintenance contracts, parts sales, and turnkey installation for our products through a network of eleven well-established field service centers in California, the Midwest, the Northeast, the Southeast and in Ontario, Canada. These centers are staffed by our full-time technicians, working from local leased facilities. The facilities provide office and warehouse space for inventory. We encourage our customers to provide internet connections to our units so that we may maintain remote monitoring and communications with the installed equipment. For connected installations, the machines are contacted daily to download their status and provide regular operational reports (daily, monthly, and quarterly) to our service managers. This communications link is used to support the diagnostic efforts of our service staff, and to send messages to pre-programmed phones if a unit has experienced an unscheduled shutdown. In many cases, communications received by service technicians from connected devices allow for proactive maintenance, minimizing equipment downtime and improving operating efficiency for the customer.

The work of our service managers, supervisors, and technicians focuses on our products. Because we manufacture our own equipment, our service technicians bring hands-on experience and competence to their jobs. They are trained at our corporate headquarters and primary manufacturing facility in Waltham, Massachusetts.

Most of our service revenue is in the form of annual service contracts, which are typically of an all-inclusive “bumper-to-bumper” type, with billing amounts proportional to the equipment's achieved operating hours for the period. Customers are thus invoiced in level, predictable amounts without unforeseen add-ons for such items as unscheduled repairs or engine replacements. We strive to maintain these contracts for many years, and work to maintain the integrity and performance of our equipment.

Our products have a long history of reliable operation. Since 1995, we have had a remote monitoring system in place that connects to hundreds of units daily and reports their “availability,” which is the amount of time a unit is running or is ready to run. More than 80% of the units operate above 90% availability, with the average being 93.8%. Our factory service agreements have directly impacted these positive results and represent an important long-term annuity-like stream of revenue for us.

New equipment sold beginning in 2016 and select upgrades to the existing installed equipment fleet include an industrial internet solution which enables Tecogen to collect, analyze, and manage valuable asset data continuously and in real-time. This provides the service team with improved insight into the functionality of our installed CHP fleet. Specifically, it enables the service department to perform remote monitoring and diagnostics and to view system results in real time via a computer, smart phone or tablet. Consequently, we can better utilize

monitoring data ensuring customers are capturing maximum possible savings and efficiencies from their cogeneration equipment.

Energy Production

Our Energy Production segment sells energy in the form of electricity, heat, hot water and cooling to our customers under long-term sales agreements which represented 7.1% and 6.5% our consolidated revenues for the years ended December 31, 2021 and 2020, respectively.

Sales & Distribution

Our products are sold directly to end-users by our sales team and by established sales agents and representatives. We have agreements with manufacturer's representatives and outside sales representatives who are compensated by commissions for designated territories and product lines. During the year ended December 31, 2021 no customer accounted for more than 10% of our revenues. During the year ended December 31, 2020 one customer accounted for more than 10% of our revenues. We typically sell our chiller products through our manufacturing representatives with assistance from our internal sales team. Our combined heat and power products are typically sold direct to end customers by our internal sales team.

Markets and Customers

Worldwide, stationary power generation applications vary from huge central stationary generating facilities (traditional electric utility providers) to back-up generators as small as 2 kW. Historically, power generation in most developed countries such as the United States has been part of a regulated central utility system utilizing high-temperature steam turbines powered by fossil-fuels. This turbine technology, though steadily refined over the years, reached a maximum efficiency (where efficiency means electrical energy output per unit of fuel energy input) of approximately 40% to 50%.

A number of developments related primarily to the deregulation of the utility industry as well as significant technological advances have now broadened the range of power supply choices available to all types of customers. Cogeneration, which harnesses waste energy from power generation processes and puts it to work for other uses on-site, can boost the energy conversion efficiency to nearly 90%, a better than two-fold improvement over the average efficiency of a fossil fuel plant. This distributed generation, or power generated on-site at the point of consumption rather than power generated centrally, eliminates the cost, complexity, and inefficiency associated with electric transmission and distribution. The implications of the CHP distributed generation approach are significant. We believe that if cogeneration were applied on a large scale, global fuel usage might be dramatically curtailed and the utility grid made far more resilient. Furthermore, with technology we have introduced, like the Ultera low-emissions technology, our products can now contribute to better air quality at the local level while complying with the strictest air quality regulations in the United States.

