OTCQX: TGEN Q3 2024 EARNINGS CALL NOVEMBER 14, 2024 1

MANAGEMENT Abinand Rangesh – CEO Robert Panora – COO & President Roger Deschenes – CAO Jack Whiting – General Counsel & Secretary 2

SAFE HARBOR STATEMENT This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, Income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 3

AGENDA Business Update Data Center Strategy 3Q 2024 Results Summary Q&A 4

BUSINESS UPDATE 5 Present backlog >$10m Expect to ramp up manufacturing, Expect sequential improvements in quarterly revenue Expect to close first data center project by early 2025

DATA CENTER STRATEGY 6 Data Center Macro Trends Power hungry chips = Increasing cooling loads (>30% of data center power) Liquid cooled chips rolling out next year Existing data centers will switch to AI If data centers switch cooling from electrical chillers to natural gas Tecochill They immediately free up electrical capacity This electrical capacity can be rented to AI tenants at a significant premium Marketing via tradeshows and sales channel partners Significant interest from existing data center owners

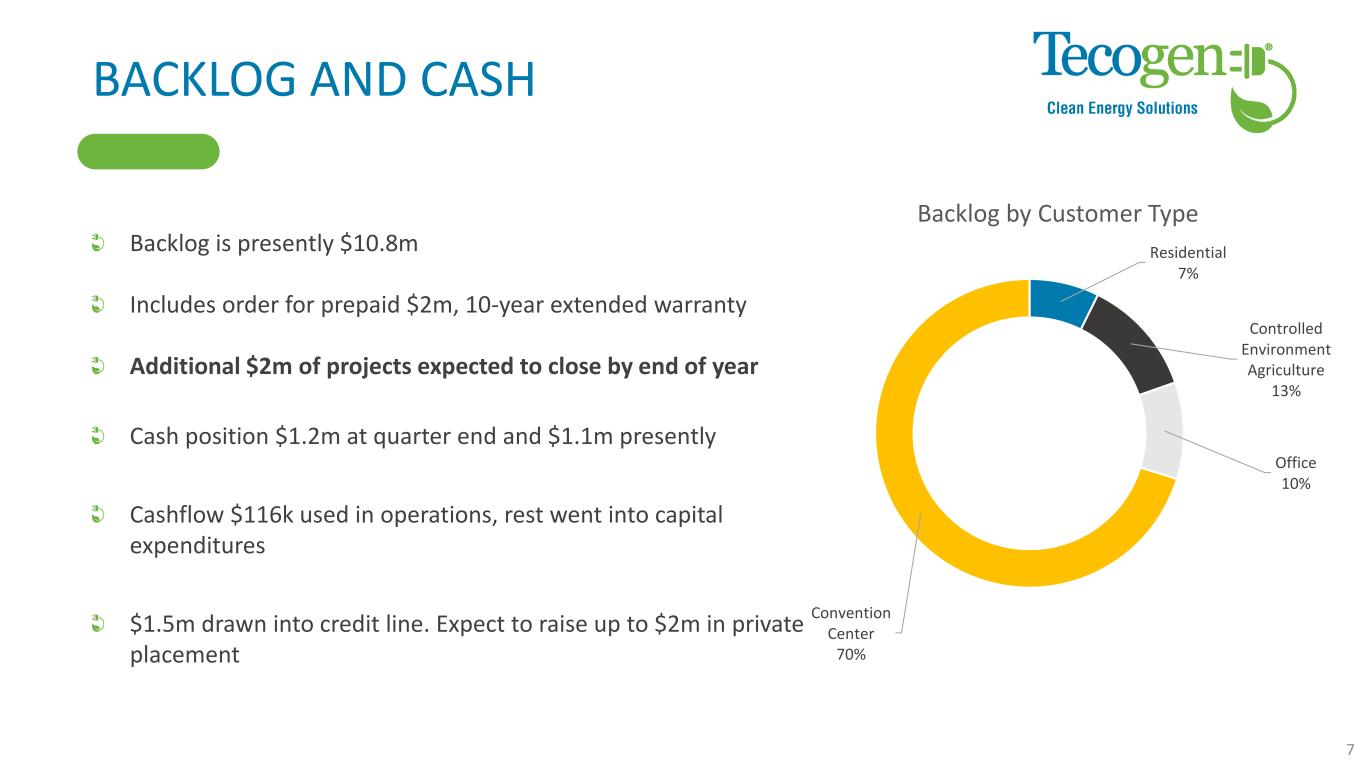

BACKLOG AND CASH Backlog is presently $10.8m Includes order for prepaid $2m, 10-year extended warranty Additional $2m of projects expected to close by end of year Cash position $1.2m at quarter end and $1.1m presently Cashflow $116k used in operations, rest went into capital expenditures $1.5m drawn into credit line. Expect to raise up to $2m in private placement Residential 7% Controlled Environment Agriculture 13% Office 10% Convention Center 70% Backlog by Customer Type 7

