OTCQX: TGEN AUGUST 11, 2022 Q2 2022 EARNINGS CALL 1

MANAGEMENT Benjamin Locke - CEO Abinand Rangesh – CFO & Treasurer Jack Whiting – General Counsel & Secretary 2

SAFE HARBOR STATEMENT This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, Income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 3

AGENDA Tecogen Overview 2Q 2022 Results Earnings Takeaways Market Update Q&A 4

Providing resiliency and energy savings with a cleaner environmental footprint Units Shipped 5

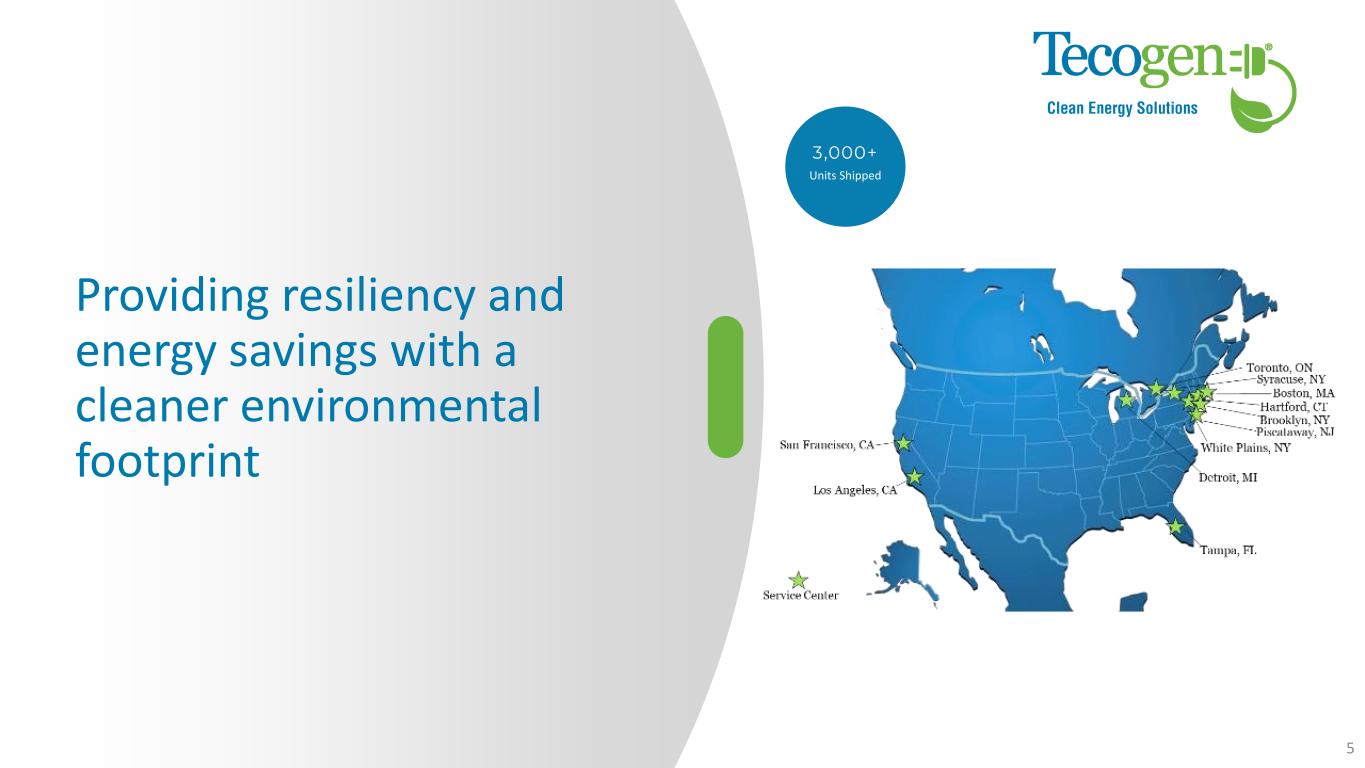

DISTRIBUTED GENERATION CLEAN COOLING Chillers with lower operating cost and lower greenhouse gas footprint compared to an equivalent electric chiller EMISSIONS 3rd in number of microgrids installed in North America Near zero NOx and CO emissions systems for gasoline, propane and natural gas engines 6