Our products can often reduce the customer’s operating costs (for the portion of the facility loads to which they are applied) by approximately 30% to 60% based on our estimates, which provides an excellent rate of return on the equipment’s capital cost in many areas of the country with high electricity rates. Our chillers are especially suited to regions where utilities impose extra charges during times of peak usage, commonly called “demand” charges. In these cases, the gas-fueled chiller reduces the use of electricity during the summer, the costliest time of year.

Decentralizing power generation or reducing energy requirements at a customer's site not only relieves the capacity burden on existing power plants, but also lessens the burden on transmission and distribution lines. This ultimately improves the grid’s reliability and reduces the need for costly upgrades.

Increasingly favorable economic conditions may improve our business prospects domestically and abroad. Specifically, we believe that natural gas prices are expected to increase from their current values, and that electric rates are expected to continue to rise more significantly over the long-term as utilities pay for grid expansion, better emission controls, efficiency improvements, and the integration of renewable power sources.

Most potential new customers in the U.S. require less than 1 MW of electric power and less than 1,200 tons of cooling capacity. We are targeting customers in states with high electricity rates in the commercial sector, such as California, Connecticut, Massachusetts, New Hampshire, New Jersey, and New York. Most of these states also have high peak demand rates, which favor utilization of our modular units in groups so as to assure redundancy and peak demand savings. Governmental agencies in some of these regions may also provide generous rebates that can improve the economic viability of our systems.

We aggressively market to potential customers where utility pricing aligns with our advantages. These areas include regions that have strict emissions regulations, such as California, or those that reward CHP systems that are especially non-polluting, such as New Jersey. Currently, more than 23 states recognize CHP as part of their Renewable Portfolio Standards or Energy Efficiency Resource Standards.

The traditional markets for CHP systems are buildings with long hours of operation and with corresponding demand for electricity or cooling and heat. Traditional customers for our cogeneration systems include controlled environment agriculture, hospitals, nursing homes, colleges, universities, health clubs, spas, hotels, motels, office and retail buildings, food and beverage processors, multi-unit residential buildings, laundries, ice rinks, swimming pools, factories, municipal buildings, and military installations.

Traditional customers for our chillers, refrigeration compressors and heat pumps overlap with those for our cogeneration systems. Engine-driven chillers are often used as replacements for electric chillers because they occupy similar amounts of floor space and require similar maintenance schedules. This is also true for refrigeration compressors.

Competition

The markets for our products are highly competitive, though we believe that we offer customers a suite of premier best-in-class clean energy and thermal solutions.

InVerde and Tecopower

Our combined heat and power products that produce electricity and hot water compete with the utility grid, existing technologies such as other reciprocating engine and microturbine CHP systems, and other emerging distributed generation technologies including solar power, wind-powered systems, and fuel cells. Our products are highly competitive between 60KW and 1.5MW in electrical generation capacity. In this size range we have other reciprocating engine competitors, although we have strong competitive advantages when it comes to ease of utility interconnection and our microgrid capabilities. We believe that Capstone Turbine Corporation is the only microturbine manufacturer with a commercial presence in CHP.

Although operating solar and wind powered systems produce no emissions, the main drawbacks to these renewable powered systems are their dependence on weather conditions, their reliance on backup utility grid-provided power, and high capital costs that can often make these systems uneconomical without government subsidies. Similarly, while the market for fuel cells is still developing, a number of fuel cell companies are focused on markets similar to ours. Fuel cells, like solar and wind powered systems, have received higher levels of incentives for the same type of applications as CHP systems in many territories. We believe that, notwithstanding these higher government incentives, our CHP solutions provide a better value and more robust solution to end users in most applications.

Additionally, our patents relating to the Ultera ultra-low emissions technology give our products a strong competitive advantage in markets where severe emissions limits are imposed or where very clean power is favored, such as New Jersey, California, and Massachusetts.

Overall, we compete with end users’ other options for electrical power, heating, and cooling on the basis of our technology’s ability to:

•Provide a more efficient solution that provides operational savings for a facility's energy needs including cooling, electricity and hot water;

•Provide power when a utility grid is not available or goes out of service;

•Reduce emissions of criteria pollutants (NOx and CO) to near-zero levels and cut the emission of greenhouse gases such as carbon dioxide due to increased efficiencies compared to the electric grid;

•Provide reliable on-site power generation, heating and cooling services.