REVENUE SEGMENTS We service most purchased Tecogen equipment in operation through long term maintenance agreements through 11 service centers in North America and perform certain equipment installation work. SERVICES CLEAN, GREEN POWER, COOLING AND HEAT Sales of combined heat and power, and clean cooling systems to building owners. Key market segments include multifamily residential, health care and indoor cultivation. PRODUCT SALES We sell electrical energy and thermal energy produced by our equipment onsite at customer facilities. ENERGY SALES 8

3Q 2024 RESULTS Key Points • Revenue = $5.63m, just below guidance of $5.7m to $6.2m • Limited working capital constrained product revenue • Net loss of $0.04/share • Net loss $930k • Opex $3.35m (1.8% increase) • Gross Margin up 4% 9 $ in thousands 3Q'24 3Q'23 QoQ Change % Revenues Products $ 1,391 $ 2,939 $ (1,548) Services 3,850 3,843 7 Energy Production 389 331 58 Total Revenue 5,630 7,113 (1,483) -20.9% Gross Profit Products 594 1,269 (675) Services 1,711 1,496 214 Energy Production 176 161 15 Total Gross Profit 2,481 2,926 (445) -15.2% Gross Margin: % Products 43% 43% 0% Services 44% 39% 5% Energy Production 45% 49% -3% Total Gross Margin 44% 41% 3% Operating Expenses General & administrative 2,681 2,709 (28) Selling 443 425 18 Research and development 234 160 74 Gain on disposition of assets (4) - (4) Total operating expenses 3,354 3,294 60 1.8% Operating loss (873) (368) (505) 137.1% Net loss $ (930) $ (482) $ (448) 93.0%