PRODUCT RUN HOURS DISTRIBUTED GENERATION AND CHILLERS SHIPPED 52M+3,000+ KWH GENERATED 2.1M+ METRIC TONS OF CO2 SAVED 200,000+ FACTS ABOUT US 7

REVENUE SEGMENTS We service most purchased Tecogen equipment in operation through long term maintenance agreements through 11 service centers in North America and perform certain equipment installation work. SERVICES CLEAN, GREEN POWER, COOLING AND HEAT Sales of combined heat and power, and clean cooling systems to building owners. Key market segments include multifamily residential, health care and indoor cultivation. PRODUCT SALES We sell electrical energy and thermal energy produced by our equipment onsite at customer facilities. ENERGY SALES 8

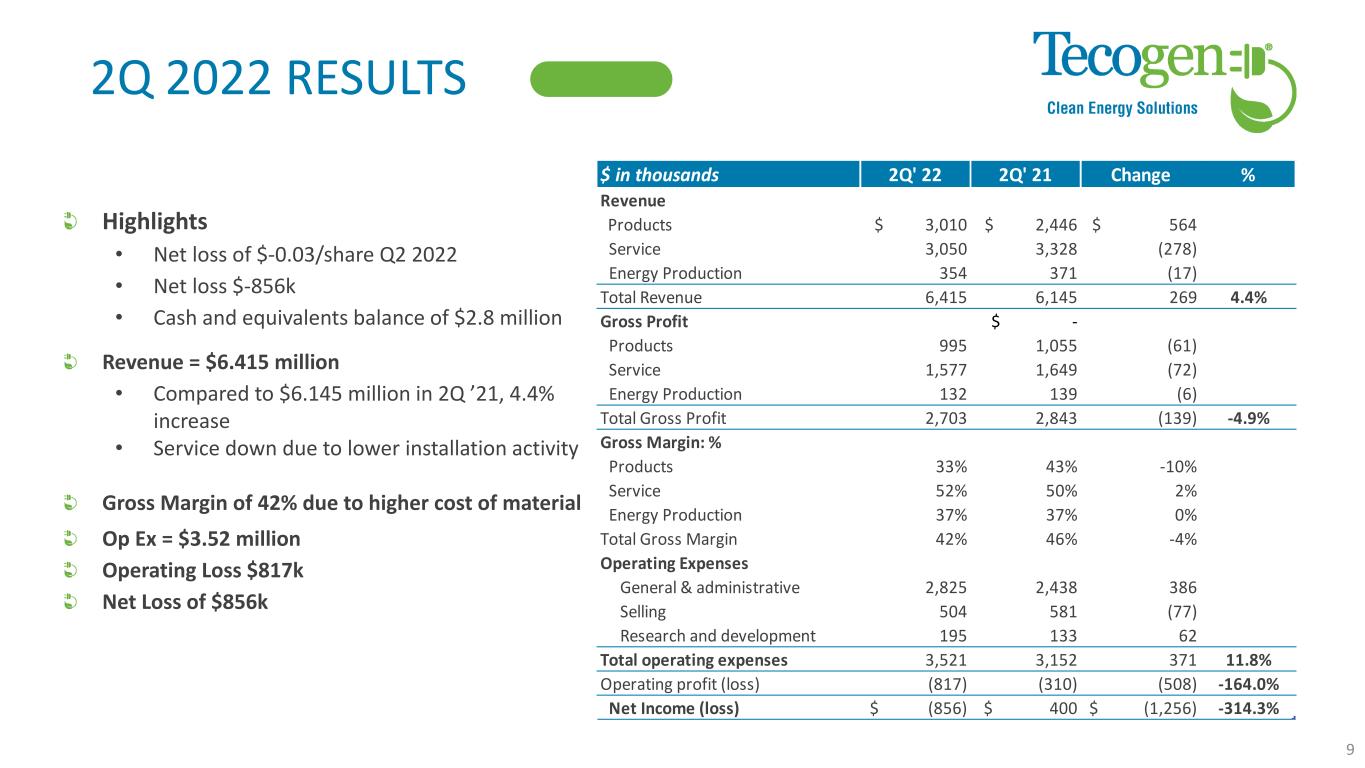

2Q 2022 RESULTS Highlights • Net loss of $-0.03/share Q2 2022 • Net loss $-856k • Cash and equivalents balance of $2.8 million Revenue = $6.415 million • Compared to $6.145 million in 2Q ’21, 4.4% increase • Service down due to lower installation activity Gross Margin of 42% due to higher cost of material Op Ex = $3.52 million Operating Loss $817k Net Loss of $856k 9 $ in thousands 2Q' 22 2Q' 21 Change % Revenue Products $ 3,010 $ 2,446 $ 564 Service 3,050 3,328 (278) Energy Production 354 371 (17) Total Revenue 6,415 6,145 269 4.4% Gross Profit $ - Products 995 1,055 (61) Service 1,577 1,649 (72) Energy Production 132 139 (6) Total Gross Profit 2,703 2,843 (139) -4.9% Gross Margin: % Products 33% 43% -10% Service 52% 50% 2% Energy Production 37% 37% 0% Total Gross Margin 42% 46% -4% Operating Expenses General & administrative 2,825 2,438 386 Selling 504 581 (77) Research and development 195 133 62 Total operating expenses 3,521 3,152 371 11.8% Operating profit (loss) (817) (310) (508) -164.0% Net Income (loss) $ (856) $ 400 $ (1,256) -314.3%