We believe that no other company has developed a product that provides the features and benefits provided by our inverter-based InVerde e+, which offers UL-certified grid connection and sophisticated off-grid and microgrid capabilities. An inverter-based product with at least some of these features has been introduced by others, but we believe that they face serious challenges in duplicating all the unique features of the InVerde e+. Competitors' product development time and costs could be significant. We have exclusive license rights to Microgrid algorithms developed by the University of Wisconsin researchers. We have exclusive rights for engine-driven systems utilizing natural gas or diesel fuel in the application of power generation where the per-unit output is less than 500kW. The software allows our products to be integrated as a Microgrid, where multiple InVerde e+® units can be seamlessly isolated from the main utility grid in the event of an outage and re-connected to it afterward. We expect that our patents and license for Microgrid software will deter others from offering certain important functions.

Similarly, in the growing Microgrid segment, neither fuel cells nor microturbines can respond to changing energy loads when the system is disconnected from the utility grid. Engines such as those used in our equipment inherently have a fast-dynamic response to step load changes, which is why they are the primary choice for emergency generators. Fuel cells and microturbines require additional energy storage systems to be utilized for time-limited off-grid operation, giving our engine-driven solutions an advantage for Microgrid and resiliency applications.

Tecochill Chillers

Our Tecochill line of chillers are the only gas-engine-driven chillers available on the market. Natural gas can also fuel absorption chillers, which use fluids to transfer heat without an engine drive. However, engine driven chillers continue to have an efficiency advantage over absorption machines. Tecochill chillers reach efficiencies well above levels achieved by similarly sized absorption systems. Low natural gas prices in the United States improve the economics of natural gas-fueled chillers while their minimal electric demand on backup power systems make them ideal for facilities requiring critical precision climate control. In 2022 we plan to expand our Tecochill range of products to include a hybrid air cooled chiller based on the inverter design used in the InVerde. The hybrid air-cooled chiller will take simultaneous inputs from the electrical grid and the natural gas engine so that it can operate with the lowest cost and/or greenhouse gas footprint at any time based on changing conditions.

Ilios Heat Pump

A few companies manufacture gas-engine heat pumps, including Yanmar and Tedom that we believe are competitive with our products. The Ilios® water heater and other heat pump products compete in both the high-efficiency water heating market and the CHP market.

The Offering

| | | | | | | | |

Common stock outstanding before the offering

| | 24,850,261 shares |

Common stock offered by selling shareholders

| | 3,800,000 shares |

OTC Markets’ OTCQX Symbol

| | TGEN |

Risks Factors

Investing in our securities involves a high degree of risk. Please see the risk factors discussed under the heading “Risk Factors” below and under Item 1A of our most recent Annual Report on Form 10-K and Part II of our Quarterly Reports on Form 10-Q, and other filings we make with the SEC, which are incorporated by reference in this prospectus.

Corporate Information

We were incorporated in the State of Delaware on September 15, 2000. Our principal executive offices are located at, and our mailing address is, 45 First Avenue, Waltham, Massachusetts 02451. Our main telephone number is (781) 466-6400. Our corporate website address is: www.tecogen.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus and should not be relied upon with respect to this offering.

RISK FACTORS

An investment in our securities is highly speculative and involves a high degree of risk. Before deciding to invest in our shares of common stock, you should carefully consider the risk factors set forth under Item 1A of our most recent Annual Report on Form 10-K as amended or supplemented, and the information contained in this reoffer prospectus, as updated by our subsequent filings under the Securities Exchange Act, which are incorporated herein by reference. Such risks are not the only ones facing our company. Additional risks not presently known to us or which we currently consider immaterial may also adversely affect our company. If any of such risks actually occur, our business, financial condition and operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and you could lose a part of your investment.

USE OF PROCEEDS

We will not receive any proceeds from this offering. However, if any of the selling shareholders exercise options granted to them under the 2022 Plan and acquire shares of our common stock to be resold pursuant to this reoffer prospectus, we would receive the option exercise price and expect to use such proceeds for general working capital purposes.

SELLING SHAREHOLDERS

All of the shares of our common stock registered for resale under the Registration Statement of which this reoffer prospectus forms a part will be owned, prior to the offer and sale of such shares, by the selling shareholders upon vesting and exercise of incentive or non-qualified stock options, restricted stock awards, restricted stock rights or the grant of stock. We have not granted any options or other awards under the 2022 Plan as of the date of this prospectus. We expect to supplement this prospectus from time to time with the names of the selling shareholders and the amounts of the shares to be offered for sale by them as selling shareholders.