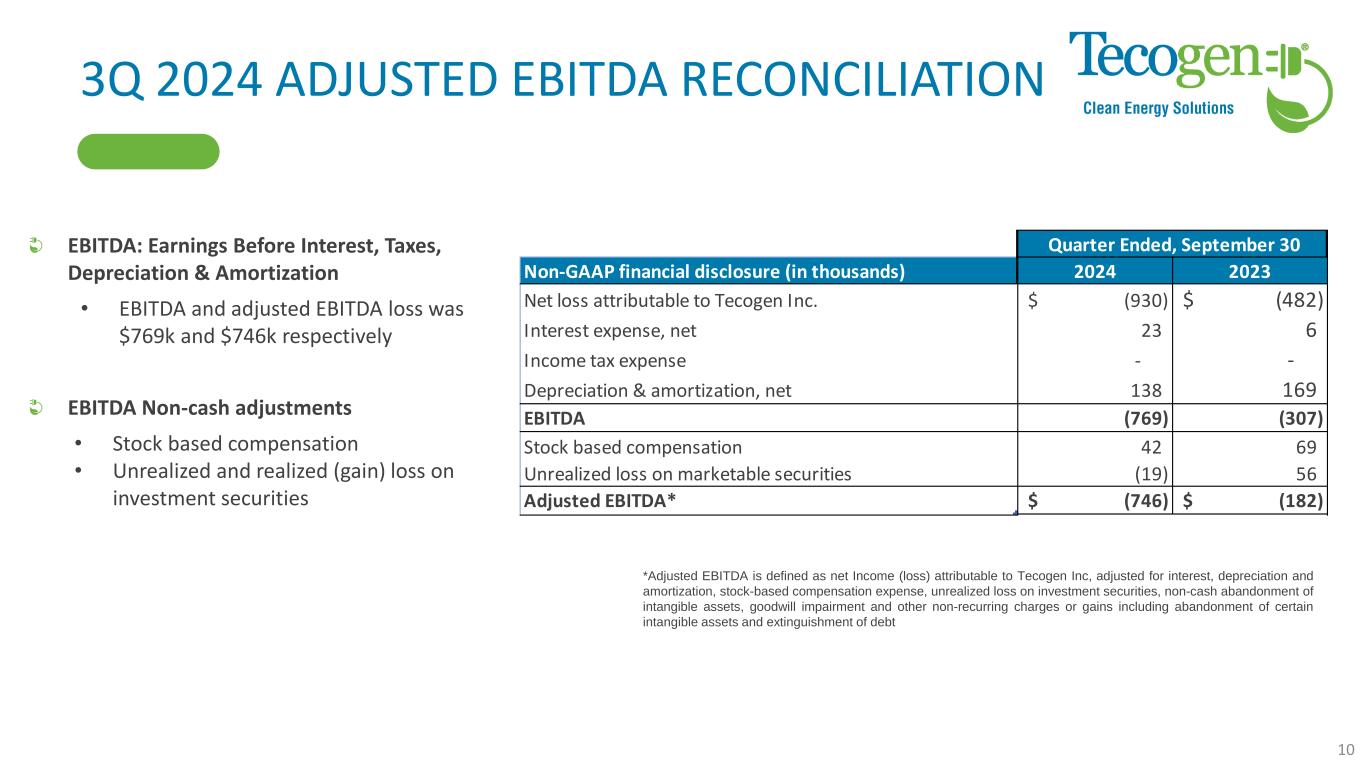

3Q 2024 ADJUSTED EBITDA RECONCILIATION EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization • EBITDA and adjusted EBITDA loss was $769k and $746k respectively EBITDA Non-cash adjustments • Stock based compensation • Unrealized and realized (gain) loss on investment securities *Adjusted EBITDA is defined as net Income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, unrealized loss on investment securities, non-cash abandonment of intangible assets, goodwill impairment and other non-recurring charges or gains including abandonment of certain intangible assets and extinguishment of debt 10 Non-GAAP financial disclosure (in thousands) 2024 2023 Net loss attributable to Tecogen Inc. (930)$ (482)$ Interest expense, net 23 6 Income tax expense - - Depreciation & amortization, net 138 169 EBITDA (769) (307) Stock based compensation 42 69 Unrealized loss on marketable securities (19) 56 Adjusted EBITDA* (746)$ (182)$ Quarter Ended, September 30