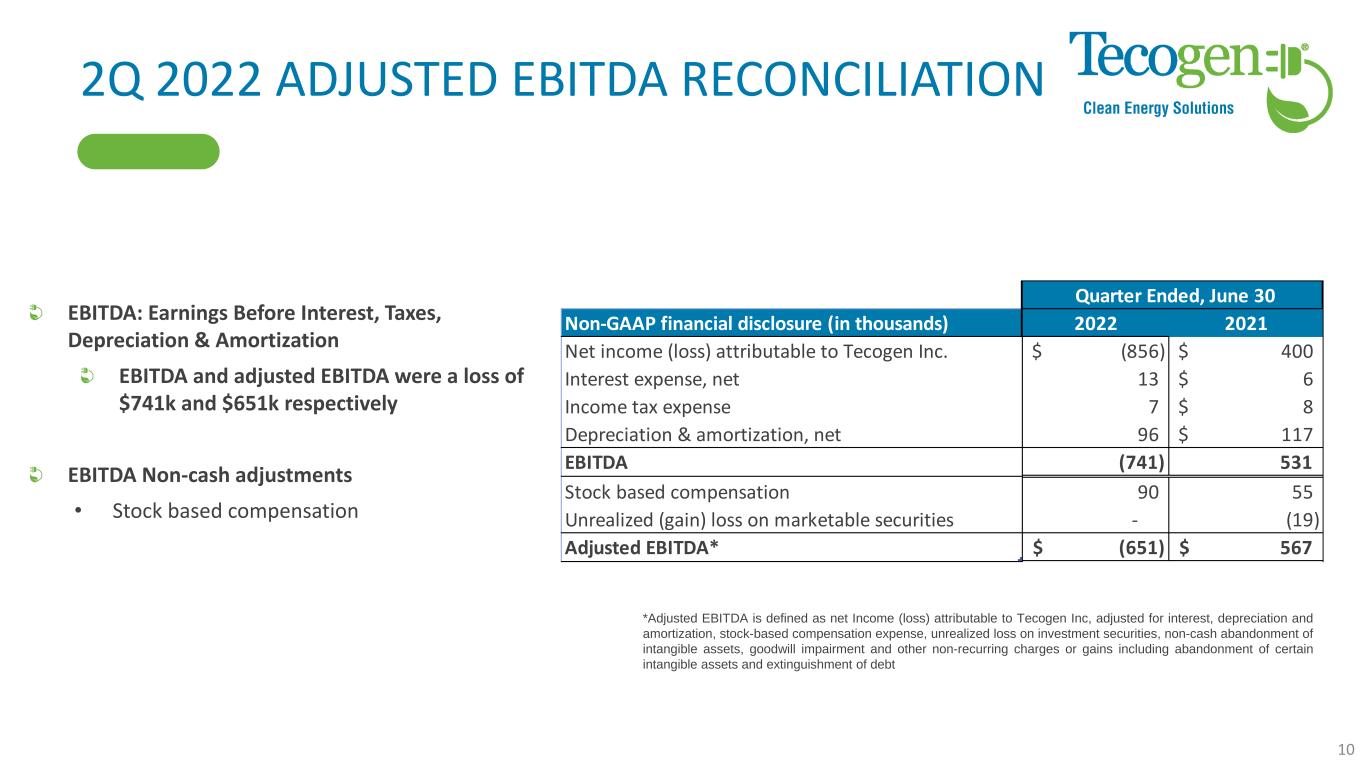

2Q 2022 ADJUSTED EBITDA RECONCILIATION EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization EBITDA and adjusted EBITDA were a loss of $741k and $651k respectively EBITDA Non-cash adjustments • Stock based compensation *Adjusted EBITDA is defined as net Income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, unrealized loss on investment securities, non-cash abandonment of intangible assets, goodwill impairment and other non-recurring charges or gains including abandonment of certain intangible assets and extinguishment of debt 10 Non-GAAP financial disclosure (in thousands) 2022 2021 Net income (loss) attributable to Tecogen Inc. (856)$ 400$ Interest expense, net 13 6$ Income tax expense 7 8$ Depreciation & amortization, net 96 117$ EBITDA (741) 531 Stock based compensation 90 55 Unrealized (gain) loss on marketable securities - (19) Adjusted EBITDA* (651)$ 567$ Quarter Ended, June 30