We have registered the shares of common stock covered by this reoffer prospectus for the selling shareholders. As used in this prospectus, selling shareholders include the pledgees, donees, transferees, or others who may later hold the selling shareholders’ interests. We are paying the costs and fees of registering the shares of our common stock covered by this prospectus, but the selling shareholders will pay any brokerage commissions, discounts, or other expense relating to the sale of such shares.

The following table sets forth as of the date of this prospectus:

•the name and principal position of each person who is, or may be deemed, an affiliated selling shareholder, and certain non-affiliated selling shareholders;

•the number and percentage of shares of common stock owned beneficially, directly or indirectly, by each selling shareholder before the offering;

•the number of shares of common stock to be offered by the selling shareholders pursuant to this reoffer prospectus; and

•the number and percentage of shares of common stock to be owned by each selling shareholder following the sale of the shares pursuant hereto.

As of the date of this prospectus, no awards have been made pursuant to the 2022 Plan. Accordingly, we expect to amend or supplement this prospectus from time to time to update the disclosures set forth in the table, below. Because the selling shareholders identified in the table as supplemented may sell some or all of the shares owned by them which are included in this prospectus, and because there are currently no agreements, arrangements, or understandings with respect to the sale of any such shares, no estimate can be given as to the number of shares available for resale hereby that will be held by the selling shareholders upon termination of the offering made hereby. We have assumed, therefore, for purposes of the following table as it may be amended or supplemented, that the selling shareholders will sell all of the shares owned by them which are being offered hereby, but will not sell any other shares of our common stock they presently own. To our knowledge, none of the selling shareholders are broker-dealers or affiliates of broker-dealers.

Because currently we do not satisfy the registrant requirements for use of Form S-3, the amount of shares of our common that may be reoffered or resold by means of this prospectus by a selling shareholder, and any other person with whom he or she is acting in concert for purpose of selling our securities, may not exceed, during any three month period, the amount specified in Rule 144(e) under the Securities Act.

| | | | | | | | | | | | | | | | | |

Name of Selling Shareholder * | Number of Shares Beneficially Owned Before Offering (1) | Percent of Common Stock Owned Before Offering (1) | Number of Shares Being Offered Hereby | Number of Shares Owned After Offering | Percent of Common Stock Owned After Offering (1) |

| | | | | |

•Names of selling shareholders who will sell “control securities” pursuant to this prospectus will be added by prospectus supplement pursuant to Rule 424(b) under the Securities Act, as permitted by General Instruction C to Form S-8.

** Less than 1%.

| | | | | |

| (1) | Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act and is generally determined by voting power and/or investment power with respect to securities. Unless otherwise noted, all shares of common stock listed above are owned of record by each individual named as beneficial owner and such individual has sole voting and dispositive power with respect to the shares of common stock owned by each of them. Such person or entity’s percentage of ownership is determined by assuming that any options or convertible securities held by such person which are exercisable within 60 days from the date hereof have been exercised or converted as the case may be. Except as otherwise indicated, the address of each selling shareholder is c/o Tecogen Inc., 45 First Avenue, Waltham, Massachusetts 02451. |

PLAN OF DISTRIBUTION

Each of the selling shareholders of our common stock and any of their pledgees, donees, transferees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on the OTC Markets LLC’s OTCQX or such other stock exchange, market or trading facility on which the shares are then traded or in private transactions. These sales may be at fixed or negotiated prices. A selling shareholder may use any one or more of the following methods when selling shares:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•short sales;

•broker-dealers may agree with the selling shareholders to sell a specified number of such shares at a stipulated price per share;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•a combination of any such methods of sale; or

•any other method permitted pursuant to applicable law.

The selling shareholders may also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling shareholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling shareholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121 and guidance thereunder.

In connection with the sale of the common stock or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling shareholders may also sell shares of common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The selling shareholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. To our knowledge, no selling shareholder has any written or oral agreement or understanding, directly or indirectly, with any person to distribute the common stock.

We are required to pay certain fees and expenses incurred by us incident to the registration of the shares. Because selling shareholders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act. There is no underwriter or coordinating broker acting in connection with the proposed sale of the resale shares by the selling shareholders.

The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with. Under applicable rules and regulations under the Securities Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling shareholders will be subject to applicable provisions of the Securities Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the common stock by the selling shareholders or any other person. We will make copies of this prospectus available to the selling shareholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale.

LEGAL MATTERS

The validity of the common stock issuable under the 2022 Plan has been passed upon for us by Somertons, PLLC, Washington, D.C.