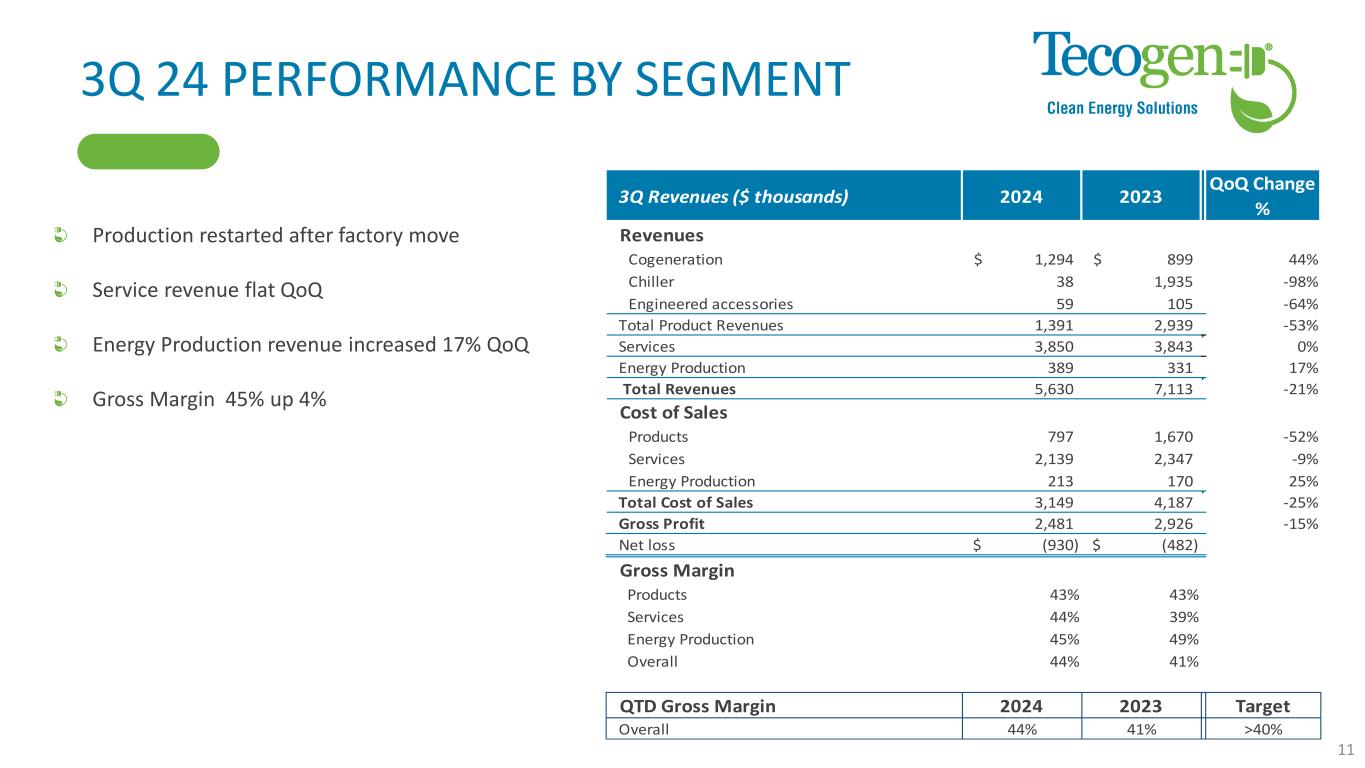

3Q 24 PERFORMANCE BY SEGMENT Production restarted after factory move Service revenue flat QoQ Energy Production revenue increased 17% QoQ Gross Margin 45% up 4% 11 3Q Revenues ($ thousands) 2024 2023 QoQ Change % Revenues Cogeneration 1,294$ 899$ 44% Chiller 38 1,935 -98% Engineered accessories 59 105 -64% Total Product Revenues 1,391 2,939 -53% Services 3,850 3,843 0% Energy Production 389 331 17% Total Revenues 5,630 7,113 -21% Cost of Sales Products 797 1,670 -52% Services 2,139 2,347 -9% Energy Production 213 170 25% Total Cost of Sales 3,149 4,187 -25% Gross Profit 2,481 2,926 -15% Net loss (930)$ (482)$ Gross Margin Products 43% 43% Services 44% 39% Energy Production 45% 49% Overall 44% 41% QTD Gross Margin 2024 2023 Target Overall 44% 41% >40%

SUMMARY AND Q&A Company Information Tecogen, Inc 76 Treble Cove Road, Building 1 North Billerica, MA 01862 www.Tecogen.com Contact information Abinand Rangesh, CEO 781.466.6487 Abinand.rangesh@Tecogen.com 12 Close projects in development by year end Expect to ramp up manufacturing, Expect sequential improvements in quarterly revenue Expect to close first data center project by early 2025