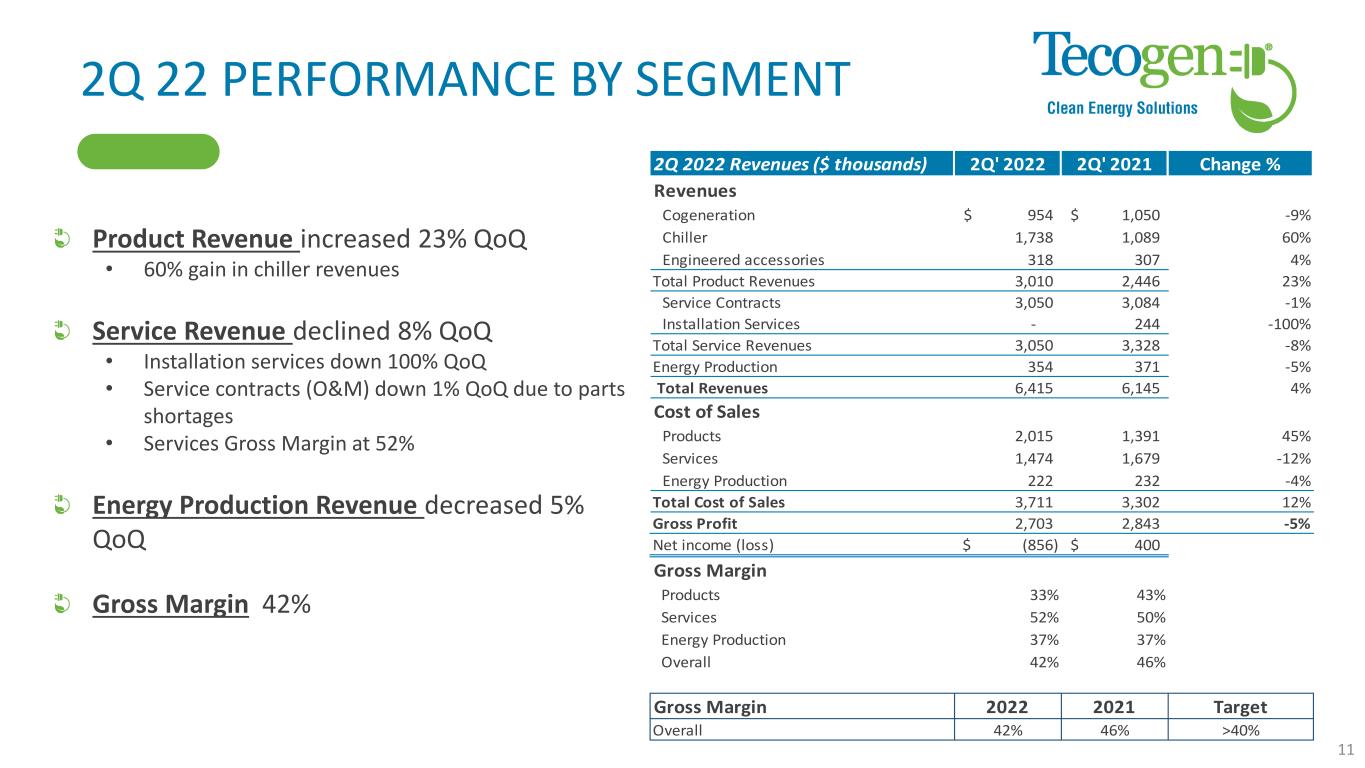

2Q 22 PERFORMANCE BY SEGMENT Product Revenue increased 23% QoQ • 60% gain in chiller revenues Service Revenue declined 8% QoQ • Installation services down 100% QoQ • Service contracts (O&M) down 1% QoQ due to parts shortages • Services Gross Margin at 52% Energy Production Revenue decreased 5% QoQ Gross Margin 42% 11 2Q 2022 Revenues ($ thousands) 2Q' 2022 2Q' 2021 Change % Revenues Cogeneration 954$ 1,050$ -9% Chiller 1,738 1,089 60% Engineered accessories 318 307 4% Total Product Revenues 3,010 2,446 23% Service Contracts 3,050 3,084 -1% Installation Services - 244 -100% Total Service Revenues 3,050 3,328 -8% Energy Production 354 371 -5% Total Revenues 6,415 6,145 4% Cost of Sales Products 2,015 1,391 45% Services 1,474 1,679 -12% Energy Production 222 232 -4% Total Cost of Sales 3,711 3,302 12% Gross Profit 2,703 2,843 -5% Net income (loss) (856)$ 400$ Gross Margin Products 33% 43% Services 52% 50% Energy Production 37% 37% Overall 42% 46% Gross Margin 2022 2021 Target Overall 42% 46% >40%