EXPERTS

Our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021, and incorporated by reference in this reoffer prospectus, have been so incorporated in reliance on the report of Wolf & Company, P.C., independent registered public accountants, given on the authority of said firm as experts in auditing and accounting.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

Our Amended and Restated Certificate of Incorporation provides that we will indemnify our officers and directors in accordance with Delaware General Corporation Law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provision, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers or controlling person in connection with the securities being registered herein, we will, unless, in the opinion of our legal counsel, the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s decision.

| | | | | | | | |

| |

TECOGEN INC.

___________________________________

Shares of Common Stock ___________________________________

______________

REOFFER PROSPECTUS

______________

June 23, 2022

|

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, and any amendments thereto, filed by the Company with the SEC under the Securities Exchange Act are incorporated by reference in this Registration Statement:

| | | | | |

• | Our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 10, 2022 |

• | Our Proxy Statement for our 2022 Annual Meeting of Stockholders filed with the SEC on April 25, 2022 |

• | Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 12, 2022 |

• | A description of our securities incorporated by reference from Exhibit 4.4 to our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on March 12, 2020 |

In addition, all reports and other documents filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act subsequent to the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that all securities offered hereunder have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such reports or documents.

Any statement contained herein or in a document incorporated or deemed incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 102 of the Delaware General Corporation Law (“DGCL”) allows a corporation to eliminate the personal liability of directors of a corporation to the corporation or its stockholders for monetary damages for a breach of fiduciary duty as a director, except where the director breached his duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit. We have included such a provision in our Amended and Restated Certificate of Incorporation.

Section 145 of the DGCL provides that a corporation has the power to indemnify a director, officer, employee or agent of the corporation and certain other persons serving at the request of the corporation in related capacities against amounts paid and expenses incurred in connection with an action or proceeding to which he is or is threatened to be made a party by reason of such position, if such person shall have acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal proceeding, if such person had no reasonable cause to believe his conduct was unlawful; provided that, in the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect to any matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the adjudicating court determines that such indemnification is proper under the circumstances. We have included such a provision in our Amended and Restated Certificate of Incorporation.

The indemnification provisions contained in our Amended and Restated Certificate of Incorporation are not exclusive of any other rights to which a person may be entitled by law, agreement, vote of stockholders or disinterested directors or otherwise.

In addition, we maintain insurance on behalf of our directors and executive officers that insures them against any liability asserted against them in their capacities as directors or officers or arising out of such status.

These indemnification provisions may be sufficiently broad to permit indemnification of directors and officers for liabilities, including reimbursement of expenses incurred, arising under the Securities Act.

INSOFAR AS INDEMNIFICATION FOR LIABILITIES ARISING UNDER THE SECURITIES ACT MAY BE PERMITTED TO DIRECTORS, OFFICERS OR PERSONS CONTROLLING THE COMPANY PURSUANT TO THE FOREGOING PROVISIONS, THE COMPANY HAS BEEN INFORMED THAT IN THE OPINION OF THE SECURITIES AND EXCHANGE COMMISSION, SUCH INDEMNIFICATION IS AGAINST PUBLIC POLICY AS EXPRESSED IN THE SECURITIES ACT AND IS THEREFORE UNENFORCEABLE.

Other Arrangements

The Company maintains a “claims made” officers and directors liability insurance policy with coverage limits of $5,000,000 and a maximum $200,000 deductible amount for each claim.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

The following exhibits are filed as part of this Registration Statement:

| | | | | | | | | | | | | | |

|

| Incorporated by Reference From |

|

Exhibit No. | Exhibit Description | Form |

Filing Date |

Filed Herewith |

3.1 | Form of Common Stock Certificate | S-1/A | 06/27/2014 |

|

3.2 | Amended and Restated Certificate of Incorporation | S-1/A | 06/27/2014 |

|

3.3 | Amended and Restated Bylaws | S-1/A | 06/27/2014 |

|

4.1 | Description of Securities | 10-K | 03/12/2020 |

|

5.1 | |

|

| X |

10.1 | Tecogen Inc. 2022 Stock Incentive Plan | 8-K | 03/09/2022 |

|

10.2 | Form of Incentive Stock Option Award Agreement (Employee Form) | 8-K | 03/09/2022 |

|

10.3 | Form of Non-Qualified Stock Option Award Agreement (Employee Form) | 8-K | 03/09/2022 |

|