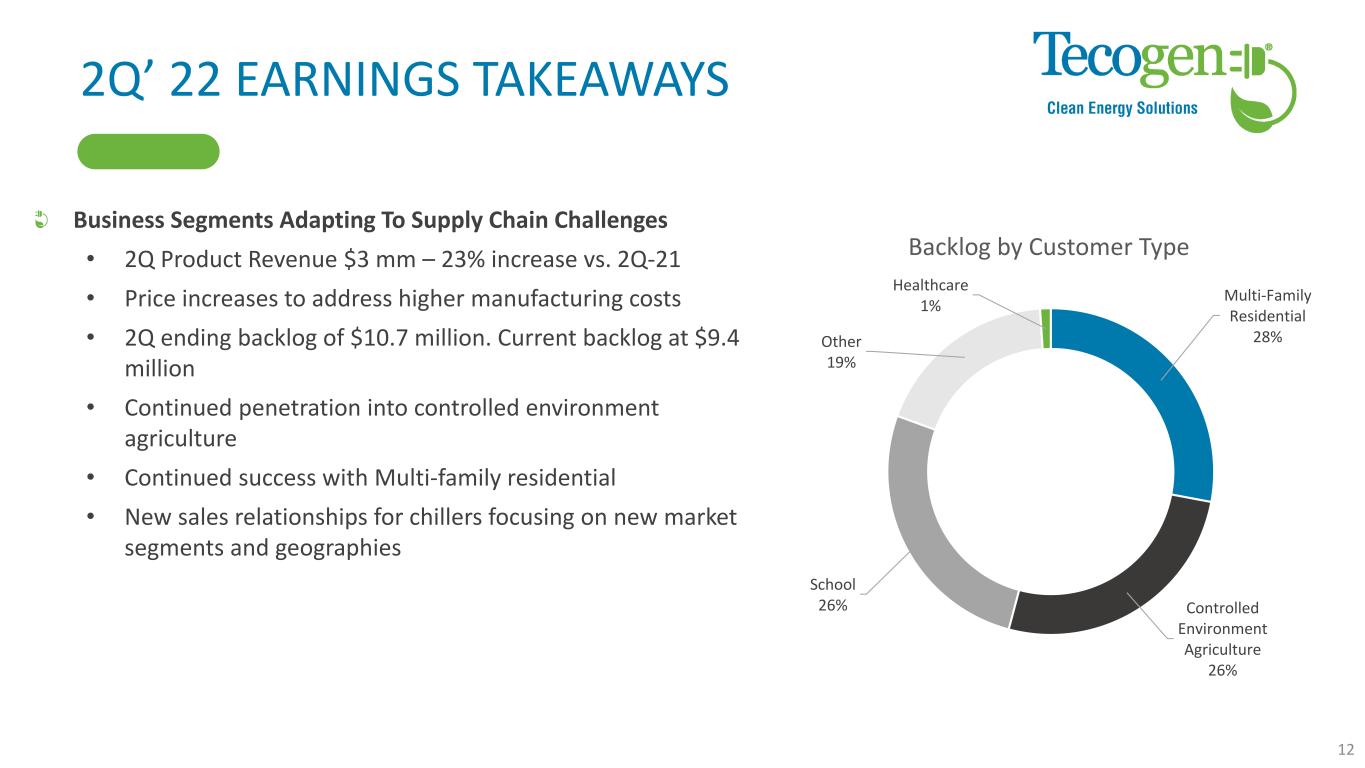

2Q’ 22 EARNINGS TAKEAWAYS Business Segments Adapting To Supply Chain Challenges • 2Q Product Revenue $3 mm – 23% increase vs. 2Q-21 • Price increases to address higher manufacturing costs • 2Q ending backlog of $10.7 million. Current backlog at $9.4 million • Continued penetration into controlled environment agriculture • Continued success with Multi-family residential • New sales relationships for chillers focusing on new market segments and geographies 12 Multi-Family Residential 28% Controlled Environment Agriculture 26% School 26% Other 19% Healthcare 1% Backlog by Customer Type

PATHWAY TO GROWTH Tecochill Hybrid Drive Air-Cooled Chiller to be launched at AHR in Feb 2023. This addresses a gap in our Tecochill offering as air cooled chillers are typically sold in larger volumes compared to water cooled chillers in our size range. Focus on Clean Cooling applications where there is a simultaneous cooling and dehumidification load. Continue to increase market share in regional cannabis markets including New England, Mid-Atlantic and Florida with a goal to have a minimum of 30% market share per state in facilities > 10,000 sq feet. Clean Microgrids using CHP in combination with other energy technologies including solar and battery 13 New Business Unit Established Focused on Controlled Environment Agriculture (CEA) markets

Q&A Company Information Tecogen, Inc 45 First Ave Waltham, MA 02451 www.Tecogen.com Contact information Benjamin Locke, CEO 781.466.6402 Benjamin.Locke@Tecogen.com 14